| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related | ||

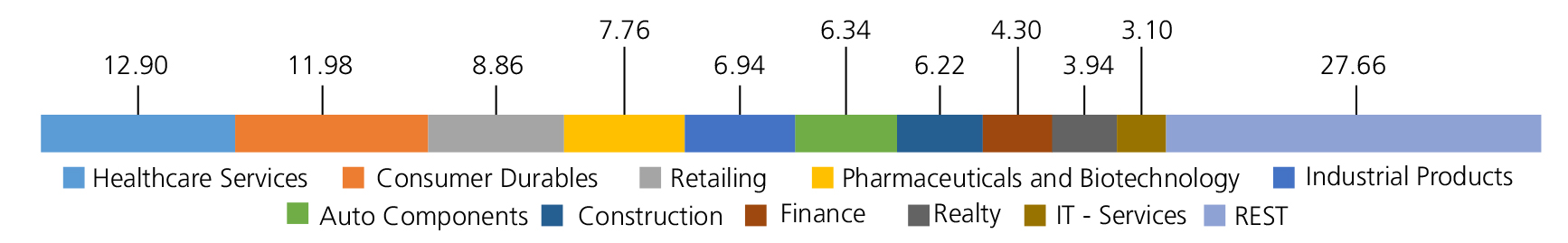

| Healthcare Services | 12.90 | |

| ASTER DM HEALTHCARE LTD | 4.22 | |

| KRISHNA INSTITUTE OF MEDICAL | 3.39 | |

| VIJAYA DIAGNOSTIC CENTRE PVT | 3.10 | |

| Metropolis Healthcare Ltd. | 1.45 | |

| SURAKSHA DIAGNOSTIC LTD | 0.52 | |

| JUPITER LIFELINE HOSPITALS LTD | 0.22 | |

| Consumer Durables | 11.98 | |

| Century Plyboards (India) Ltd. | 3.08 | |

| V-Guard Industries Ltd. | 1.72 | |

| BLUE STAR LTD. | 1.62 | |

| CELLO WORLD LTD. | 1.02 | |

| Hawkins Cooker Ltd | 0.89 | |

| Crompton Greaves Consumer Electricals Ltd | 0.85 | |

| Sheela Foam Ltd | 0.73 | |

| SOMANY CERAMICS LTD. | 0.72 | |

| Orient Electric Ltd. | 0.71 | |

| Nilkamal Ltd | 0.64 | |

| Retailing | 8.86 | |

| VISHAL MEGA MART LIMITED | 2.20 | |

| Medplus Health Services Ltd. | 1.55 | |

| AVENUE SUPERMARTS LTD. | 1.52 | |

| V-Mart Retail Ltd. | 1.42 | |

| Shoppers Stop Ltd. | 1.27 | |

| SWIGGY LTD | 0.90 | |

| Pharmaceuticals and Biotechnology | 7.76 | |

| Alembic Pharmaceuticals Ltd. | 1.77 | |

| Ajanta Pharma Ltd. | 1.68 | |

| JB CHEMICALS & PHARMACEUTICALS LTD. | 1.27 | |

| MANKIND PHARMA LTD | 1.11 | |

| ANTHEM BIOSCIENCES LTD | 0.97 | |

| Torrent Pharmaceuticals Ltd. | 0.96 | |

| Industrial Products | 6.94 | |

| Carborundum Universal Ltd. | 1.44 | |

| Ratnamani Metals & Tubes Ltd. | 1.30 | |

| KEI INDUSTRIES LTD. | 0.96 | |

| BANSAL WIRE INDUSTRIES LIMITED | 0.89 | |

| HAPPY FORGINGS LTD | 0.84 | |

| R R KABEL LTD | 0.72 | |

| WPIL LTD | 0.50 | |

| Apollo Pipes Ltd. | 0.29 | |

| Auto Components | 6.34 | |

| Sansera Engineering Ltd. | 2.05 | |

| MINDA CORPORATION LIMITED | 1.66 | |

| Schaeffler India Ltd | 1.23 | |

| Rolex Rings Ltd. | 0.91 | |

| Sandhar Technologies Ltd. | 0.49 | |

| Construction | 6.22 | |

| TECHNO ELECTRIC & ENGINEERING COMPANY LIMITED | 2.78 | |

| KALPATARU PROJECTS INTERNATIONAL LIMITED | 2.49 | |

| G R Infraprojects Limited | 0.95 | |

| Finance | 4.30 | |

| APTUS VALUE HOUSING FINANCE | 1.47 | |

| FIVE STAR BUSINESS FINANCE LTD | 1.09 | |

| HOME FIRST FINANCE CO INDIA | 0.87 | |

| SHRIRAM FINANCE LTD. | 0.87 | |

| Realty | 3.94 | |

| BRIGADE ENTERPRISES LIMITED | 2.11 | |

| Mahindra Lifespace Developers Ltd | 1.19 | |

| MAX ESTATES LIMITED | 0.64 | |

| IT - Services | 3.10 | |

| CYIENT LTD. | 2.17 | |

| SAGILITY INDIA LTD. | 0.93 | |

| Agricultural, Commercial and Construction Vehicles | 3.04 | |

| BEML Ltd. | 1.74 | |

| V.S.T Tillers Tractors Ltd | 1.30 | |

| Transport Services | 2.78 | |

| Blue Dart Express Ltd. | 1.45 | |

| Great Eastern Shipping Company Ltd | 1.33 | |

| Chemicals and Petrochemicals | 2.69 | |

| JUBILANT INGREVIA LTD | 1.28 | |

| SOLAR INDUSTRIES INDIA LIMITED | 0.89 | |

| Atul Ltd. | 0.52 | |

| Textiles and Apparels | 2.31 | |

| Garware Technical Fibres Ltd. | 2.03 | |

| Kewal Kiran Clothing Limited. | 0.28 | |

| Banks | 1.78 | |

| ICICI Bank Ltd. | 0.90 | |

| Axis Bank Ltd. | 0.61 | |

| KARUR VYSYA BANK LTD. | 0.27 | |

| Insurance | 1.65 | |

| ICICI Lombard General Insurance Company Ltd | 1.08 | |

| MEDI ASSIST HEALTHCARE SERVICES LIMITED | 0.57 | |

| Electrical Equipment | 1.62 | |

| GE VERNOVA T&D INDIA LIMITED | 1.62 | |

| Telecom - Services | 1.33 | |

| BHARTI HEXACOM LTD. | 1.33 | |

| Capital Markets | 1.29 | |

| KFIN TECHNOLOGIES LTD. | 1.15 | |

| ANAND RATHI SHARE AND STOCK BROKERS LIMITED | 0.14 | |

| Fertilizers and Agrochemicals | 1.18 | |

| Dhanuka Agritech Ltd. | 1.18 | |

| Leisure Services | 1.18 | |

| DEVYANI INTERNATIONAL LIMITED | 0.99 | |

| TRAVEL FOOD SERVICES LTD | 0.19 | |

| Agricultural Food and other Product | 1.13 | |

| Balrampur Chini Mills Ltd. | 1.13 | |

| Cement and Cement Products | 1.13 | |

| JK Cement Ltd. | 1.13 | |

| Commercial Services and Supplies | 0.97 | |

| CMS INFO SYSTEMS LTD | 0.97 | |

| Entertainment | 0.59 | |

| PVR INOX LIMITED | 0.59 | |

| IT - Software | 0.54 | |

| HEXAWARE TECHNOLOGIES LTD. | 0.54 | |

| Equity & Equity related - Total | 97.55 | |

| Triparty Repo | 3.08 | |

| Net Current Assets/(Liabilities) | -0.63 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 24,80,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Sep 30, 2025 (₹) | 1,88,04,760 | 32,02,488 | 17,94,535 | 8,93,561 | 4,30,488 | 1,18,574 |

| Scheme Returns (%) | 16.93 | 18.66 | 21.31 | 15.94 | 11.98 | -2.21 |

| NIFTY Smallcap 250 (TRI) Returns (%) | NA | 18.24 | 22.97 | 20.42 | 17.44 | 2.34 |

| Alpha* | NA | 0.42 | -1.66 | -4.48 | -5.46 | -4.54 |

| NIFTY Smallcap 250 (TRI) (₹)# | NA | 31,31,474 | 19,03,248 | 9,96,887 | 4,65,467 | 1,21,500 |

| Nifty Smallcap 100 (TRI) Returns (%) | 13.22 | 16.29 | 20.92 | 18.97 | 17.90 | 1.30 |

| Alpha* | 3.71 | 2.37 | 0.39 | -3.03 | -5.92 | -3.51 |

| Nifty Smallcap 100 (TRI) (₹)# | 1,16,81,065 | 28,19,009 | 17,69,740 | 9,62,229 | 4,68,523 | 1,20,836 |

| Nifty 50 (TRI) (₹)^ | 1,11,33,784 | 24,89,413 | 14,05,814 | 8,25,349 | 4,26,327 | 1,23,248 |

| Nifty 50 (TRI) Returns (%) | 12.84 | 13.97 | 14.46 | 12.72 | 11.31 | 5.08 |

| Regular | Direct | |

| Growth | Rs253.9100 | Rs298.5979 |

| IDCW | Rs110.7724 | Rs131.1533 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Harish Bihani |

| Benchmark*** | NIFTY Smallcap 250 TRI (Tier 1), NIFTY Smallcap 100 TRI (Tier 2) |

| Allotment date | February 24, 2005 |

| AAUM | Rs17,919.57 crs |

| AUM | Rs17,480.17 crs |

| Folio count | 10,11,263 |

Trustee's Discretion

| Portfolio Turnover | 24.70% |

| $Beta | 0.80 |

| $Sharpe ## | 0.60 |

| $Standard Deviation | 16.59% |

| ^^(P/E) | 38.55 |

| ^^P/BV | 4.30 |

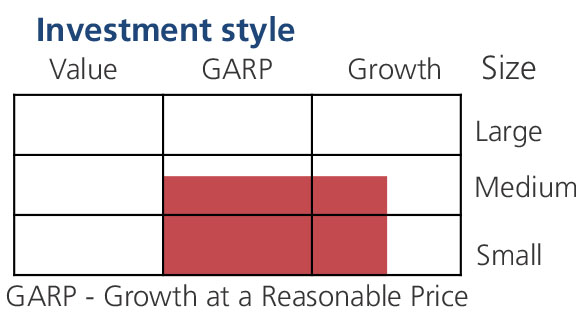

| Large Cap | 6.86% |

| Mid Cap | 15.26% |

| Small Cap | 75.43% |

| Debt & Money Market | 2.45% |

*% of Net Asset

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

• If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

• If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL.

| Regular Plan: | 1.65% |

| Direct Plan: | 0.52% |

Folio Count data as on 29th August 2025.

Benchmark - Tier 1 : NIFTY Smallcap 250 TRI

Benchmark - Tier 2 : Nifty Smallcap 100 TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity & equity related securities predominantly in small cap Stocks.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

***As per para 1.9 of of SEBI Master circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024 The first tier benchmark is reflective of the category of the scheme and the second tier benchmark is demonstrative of the investment style / strategy of the Fund Manager within the category.

## Risk rate assumed to be 5.74% (FBIL Overnight MIBOR rate as on 30th Sep 2025). **Total Expense Ratio includes applicable GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'