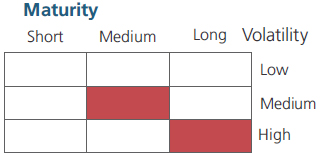

An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 4 years and 7 years.

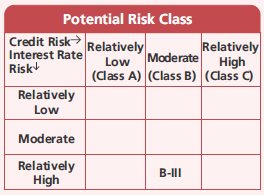

A relatively high interest rate risk and moderate credit risk.

An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 4 years and 7 years.

A relatively high interest rate risk and moderate credit risk.

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Debt Instruments | ||

| Debentures and Bonds | ||

| Government Dated Securities | ||

| 7.32% Central Government | SOV | 15.40 |

| 7.02% Central Government | SOV | 14.03 |

| 7.34% Central Government | SOV | 7.19 |

| 7.25% Central Government | SOV | 7.09 |

| 7.18% Central Government | SOV | 6.71 |

| 7.30% Central Government | SOV | 5.98 |

| 7.93% Central Government | SOV | 5.47 |

| 7.37% Central Government | SOV | 4.94 |

| 7.09% Central Government | SOV | 2.68 |

| 6.79% Central Government | SOV | 1.21 |

| 7.63% Maharashtra State Govt-Maharashtra | SOV | 1.00 |

| 7.10% Central Government | SOV | 0.99 |

| GS CG 22/04/2038 - (STRIPS) | SOV | 0.60 |

| 6.80% Central Government | SOV | 0.47 |

| 8.31% Telangana State Govt-Telangana | SOV | 0.25 |

| GS CG 25/11/2035 - (STRIPS) | SOV | 0.13 |

| GS CG 25/11/2036 - (STRIPS) | SOV | 0.12 |

| GS CG 25/11/2037 - (STRIPS) | SOV | 0.11 |

| 6.58% Gujarat State Govt-Gujarat | SOV | 0.11 |

| GS CG 25/05/2039 - (STRIPS) | SOV | 0.10 |

| 7.78% West Bengal State Govt-West Bengal | SOV | 0.10 |

| GS CG 22 Aug 2026 - (STRIPS) | SOV | 0.07 |

| Government Dated Securities - Total | 74.75 | |

| Public Sector Undertakings | ||

| Power Finance Corporation Ltd. | CRISIL AAA | 2.95 |

| NATIONAL BANK FOR AGRICULTURE & RURAL DEVELOPMENT | CRISIL AAA | 2.42 |

| REC LTD | CRISIL AAA | 1.62 |

| SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA | CRISIL AAA | 1.22 |

| Export-Import Bank of India | CRISIL AAA | 0.07 |

| Public Sector Undertakings - Total | 8.28 | |

| Corporate Debt/Financial Institutions | ||

| HDFC BANK LTD. | CRISIL AAA | 6.15 |

| Larsen and Toubro Ltd. | CRISIL AAA | 0.73 |

| LIC HOUSING FINANCE LTD. | CRISIL AAA | 0.24 |

| HDB Financial Services Ltd. | CRISIL AAA | 0.11 |

| Corporate Debt/Financial Institutions - Total | 7.23 | |

| Money Market Instruments | ||

| Commercial Paper(CP)/Certificate of Deposits(CD) | ||

| Public Sector Undertakings | ||

| PUNJAB NATIONAL BANK | CARE A1+ | 5.94 |

| Public Sector Undertakings - Total | 5.94 | |

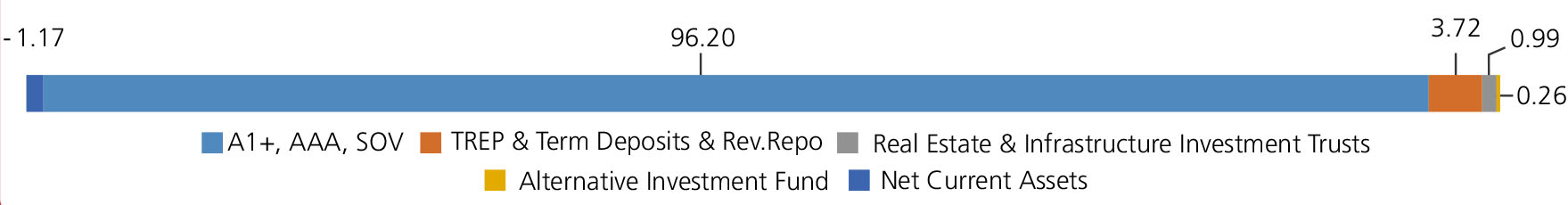

| Triparty Repo | 3.72 | |

| Alternative Investment Fund | ||

| CORPORATE DEBT MARKET DEVELOPMENT FUND - CLASS A2 | Alternative Investment Fund | 0.26 |

| Alternative Investment Fund - Total | 0.26 | |

| Real Estate & Infrastructure Investment Trusts | ||

| MINDSPACE BUSINESS PARKS REIT | Realty | 0.65 |

| BHARAT HIGHWAYS INVIT | Construction | 0.34 |

| Real Estate & Infrastructure Investment Trusts - Total | 0.99 | |

| Net Current Assets/(Liabilities) | -1.17 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 30,20,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on December 31, 2024 (₹) | 86,45,098 | 16,65,737 | 10,54,271 | 6,97,697 | 4,00,624 | 1,24,731 |

| Scheme Returns (%) | 7.52 | 6.38 | 6.39 | 5.97 | 7.06 | 7.39 |

| CRISIL Medium to Long Duration Debt A-III Index Returns (%) | 7.99 | 7.27 | 7.08 | 6.51 | 7.65 | 8.39 |

| Alpha* | -0.46 | -0.89 | -0.69 | -0.54 | -0.58 | -1.00 |

| CRISIL Medium to Long Duration Debt A-III Index (₹)# | 92,72,994 | 17,44,896 | 10,80,545 | 7,07,289 | 4,04,114 | 1,25,363 |

| CRISIL 10 Year Gilt Index (₹)^ | NA | 16,54,078 | 10,52,024 | 7,00,616 | 4,07,240 | 1,25,801 |

| CRISIL 10 Year Gilt Index Returns (%) | NA | 6.25 | 6.33 | 6.14 | 8.17 | 9.08 |

| Regular | Direct | |

| Growth | Rs73.7361 | Rs82.4021 |

| IDCW | Rs45.1757 | Rs27.4261 |

| Fund Manager* | Mr. Abhishek Bisen |

| Benchmark*** | CRISIL Medium to Long Duration Debt A-III Index |

| Allotment date | November 25, 1999 |

| AAUM | Rs2,071.57 crs |

| AUM | Rs2,065.88 crs |

| Folio count | 5,426 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

At discretion of trustees

| Average Maturity | 13.09 yrs |

| Modified Duration | 6.16 yrs |

| Macaulay Duration | 6.40 yrs |

| Annualised YTM* | 7.10% |

| $Standard Deviation | 1.75% |

Source: $ICRA MFI Explorer

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 2-3 years

Entry Load:

Nil. (applicable for all plans)

Exit Load: Nil.(applicable for all plans)

| Regular Plan: | 1.65% |

| Direct Plan: | 0.70% |

Folio Count data as on 30th November 2024.

Fund

Benchmark: CRISIL Medium to Long Duration Debt A-III Index

This product is suitable for investors who are seeking*:

- Income over a long investment horizon

- Investment in debt & money market securities with a portfolio Macaulay duration between 4 years & 7 years.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 30th November, 2024. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'