An open-ended equity scheme following momentum theme

An open-ended equity scheme following momentum theme

The scheme shall seek to generate long term capital appreciation by investing predominantly in equity and equity related securities selected based on momentum theme, following an in-house model i.e. enhanced earnings factor model. However, there is no assurance that the objective of the scheme will be achieved

The scheme shall seek to generate long term capital appreciation by investing predominantly in equity and equity related securities selected based on momentum theme, following an in-house model i.e. enhanced earnings factor model. However, there is no assurance that the objective of the scheme will be achieved

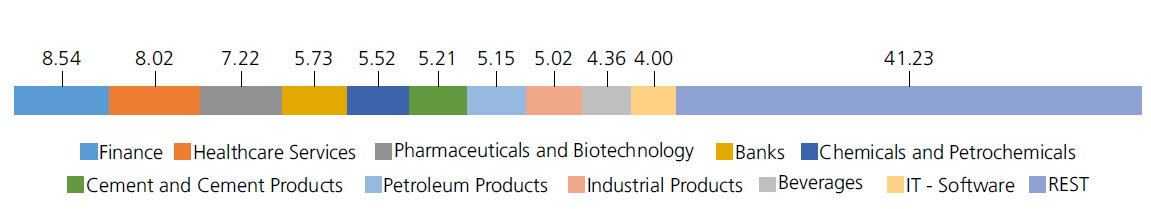

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related | ||

| Finance | 8.54 | |

| Muthoot Finance Ltd | 3.02 | |

| L&T FINANCE HOLDINGS LTD | 2.74 | |

| Power Finance Corporation Ltd. | 1.52 | |

| REC LTD | 1.26 | |

| Healthcare Services | 8.02 | |

| Fortis Healthcare India Ltd | 3.24 | |

| Narayana Hrudayalaya Ltd. | 2.53 | |

| Global Health Ltd. | 2.25 | |

| Pharmaceuticals and Biotechnology | 7.22 | |

| Glenmark Pharmaceuticals Ltd | 2.12 | |

| Abbott India Ltd. | 1.85 | |

| Alkem Laboratories Ltd. | 1.63 | |

| Lupin Ltd. | 1.62 | |

| Banks | 5.73 | |

| CANARA BANK | 2.00 | |

| UNION BANK OF INDIA | 2.00 | |

| PUNJAB NATIONAL BANK | 1.73 | |

| Chemicals and Petrochemicals | 5.52 | |

| SRF Ltd. | 2.09 | |

| Gujarat Fluorochemicals Ltd. | 1.79 | |

| Pidilite Industries Ltd. | 1.64 | |

| Cement and Cement Products | 5.21 | |

| JK Cement Ltd. | 2.81 | |

| Dalmia Bharat Limited | 2.40 | |

| Petroleum Products | 5.15 | |

| HINDUSTAN PETROLEUM CORPORATION LTD | 2.01 | |

| Bharat Petroleum Corporation Ltd. | 1.69 | |

| Indian Oil Corporation Ltd | 1.45 | |

| Industrial Products | 5.02 | |

| Cummins India Ltd. | 1.88 | |

| KEI INDUSTRIES LTD. | 1.71 | |

| SUPREME INDUSTRIES LIMITED | 1.43 | |

| Beverages | 4.36 | |

| Radico Khaitan Ltd. | 2.84 | |

| United Breweries Ltd. | 1.52 | |

| IT - Software | 4.00 | |

| Wipro Ltd. | 1.67 | |

| Tech Mahindra Ltd. | 1.54 | |

| Tata Consultancy Services Ltd. | 0.79 | |

| Consumer Durables | 3.87 | |

| Dixon Technologies India Ltd. | 2.18 | |

| Titan Company Ltd. | 1.69 | |

| Auto Components | 3.60 | |

| Bosch Ltd. | 2.24 | |

| Balkrishna Industries Ltd. | 1.36 | |

| Financial Technology (Fintech) | 3.13 | |

| ONE 97 COMMUNICATIONS LTD. | 3.13 | |

| Capital Markets | 3.08 | |

| BSE LTD. | 3.08 | |

| Electrical Equipment | 2.91 | |

| GE VERNOVA T&D INDIA LIMITED | 2.91 | |

| Automobiles | 2.75 | |

| Eicher Motors Ltd. | 2.75 | |

| Industrial Manufacturing | 2.45 | |

| KAYNES TECHNOLOGY INDIA LTD. | 2.45 | |

| Non - Ferrous Metals | 2.26 | |

| National Aluminium Company Ltd | 2.26 | |

| Ferrous Metals | 2.25 | |

| JSW Steel Ltd. | 2.25 | |

| Transport Infrastructure | 2.01 | |

| Adani Port and Special Economic Zone Ltd. | 1.71 | |

| GMR AIRPORTS LIMITED | 0.30 | |

| Agricultural, Commercial and Construction Vehicles | 1.99 | |

| Ashok Leyland Ltd. | 1.99 | |

| Transport Services | 1.93 | |

| DELHIVERY LTD | 1.93 | |

| Minerals and Mining | 1.90 | |

| NMDC Ltd. | 1.90 | |

| Food Products | 1.84 | |

| Britannia Industries Ltd. | 1.84 | |

| Aerospace and Defense | 1.82 | |

| HINDUSTAN AERONAUTICS LTD. | 1.82 | |

| Retailing | 1.66 | |

| AVENUE SUPERMARTS LTD. | 1.66 | |

| Power | 1.37 | |

| NTPC LTD | 1.37 | |

| Equity & Equity related - Total | 99.59 | |

| Triparty Repo | 0.52 | |

| Net Current Assets/(Liabilities) | -0.11 | |

| Grand Total | 100.00 | |

| | ||

| Regular | Direct | |

| Growth | Rs9.9151 | Rs9.9309 |

| IDCW | Rs9.9151 | Rs9.9310 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager* |

Mr. Rohit Tandon Mr. Abhishek Bisen |

| Benchmark | Nifty 500 TRI |

| Allotment date | August 20, 2025 |

| AAUM | Rs1,400.26 crs |

| AUM | Rs1,376.24 crs |

| Folio count | 45,309 |

Trustee's Discretion

| ^^(P/E) | 25.13 |

| ^^P/BV | 3.53 |

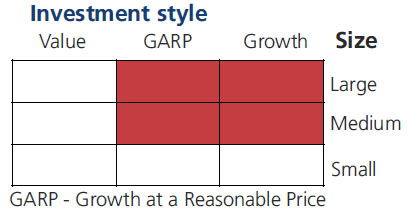

| Large Cap | 32.00% |

| Mid Cap | 65.66% |

| Small Cap | 1.93% |

| Debt & Money Market | 0.41% |

*% of Net Asset

Initial & Additional Investment

• Rs5000 and any amount thereafter

Additional Investment

• Rs1000 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 500 (Subject to a minimum of 10 SIP

installments of `500/- each)

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption/switch out within 90

days from the date of allotment:0.5%.

• If units are redeemed or switched out on

or after 90 days from the date of allotment:

Nil

| Regular Plan: | 2.13% |

| Direct Plan: | 0.74% |

Folio Count data as on 29th August 2025.

Benchmark : Nifty 500 TRI

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Investment in portfolio of predominantly in equity and equity related securities exhibiting momentum characteristics

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

Scheme has not completed 6 months since inception

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'