Key Events for the Month of November 2021:

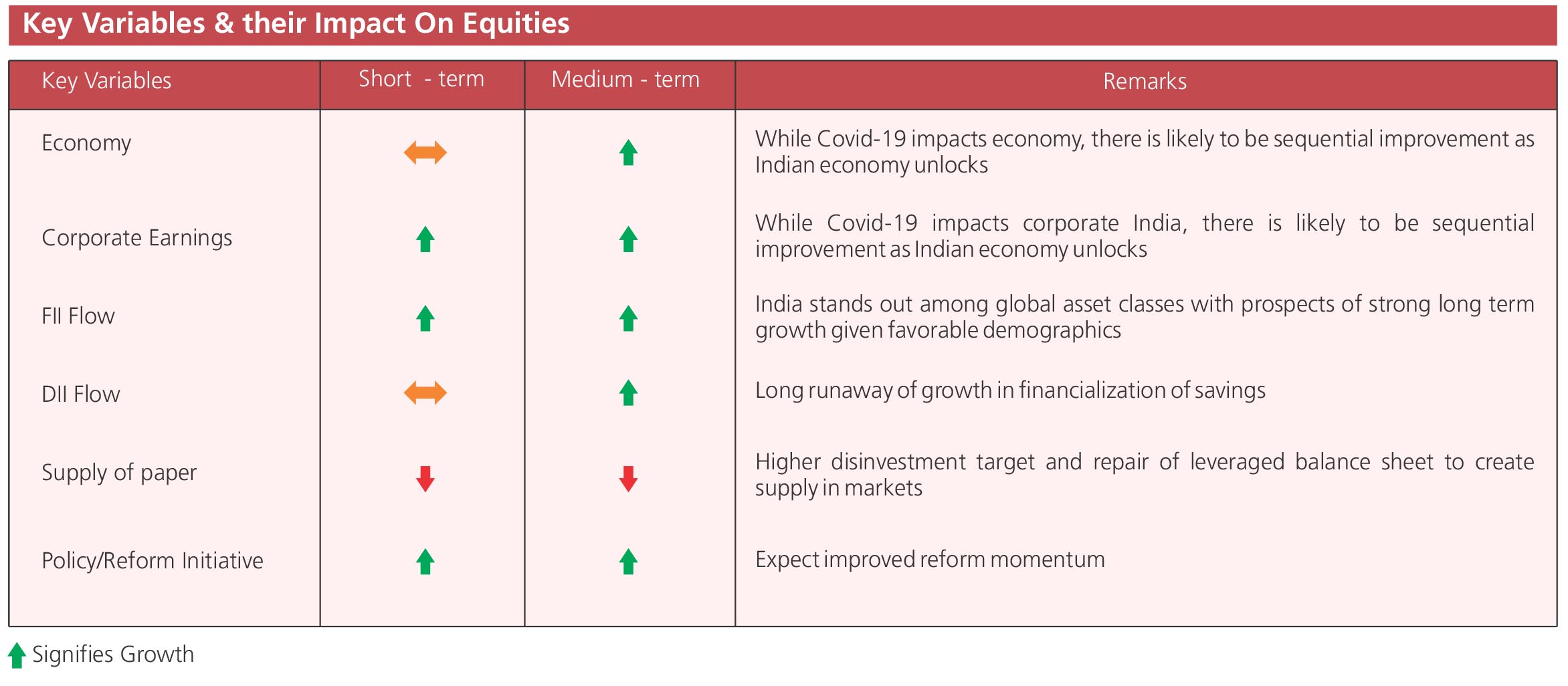

• Nifty (-3.9%) suffered the biggest 1m fall of 2021 in November due to several factors ranging from a global risk-off driven by accelerated taper

worries / Omicron concerns to disappointing listing of India’s largest IPO.

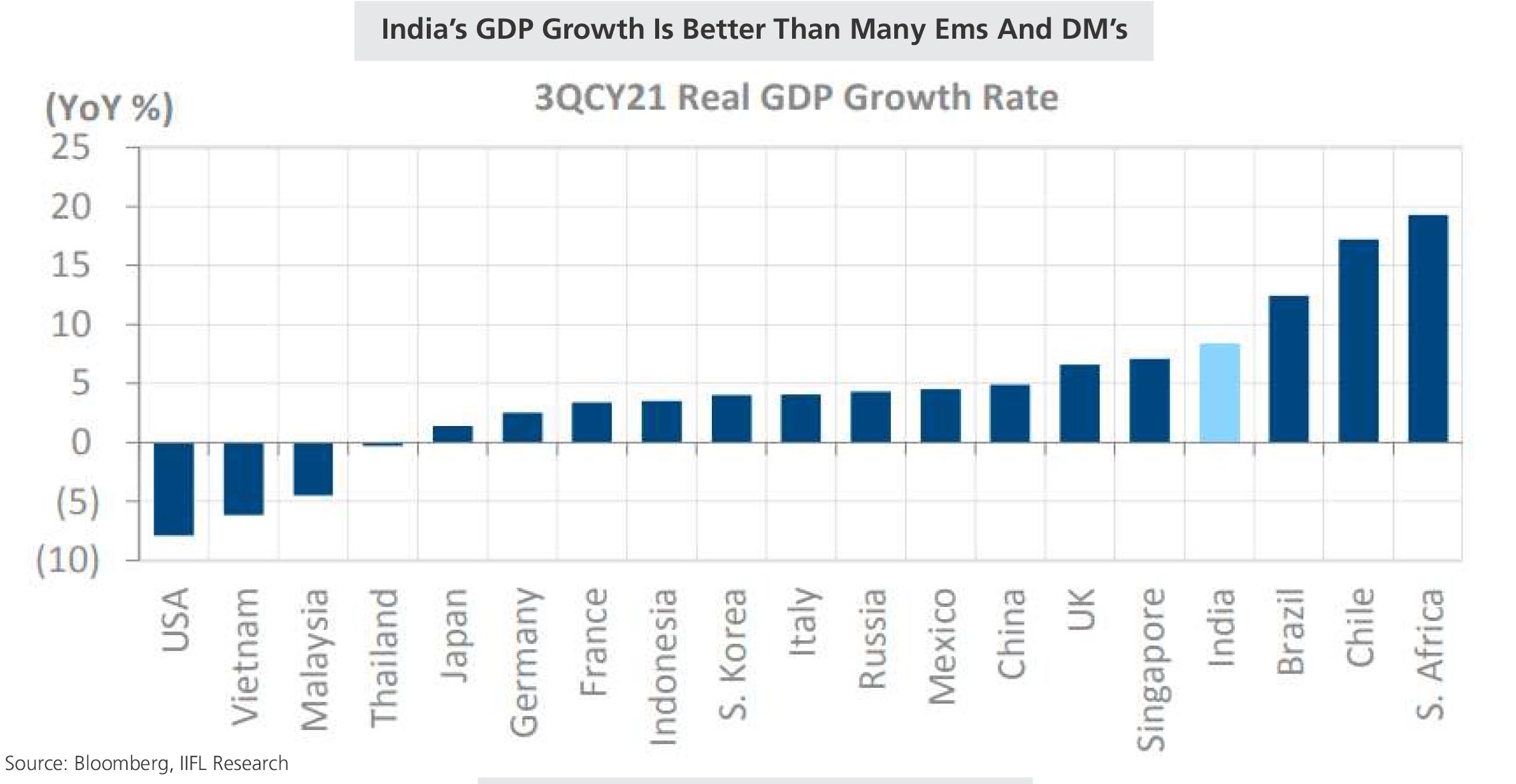

• India’s GDP grew by 8.4% in Q2FY22, with private consumption (PFCE) and investments (GFCF) up 8.6% y/y and 8.7% y/y respectively.

Services, particularly the contact based industry created the drag on the economy

• Headline CPI print for October came at 4.5%, with upside surprise coming in from core CPI which rose to 6.1%, the first above 6% print in

four months. Food & Beverages CPI inflation also seemed to have bottomed out

• Centre’s fiscal deficit stood at 36.3% for April-October period. The deficit stood at 6.4% of GDP during 1H vs 6.8% target for full year.

Revenues stood at Rs12.6 trillion with tax collections at 68% of budgeted estimate

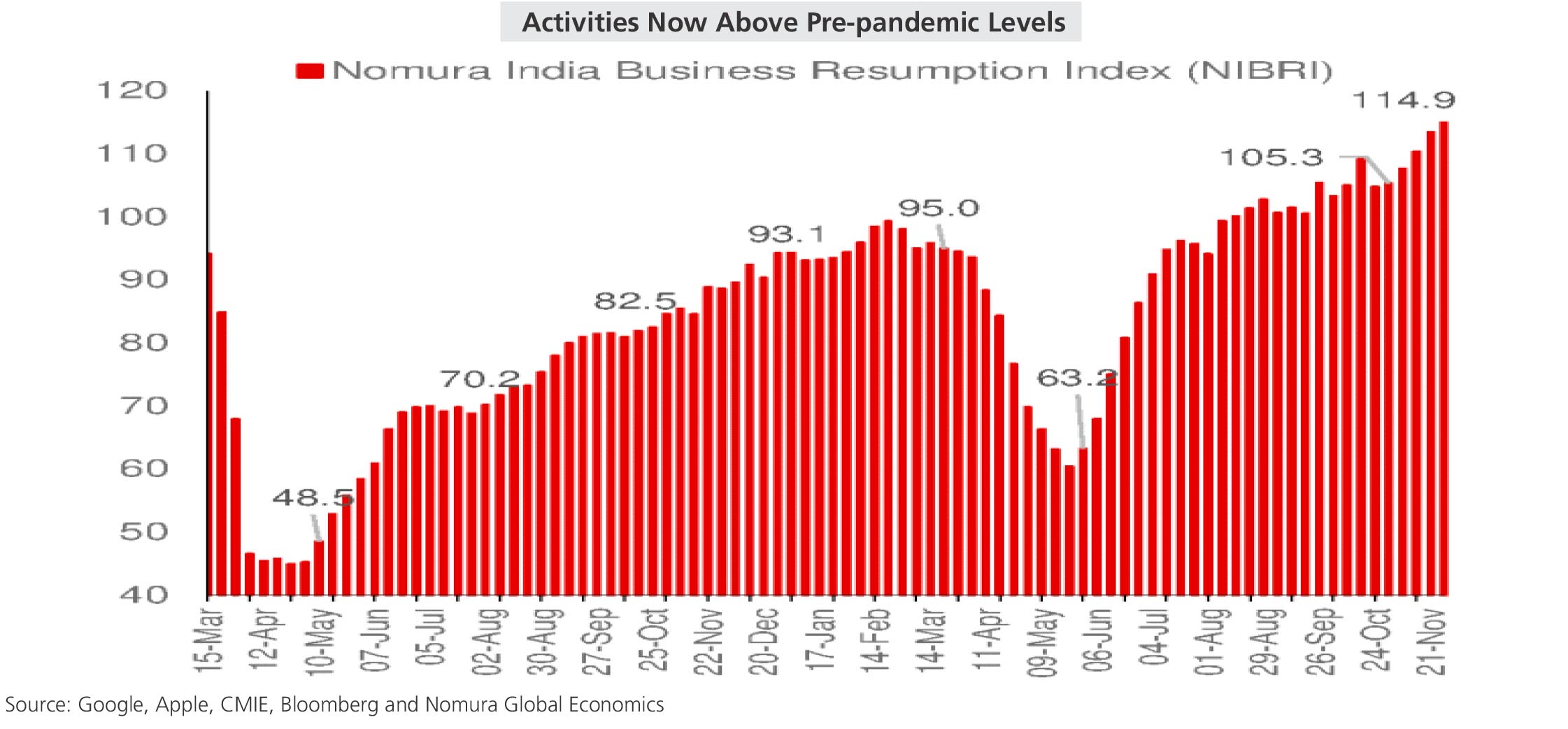

• By the last week of November, India had administered over 1.22bn vaccine doses wherein ~55% of the population received the first dose

while ~32% of the population was fully vaccinated

• FII selling continued, to the tune of -$0.8bn in Nov (YTD +$5.5bn), despite healthy participation in IPOs and MSCI rebal inflows while

DII buying ramped up to +$4.1bn (YTD +$8.4bn) driven by both MFs (+$1.8bn) and Insurance

• India’s manufacturing PMI increased the fastest in 10 months in November. Manufacturing activity increased at 57.6, which is a jump from

55.9 in October.