Key Events for the Month of September 2021:

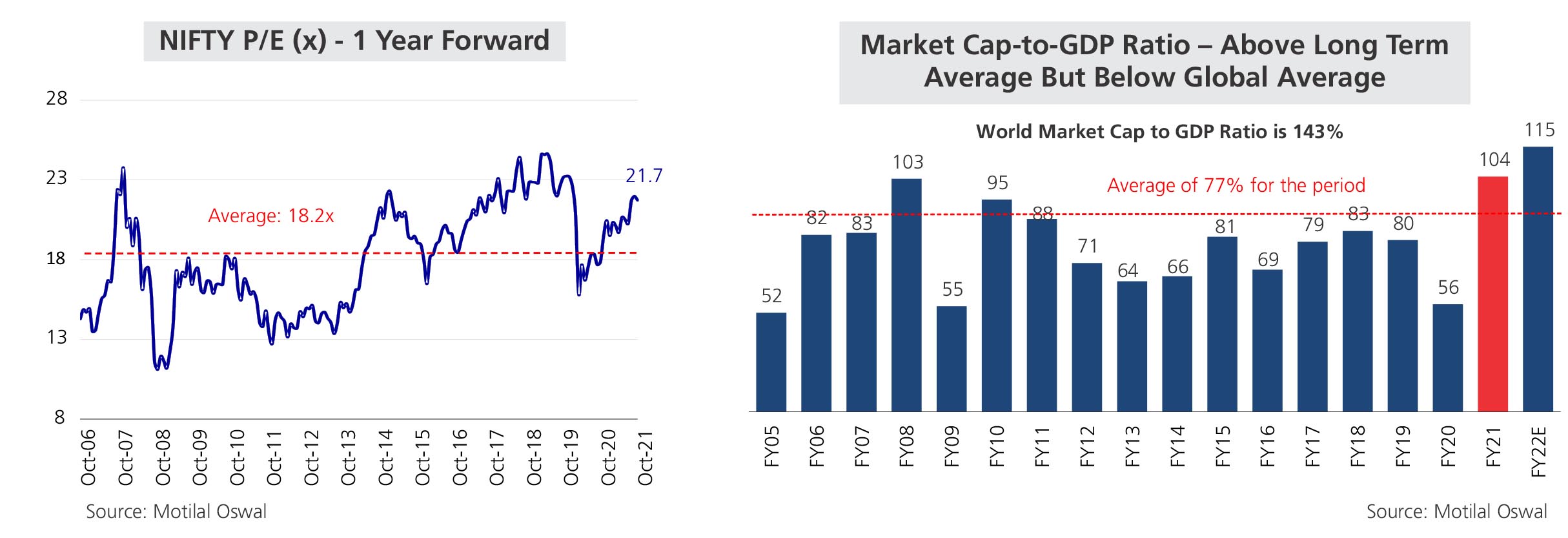

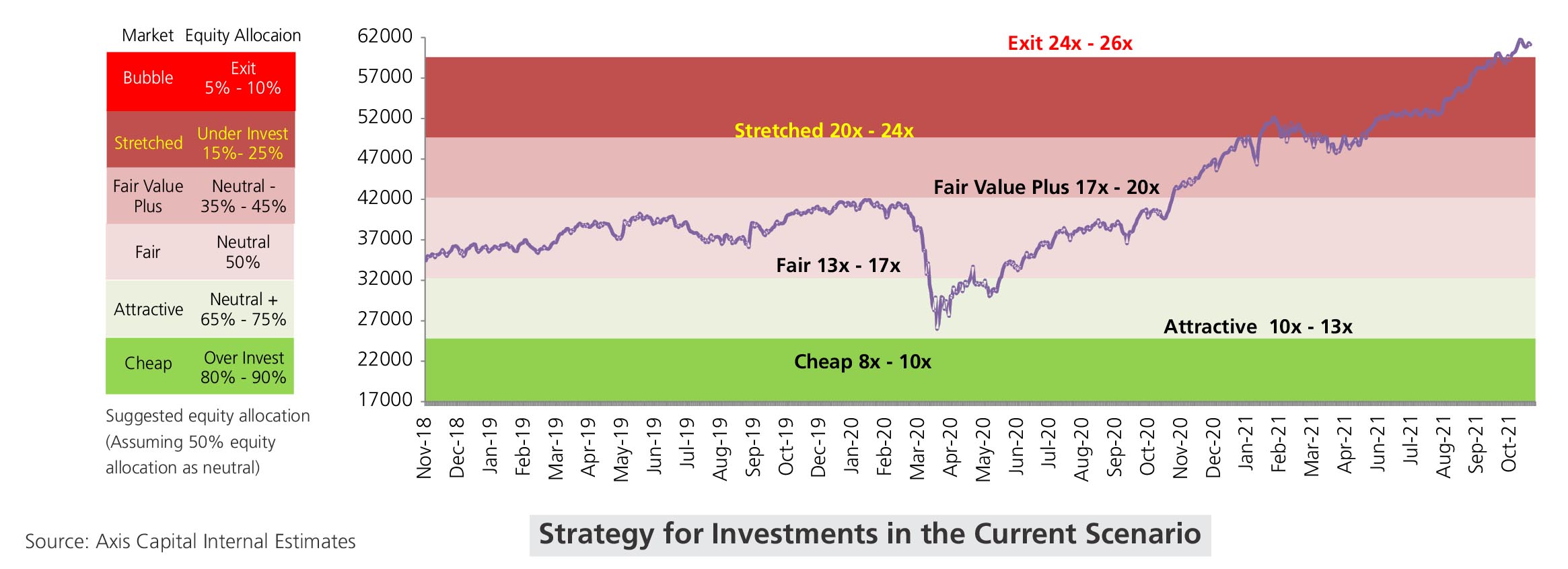

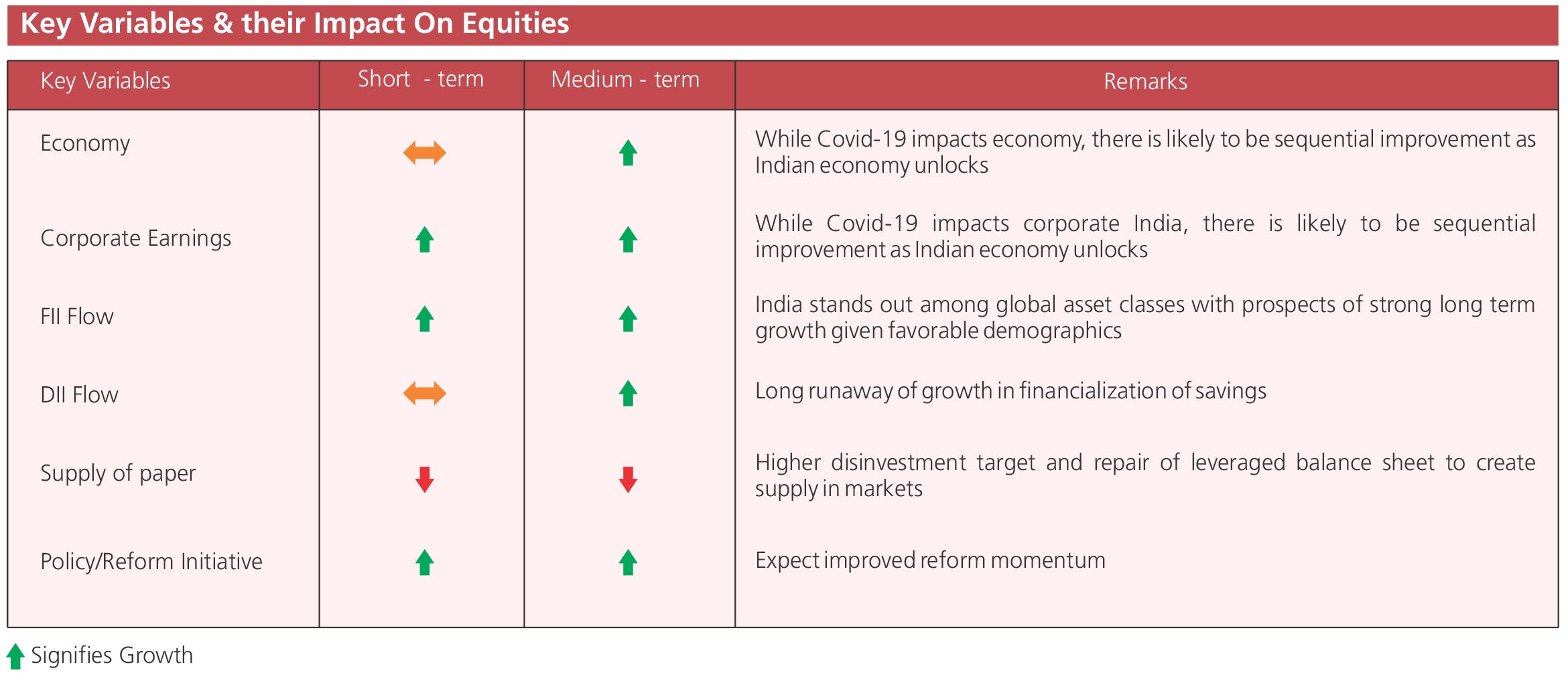

• Nifty (+0.3%) closed almost flat for the month (u/p the region) after making a new all-time high and then falling on most days in the second

half of October. Stretched valuations, rising crude, mixed earnings, a slew of large upcoming IPOs were some of the reasons that could be

attributed to the sell-off.

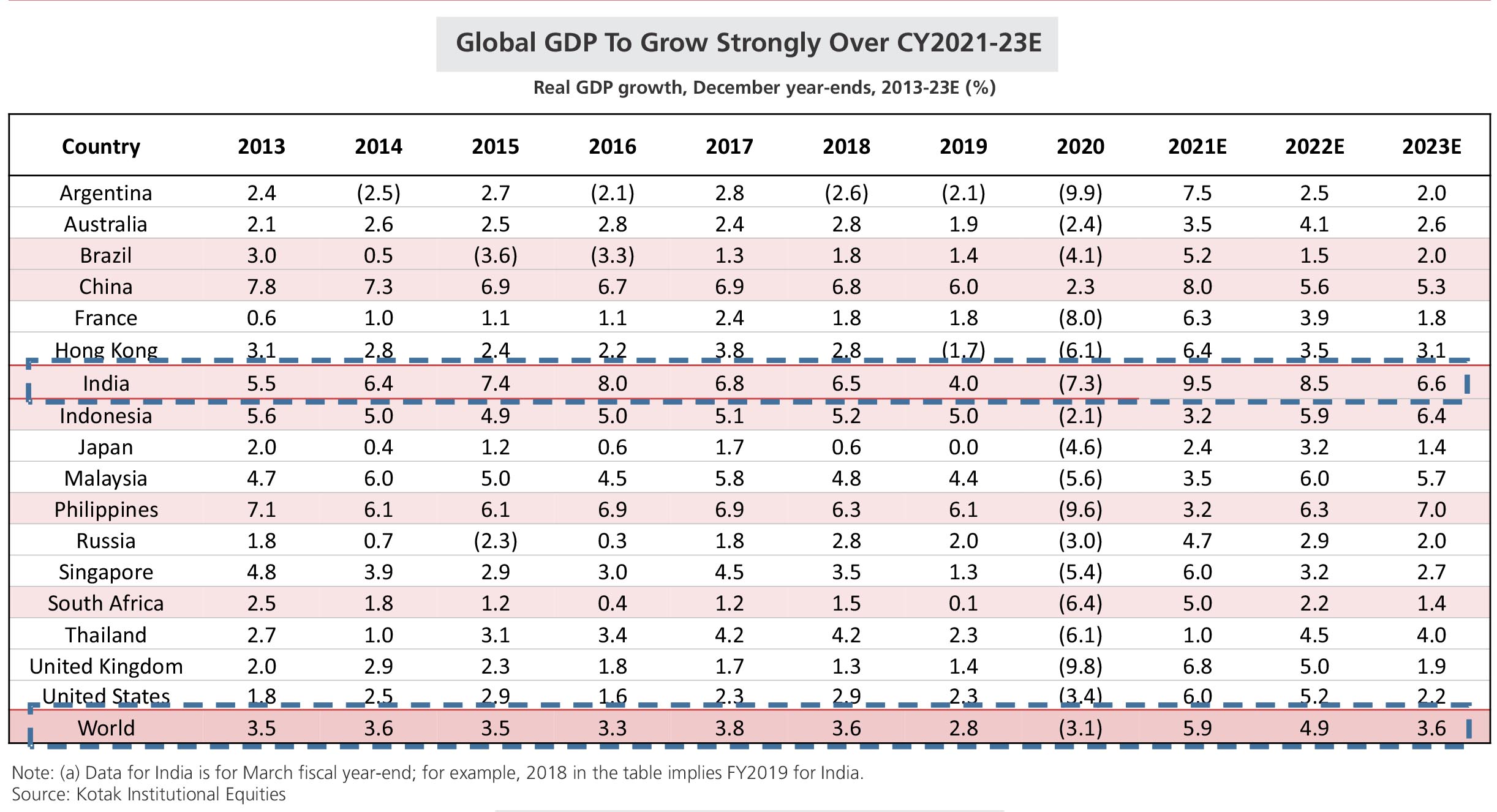

• IMF retained India’s GDP growth forecast for FY22 at 9.5%and for FY23, IMF’s forecast stood at 8.5%. With this, India retained the tag of

the fastest growing large economy, both for FY22 and FY23

• RBI MPC maintained status quo on rates while maintaining FY22 GDP growth forecast at 9.5%.

• Services PMI rises to over a decade high of 58.4 in October 2021

• Exports rise over 42% to $35.5 billion in Oct 2021

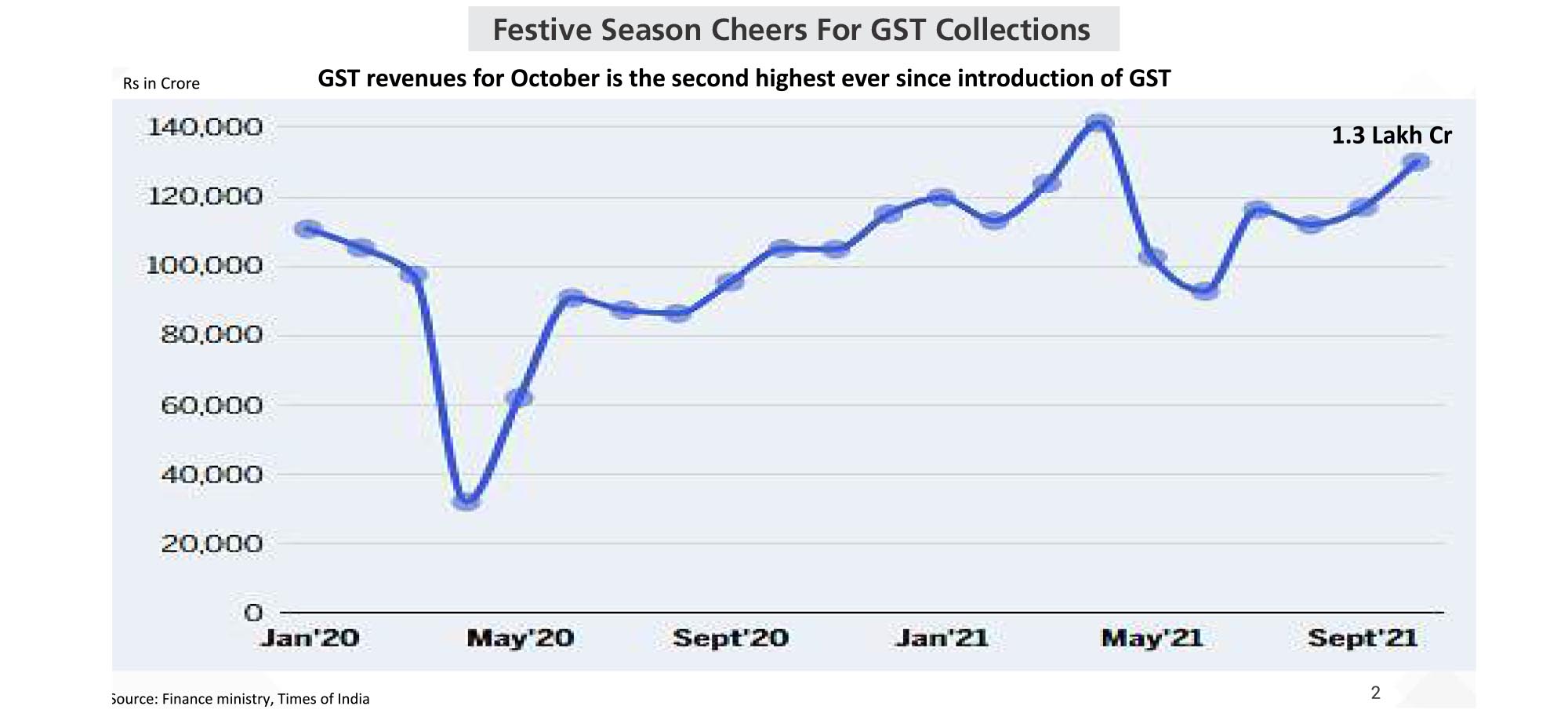

• GST revenues (1.3 lakh Cr) for October is the second highest ever since introduction of GST

• Favourable base and subdued food inflation led to Sep CPI print at 4.35%

• Centre’s fiscal deficit stood at just 35% of the annual target by 1H-end. Gross tax revenues continued to beat expectations, with 1H collections

at 53% of full year budget

• Covid cases during the month remained under control (daily sub-20k) even as vaccine doses crossed the 1bn mark

• FIIs turned net sellers to the tune of ~$2.2bn while DIIs were net buyers of ~$0.6bn.In terms of sectors, autos, banks and utilities

outperformed while FMCG, Pharma and Realty underperformed.