| KOTAK BOND FUND

An open-ended medium term debt scheme investing in instruments such that the macaulay duration of the portfolio is between 4 years and 7 years

An open-ended medium term debt scheme investing in instruments such that the macaulay duration of the portfolio is between 4 years and 7 years

| KOTAK BOND FUND

An open-ended medium term debt scheme investing in instruments such that the macaulay duration of the portfolio is between 4 years and 7 years

An open-ended medium term debt scheme investing in instruments such that the macaulay duration of the portfolio is between 4 years and 7 years

Investment Objective

The investment objective of the Scheme is

to create a portfolio of debt instruments

such as bonds, debentures, Government

Securities and money market instruments,

including repos in permitted securities of

different maturities, so as to spread the risk

across different kinds of issuers in the debt

markets. There is no assurance that the

investment objective of the Scheme will be

achieved.

The investment objective of the Scheme is

to create a portfolio of debt instruments

such as bonds, debentures, Government

Securities and money market instruments,

including repos in permitted securities of

different maturities, so as to spread the risk

across different kinds of issuers in the debt

markets. There is no assurance that the

investment objective of the Scheme will be

achieved.

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Debt Instruments | ||

| Debentures and Bonds | ||

| Government Dated Securities | ||

| 4.62% Central Government(^) | SOV | 14.13 |

| 6.38% State Government-Maharashtra | SOV | 10.33 |

| 6.58% State Government-Gujarat | SOV | 10.18 |

| 6.64% Central Government | SOV | 8.62 |

| 7.84% State Government-Tamil Nadu | SOV | 6.58 |

| 4.04% Central Government | SOV | 6.33 |

| 7.92% State Government-West Bengal | SOV | 5.53 |

| 6.72% State Government-Kerala | SOV | 5.43 |

| 6.67% Central Government | SOV | 3.73 |

| 7.85% State Government-Rajasthan | SOV | 2.02 |

| 7.61% State Government-Tamil Nadu | SOV | 1.82 |

| 7.23% State Government-Rajasthan | SOV | 1.79 |

| 7.29% State Government-Kerala | SOV | 1.44 |

| 6.45% State Government-Rajasthan | SOV | 1.33 |

| 7.18% State Government-Uttarakhand | SOV | 1.25 |

| 7.39% State Government-Maharashtra | SOV | 1.08 |

| GS CG 22 Feb 2029 - (STRIPS) | SOV | 1.02 |

| GS CG 22 Aug 2029 - (STRIPS) | SOV | 0.99 |

| 7.29% State Government-West Bengal | SOV | 0.90 |

| 7.15% State Government-Rajasthan | SOV | 0.89 |

| 4.59% Central Government | SOV | 0.87 |

| 8.39% State Government-Rajasthan | SOV | 0.74 |

| GS CG 22 Feb 2027 - (STRIPS) | SOV | 0.68 |

| GS CG 22 Feb 2028 - (STRIPS) | SOV | 0.62 |

| GS CG 22 Aug 2027 - (STRIPS) | SOV | 0.52 |

| GS CG 22/02/2026 - (STRIPS) | SOV | 0.46 |

| 1.44% Central Government | SOV | 0.43 |

| GS CG 22 Aug 2028 - (STRIPS) | SOV | 0.38 |

| GS CG 23/12/2025 - (STRIPS) | SOV | 0.22 |

| 8.24% State Government-Tamil Nadu | SOV | 0.19 |

| 6.85% State Government-Kerala | SOV | 0.18 |

| GS 6.76% CG 22/02/2061 - (STRIPS) | SOV | 0.11 |

| GS CG 22 Feb 2022 - (STRIPS) | SOV | 0.06 |

| GS CG 22 Aug 2022 - (STRIPS) | SOV | 0.06 |

| GS CG 22 Feb 2023 - (STRIPS) | SOV | 0.06 |

| GS CG 22 Feb 2025 - (STRIPS) | SOV | 0.05 |

| GS CG 22 Aug 2025 - (STRIPS) | SOV | 0.05 |

| GS CG 22 Aug 2023 - (STRIPS) | SOV | 0.05 |

| GS CG 22 Aug 2026 - (STRIPS) | SOV | 0.04 |

| GS CG 22 Aug 2031 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Aug 2030 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Feb 2031 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Aug 2032 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Feb 2030 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Feb 2032 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Feb 2036 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Aug 2036 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Aug 2047 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2037 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2052 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2055 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2052 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2048 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2043 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2054 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2049 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2055 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2046 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2050 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2053 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2044 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2043 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2056 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2049 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2051 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2050 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2047 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2046 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2045 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2048 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2045 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2051 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2044 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2053 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2054 - (STRIPS) | SOV | 0.01 |

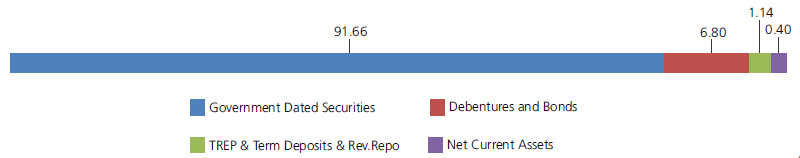

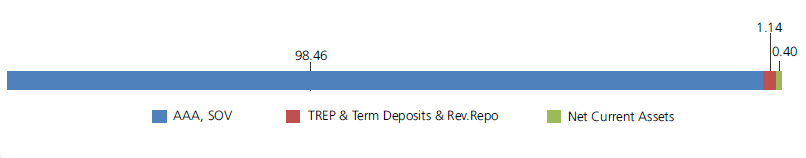

| Government Dated Securities - Total | 91.66 | |

| Public Sector Undertakings | ||

| Power Finance Corporation Ltd. | CRISIL AAA | 5.03 |

| Rural Electrification Corporation Ltd. | CRISIL AAA | 1.72 |

| National Highways Authority Of India | CRISIL AAA | 0.05 |

| Public Sector Undertakings - Total | 6.80 | |

| Triparty Repo | 1.14 | |

| Net Current Assets/(Liabilities) | 0.40 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (Rs) | 26,40,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Oct 29, 2021 (₹) | 69,55,793 | 17,64,184 | 10,83,330 | 7,18,369 | 4,01,282 | 1,22,709 |

| Scheme Returns (%) | 8.02 | 7.49 | 7.16 | 7.15 | 7.20 | 4.26 |

| Nifty Medium to Long Duration Debt Index Returns (%) | NA | 8.44 | 8.22 | 8.24 | 8.42 | 5.33 |

| Alpha | NA | -0.95 | -1.05 | -1.09 | -1.22 | -1.07 |

| Nifty Medium to Long Duration Debt Index (Rs)# | NA | 18,54,757 | 11,24,806 | 7,38,163 | 4,08,560 | 1,23,385 |

| CRISIL 10 Year Gilt Index (Rs)^ | NA | 17,13,139 | 10,57,223 | 6,98,815 | 3,90,036 | 1,20,701 |

| CRISIL 10 Year Gilt Index Returns (%) | NA | 6.93 | 6.48 | 6.05 | 5.29 | 1.10 |

Scheme Inception : - November 25,1999. The returns are calculated by XIRR approach assuming investment of ₹10,000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial and final value and a series of cash inflows and outflows and taking the time of investment into consideration. Since inception returns are assumed to be starting from the beginning of the subsequent month from the date of inception. # Benchmark ; ^ Additional Benchmark.

Alpha is difference of scheme return with benchmark return.

Alpha is difference of scheme return with benchmark return.

NAV

| Growth Option | Rs62.3970 |

| Direct Growth Option | Rs67.3708 |

| Quarterly-Reg-Plan-IDCW | Rs13.1762 |

| Quarterly-Dir-Plan-IDCW | Rs18.1254 |

| Annual-Reg-Plan-IDCW | Rs38.2285 |

| Annual-Dir-Plan-IDCW | Rs22.4231 |

| Fund Manager | Mr. Abhishek Bisen* |

| Benchmark | NIFTY Medium to Long Duration Debt Index |

| Allotment date | November 25, 1999 |

| AAUM | Rs2,900.29 crs |

| AUM | Rs2,903.83 crs |

| Folio count | 5,669 |

Available Plans/Options

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

IDCW Frequency

At discretion of trustees

Ratios

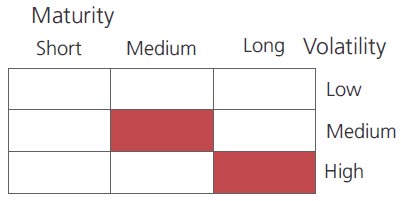

| Portfolio Average Maturity | 7.65 yrs |

| IRS Average Maturity* | 0.47 yrs |

| Net Average Maturity | 8.12 yrs |

| Portfolio Modified Duration | 4.02 yrs |

| IRS Modified Duration* | 0.40 yrs |

| Net Modified Duration | 4.43 yrs |

| Portfolio Macaulay Duration | 4.16 yrs |

| IRS Macaulay Duration* | 0.42 yrs |

| Net Macaulay Duration | 4.57 yrs |

| YTM | 6.08% |

| $Standard Deviation | 3.57% |

Minimum Investment Amount

Initial Investment: Rs5000 and in multiple

of Rs1 for purchase and for Rs0.01 for

switches

Additional Investment: Rs1000 & in multiples

of Rs1

Ideal Investments Horizon: 2-3 years

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load: Nil.(applicable for all plans)

Note: The aforesaid revised exit load

structure will be applicable only on a

prospective basis for Units purchased

/SIP/STP registered on or after April 20,

2021.

Total Expense Ratio**

Regular: 1.62%; Direct: 0.74%

Data as on October 31, 2021

Fund

Benchmark

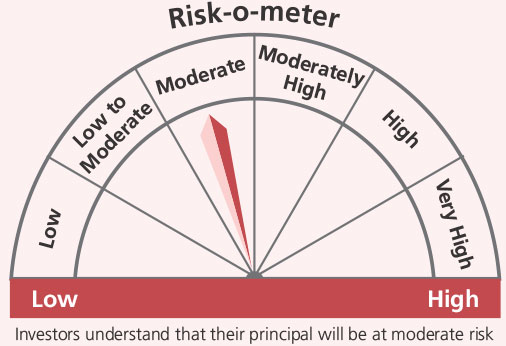

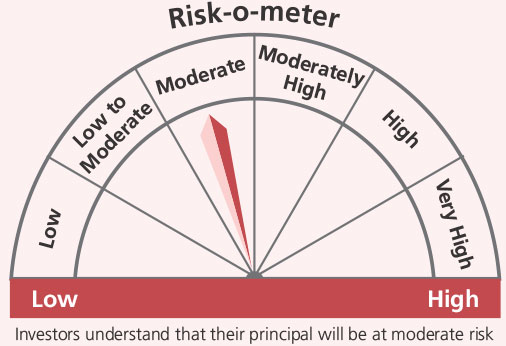

This product is suitable for investors who are seeking*:

- Income over a long investment horizon

- Investment in debt & money market securities with a portfolio Macaulay duration between 4 years & 7 years.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'