(ERSTWHILE KNOWN AS KOTAK EQUITY HYBRID FUND)

An open ended hybrid scheme investing predominantly in equity and equity related instruments

(ERSTWHILE KNOWN AS KOTAK EQUITY HYBRID FUND)

An open ended hybrid scheme investing predominantly in equity and equity related instruments

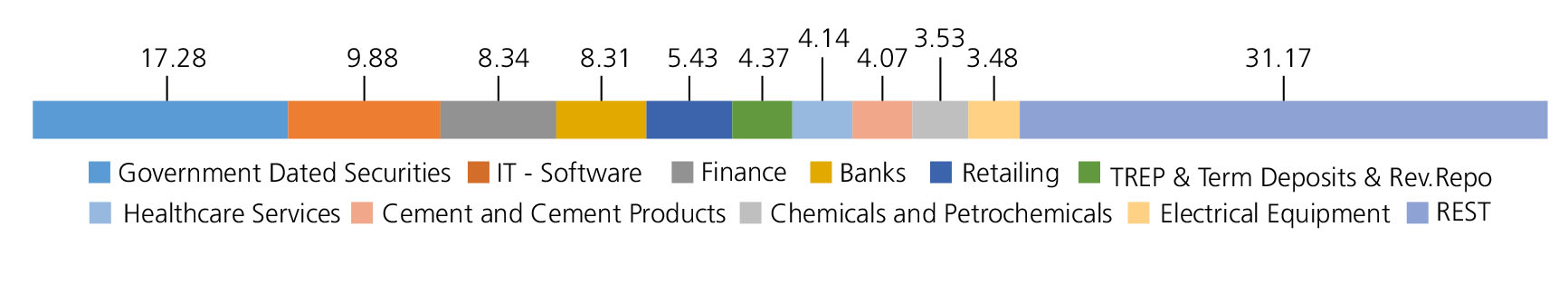

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Equity & Equity related |

||

| IT - Software | 9.88 | |

| Infosys Ltd. | 2.41 | |

| Wipro Ltd. | 1.98 | |

| Oracle Financial Services Software Ltd | 1.69 | |

| Mphasis Ltd | 1.31 | |

| Tata Consultancy Services Ltd. | 1.25 | |

| Birlasoft Ltd. | 0.64 | |

| Tech Mahindra Ltd. | 0.60 | |

| Finance | 8.34 | |

| BAJAJ FINANCE LTD. | 2.63 | |

| Cholamandalam Investment and Finance Company Ltd. | 1.99 | |

| Power Finance Corporation Ltd. | 1.98 | |

| REC LTD | 0.96 | |

| SHRIRAM FINANCE LTD. | 0.78 | |

| Banks | 8.31 | |

| HDFC Bank Ltd. | 4.17 | |

| STATE BANK OF INDIA | 2.15 | |

| ICICI Bank Ltd. | 1.41 | |

| INDIAN BANK | 0.58 | |

| Retailing | 5.43 | |

| ETERNAL LIMITED | 3.73 | |

| SWIGGY LTD | 0.92 | |

| VISHAL MEGA MART LIMITED | 0.78 | |

| Healthcare Services | 4.14 | |

| Fortis Healthcare India Ltd | 3.47 | |

| MAX HEALTHCARE INSTITUTE LTD. | 0.67 | |

| Cement and Cement Products | 4.07 | |

| Ultratech Cement Ltd. | 2.89 | |

| JK Cement Ltd. | 1.18 | |

| Chemicals and Petrochemicals | 3.53 | |

| SRF Ltd. | 1.42 | |

| SOLAR INDUSTRIES INDIA LIMITED | 1.32 | |

| Deepak Nitrite Ltd. | 0.79 | |

| Electrical Equipment | 3.48 | |

| GE VERNOVA T&D INDIA LIMITED | 2.54 | |

| Apar Industries Limited | 0.94 | |

| Pharmaceuticals and Biotechnology | 3.01 | |

| Ipca Laboratories Ltd. | 1.16 | |

| Sun Pharmaceuticals Industries Ltd. | 1.12 | |

| JB CHEMICALS & PHARMACEUTICALS LTD. | 0.73 | |

| Telecom - Services | 2.98 | |

| Bharti Airtel Ltd | 1.80 | |

| Bharti Airtel Ltd - Partly Paid Shares | 1.18 | |

| Consumer Durables | 2.64 | |

| Havells India Ltd. | 1.35 | |

| Century Plyboards (India) Ltd. | 1.29 | |

| Power | 2.23 | |

| NTPC LTD | 2.23 | |

| Aerospace and Defense | 2.00 | |

| Bharat Electronics Ltd. | 2.00 | |

| Auto Components | 1.89 | |

| UNO MINDA LIMITED | 1.22 | |

| Schaeffler India Ltd | 0.67 | |

| Petroleum Products | 1.79 | |

| Bharat Petroleum Corporation Ltd. | 1.29 | |

| RELIANCE INDUSTRIES LTD. | 0.50 | |

| Construction | 1.53 | |

| TECHNO ELECTRIC & ENGINEERING COMPANY LIMITED | 1.53 | |

| Capital Markets | 1.44 | |

| Prudent Corporate Advisory Services Ltd. | 0.80 | |

| NUVAMA WEALTH MANAGEMENT LIMITED | 0.64 | |

| Realty | 1.11 | |

| Mahindra Lifespace Developers Ltd | 0.63 | |

| Oberoi Realty Ltd | 0.48 | |

| Beverages | 1.17 | |

| UNITED SPIRITS LTD. | 1.17 | |

| Diversified FMCG | 1.13 | |

| ITC Ltd. | 1.13 | |

| Automobiles | 1.10 | |

| Mahindra & Mahindra Ltd. | 1.10 | |

| Ferrous Metals | 1.06 | |

| Jindal Steel & Power Ltd. | 1.06 | |

| Industrial Products | 1.05 | |

| Polycab India Ltd. | 1.05 | |

| Fertilizers and Agrochemicals | 1.01 | |

| P I Industries Ltd | 1.01 | |

| Insurance | 0.94 | |

| ICICI Lombard General Insurance Company Ltd | 0.94 | |

| Personal Products | 0.77 | |

| Emami Ltd. | 0.77 | |

| Oil | 0.55 | |

| OIL INDIA LIMITED | 0.55 | |

| Agricultural, Commercial and Construction Vehicles | 0.36 | |

| V.S.T Tillers Tractors Ltd | 0.36 | |

| Equity & Equity related - Total | 76.94 | |

| Debt Instruments | ||

| Debentures and Bonds | ||

| Corporate Debt/Financial Institutions | ||

| ADITYA BIRLA CAPITAL LTD | ICRA AAA | 0.09 |

| Larsen and Toubro Ltd. | CRISIL AAA | 0.06 |

| Corporate Debt/Financial Institutions - Total | 0.15 | |

| Public Sector Undertakings | ||

| TELANGANA STATE INDUSTRIAL INFRASTRUCTURE CORPORATION LTD. | FITCH AA(CE) | 0.82 |

| REC LTD | CRISIL AAA | 0.62 |

| Power Finance Corporation Ltd. | CRISIL AAA | 0.41 |

| SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA | CRISIL AAA | 0.32 |

| Public Sector Undertakings - Total | 2.17 | |

| Government Dated Securities | ||

| 7.34% Central Government | SOV | 4.14 |

| 7.30% Central Government(^) | SOV | 3.29 |

| 7.09% Central Government(^) | SOV | 3.11 |

| 6.90% Central Government(^) | SOV | 2.31 |

| 6.68% Central Government | SOV | 1.86 |

| 6.79% Central Government(^) | SOV | 0.71 |

| 7.25% Central Government | SOV | 0.50 |

| GS CG 22/10/2038 - (STRIPS) | SOV | 0.16 |

| GS CG 15/10/2038 - (STRIPS) | SOV | 0.15 |

| 7.21% Karnataka State Govt-Karnataka | SOV | 0.13 |

| GS CG 15/04/2036 - (STRIPS) | SOV | 0.09 |

| 7.62% Haryana State Govt-Haryana | SOV | 0.07 |

| 7.67% Punjab State Govt-Punjab | SOV | 0.07 |

| 8.00% Kerala State Govt-Kerala | SOV | 0.07 |

| 8.15% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.07 |

| GS CG 25/11/2043 - (STRIPS) | SOV | 0.07 |

| 7.18% Central Government(^) | SOV | 0.06 |

| 8.01% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.06 |

| GS CG 22/10/2036 - (STRIPS) | SOV | 0.06 |

| GS CG 22/10/2039 - (STRIPS) | SOV | 0.05 |

| 7.26% Central Government | SOV | 0.04 |

| 7.39% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.03 |

| 7.71% Gujarat State Govt-Gujarat | SOV | 0.03 |

| GS CG 19/06/2036 - (STRIPS) | SOV | 0.03 |

| 7.71% Andhra Pradesh State Govt-Andhra Pradesh | SOV | 0.02 |

| 7.78% Rajasthan State Govt-Rajasthan | SOV | 0.02 |

| GS CG 22/04/2041 - (STRIPS) | SOV | 0.02 |

| GS CG 22/04/2042 - (STRIPS) | SOV | 0.02 |

| 6.91% Rajasthan State Govt-Rajasthan | SOV | 0.01 |

| GS CG 22 Aug 2026 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2027 - (STRIPS) | SOV | 0.01 |

| GS CG 23/12/2025 - (STRIPS) | SOV | 0.01 |

| Government Dated Securities - Total | 17.28 | |

| Triparty Repo | 4.37 | |

| Real Estate & Infrastructure Investment Trusts | ||

| MINDSPACE BUSINESS PARKS REIT | Realty | 0.20 |

| BROOKFIELD INDIA REAL ESTATE TRUST | Realty | 0.09 |

| Real Estate & Infrastructure Investment Trusts - Total | 0.29 | |

| Net Current Assets/(Liabilities) | -1.20 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 13,00,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Aug 29, 2025 (₹) | 28,48,635 | 25,15,265 | 14,75,458 | 8,62,848 | 4,40,866 | 1,22,983 |

| Scheme Returns (%) | 13.78 | 14.18 | 15.83 | 14.54 | 13.66 | 4.71 |

| NIFTY 50 Hybrid Composite Debt 65:35 Index TRI Returns (%) | 11.70 | 11.93 | 12.07 | 10.89 | 10.18 | 4.13 |

| Alpha* | 2.08 | 2.25 | 3.76 | 3.66 | 3.49 | 0.58 |

| NIFTY 50 Hybrid Composite Debt 65:35 Index TRI (₹)# | 25,22,166 | 22,30,775 | 12,90,560 | 7,88,380 | 4,19,189 | 1,22,620 |

| Nifty 50 (TRI) (₹)^ | 28,22,311 | 24,96,117 | 14,08,590 | 8,31,688 | 4,27,549 | 1,22,166 |

| Nifty 50 (TRI) Returns (%) | 13.62 | 14.03 | 14.53 | 13.05 | 11.54 | 3.41 |

| Regular | Direct | |

| Growth | Rs61.3640 | Rs72.1730 |

| IDCW | Rs36.0630 | Rs44.2430 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Atul Bhole & Mr. Abhishek Bisen |

| Benchmark | Nifty 50 Hybrid Composite Debt 65:35 Index TRI |

| Allotment date | November 25, 1999 |

| AAUM | Rs7,882.63 crs |

| AUM | Rs7,853.42 crs |

| Folio count | 1,55,088 |

Trustee’s Discretion

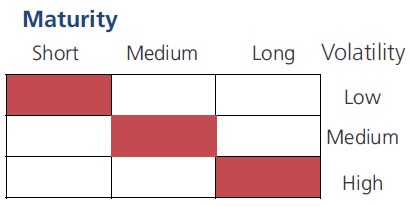

| Average Maturity | 19.63 yrs |

| Modified Duration | 9.08 yrs |

| Macaulay Duration | 9.42 yrs |

| Annualised YTM* | 7.14% |

| $Standard Deviation | 10.49% |

| $Beta | 1.13 |

| $Sharpe## | 0.79 |

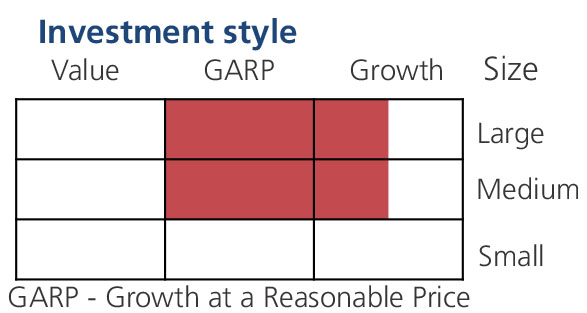

| ^^P/E$$ | 27.43 |

| ^^P/BV$$ | 4.42 |

| Equity Portfolio Turnover$$ | 26.37% |

| Total Portfolio Turnover@ | 68.42% |

$$Equity Component of the Portfolio.

@Total Portfolio Turnover=Equity+Debt+Derivative.

| Large Cap | 46.85% |

| Mid Cap | 20.97% |

| Small Cap | 9.12% |

| Debt & Money Market | 23.06% |

*% of Net Asset

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out of upto 8% of

the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

• If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

• If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

| Regular Plan: | 1.75% |

| Direct Plan: | 0.47% |

Folio Count data as on 31st July 2025.

Fund

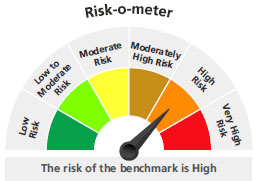

Benchmark: Nifty 50 Hybrid Composite Debt 65:35 Index TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity & equity related securities balanced with income generation by investing in debt & money.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

(^) Fully or Party blocked against Interest Rate Swap (IRS) This scheme has exposure to floating rate instruments and / or interest rate derivatives. The duration of these instruments is linked to the interest rate reset period. The interest rate risk in a floating rate instrument or in a fixed rate instrument hedged with derivatives is likely to be lesser than that in an equivalent maturity fixed rate instrument. Under some market circumstances the volatility may be of an order greater than what may ordinarily be expected considering only its duration. Hence investors are recommended to consider the unadjusted portfolio maturity of the scheme as well and exercise adequate due diligence when deciding to make their investments.Hedging Position through Interest Rate Swaps as on 31 Aug 2025 is 1.92%

## Risk rate assumed to be 5.54% (FBIL Overnight MIBOR rate as on 29th Aug 2025).**Total Expense Ratio includes applicable GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'