The investment objective of the scheme is to generate capital appreciation and income by predominantly investing in arbitrage opportunities in the cash and derivatives segment of the equity market, and by investing the balance in debt and money market instruments.

The investment objective of the scheme is to generate capital appreciation and income by predominantly investing in arbitrage opportunities in the cash and derivatives segment of the equity market, and by investing the balance in debt and money market instruments.

| Issuer/ Instrument |

Industry/ Rating |

% to Net Assets |

% to Net Assets Derivatives |

|---|---|---|---|

| Equity & Equity related | |||

| Reliance Industries Ltd. | Petroleum Products | 2.90 | -2.91 |

| HDFC Bank Ltd. | Banks | 2.61 | -2.61 |

| ICICI Bank Ltd. | Banks | 2.41 | -2.43 |

| Adani Port and Special Economic Zone Ltd. | Transport Infrastructure | 2.32 | -2.33 |

| Tata Consultancy Services Ltd. | IT - Software | 2.31 | -2.31 |

| Maruti Suzuki India Limited | Automobiles | 1.83 | -1.84 |

| HDFC Ltd. | Finance | 1.61 | -1.62 |

| UPL Ltd | Fertilizers & Agrochemicals | 1.44 | -1.44 |

| Ambuja Cements Ltd. | Cement & Cement Products | 1.35 | -1.35 |

| IndusInd Bank Ltd. | Banks | 1.32 | -1.32 |

| Others | 50.05 | -50.33 | |

| Equity & Equity related - Total | 70.15 | -70.49 | |

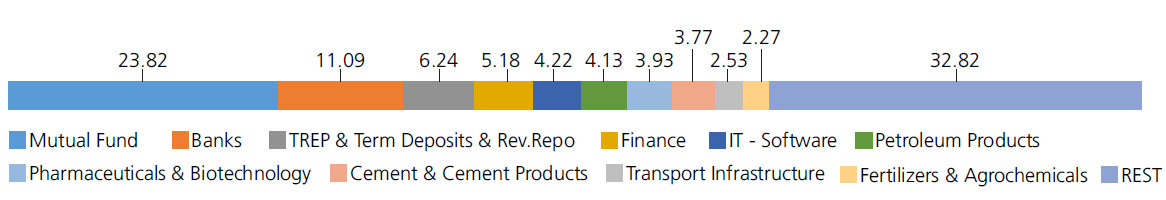

| Mutual Fund Units | 23.82 | ||

| Treasury Bills | 0.16 | ||

| Triparty Repo | 6.24 | ||

| Net Current Assets/(Liabilities) | -0.37 | ||

| Grand Total | 100.00 | ||

| | |||

For detailed portfolio log on to

https://www.kotakmf.com/Products/funds/hybrid-funds/Kotak-Equity-Arbitrage-Fund/Dir-G

Also you can scan the QR code for detailed portfolio

Mutual Fund Units as provided above is towards margin for derivatives transactions

Equity Derivative Exposuer is 70.49%

| Monthly-Reg-Plan-IDCW | Rs10.7565 |

| Monthly-Dir-Plan-IDCW | Rs11.2447 |

| Growth Option | Rs30.8343 |

| Direct Growth Option | Rs32.4192 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Hiten Shah* |

| Benchmark | Nifty 50 Arbitrage Index |

| Allotment date | September 29, 2005 |

| AAUM | Rs22,842.98 crs |

| AUM | Rs22,408.41 crs |

| Folio count | 48,020 |

Monthly (Monday preceding the last Thursday of the month)

| Portfolio Turnover | 536.65% |

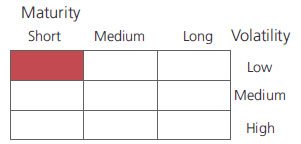

| Portfolio Average Maturity | 0.01 yrs |

| IRS Average Maturity* | - |

| Portfolio Modified Duration | 0.01 yrs |

| Net Average Maturity | 0.01 yrs |

| IRS Modified Duration* | - |

| Net Modified Duration | 0.01 yrs |

| Portfolio Macaulay Duration | 0.01 yrs |

| IRS Macaulay Duration* | - |

| Net Macaulay Duration | 0.01 yrs |

| YTM | 6.04% |

| $Beta | 0.64 |

| $Sharpe ## | -2.76 |

| $Standard Deviation | 0.74% |

Initial Investment: Rs5000 and in multiple of

Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in

multiples of Rs1

Ideal Investments Horizon: 3 months &

above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemptions/switch outs (including

SIP/STP) within 30 days from the date of

allotment of units: 0.25%

b) For redemptions/switch outs (including

SIP/STP) after 30 days from the date of

allotment of units: Nil

Regular: 1.01%; Direct: 0.43%

Fund

Benchmark

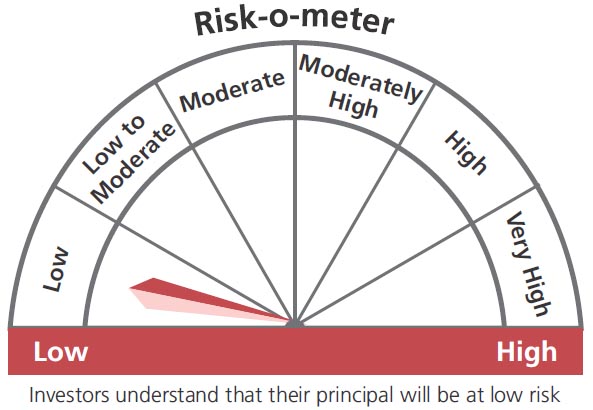

This product is suitable for investors who are seeking*:

- Income from arbitrage opportunities in the equity market

- Investment in arbitrage opportunities in the cash & derivatives segment of the equity market.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

## Risk rate assumed to be 6.17% (FBIL Overnight MIBOR rate as on 30th September 2022).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'