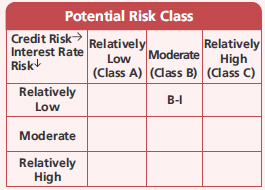

An open ended debt scheme investing in money market instruments. A relatively low interest rate risk and moderate credit risk.

An open ended debt scheme investing in money market instruments. A relatively low interest rate risk and moderate credit risk.

| Issuer/Instrument | Industry/Rating | % to Net Assets |

|---|---|---|

| Government Dated Securities | ||

| 5.22% Central Government | SOV | 1.30 |

| 5.80% Maharashtra State Govt-Maharashtra | SOV | 0.93 |

| 8.29% Maharashtra State Govt-Maharashtra | SOV | 0.78 |

| 8.23% Gujarat State Govt-Gujarat | SOV | 0.75 |

| 8.24% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.72 |

| 8.06% Maharashtra State Govt-Maharashtra | SOV | 0.47 |

| 8.59% Karnataka State Govt-Karnataka | SOV | 0.40 |

| 8.05% Karnataka State Govt-Karnataka | SOV | 0.32 |

| 8.05% Gujarat State Govt-Gujarat | SOV | 0.28 |

| 8.15% Gujarat State Govt-Gujarat | SOV | 0.27 |

| 8.21% Haryana State Govt-Haryana | SOV | 0.25 |

| 7.96% Gujarat State Govt-Gujarat | SOV | 0.19 |

| 8.07% Gujarat State Govt-Gujarat | SOV | 0.19 |

| 8.27% Madhya Pradesh State Govt-Madhya Pradesh | SOV | 0.18 |

| 6.90% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.13 |

| 8.16% Maharashtra State Govt-Maharashtra | SOV | 0.06 |

| 8.29% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.02 |

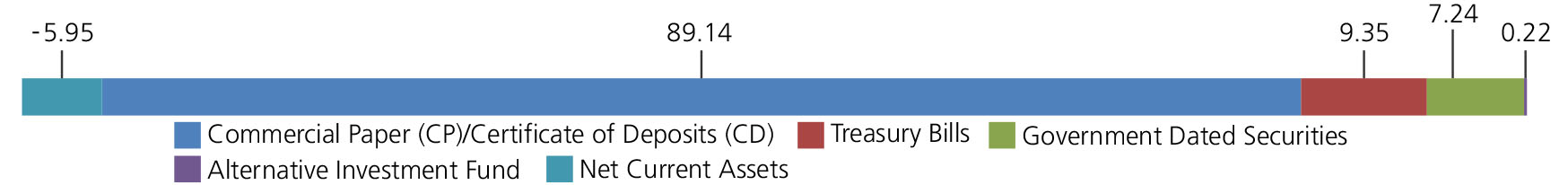

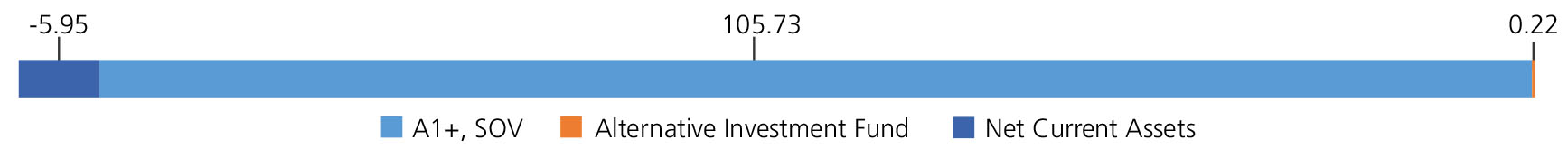

| Government Dated Securities - Total | 7.24 | |

| Money Market Instruments | ||

| Commercial Paper(CP)/Certificate of Deposits(CD) | ||

| Corporate Debt/Financial Institutions | ||

| HDFC BANK LTD. | CARE A1+ | 9.69 |

| AXIS BANK LTD. | CRISIL A1+ | 6.45 |

| INDUSIND BANK LTD. | CRISIL A1+ | 4.18 |

| FEDERAL BANK LTD. | CRISIL A1+ | 3.98 |

| BHARTI TELECOM LTD. | CRISIL A1+ | 2.46 |

| ICICI SECURITIES LIMITED | CRISIL A1+ | 2.32 |

| PIRAMAL CAPITAL & HOUSING FINANCE LTD. | CRISIL A1+ | 2.22 |

| STANDARD CHARTERED CAPITAL LTD. | CRISIL A1+ | 1.58 |

| MUTHOOT FINANCE LTD. | CRISIL A1+ | 1.57 |

| SHAREKHAN LIMITED | CRISIL A1+ | 1.42 |

| MANKIND PHARMA LTD | CRISIL A1+ | 1.39 |

| DBS BANK INDIA | FITCH A1+ | 1.11 |

| MOTILAL OSWAL FINANCIAL SERVICES LIMITED | ICRA A1+ | 1.11 |

| ICICI BANK LTD. | ICRA A1+ | 1.05 |

| AXIS SECURITIES LIMITED | CRISIL A1+ | 0.92 |

| IDFC FIRST BANK LIMITED | CRISIL A1+ | 0.92 |

| RBL BANK LTD. | ICRA A1+ | 0.92 |

| ADITYA BIRLA FINANCE LTD. | ICRA A1+ | 0.90 |

| Hero FinCorp Ltd. | CRISIL A1+ | 0.87 |

| BIRLA GROUP HOLDING PRIVATE LIMITED | CRISIL A1+ | 0.74 |

| HDFC CREDILA FINANCIAL SERVICES PVT LTD | CRISIL A1+ | 0.74 |

| TATA CAPITAL HOUSING FINANCE LTD. | CRISIL A1+ | 0.74 |

| TATA MOTORS FINANCE LTD. | ICRA A1+ | 0.74 |

| Muthoot Fincorp Ltd. | CRISIL A1+ | 0.72 |

| BARCLAYS INVESTMENTS & LOAN (INDIA) PVT. LTD. | CRISIL A1+ | 0.56 |

| IIFL FINANCE LIMITED | CRISIL A1+ | 0.55 |

| Bahadur Chand Investments Private Limited | ICRA A1+ | 0.38 |

| 360 ONE WAM LIMITED | ICRA A1+ | 0.37 |

| AU SMALL FINANCE BANK LTD. | CARE A1+ | 0.37 |

| GODREJ FINANCE LTD | CRISIL A1+ | 0.37 |

| HINDUJA LEYLAND FINANCE LTD. | CRISIL A1+ | 0.37 |

| NUVAMA WEALTH FINANCE LIMITED | CRISIL A1+ | 0.37 |

| HDFC BANK LTD. | FITCH A1+ | 0.28 |

| MOTILAL OSWAL FINVEST LTD. | CRISIL A1+ | 0.28 |

| NUVAMA WEALTH MANAGEMENT LIMITED | CRISIL A1+ | 0.19 |

| PILANI INVESTMENT AND INDUSTRIES CORPORATION LTD | CRISIL A1+ | 0.19 |

| AU SMALL FINANCE BANK LTD. | CRISIL A1+ | 0.18 |

| NUVAMA WEALTH AND INVESTMENT LTD | CRISIL A1+ | 0.18 |

| Panatone Finvest Ltd. | CRISIL A1+ | 0.09 |

| Corporate Debt/Financial Institutions - Total | 53.47 | |

| Public Sector Undertakings | ||

| SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA | CARE A1+ | 7.61 |

| BANK OF BARODA | FITCH A1+ | 4.90 |

| NATIONAL BANK FOR AGRICULTURE & RURAL DEVELOPMENT | CRISIL A1+ | 4.58 |

| INDIAN BANK | CRISIL A1+ | 4.08 |

| Union Bank of India | FITCH A1+ | 4.06 |

| PUNJAB NATIONAL BANK | FITCH A1+ | 3.59 |

| PUNJAB NATIONAL BANK | ICRA A1+ | 2.04 |

| CANARA BANK | CRISIL A1+ | 1.35 |

| Union Bank of India | ICRA A1+ | 0.92 |

| PUNJAB NATIONAL BANK | CARE A1+ | 0.87 |

| BANK OF INDIA | CRISIL A1+ | 0.74 |

| PUNJAB & SIND BANK | ICRA A1+ | 0.74 |

| Export-Import Bank of India | CRISIL A1+ | 0.19 |

| Public Sector Undertakings - Total | 35.67 | |

| Treasury Bills | ||

| 182 DAYS TREASURY BILL 01/05/2025 | SOV | 1.92 |

| 182 DAYS TREASURY BILL 06/03/2025 | SOV | 1.85 |

| 182 DAYS TREASURY BILL 15/05/2025 | SOV | 1.83 |

| 364 DAYS TREASURY BILL 04/12/2025 | SOV | 1.41 |

| 182 DAYS TREASURY BILL 08/05/2025 | SOV | 0.73 |

| 364 DAYS TREASURY BILL 06/11/2025 | SOV | 0.71 |

| 182 DAYS TREASURY BILL 27/02/2025 | SOV | 0.37 |

| 364 DAYS TREASURY BILL 21/11/2025 | SOV | 0.34 |

| 364 DAYS TREASURY BILL 20/02/2025 | SOV | 0.19 |

| Treasury Bills - Total | 9.35 | |

| Alternative Investment Fund | ||

| CORPORATE DEBT MARKET DEVELOPMENT FUND - CLASS A2 | Alternative Investment Fund | 0.22 |

| Alternative Investment Fund - Total | 0.22 | |

| Net Current Assets/(Liabilities) | -5.95 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 25,80,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on December 31, 2024 (₹) | 59,39,654 | 16,69,814 | 10,50,102 | 7,04,886 | 4,01,680 | 1,24,795 |

| Scheme Returns (%) | 7.13 | 6.43 | 6.28 | 6.38 | 7.24 | 7.49 |

| CRISIL Money Market A-I Index Returns (%) | 6.99 | 6.30 | 6.17 | 6.33 | 7.16 | 7.25 |

| Alpha* | 0.15 | 0.13 | 0.11 | 0.05 | 0.08 | 0.24 |

| CRISIL Money Market A-I Index (₹)# | 58,33,080 | 16,58,373 | 10,45,935 | 7,04,000 | 4,01,178 | 1,24,645 |

| NIFTY 1 Year T-Bill Index (₹)^ | 54,97,346 | 16,38,917 | 10,34,770 | 6,95,475 | 3,97,815 | 1,24,412 |

| NIFTY 1 Year T-Bill Index Returns (%) | 6.51 | 6.07 | 5.87 | 5.84 | 6.59 | 6.88 |

| Regular | Direct | |

| Growth | Rs4318.3411 | Rs4355.7147 |

| Monthly IDCW | Rs1054.1513 | Rs1193.3302 |

A)Regular Plan B)Direct Plan

Options: Payout of IDCW (Under Monthly

IDCW option only), Reinvestment of IDCW

& Growth applicable for all plans

| Fund Manager* | Mr. Deepak Agrawal, Mr. Manu Sharma |

| Benchmark*** | CRISIL Money Market A-I Index |

| Allotment date | July 14, 2003 |

| AAUM | Rs29,191.72 crs |

| AUM | Rs26,727.60 crs |

| Folio count | 15,322 |

Monthly (12th of every Month)

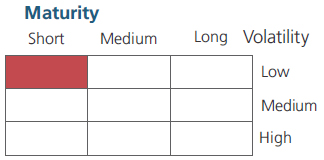

| Average Maturity | 0.46 yrs |

| Modified Duration | 0.46 yrs |

| Macaulay Duration | 0.46 yrs |

| Annualised YTM* | 7.51% |

| $Standard Deviation | 0.21% |

Source: $ICRA MFI Explorer.

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 3-6 months

Entry Load:

Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

| Regular Plan: | 0.35% |

| Direct Plan: | 0.23% |

Folio Count data as on 30th November 2024.

Fund

Benchmark: CRISIL Money Market A-I Index

This product is suitable for investors who are seeking*:

- Income over a short term investment horizon

- Investment in money market securities

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

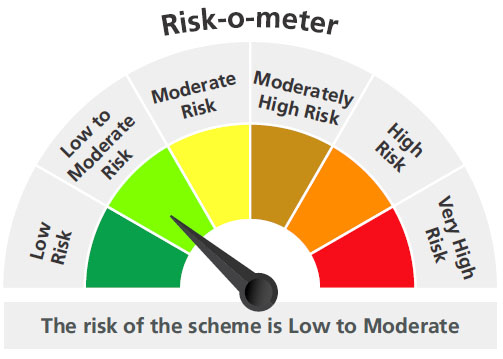

The above risk-o—meter is based on the scheme portfolio as on 30th November, 2024. An addendum may be issued or updated on the website for new riskometer

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'