An open ended equity scheme investing in the Banking and Financial Services sectors

An open ended equity scheme investing in the Banking and Financial Services sectors

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services sector. However, there is no assurance that the objective of the scheme will be achieved.

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services sector. However, there is no assurance that the objective of the scheme will be achieved.

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

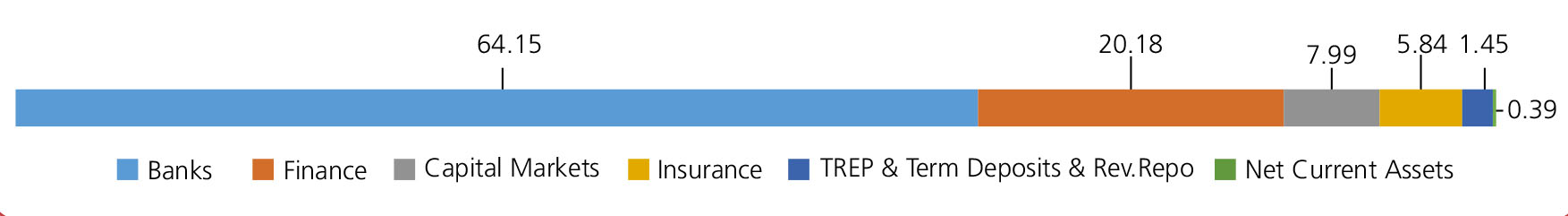

| Banks | 64.15 | |

| HDFC Bank Ltd. | 18.98 | |

| ICICI Bank Ltd. | 18.25 | |

| STATE BANK OF INDIA | 6.68 | |

| Axis Bank Ltd. | 4.47 | |

| Kotak Mahindra Bank Ltd. | 4.18 | |

| INDIAN BANK | 2.15 | |

| KARUR VYSYA BANK LTD. | 2.07 | |

| Bank Of Baroda | 1.68 | |

| Ujjivan Small Finance Bank Ltd. | 1.64 | |

| IndusInd Bank Ltd. | 1.62 | |

| RBL Bank Ltd | 1.37 | |

| SOUTH INDIAN BANK LTD. | 1.06 | |

| Finance | 20.18 | |

| BAJAJ FINANCE LTD. | 5.81 | |

| SHRIRAM FINANCE LTD. | 2.95 | |

| POONAWALLA FINCORP LTD. | 2.67 | |

| HDB FINANCIAL SERVICES LTD | 2.07 | |

| Power Finance Corporation Ltd. | 1.95 | |

| Cholamandalam Investment and Finance Company Ltd. | 1.27 | |

| INDIA SHELTER FINANCE CORPORATION LTD | 1.24 | |

| APTUS VALUE HOUSING FINANCE | 1.21 | |

| HOME FIRST FINANCE CO INDIA | 1.01 | |

| Capital Markets | 7.99 | |

| COMPUTER AGE MANAGEMENT SERVICES LIMITED | 1.90 | |

| Nippon Life India Asset Management Ltd. | 1.89 | |

| NUVAMA WEALTH MANAGEMENT LIMITED | 1.60 | |

| Prudent Corporate Advisory Services Ltd. | 1.35 | |

| Aditya Birla Sun Life AMC Ltd | 1.25 | |

| Insurance | 5.84 | |

| HDFC Life Insurance Company Ltd. | 2.08 | |

| Max Financial Services Ltd. | 1.86 | |

| ICICI Lombard General Insurance Company Ltd | 1.28 | |

| SBI Life Insurance Company Ltd | 0.62 | |

| Equity & Equity related - Total | 98.16 | |

| Triparty Repo | 1.45 | |

| Net Current Assets/(Liabilities) | 0.39 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of (Rs) 10000 | Since Inception | 1 year |

| Total amount invested (₹) | 3,10,000 | 1,20,000 |

| Total Value as on Aug 29, 2025 (₹) | 3,60,403 | 1,22,736 |

| Scheme Returns (%) | 11.77 | 4.31 |

| Nifty Financial Services TRI Returns (%) | 13.95 | 8.93 |

| Alpha* | -2.19 | -4.62 |

| Nifty Financial Services Index TRI (₹)# | 3,70,244 | 1,25,627 |

| Nifty 50 (TRI) (₹)^ | 3,57,133 | 1,22,166 |

| Nifty 50 (TRI) Returns (%) | 11.03 | 3.41 |

| Regular | Direct | |

| Growth | Rs14.7710 | Rs15.3690 |

| IDCW | Rs14.7710 | Rs15.3670 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution cum capital withdrawal (IDCW) (Payout and Reinvestment)

| Fund Manager* | Ms. Shibani Sircar

Kurian & Mr. Abhishek Bisen |

| Benchmark | Nifty Financial Services Index TRI |

| Allotment date | February 27, 2023 |

| AAUM | Rs1,226.37 crs |

| AUM | Rs1,203.50 crs |

| Folio count | 59,396 |

Trustee's Discretion

| Portfolio Turnover | 30.92% |

| $Beta | 0.98 |

| $Sharpe ## | 0.86 |

| $Standard Deviation | 12.84% |

| ^^(P/E) | 16.68 |

| ^^P/BV | 2.29 |

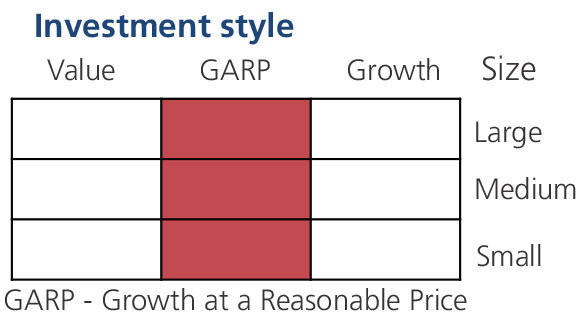

| Large Cap | 68.92% |

| Mid Cap | 10.87% |

| Small Cap | 18.37% |

| Debt & Money Market | 1.84% |

*% of Net Asset

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out within 30

days from the date of allotment: 0.5%

• If units are redeemed or switched out on

or after 30 days from the date of allotment:

NIL

| Regular Plan: | 2.14% |

| Direct Plan: | 0.65% |

Folio Count data as on 31st July 2025.

Benchmark : Nifty Financial Services Index TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in portfolio of predominantly equity & equity related securities of companies engaged in Banking & Financial Services

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'