Investment Objective

The investment objective of the scheme is to provide returns that, before expenses, corresponding to the total

returns of the securities as represented by the underlying index, subject to tracking errors. However, there is no assurance that the investment

objective of the Scheme will be achieved.

The investment objective of the scheme is to provide returns that, before expenses, corresponding to the total

returns of the securities as represented by the underlying index, subject to tracking errors. However, there is no assurance that the investment

objective of the Scheme will be achieved.

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

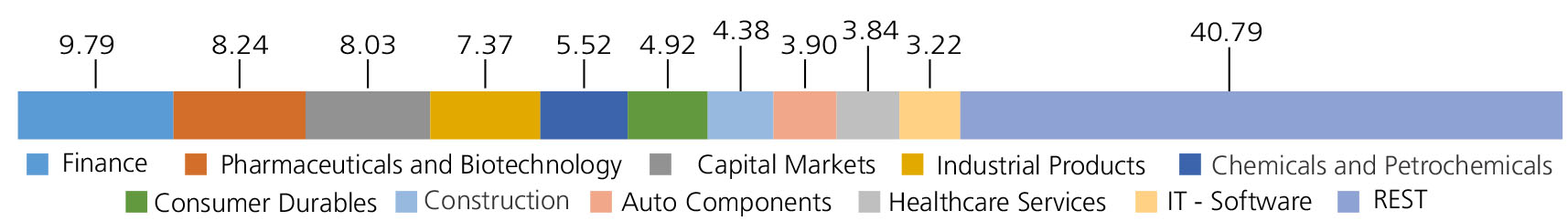

| Finance | 9.79 | |

| Cholamandalam Financial Holdings Ltd. | 0.97 | |

| PNB HOUSING FINANCE LTD. | 0.88 | |

| FIVE STAR BUSINESS FINANCE LTD | 0.69 | |

| Manappuram Finance Ltd | 0.69 | |

| Piramal Enterprises Limited | 0.69 | |

| POONAWALLA FINCORP LTD. | 0.61 | |

| Aavas Financiers Ltd. | 0.55 | |

| IIFL Finance Ltd | 0.53 | |

| AUTHUM INVESTMENT & INFRASTRUCTURE LTD. | 0.53 | |

| HOME FIRST FINANCE CO INDIA | 0.52 | |

| SAMMAAN CAPITAL LIMITED | 0.50 | |

| JSW HOLDINGS LTD. | 0.45 | |

| APTUS VALUE HOUSING FINANCE | 0.37 | |

| CAN FIN HOMES LTD | 0.35 | |

| CREDITACCESS GRAMEEN LTD. | 0.32 | |

| JM FINANCIAL LTD | 0.27 | |

| AADHAR HOUSING FINANCE LTD. | 0.24 | |

| IFCI Ltd. | 0.23 | |

| CAPRI GLOBAL CAPITAL LTD | 0.20 | |

| SBFC FINANCE LTD | 0.20 | |

| Pharmaceuticals and Biotechnology | 8.24 | |

| Laurus Labs Ltd. | 1.25 | |

| COHANCE LIFESCIENCES LIMITED | 0.70 | |

| PIRAMAL PHARMA LTD. | 0.67 | |

| Wockhardt Ltd. | 0.63 | |

| JB CHEMICALS & PHARMACEUTICALS LTD. | 0.63 | |

| NEULAND LABORATORIES LTD. | 0.51 | |

| JUBILANT PHARMOVA LIMITED | 0.47 | |

| Pfizer Ltd. | 0.45 | |

| Eris Lifesciences Ltd. | 0.45 | |

| Natco Pharma Ltd | 0.41 | |

| Granules India Ltd. | 0.40 | |

| CONCORD BIOTECH LTD. | 0.30 | |

| Alembic Pharmaceuticals Ltd. | 0.30 | |

| Astrazeneca Pharma (I) Ltd | 0.26 | |

| CAPLIN POINT LABORATORIES LTD. | 0.23 | |

| SAI LIFE SCIENCES LIMITED | 0.19 | |

| ALIVUS LIFE SCIENCES LTD. | 0.17 | |

| EMCURE PHARMACEUTICALS LIMITED | 0.14 | |

| AKUMS DRUGS & PHARMACEUTICALS LTD. | 0.08 | |

| Capital Markets | 8.03 | |

| Multi Commodity Exchange of India Limited | 1.77 | |

| CENTRAL DEPOSITORY SERVICES (INDIA) LTD. | 1.43 | |

| COMPUTER AGE MANAGEMENT SERVICES LIMITED | 0.99 | |

| ANGEL ONE LIMITED | 0.92 | |

| Indian Energy Exchange Ltd | 0.80 | |

| KFIN TECHNOLOGIES LTD. | 0.65 | |

| NUVAMA WEALTH MANAGEMENT LIMITED | 0.56 | |

| Anand Rathi Wealth Ltd. | 0.37 | |

| Aditya Birla Sun Life AMC Ltd | 0.28 | |

| UTI Asset Management Company Ltd | 0.26 | |

| Industrial Products | 7.37 | |

| Welspun Corp Limited | 0.64 | |

| Elgi Equipments Limited | 0.61 | |

| Carborundum Universal Ltd. | 0.59 | |

| Timken India Ltd. | 0.59 | |

| SKF India Ltd | 0.57 | |

| PTC INDUSTRIES LTD | 0.48 | |

| Finolex Cables Ltd. | 0.39 | |

| Kirloskar Oil Engines Ltd. | 0.39 | |

| HBL ENGINEERING LTD | 0.35 | |

| FINOLEX INDUSTRIES LTD. | 0.32 | |

| Shyam Metalics and Energy Ltd | 0.31 | |

| Usha Martin Ltd. | 0.28 | |

| JINDAL SAW LTD. | 0.26 | |

| R R KABEL LTD | 0.25 | |

| GODAWARI POWER AND ISPAT LIMITED | 0.24 | |

| Kirloskar Brothers Ltd. | 0.24 | |

| H.E.G. LTD. | 0.23 | |

| Graphite India Ltd. | 0.19 | |

| Maharashtra Seamless Ltd. | 0.15 | |

| RHI MAGNESITA INDIA LTD. | 0.15 | |

| INOX INDIA LTD | 0.14 | |

| Chemicals and Petrochemicals | 5.52 | |

| Navin Fluorine International Ltd. | 0.78 | |

| Tata Chemicals Ltd | 0.73 | |

| Atul Ltd. | 0.59 | |

| HIMADRI SPECIALITY CHEMICAL LTD. | 0.58 | |

| Deepak Fertilizers & Petrochemicals Corp Ltd | 0.52 | |

| Aarti Industries Ltd. | 0.50 | |

| PCBL LTD | 0.37 | |

| SWAN ENERGY LTD | 0.32 | |

| BASF INDIA LIMITED | 0.31 | |

| JUBILANT INGREVIA LTD | 0.27 | |

| Gujarat Narmada Valley Fertilisers Co Ltd. | 0.23 | |

| Clean Science and Technology Ltd | 0.18 | |

| Alkyl Amines Chemicals Ltd. | 0.14 | |

| Consumer Durables | 4.92 | |

| Crompton Greaves Consumer Electricals Ltd | 1.19 | |

| Amber Enterprises India Ltd. | 0.69 | |

| PG ELECTROPLAST LTD | 0.58 | |

| Kajaria Ceramics Ltd. | 0.45 | |

| Bata India Ltd. | 0.42 | |

| Whirlpool of India Ltd. | 0.40 | |

| V-Guard Industries Ltd. | 0.36 | |

| Kansai Nerolac Paints Ltd | 0.27 | |

| Century Plyboards (India) Ltd. | 0.25 | |

| CERA SANITARYWARE LTD | 0.19 | |

| CAMPUS ACTIVEWEAR LTD | 0.12 | |

| Construction | 4.38 | |

| KALPATARU PROJECTS INTERNATIONAL LIMITED | 0.68 | |

| NBCC (India) Ltd | 0.67 | |

| Kec International Ltd. | 0.57 | |

| NCC LIMITED | 0.50 | |

| TECHNO ELECTRIC & ENGINEERING COMPANY LIMITED | 0.37 | |

| Engineers India Ltd. | 0.33 | |

| Ircon International Ltd | 0.33 | |

| AFCONS INFRASTRUCTURE LTD. | 0.22 | |

| RITES Ltd. | 0.19 | |

| STERLING & WILSON RENEWABLE ENERGY LTD | 0.19 | |

| PNC Infratech Ltd | 0.17 | |

| KNR Constructions Ltd. | 0.16 | |

| Auto Components | 3.90 | |

| AMARA RAJA ENERGY MOB LTD. | 0.66 | |

| Sundaram Fasteners Ltd. | 0.59 | |

| ZF Commercial Vehicle Control Systems India Limited | 0.48 | |

| Asahi India Glass Ltd. | 0.43 | |

| CEAT Ltd. | 0.42 | |

| CRAFTSMAN AUTOMATION LTD | 0.36 | |

| RAMKRISHNA FORGINGS LTD. | 0.33 | |

| JK TYRE & INDUSTRIES LTD. | 0.26 | |

| MINDA CORPORATION LIMITED | 0.22 | |

| JBM AUTO LTD. | 0.15 | |

| Healthcare Services | 3.84 | |

| KRISHNA INSTITUTE OF MEDICAL | 0.88 | |

| ASTER DM HEALTHCARE LTD | 0.66 | |

| Narayana Hrudayalaya Ltd. | 0.62 | |

| DR.Lal Pathlabs Ltd. | 0.54 | |

| RAINBOW CHILDRENS MEDICARE LTD | 0.37 | |

| INDEGENE LTD | 0.30 | |

| VIJAYA DIAGNOSTIC CENTRE PVT | 0.24 | |

| Metropolis Healthcare Ltd. | 0.23 | |

| IT - Software | 3.22 | |

| Intellect Design Arena Ltd. | 0.56 | |

| ZENSAR TECHNOLGIES LTD. | 0.50 | |

| Sonata Software Ltd. | 0.42 | |

| NEWGEN SOFTWARE TECHNOLOGIES LTD | 0.41 | |

| Birlasoft Ltd. | 0.35 | |

| Happiest Minds Technologies Limited | 0.25 | |

| TANLA PLATFORMS LTD | 0.23 | |

| Mastek Ltd. | 0.20 | |

| Latent View Analytics Ltd | 0.16 | |

| C.E. INFO SYSTEMS LTD. | 0.14 | |

| Banks | 3.19 | |

| KARUR VYSYA BANK LTD. | 0.91 | |

| City Union Bank Ltd. | 0.74 | |

| RBL Bank Ltd | 0.66 | |

| IDBI Bank Ltd. | 0.28 | |

| JAMMU AND KASHMIR BANK LTD. | 0.24 | |

| Indian Overseas Bank | 0.14 | |

| Central Bank Of India | 0.12 | |

| UCO Bank | 0.10 | |

| Leisure Services | 2.75 | |

| SAPPHIRE FOODS INDIA LTD. | 0.39 | |

| EIH Ltd. | 0.38 | |

| LEMON TREE HOTELS LTD | 0.36 | |

| DEVYANI INTERNATIONAL LIMITED | 0.35 | |

| CHALET HOTELS LTD. | 0.34 | |

| BLS INTERNATIONAL SERVICES LTD. | 0.26 | |

| D B Realty Limited | 0.25 | |

| Westlife Development Ltd. | 0.24 | |

| TBO TEK LIMITED | 0.18 | |

| Industrial Manufacturing | 2.56 | |

| KAYNES TECHNOLOGY INDIA LTD. | 0.85 | |

| JYOTI CNC AUTOMATION LTD | 0.58 | |

| TITAGARH RAIL SYSTEMS LTD. | 0.37 | |

| Praj Industries Ltd. | 0.31 | |

| JUPITER WAGONS LTD | 0.28 | |

| SYRMA SGS TECHNOLOGY LTD. | 0.17 | |

| Power | 2.27 | |

| Reliance Power Ltd | 0.85 | |

| CESC LTD | 0.54 | |

| Jaiprakash Power Ventures Ltd. | 0.39 | |

| NAVA LTD. | 0.38 | |

| ACME SOLAR HOLDINGS LTD. | 0.11 | |

| Realty | 2.05 | |

| BRIGADE ENTERPRISES LIMITED | 0.79 | |

| Anant Raj Industries Ltd. | 0.40 | |

| Sobha Developers Ltd. | 0.33 | |

| SIGNATURE GLOBAL LTD | 0.25 | |

| RAYMOND REALTY LIMITED | 0.17 | |

| RAYMOND LIMITED | 0.11 | |

| Commercial Services and Supplies | 2.01 | |

| Redington India Ltd | 0.81 | |

| Firstsource Solutions Ltd. | 0.62 | |

| ECLERX SERVICES LTD. | 0.40 | |

| INTERNATIONAL GEMMOLOGICAL INSTITUTE (INDIA) LTD. | 0.11 | |

| MMTC LTD | 0.07 | |

| Electrical Equipment | 1.87 | |

| INOX WIND LIMITED | 0.69 | |

| TRIVENI TURBINE LTD | 0.35 | |

| ELECON ENGINEERING CO.LTD | 0.31 | |

| TRANSFORMERS & RECTIFIERS (INDIA) LTD. | 0.29 | |

| Schneider Electric Infrastructure Ltd | 0.23 | |

| Transport Services | 1.82 | |

| DELHIVERY LTD | 0.96 | |

| Great Eastern Shipping Company Ltd | 0.48 | |

| Blue Dart Express Ltd. | 0.20 | |

| Shipping Corporation of India Ltd. | 0.18 | |

| IT - Services | 1.58 | |

| CYIENT LTD. | 0.60 | |

| Affle (India) Ltd. | 0.57 | |

| NETWEB TECHNOLOGIES INDIA LTD. | 0.17 | |

| INVENTURUS KNOWLEDGE SOLUTIONS LTD. | 0.13 | |

| SAGILITY INDIA LTD. | 0.11 | |

| Fertilizers and Agrochemicals | 1.55 | |

| Chambal Fertilisers & Chemicals Ltd. | 0.44 | |

| Bayer Cropscience Ltd. | 0.38 | |

| SUMITOMO CHEMICAL INDIA LTD | 0.33 | |

| FERTILISERS AND CHEMICALS TRAVANCORE LTD | 0.29 | |

| RASHTRIYA CHEMICALS & FERTILIZERS LTD | 0.11 | |

| Gas | 1.49 | |

| Gujarat State Petronet Ltd. | 0.57 | |

| AEGIS LOGISTICS LTD | 0.52 | |

| Mahanagar Gas Ltd | 0.40 | |

| Aerospace and Defense | 1.41 | |

| ZEN TECHNOLOGIES LTD | 0.51 | |

| GARDEN REACH SHIPBUILDERS & ENGINEERS LTD | 0.46 | |

| Data Patterns (India) Ltd. | 0.44 | |

| Entertainment | 1.41 | |

| Zee Entertainment Enterprises Ltd | 0.63 | |

| PVR INOX LIMITED | 0.37 | |

| SAREGAMA INDIA LTD. | 0.22 | |

| Network18 Media & Investments Limited | 0.19 | |

| Agricultural Food and other Product | 1.35 | |

| Balrampur Chini Mills Ltd. | 0.36 | |

| CCL PRODUCTS INDIA LTD | 0.33 | |

| LT FOODS LTD. | 0.32 | |

| Triveni Engineering & Industries Ltd. | 0.20 | |

| Shree Renuka Sugars Ltd. | 0.14 | |

| Food Products | 1.11 | |

| EID Parry (India) Ltd | 0.51 | |

| Bikaji Foods International Ltd. | 0.25 | |

| Bombay Burmah Trading Corporation Ltd. | 0.18 | |

| Godrej Agrovet Ltd. | 0.17 | |

| Retailing | 1.06 | |

| INDIAMART INTERMESH LTD. | 0.37 | |

| BRAINBEES SOLUTIONS LIMITED | 0.26 | |

| Vedant Fashions Ltd | 0.25 | |

| Just Dial Limited | 0.10 | |

| RATTANINDIA ENTERPRISES LTD | 0.08 | |

| Beverages | 1.04 | |

| Radico Khaitan Ltd. | 1.04 | |

| Textiles and Apparels | 0.95 | |

| Vardhman Textiles Ltd. | 0.26 | |

| WELSPUN LIVING LTD | 0.22 | |

| Trident Ltd | 0.20 | |

| RAYMOND LIFESTYLE LIMITED | 0.14 | |

| ALOK INDUSTRIES LTD. | 0.13 | |

| Telecom - Services | 0.87 | |

| HFCL LTD | 0.42 | |

| Tata Teleservices Ltd | 0.19 | |

| RAILTEL CORPORATION OF INDIA LTD | 0.18 | |

| ROUTE MOBILE LTD | 0.08 | |

| Cement and Cement Products | 0.86 | |

| The Ramco Cements Ltd | 0.64 | |

| India Cements Ltd. | 0.22 | |

| Petroleum Products | 0.72 | |

| Castrol (India ) Ltd. | 0.55 | |

| Chennai Petroleum Corporation Ltd. | 0.17 | |

| Agricultural, Commercial and Construction Vehicles | 0.69 | |

| BEML Ltd. | 0.42 | |

| ACTION CONSTRUCTION EQUIPMENT LTD. | 0.27 | |

| Personal Products | 0.63 | |

| Gillette India Ltd | 0.40 | |

| HONASA CONSUMER LTD | 0.23 | |

| Cigarettes and Tobacco Products | 0.62 | |

| Godfrey Phillips India Ltd. | 0.62 | |

| Paper, Forest and Jute Products | 0.60 | |

| ADITYA BIRLA REAL ESTATE LTD | 0.60 | |

| Insurance | 0.55 | |

| GO DIGIT GENERAL INSURANCE LTD. | 0.40 | |

| NIVA BUPA HEALTH INSURANCE COMPANY LTD. | 0.15 | |

| Household Products | 0.48 | |

| JYOTHY LABORATORIES LIMITED | 0.25 | |

| DOMS INDUSTRIES LTD | 0.23 | |

| Telecom - Equipment and Accessorie | 0.48 | |

| Tejas Networks Ltd | 0.30 | |

| ITI LTD | 0.18 | |

| Healthcare Equipment and Supplies | 0.45 | |

| POLY MEDICURE LTD | 0.45 | |

| Ferrous Metals | 0.44 | |

| NMDC STEEL LTD | 0.23 | |

| SARDA ENERGY AND MINERALS LTD. | 0.21 | |

| Minerals and Mining | 0.43 | |

| GRAVITA INDIA LTD. | 0.28 | |

| Gujarat Mineral Development Corporation Ltd. | 0.15 | |

| Non - Ferrous Metals | 0.43 | |

| HINDUSTAN COPPER LTD. | 0.43 | |

| Diversified | 0.28 | |

| DCM SHRIRAM LTD. | 0.28 | |

| Automobiles | 0.26 | |

| OLECTRA GREENTECH LTD | 0.26 | |

| Transport Infrastructure | 0.22 | |

| Gujarat Pipavav Port Limited | 0.22 | |

| Equity & Equity related - Total | 99.69 | |

| Net Current Assets/(Liabilities) | 0.31 | |

| Grand Total | 100.00 | |

Net Asset Value (NAV)

| Regular | Direct | |

| Growth | Rs10.8910 | Rs10.9090 |

| IDCW | Rs10.8910 | Rs10.9090 |

Available Plans/Options

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout

and Reinvestment)

| Fund Manager* | Mr. Devender Singhal, Mr. Satish Dondapati & Mr. Abhishek Bisen |

| Benchmark | Nifty Smallcap 250 Index TRI |

| Allotment date | January 27, 2025 |

| AAUM | Rs22.76 crs |

| AUM | Rs24.97 crs |

| Folio count | 13,185 |

Ratios

| Portfolio Turnover | 25.36% |

| Tracking Error | 0.17% |

Minimum Investment Amount

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

Ideal Investments Horizon

• 5 years & above

IDCW Frequency

Trustee's Discretion

Load Structure

Entry Load:

Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Total Expense Ratio**

| Regular Plan: | 0.73% |

| Direct Plan: | 0.24% |

Data as on 31st May, 2025 unless otherwise specified.

Folio Count data as on 30th April 2025.

Folio Count data as on 30th April 2025.

Fund

Benchmark : Nifty Smallcap 250 Index TRI

This product is suitable for investors who are seeking*:

- Long term capital appreciation

- Return that corresponds to the performance of Nifty SmallCap 250 Index subject to tracking error.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

The scheme has not completed 6 month since inception

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'