| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

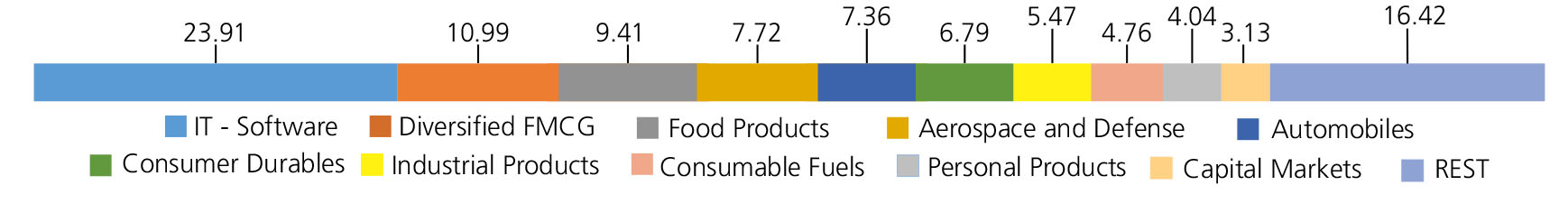

| IT - Software | 23.91 | |

| Infosys Ltd. | 4.65 | |

| Tata Consultancy Services Ltd. | 4.57 | |

| HCL Technologies Ltd. | 4.33 | |

| PERSISTENT SYSTEMS LIMITED | 2.64 | |

| LTIMindtree Limited | 2.41 | |

| Oracle Financial Services Software Ltd | 1.78 | |

| KPIT TECHNOLOGIES LTD. | 1.77 | |

| TATA ELXSI LTD. | 1.76 | |

| Diversified FMCG | 10.99 | |

| Hindustan Unilever Ltd. | 5.96 | |

| ITC Ltd. | 5.03 | |

| Food Products | 9.41 | |

| NESTLE INDIA LTD. | 4.91 | |

| Britannia Industries Ltd. | 4.50 | |

| Aerospace and Defense | 7.72 | |

| Bharat Electronics Ltd. | 4.49 | |

| HINDUSTAN AERONAUTICS LTD. | 3.23 | |

| Automobiles | 7.36 | |

| Bajaj Auto Ltd. | 4.00 | |

| Hero MotoCorp Ltd. | 3.36 | |

| Consumer Durables | 6.79 | |

| Asian Paints Ltd. | 4.66 | |

| Havells India Ltd. | 2.13 | |

| Industrial Products | 5.47 | |

| Cummins India Ltd. | 3.01 | |

| Polycab India Ltd. | 2.46 | |

| Consumable Fuels | 4.76 | |

| Coal India Ltd. | 4.76 | |

| Personal Products | 4.04 | |

| Colgate Palmolive (India ) Ltd. | 4.04 | |

| Capital Markets | 3.13 | |

| HDFC Asset Management Company Ltd. | 3.13 | |

| Agricultural Food and other Product | 2.92 | |

| Marico Ltd. | 2.92 | |

| Petroleum Products | 2.79 | |

| Bharat Petroleum Corporation Ltd. | 2.79 | |

| Chemicals and Petrochemicals | 2.65 | |

| Pidilite Industries Ltd. | 2.65 | |

| Textiles and Apparels | 2.35 | |

| Page Industries Ltd | 2.35 | |

| Leisure Services | 2.19 | |

| Indian Railway Catering And Tourism Corporation Ltd. | 2.19 | |

| Non - Ferrous Metals | 1.97 | |

| Hindustan Zinc Ltd. | 1.97 | |

| Gas | 1.36 | |

| Indraprastha Gas Ltd. | 1.36 | |

| Equity & Equity related - Total | 99.81 | |

| Net Current Assets/(Liabilities) | 0.19 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs9.8270 | Rs9.8320 |

| IDCW | Rs9.8270 | Rs9.8320 |

A) Regular B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout

and Reinvestment)

| Fund Manager* | Mr. Devender Singhal, Mr. Satish Dondapati, Mr. Abhishek Bisen |

| Benchmark | Nifty 200 Quality 30 Index TRI |

| Allotment date | July 14, 2025 |

| AAUM | Rs11.22 crs |

| AUM | Rs12.24 crs |

| Folio count | 7,522 |

| Portfolio Turnover | 0.98% |

| Tracking Error | 0.33% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Trustee's Discretion

Entry Load:

Nil. (applicable for all plans)

Exit Load: NIL. (applicable for all plans)

| Regular Plan: | 0.60% |

| Direct Plan: | 0.23% |

Fund

Benchmark : Nifty 200 Quality 30 Index TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Return that corresponds to the performance of Nifty 200 Quality 30 Index, subject to tracking error

The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable GST.

The scheme has not completed 6 month since inception

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'