Investment Objective

The investment objective of the scheme is to replicate the composition of the Nifty Smallcap 50 Index TRI and to

generate returns that are commensurate with the performance of the Nifty Small cap 50 Index, subject to tracking errors. There is no

assurance or guarantee that the investment objective of the scheme would be achieved.

The investment objective of the scheme is to replicate the composition of the Nifty Smallcap 50 Index TRI and to

generate returns that are commensurate with the performance of the Nifty Small cap 50 Index, subject to tracking errors. There is no

assurance or guarantee that the investment objective of the scheme would be achieved.

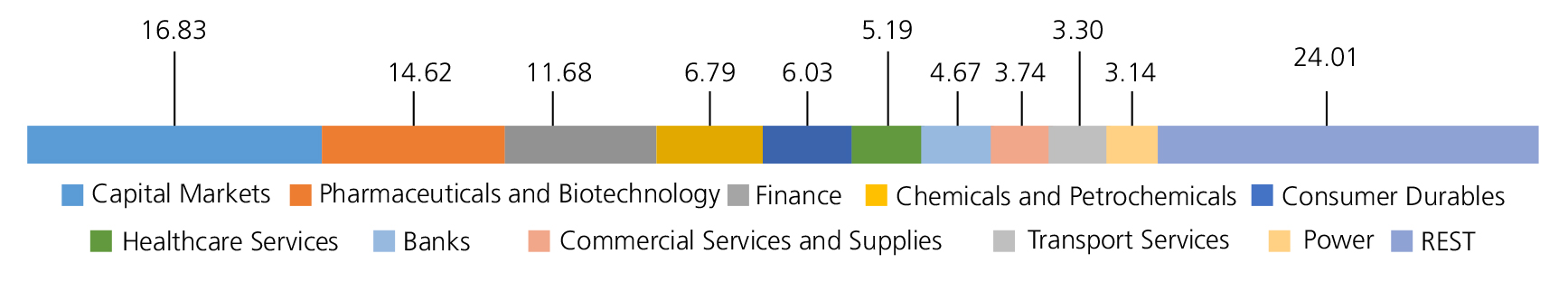

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related | ||

| Capital Markets | 16.83 | |

| Multi Commodity Exchange of India Limited | 5.46 | |

| CENTRAL DEPOSITORY SERVICES (INDIA) LTD. | 3.57 | |

| COMPUTER AGE MANAGEMENT SERVICES LIMITED | 2.48 | |

| KFIN TECHNOLOGIES LTD. | 1.92 | |

| ANGEL ONE LIMITED | 1.88 | |

| Indian Energy Exchange Ltd | 1.52 | |

| Pharmaceuticals and Biotechnology | 14.62 | |

| Laurus Labs Ltd. | 4.49 | |

| GLAND PHARMA LIMITED | 2.18 | |

| JB CHEMICALS & PHARMACEUTICALS LTD. | 1.91 | |

| NEULAND LABORATORIES LTD. | 1.72 | |

| Wockhardt Ltd. | 1.72 | |

| PIRAMAL PHARMA LTD. | 1.62 | |

| Natco Pharma Ltd | 0.98 | |

| Finance | 11.68 | |

| Cholamandalam Financial Holdings Ltd. | 2.56 | |

| PNB HOUSING FINANCE LTD. | 2.23 | |

| Manappuram Finance Ltd | 2.12 | |

| POONAWALLA FINCORP LTD. | 1.96 | |

| IIFL Finance Ltd | 1.44 | |

| FIVE STAR BUSINESS FINANCE LTD | 1.37 | |

| Chemicals and Petrochemicals | 6.79 | |

| Navin Fluorine International Ltd. | 2.33 | |

| Tata Chemicals Ltd | 1.98 | |

| HIMADRI SPECIALITY CHEMICAL LTD. | 1.42 | |

| Aarti Industries Ltd. | 1.06 | |

| Consumer Durables | 6.03 | |

| Crompton Greaves Consumer Electricals Ltd | 2.57 | |

| AMBER ENTERPRISES INDIA LTD. | 2.36 | |

| PG ELECTROPLAST LTD | 1.10 | |

| Healthcare Services | 5.19 | |

| ASTER DM HEALTHCARE LTD | 1.94 | |

| DR.Lal Pathlabs Ltd. | 1.63 | |

| Narayana Hrudayalaya Ltd. | 1.62 | |

| Banks | 4.67 | |

| KARUR VYSYA BANK LTD. | 2.73 | |

| Bandhan Bank Ltd. | 1.94 | |

| Commercial Services and Supplies | 3.74 | |

| Redington India Ltd | 2.31 | |

| Firstsource Solutions Ltd. | 1.43 | |

| Transport Services | 3.30 | |

| DELHIVERY LTD | 3.30 | |

| Power | 3.14 | |

| RELIANCE POWER LTD | 1.74 | |

| CESC LTD | 1.40 | |

| Beverages | 3.10 | |

| Radico Khaitan Ltd. | 3.10 | |

| Construction | 3.07 | |

| Kec International Ltd. | 1.55 | |

| NBCC (India) Ltd | 1.52 | |

| Industrial Manufacturing | 3.02 | |

| KAYNES TECHNOLOGY INDIA LTD. | 3.02 | |

| IT - Services | 3.02 | |

| Affle (India) Ltd. | 1.69 | |

| CYIENT LTD. | 1.33 | |

| Electrical Equipment | 1.86 | |

| INOX WIND LIMITED | 1.86 | |

| Cement and Cement Products | 1.71 | |

| The Ramco Cements Ltd | 1.71 | |

| Auto Components | 1.66 | |

| AMARA RAJA ENERGY MOB LTD. | 1.66 | |

| Industrial Products | 1.54 | |

| Welspun Corp Limited | 1.54 | |

| Petroleum Products | 1.33 | |

| Castrol (India ) Ltd. | 1.33 | |

| Gas | 1.32 | |

| AEGIS LOGISTICS LTD | 1.32 | |

| Paper, Forest and Jute Products | 1.21 | |

| ADITYA BIRLA REAL ESTATE LTD | 1.21 | |

| IT - Software | 1.20 | |

| ZENSAR TECHNOLGIES LTD. | 1.20 | |

| Equity & Equity related - Total | 100.03 | |

| Triparty Repo | 0.56 | |

| Net Current Assets/(Liabilities) | -0.59 | |

| Grand Total | 100.00 | |

Net Asset Value (NAV)

| Regular | Direct | |

| Growth | Rs19.3337 | Rs19.6423 |

| IDCW | Rs19.3336 | Rs19.6531 |

Available Plans/Options

A) Regular Plan B) Direct Plan

Options: Growth, Payout of Income

Distribution cum capital withdrawal

(IDCW) & Reinvestment of Income

Distribution cum capital withdrawal

(IDCW)

| Fund Manager* | Mr. Devender Singhal, Mr. Satish Dondapati & Mr. Abhishek Bisen |

| Benchmark | Nifty Smallcap 50 Index TRI |

| Allotment date | April 10, 2023 |

| AAUM | Rs156.11 crs |

| AUM | Rs160.50 crs |

| Folio count | 24,977 |

Ratios

| Portfolio Turnover | 78.12% |

| Tracking Error | 0.11% |

Minimum Investment Amount

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

IDCW Frequency

Trustee's Discretion

Load Structure

Entry Load:

Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Total Expense Ratio**

| Regular Plan: | 0.90% |

| Direct Plan: | 0.26% |

Data as on 30th September, 2025 unless otherwise specified.

Folio Count data as on 29th August 2025.

Folio Count data as on 29th August 2025.

Fund

Benchmark : Nifty Smallcap 50 Index TRI

This product is suitable for investors who are seeking*:

- Long term capital appreciation

- Investment stocks comprising the underlying index and endeavours to track the benchmark index, subject to tracking errors

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

Total Expense Ratio includes applicable GST

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'