An open-ended equity scheme following Energy theme

An open-ended equity scheme following Energy theme

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in Energy and Energy related activities. However, there is no assurance that the objective of the scheme will be achieved.

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in Energy and Energy related activities. However, there is no assurance that the objective of the scheme will be achieved.

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

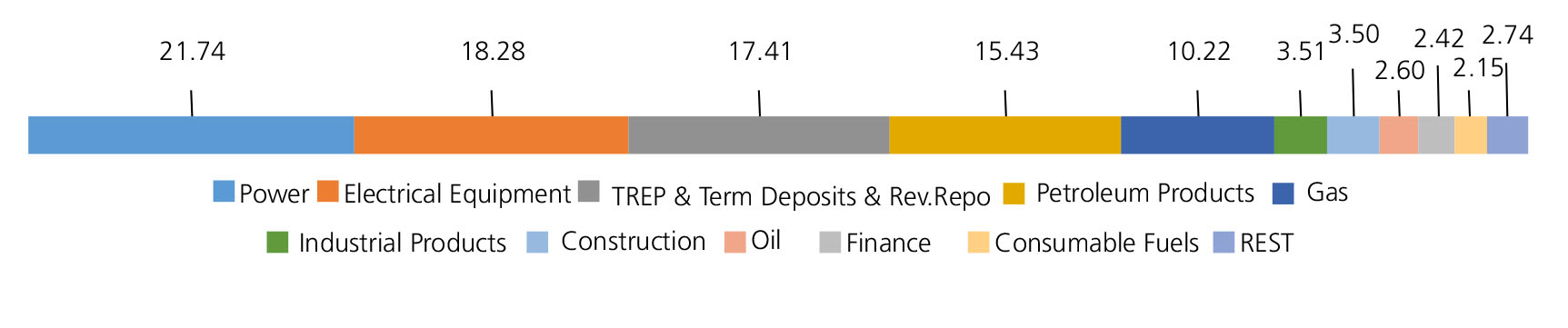

| Power | 21.74 | |

| NTPC LTD | 8.15 | |

| Power Grid Corporation Of India Ltd. | 6.29 | |

| Tata Power Co. Ltd. | 3.20 | |

| TORRENT POWER LTD | 1.86 | |

| ACME SOLAR HOLDINGS LTD. | 0.86 | |

| CESC LTD | 0.79 | |

| NLC India Ltd. | 0.59 | |

| Electrical Equipment | 18.28 | |

| ABB India Ltd | 5.83 | |

| Siemens Ltd. | 5.31 | |

| GE VERNOVA T&D INDIA LIMITED | 3.28 | |

| Thermax Ltd. | 2.02 | |

| WAAREE ENERGIES LIMITED | 1.45 | |

| SUZLON ENERGY LTD. | 0.39 | |

| Petroleum Products | 15.43 | |

| RELIANCE INDUSTRIES LTD. | 8.48 | |

| Bharat Petroleum Corporation Ltd. | 3.11 | |

| HINDUSTAN PETROLEUM CORPORATION LTD | 2.68 | |

| Gulf Oil Lubricants India Ltd. | 1.16 | |

| Gas | 10.22 | |

| GAIL (India) Ltd. | 6.86 | |

| Petronet LNG Ltd. | 3.00 | |

| Gujarat State Petronet Ltd. | 0.36 | |

| Industrial Products | 3.51 | |

| KEI INDUSTRIES LTD. | 1.76 | |

| Cummins India Ltd. | 1.60 | |

| Ratnamani Metals & Tubes Ltd. | 0.15 | |

| Construction | 3.50 | |

| Larsen And Toubro Ltd. | 2.39 | |

| KALPATARU PROJECTS INTERNATIONAL LIMITED | 1.11 | |

| Oil | 2.60 | |

| Oil & Natural Gas Corporation Ltd. | 2.60 | |

| Finance | 2.42 | |

| Power Finance Corporation Ltd. | 2.42 | |

| Consumable Fuels | 2.15 | |

| Coal India Ltd. | 2.15 | |

| Consumer Durables | 2.04 | |

| V-Guard Industries Ltd. | 1.13 | |

| Havells India Ltd. | 0.91 | |

| Chemicals and Petrochemicals | 1.22 | |

| Linde India Ltd. | 1.22 | |

| Equity & Equity related - Total | 83.11 | |

| Triparty Repo | 17.41 | |

| Net Current Assets/(Liabilities) | -0.52 | |

| Grand Total | 100.00 | |

| | ||

| Regular | Direct | |

| Growth | Rs10.1930 | Rs10.2080 |

| IDCW | Rs10.1930 | Rs10.2080 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager* |

Mr. Harsha Upadhyaya, Mr. Mandar Pawar & & Mr. Abhishek Bisen |

| Benchmark | Nifty Energy TRI |

| Allotment date | April 25, 2025 |

| AAUM | Rs177.90 crs |

| AUM | Rs184.37 crs |

| Folio count | 22,642 |

Trustee's Discretion

| ^^(P/E) | 17.75 |

| ^^P/BV | 2.61 |

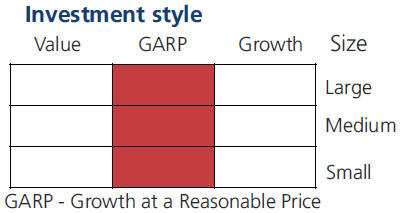

| Large Cap | 59.30% |

| Mid Cap | 18.25% |

| Small Cap | 5.56% |

| Debt & Money Market | 16.89% |

*% of Net Asset

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out of upto

10% of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

• If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

• If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL.

| Regular Plan: | 2.42% |

| Direct Plan: | 0.93% |

Folio Count data as on 30th April 2025.

Benchmark : Nifty Energy TRI

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Investment in portfolio of predominantly equity and equity related securities of companies engaged in Energy and Energy related activities.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

Scheme has not completed 6 months since inception

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'