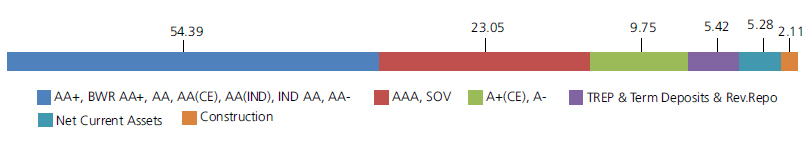

An open-ended debt scheme predominantly investing in aa and below rated corporate bonds (excluding AA+ rated corporate bonds)

An open-ended debt scheme predominantly investing in aa and below rated corporate bonds (excluding AA+ rated corporate bonds)

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

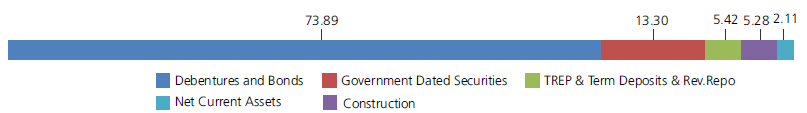

| Mutual Fund Units - Total | 2.11 | |

| Embassy Office Parks REIT | Construction | 1.11 |

| Brookfield India Real Estate Trust | Construction | 1.00 |

| Debt Instruments | ||

| Debentures and Bonds | ||

| Government Dated Securities | ||

| 4.62% Central Government | SOV | 4.81 |

| 7.20% State Government-Karnataka | SOV | 2.91 |

| 6.12% State Government-Karnataka | SOV | 2.76 |

| 6.57% State Government-Gujarat | SOV | 1.67 |

| 6.97% State Government-Maharashtra | SOV | 1.15 |

| Government Dated Securities - Total | 13.30 | |

| Public Sector Undertakings | ||

| Punjab & Sind Bank(Basel III TIER I Bonds) | ICRA A- | 6.53 |

| Power Finance Corporation Ltd.(^) | CRISIL AAA | 4.71 |

| Union Bank of India(Basel III TIER I Bonds) | CARE AA- | 3.72 |

| U P Power Corporation Ltd ( Guaranteed By UP State Government ) | CRISIL A+(CE) | 3.22 |

| THDC India Ltd. (THDCIL) | FITCH AA(IND) | 2.26 |

| THDC India Ltd. (THDCIL)(^) | CARE AA | 1.43 |

| Punjab National Bank(Basel III TIER II Bonds)(^) | CRISIL AA+ | 0.29 |

| National Bank for Agriculture & Rural Development | CRISIL AAA | 0.16 |

| Public Sector Undertakings - Total | 22.32 | |

| Corporate Debt/Financial Institutions | ||

| Coastal Gujarat Power Ltd. ( Guarenteed by TATA Power Co. Ltd ) (^) | CARE AA(CE) | 6.39 |

| Telesonic Networks Limited (^) | CRISIL AA+ | 6.16 |

| Aadhar Housing Finance Limited | CARE AA | 5.60 |

| Bahadur Chand Investments Private Limited | ICRA AA | 4.20 |

| Bajaj Housing Finance Ltd. | CRISIL AAA | 4.18 |

| Godrej Industries Ltd | CRISIL AA | 3.40 |

| Godrej Properties Limited(^) | ICRA AA | 2.86 |

| Nuvoco Vistas Corporation Ltd. (^) | CRISIL AA | 2.83 |

| Tata Projects Ltd. | FITCH IND AA | 2.81 |

| Godrej Industries Ltd | CRISIL AA | 2.57 |

| Muthoot Finance Ltd.(^) | CRISIL AA+ | 2.21 |

| Manappuram Finance Ltd. | CRISIL AA | 1.69 |

| Tata Power Company Ltd. | FITCH IND AA | 1.64 |

| Tata Steel Ltd. | BRICKWORK BWR AA+ | 1.53 |

| Muthoot Finance Ltd. (^) | CRISIL AA+ | 0.85 |

| Jamnagar Utilities & Power Private Limited ( Mukesh Ambani Group ) (^) | CRISIL AAA | 0.59 |

| SEI Enerstar Renewable Energy Pvt. Ltd. # | CARE AA(CE) | 0.43 |

| Zuvan Energy Pvt. Ltd. # | CARE AA(CE) | 0.18 |

| Shreyas Renwable Energy Pvt. Ltd. # | CARE AA(CE) | 0.18 |

| Pratyash Renewable Pvt. Ltd. # | CARE AA(CE) | 0.18 |

| SEI Baskara Power Pvt. Ltd. # | CARE AA(CE) | 0.18 |

| Aarish Solar Power Ltd. # | CARE AA(CE) | 0.18 |

| Divyesh Power Pvt. Ltd. # | CARE AA(CE) | 0.18 |

| Elena Renewable Energy Pvt. Ltd. # | CARE AA(CE) | 0.18 |

| Aashman Energy Pvt. Ltd. # | CARE AA(CE) | 0.18 |

| Shriram City Union Finance Ltd. | CARE AA | 0.08 |

| HDFC Ltd. | CRISIL AAA | 0.06 |

| LIC Housing Finance Ltd. | CRISIL AAA | 0.05 |

| Corporate Debt/Financial Institutions - Total | 51.57 | |

| Triparty Repo | 5.42 | |

| Net Current Assets/(Liabilities) | 5.28 | |

| Grand Total | 100.00 | |

# (Solar power generating SPV of Greenko Group with offtaker as NTPC & secured by corporate guarantee of Greenko Energies Pvt. Ltd.)

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (Rs) | 13,80,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Oct 29, 2021 (Rs) | 22,05,525 | 17,84,634 | 10,84,103 | 7,12,627 | 3,98,791 | 1,23,854 |

| Scheme Returns (%) | 7.85 | 7.71 | 7.18 | 6.83 | 6.78 | 6.08 |

| NIFTY Credit Risk Bond Index Returns (%) | 9.30 | 9.23 | 8.99 | 9.04 | 9.55 | 8.27 |

| Alpha* | -1.44 | -1.53 | -1.80 | -2.21 | -2.76 | -2.19 |

| NIFTY Credit Risk Bond Index (Rs)# | 24,10,122 | 19,33,878 | 11,56,002 | 7,53,118 | 4,15,347 | 1,25,228 |

| CRISIL 10 Year Gilt Index (Rs)^ | 20,74,820 | 17,13,139 | 10,57,223 | 6,98,815 | 3,90,036 | 1,20,701 |

| CRISIL 10 Year Gilt Index (%) | 6.85 | 6.93 | 6.48 | 6.05 | 5.29 | 1.10 |

Alpha is difference of scheme return with benchmark return.

| Growth Option | Rs24.2500 |

| Direct Growth Option | Rs26.3404 |

| Weekly-Reg-Plan-IDCW | Rs10.0846 |

| Weekly-Dir-Plan-IDCW | Rs10.4393 |

| Monthly-Reg-Plan-IDCW | Rs10.9007 |

| Monthly-Dir-Plan-IDCW | Rs10.6242 |

| Quarterly-Reg-Plan-IDCW | Rs11.5359 |

| Quarterly Dir-Plan-IDCW | Rs10.5550 |

| Annual-Reg-Plan-IDCW | Rs10.5460 |

| Annual-Dir-Plan-IDCW | Rs19.7842 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Deepak Agrawal* |

| Benchmark | Nifty Credit Risk Bond Index |

| Allotment date | May 11, 2010 |

| AAUM | Rs1,799.77 crs |

| AUM | Rs1,786.28 crs |

| Folio count | 14,943 |

At discretion of trustees

| Portfolio Average Maturity | 3.87 yrs |

| IRS Average Maturity* | -0.27 yrs |

| Net Average Maturity | 3.60 yrs |

| Portfolio Modified Duration | 2.43 yrs |

| IRS Modified Duration* | -0.26 yrs |

| Net Modified Duration | 2.18 yrs |

| Portfolio Macaulay Duration | 2.60 yrs |

| IRS Macaulay Duration* | -0.26 yrs |

| Net Macaulay Duration | 2.34 yrs |

| YTM | 6.33% |

| $Standard Deviation | 1.18% |

Initial Investment:Rs5000 and in multiple

of Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in multiples of Rs1

Ideal Investments Horizon: 3 year & above

Entry Load: Nil. (applicable for all plans)

Exit Load: a) For redemption / switch out of

upto 6% of the initial investment amount

(limit) purchased or switched in within 1

year from the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

Regular: 1.72%; Direct: 0.74%

Fund

Benchmark

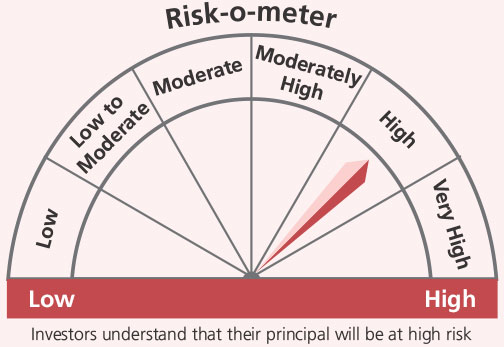

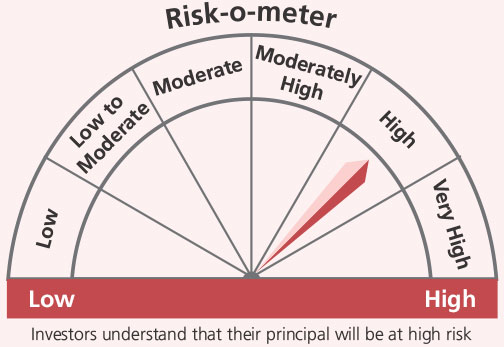

This product is suitable for investors who are seeking*:

- Income over a medium term investment horizon

- Investment predominantly in in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds)

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

(^) Fully or Party blocked against Interest Rate Swap (IRS) Hedging Position through Interest Rate Swaps as on 31 Oct 2021 is 22.44% of the net assets.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'