Investment Objective

The investment objective of the scheme is

to generate long-term capital appreciation

from a diversified portfolio of equity and

equity related securities and enable

investors to avail the income tax rebate, as

permitted from time to time however, there

is no assurance that the objective of the

scheme will be realized.

The investment objective of the scheme is

to generate long-term capital appreciation

from a diversified portfolio of equity and

equity related securities and enable

investors to avail the income tax rebate, as

permitted from time to time however, there

is no assurance that the objective of the

scheme will be realized.

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related | ||

| Banks | 22.39 | |

| ICICI Bank Ltd. | 8.63 | |

| State Bank Of India | 5.73 | |

| HDFC Bank Ltd. | 3.75 | |

| Axis Bank Ltd. | 2.32 | |

| AU Small Finance Bank Ltd. | 1.96 | |

| Software | 10.30 | |

| Infosys Ltd. | 5.74 | |

| Tata Consultancy Services Ltd. | 3.29 | |

| Tech Mahindra Ltd. | 1.27 | |

| Chemicals | 6.70 | |

| SRF Ltd. | 3.51 | |

| Linde India Ltd. | 2.23 | |

| Solar Industries India Limited | 0.96 | |

| Consumer Non Durables | 6.30 | |

| United Spirits Ltd. | 1.84 | |

| ITC Ltd. | 1.83 | |

| FSN E-Commerce Ventures Ltd. | 1.79 | |

| Balrampur Chini Mills Ltd. | 0.84 | |

| Cement & Cement Products | 5.73 | |

| Ultratech Cement Ltd. | 2.14 | |

| Ambuja Cements Ltd. | 1.31 | |

| The Ramco Cements Ltd | 1.15 | |

| Dalmia Bharat Limited | 1.13 | |

| Pharmaceuticals | 5.19 | |

| Sun Pharmaceuticals Industries Ltd. | 2.22 | |

| Cipla Ltd. | 1.56 | |

| Cadila Healthcare Ltd | 1.41 | |

| Construction Project | 4.37 | |

| Larsen And Toubro Ltd. | 4.37 | |

| Consumer Durables | 3.71 | |

| Blue Star Ltd. | 1.06 | |

| Sheela Foam Ltd | 1.06 | |

| V-Guard Industries Ltd. | 0.95 | |

| Bata India Ltd. | 0.64 | |

| Industrial Products | 3.33 | |

| SKF India Ltd | 1.43 | |

| Bharat Forge Ltd. | 1.16 | |

| AIA Engineering Limited. | 0.62 | |

| Mold-Tek Packaging Ltd. | 0.12 | |

| Petroleum Products | 3.28 | |

| Reliance Industries Ltd. | 3.28 | |

| Finance | 3.03 | |

| Bajaj Finance Ltd. | 3.03 | |

| Industrial Capital Goods | 2.91 | |

| Thermax Ltd. | 1.63 | |

| ABB India Ltd. | 1.28 | |

| Auto | 2.45 | |

| Bajaj Auto Ltd. | 1.01 | |

| Hero MotoCorp Ltd. | 0.80 | |

| Maruti Suzuki India Limited | 0.64 | |

| Ferrous Metals | 2.43 | |

| Jindal Steel & Power Ltd. | 2.43 | |

| Transportation | 2.14 | |

| Blue Dart Express Ltd. | 1.15 | |

| Container Corporation of India Ltd. | 0.99 | |

| Insurance | 1.99 | |

| Bajaj Finserv Ltd. | 1.15 | |

| Max Financial Services Ltd. | 0.84 | |

| Fertilisers | 1.86 | |

| Coromandel International Ltd. | 1.86 | |

| Gas | 1.72 | |

| Gujarat State Petronet Ltd. | 1.18 | |

| Gujarat Gas Ltd. | 0.54 | |

| Telecom - Services | 1.52 | |

| Bharti Airtel Ltd | 1.48 | |

| Bharti Airtel Ltd - Partly Paid Shares | 0.04 | |

| Auto Ancillaries | 1.27 | |

| Balkrishna Industries Ltd. | 1.27 | |

| Construction | 1.21 | |

| Ashoka Buildcon Limited | 0.68 | |

| JMC Projects (India) Ltd. | 0.53 | |

| Non - Ferrous Metals | 1.19 | |

| Hindalco Industries Ltd | 1.19 | |

| Retailing | 1.02 | |

| Zomato Ltd. | 1.02 | |

| Power | 1.00 | |

| Kalpataru Power Transmission Ltd. | 1.00 | |

| Household Appliances | 0.52 | |

| Hawkins Cooker Ltd | 0.52 | |

| Capital Markets | 0.08 | |

| Aditya Birla Sun Life AMC Ltd | 0.08 | |

| Equity & Equity Related - Total | 97.64 | |

| 6% Redm Preference Sh Zee Entertainment Enterprises Ltd. | Entertainment | 0.01 |

| Preference Share - Total | 0.01 | |

| Triparty Repo | 0.56 | |

| Net Current Assets/(Liabilities) | 1.79 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (Rs) | 19,20,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on October 29, 2021 (Rs) | 64,74,129 | 29,03,808 | 15,32,559 | 9,78,420 | 5,45,124 | 1,44,169 |

| Scheme Returns (%) | 13.84 | 16.85 | 16.89 | 19.69 | 29.00 | 39.77 |

| Nifty 500 (TRI) Returns (%) | 13.97 | 16.61 | 17.51 | 20.57 | 30.75 | 44.54 |

| Alpha | -0.13 | 0.24 | -0.62 | -0.88 | -1.76 | -4.77 |

| Nifty 500 (TRI) (Rs)# | 65,54,478 | 28,66,622 | 15,66,777 | 9,99,571 | 5,58,021 | 1,46,918 |

| Nifty 50 (TRI) (Rs)^ | 63,19,897 | 27,56,874 | 15,50,258 | 9,94,273 | 5,42,038 | 1,44,782 |

| Nifty 50 (TRI) Returns (%) | 13.58 | 15.89 | 17.22 | 20.35 | 28.57 | 40.83 |

Scheme Inception : - November 23, 2005. The returns are calculated by XIRR approach assuming investment of Rs10,000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial

and final value and a series of cash inflows and outflows and taking the time of investment into consideration. Since inception returns are assumed to be starting from the beginning of the subsequent month from the date of

inception. # Benchmark ; ^ Additional Benchmark

TRI - Total Return Index, In terms of SEBI circular dated January 4, 2018, the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI).

Alpha is difference of scheme return with benchmark return.

TRI - Total Return Index, In terms of SEBI circular dated January 4, 2018, the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI).

Alpha is difference of scheme return with benchmark return.

NAV

| Reg-Plan-IDCW | Rs26.5140 |

| Dir-Plan-IDCW | Rs33.1790 |

| Growth option | Rs70.8460 |

| Direct Growth option | Rs79.2070 |

Available Plans/Options

A) Regular Plan B) Direct Plan

Options: Payout of IDCW & Growth

(applicable for all plans)

Ratios

| Fund Manager | Mr. Harsha Upadhyaya* |

| Benchmark | Nifty 500 TRI |

| Allotment date | November 23, 2005 |

| AAUM | Rs2,338.08 crs |

| AUM | Rs2,323.06 crs |

| Folio count | 2,64,869 |

IDCW Frequency

Trustee's Discretion

Ratios

| Portfolio Turnover | 38.92% |

| $Beta | 0.92 |

| $Sharpe ## | 0.91 |

| $Standard Deviation | 20.62% |

| (P/E) | 32.97 |

| P/BV | 4.00 |

| IDCW Yield | 0.73 |

Minimum Investment Amount

Initial Investment:

Rs500 and in multiple of

Rs500

Additional Investment: Rs500 & in

multiples of Rs500

Ideal Investments Horizon: 5 years & above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load: Exit Load is not applicable for

Kotak Tax Saver Fund. (applicable for all

plans)

Total Expense Ratio**

Regular: 2.08%; Direct: 0.72%

Data as on October 31, 2021

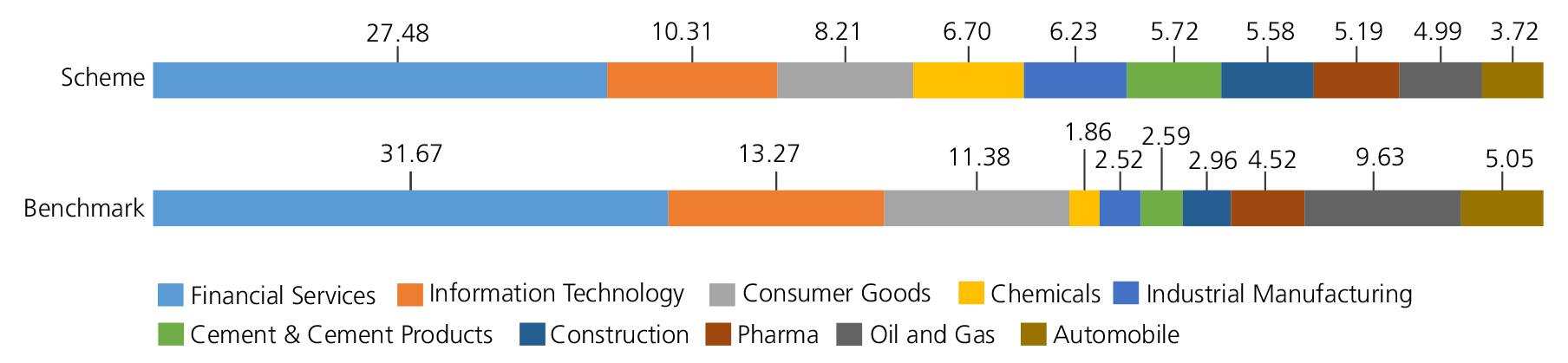

Fund

Benchmark

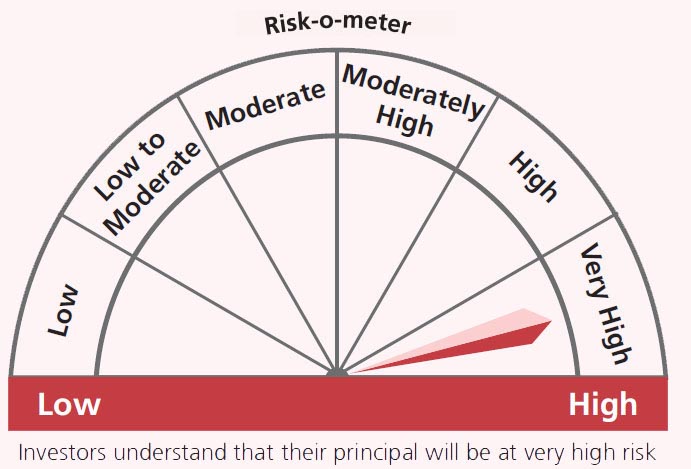

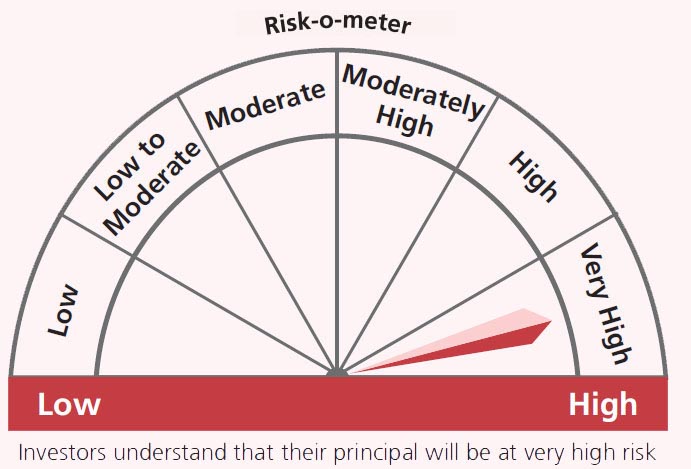

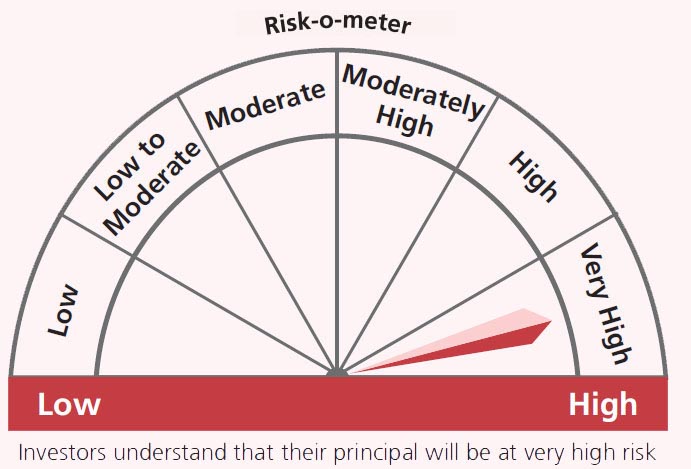

This product is suitable for investors who are seeking*:

Benchmark

This product is suitable for investors who are seeking*:

- long term capital growth with a 3 year lock in

- Investment in portfolio of predominantly equity & equity related securities.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

## Risk rate assumed to be 3.42% (FBIL Overnight MIBOR rate as on 29th October 2021).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'