| Issuer/Instrument | Industry/Rating | % to Net Assets |

|---|---|---|

| Debt Instruments | ||

| Debentures and Bonds | ||

| Corporate Debt/Financial Institutions | ||

| L & T Finance Ltd. | CRISIL AAA | 0.03 |

| Corporate Debt/Financial Institutions - Total | 0.03 | |

| Public Sector Undertakings | ||

| Power Finance Corporation Ltd. | CRISIL AAA | 0.61 |

| Public Sector Undertakings - Total | 0.61 | |

| Government Dated Securities | ||

| 8.00% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.49 |

| 7.96% Gujarat State Govt-Gujarat | SOV | 0.01 |

| 7.99% Maharashtra State Govt-Maharashtra | SOV | 0.01 |

| 8.23% Maharashtra State Govt-Maharashtra | SOV | 0.01 |

| Government Dated Securities - Total | 0.52 | |

| Money Market Instruments | ||

| Commercial Paper(CP)/Certificate of Deposits(CD) | ||

| Corporate Debt/Financial Institutions | ||

| HDFC BANK LTD. | CARE A1+ | 4.72 |

| Reliance Retail Ventures Ltd | CRISIL A1+ | 3.81 |

| MOTILAL OSWAL FINANCIAL SERVICES LIMITED | ICRA A1+ | 2.69 |

| Reliance Jio Infocomm Ltd. | CRISIL A1+ | 2.44 |

| KARUR VYSYA BANK LTD. | ICRA A1+ | 2.43 |

| ICICI SECURITIES LIMITED | CRISIL A1+ | 2.20 |

| PNB HOUSING FINANCE LTD. | CRISIL A1+ | 1.94 |

| IIFL FINANCE LIMITED | CRISIL A1+ | 1.84 |

| SBICAP SECURITIES LIMITED | CRISIL A1+ | 1.84 |

| RELIANCE INDUSTRIES LTD. | CRISIL A1+ | 1.71 |

| BAJAJ FINANCE LTD. | CRISIL A1+ | 1.36 |

| AXIS SECURITIES LIMITED | CRISIL A1+ | 1.28 |

| Adani Ports and Special Economic Zone Limited | CRISIL A1+ | 1.23 |

| BHARTI AIRTEL LTD. | CRISIL A1+ | 1.23 |

| Hindustan Zinc Ltd. | CRISIL A1+ | 1.23 |

| L&T METRO RAIL (HYDERABAD) LTD | CRISIL A1+ | 1.23 |

| Sikka Ports & Terminals Ltd. | CRISIL A1+ | 1.23 |

| AXIS BANK LTD. | CRISIL A1+ | 1.22 |

| BAJAJ FINANCIAL SECURITIES LIMITED | CRISIL A1+ | 0.98 |

| ANGEL ONE LIMITED | ICRA A1+ | 0.92 |

| JULIUS BAER CAPITAL (INDIA) PVT. LTD | CRISIL A1+ | 0.86 |

| Nirma Ltd. | CRISIL A1+ | 0.74 |

| SHAREKHAN LIMITED | ICRA A1+ | 0.74 |

| ADITYA BIRLA CAPITAL LTD | ICRA A1+ | 0.73 |

| ADITYA BIRLA HOUSING FINANCE LTD | CRISIL A1+ | 0.73 |

| PIRAMAL FINANCE LTD | CRISIL A1+ | 0.72 |

| ASEEM INFRASTRUCTURE FINANCE LIMITED | FITCH A1+ | 0.61 |

| IDFC FIRST BANK LIMITED | CRISIL A1+ | 0.55 |

| CESC Ltd. | ICRA A1+ | 0.49 |

| Larsen and Toubro Ltd. | CRISIL A1+ | 0.49 |

| NUVAMA WEALTH AND INVESTMENT LTD | CRISIL A1+ | 0.49 |

| GODREJ HOUSING FINANCE LTD | CRISIL A1+ | 0.48 |

| IIFL CAPITAL SERVICES LTD. | CRISIL A1+ | 0.48 |

| NETWORK18 MEDIA & INVESTMENTS LTD. | FITCH A1+ | 0.43 |

| 360 ONE PRIME LTD. | CRISIL A1+ | 0.36 |

| AU SMALL FINANCE BANK LTD. | FITCH A1+ | 0.36 |

| FEDERAL BANK LTD. | CRISIL A1+ | 0.36 |

| GODREJ INDUSTRIES LTD | CRISIL A1+ | 0.36 |

| 360 ONE WAM LIMITED | ICRA A1+ | 0.25 |

| ADITYA BIRLA HOUSING FINANCE LTD | ICRA A1+ | 0.25 |

| ADITYA BIRLA MONEY LTD | CRISIL A1+ | 0.25 |

| GODREJ FINANCE LTD | CRISIL A1+ | 0.24 |

| HDFC SECURITIES LIMITED | ICRA A1+ | 0.24 |

| JIO CREDIT LIMITED | CRISIL A1+ | 0.24 |

| SUNDARAM FINANCE LTD. | CRISIL A1+ | 0.24 |

| CHOLAMANDALAM SECURITIES LIMITED | ICRA A1+ | 0.12 |

| JM FINANCIAL SERVICES LIMITED | CRISIL A1+ | 0.12 |

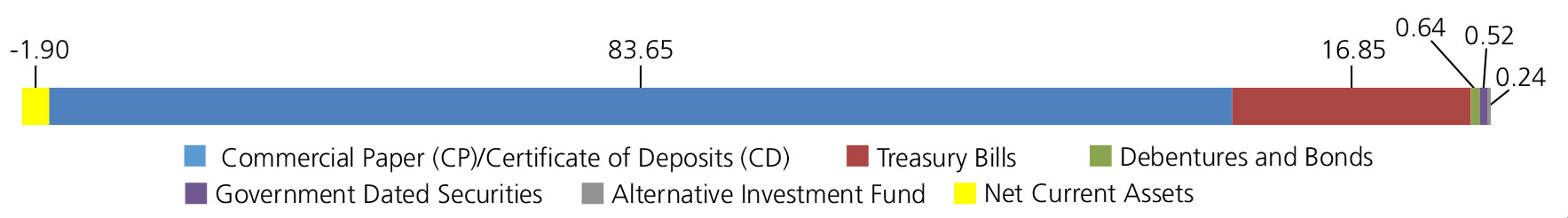

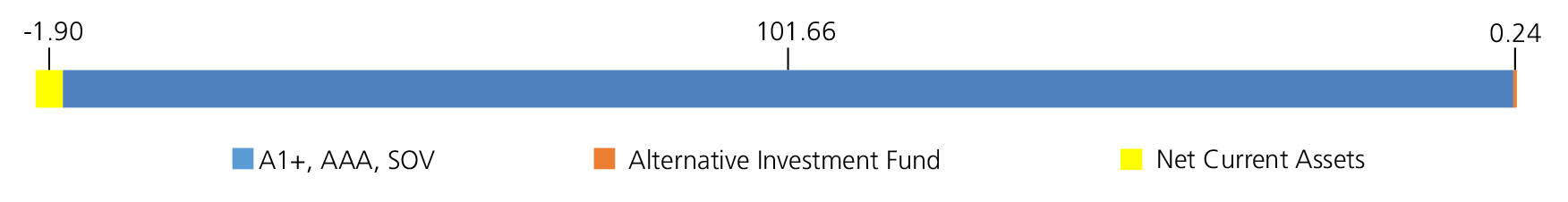

| Corporate Debt/Financial Institutions - Total | 49.46 | |

| Public Sector Undertakings | ||

| CANARA BANK | CRISIL A1+ | 7.37 |

| NATIONAL BANK FOR AGRICULTURE & RURAL DEVELOPMENT | ICRA A1+ | 6.10 |

| BANK OF BARODA | FITCH A1+ | 4.44 |

| INDIAN BANK | CRISIL A1+ | 3.65 |

| INDIAN OIL CORPORATION LTD. | ICRA A1+ | 2.51 |

| SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA | CRISIL A1+ | 2.44 |

| PUNJAB NATIONAL BANK | CARE A1+ | 1.97 |

| INDIAN OVERSEAS BANK | CARE A1+ | 1.84 |

| UNION BANK OF INDIA | ICRA A1+ | 1.29 |

| UCO BANK | CRISIL A1+ | 1.23 |

| SBI CARDS & PAYMENT SERVICES PVT. LTD. | CRISIL A1+ | 0.74 |

| BANK OF INDIA | CRISIL A1+ | 0.61 |

| Public Sector Undertakings - Total | 34.19 | |

| Treasury Bills | ||

| 91 DAYS TREASURY BILL 13/11/2025 | SOV | 2.43 |

| 91 DAYS TREASURY BILL 04/09/2025 | SOV | 2.21 |

| 182 DAYS TREASURY BILL 25/09/2025 | SOV | 2.12 |

| 91 DAYS TREASURY BILL 23/10/2025 | SOV | 1.95 |

| 91 DAYS TREASURY BILL 18/09/2025 | SOV | 1.68 |

| 91 DAYS TREASURY BILL 02/10/2025 | SOV | 1.22 |

| 91 DAYS TREASURY BILL 06/11/2025 | SOV | 1.22 |

| 91 DAYS TREASURY BILL 20/11/2025 | SOV | 1.21 |

| 91 DAYS TREASURY BILL 28/11/2025 | SOV | 1.21 |

| 182 DAYS TREASURY BILL 13/11/2025 | SOV | 1.11 |

| 182 DAYS TREASURY BILL 23/10/2025 | SOV | 0.49 |

| Treasury Bills - Total | 16.85 | |

| Alternative Investment Fund | ||

| CORPORATE DEBT MARKET DEVELOPMENT FUND - CLASS A2 | Alternative Investment Fund | 0.24 |

| Alternative Investment Fund - Total | 0.24 | |

| Net Current Assets/(Liabilities) | -1.90 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs5328.3848 | Rs5379.885 |

| Daily IDCW | Rs1222.8100 | Rs1222.8100 |

A)Regular Plan B)Direct Plan

Options: Payout of IDCW, Growth &

Reinvestment of IDCW (applicable for all plans)

| Fund Manager* | Mr. Deepak Agrawal & Mr. Sunil Pandey (w.e.f. June 01, 2025) |

| Benchmark*** | Nifty Liquid Index A-I |

| Allotment date | November 4, 2003 |

| AAUM | Rs41,044.12 crs |

| AUM | Rs40,674.68 crs |

| Folio count | 55,902 |

Daily and Weekly

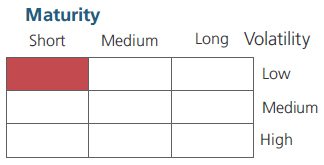

| Average Maturity | 0.11 yrs |

| Modified Duration | 0.11 yrs |

| Macaulay Duration | 0.11 yrs |

| Annualised YTM* | 5.94% |

| $Standard Deviation | 0.18% |

*in case of semi annual YTM, it will be annualized

Source: $ICRA MFI Explorer

Initial & Additional Investment

• Rs100 and any amount thereafter

• 7 days to month

Entry Load: Nil. (applicable for all plans)

1. Exit load shall applicable be as per the graded basis as specified below:

| Investor exit upon subscription | Exit load as a % of redemption proceeds |

| Day 1 | 0.0070% |

| Day 2 | 0.0065% |

| Day 3 | 0.0060% |

| Day 4 | 0.0055% |

| Day 5 | 0.0050% |

| Day 6 | 0.0045% |

| Day 7 onwards | 0.0000% |

Any exit load charged (net off Goods and Services tax, if any) shall be credited back to the Scheme. Units issued on reinvestment of IDCW shall not be subject to entry and exit load.

| Regular Plan: | 0.31% |

| Direct Plan: | 0.20% |

Folio Count data as on 31st July 2025.

Fund

Benchmark: Nifty Liquid Index A-I

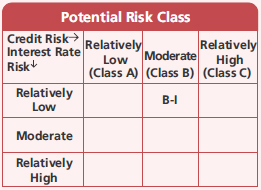

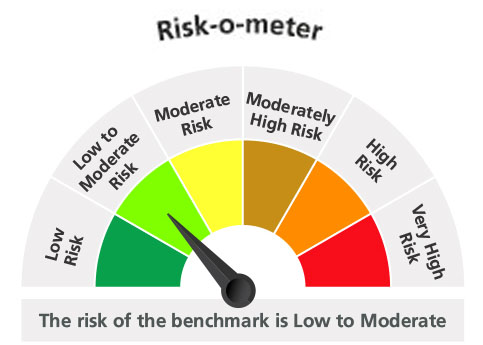

This product is suitable for investors who are seeking*:

- Income over a short term investment horizon

- Investment in debt & money market securities

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

**Total Expense Ratio includes applicable GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'