| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related | ||

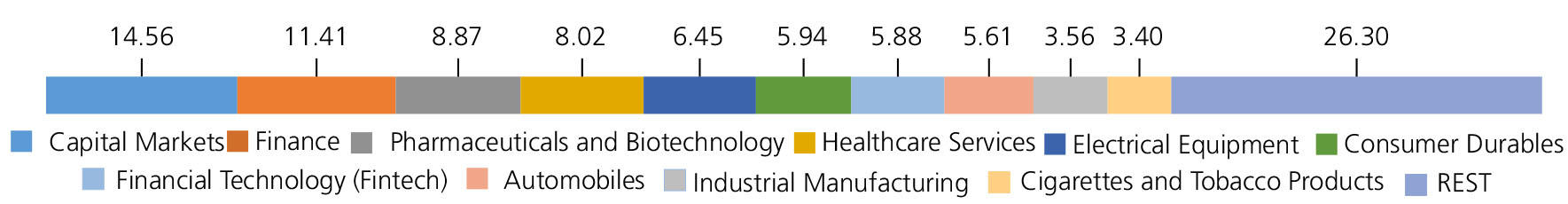

| Capital Markets | 14.56 | |

| BSE LTD. | 6.97 | |

| Multi Commodity Exchange of India Limited | 3.29 | |

| MOTILAL OSWAL FINANCIAL SERVICES LTD | 1.88 | |

| HDFC Asset Management Company Ltd. | 1.68 | |

| CENTRAL DEPOSITORY SERVICES (INDIA) LTD. | 0.45 | |

| KFIN TECHNOLOGIES LTD. | 0.29 | |

| Finance | 11.41 | |

| L&T FINANCE HOLDINGS LTD | 2.33 | |

| Aditya Birla Capital Ltd. | 2.26 | |

| Muthoot Finance Ltd | 2.05 | |

| Bajaj Holdings and Investment Ltd. | 1.75 | |

| BAJAJ FINANCE LTD. | 1.61 | |

| Manappuram Finance Ltd | 1.41 | |

| Pharmaceuticals and Biotechnology | 8.87 | |

| Laurus Labs Ltd. | 4.55 | |

| Wockhardt Ltd. | 2.17 | |

| Divi s Laboratories Ltd. | 1.46 | |

| Glenmark Pharmaceuticals Ltd | 0.69 | |

| Healthcare Services | 8.02 | |

| Fortis Healthcare India Ltd | 3.67 | |

| Narayana Hrudayalaya Ltd. | 2.18 | |

| MAX HEALTHCARE INSTITUTE LTD. | 2.17 | |

| Electrical Equipment | 6.45 | |

| GE VERNOVA T&D INDIA LIMITED | 3.45 | |

| HITACHI ENERGY INDIA LIMITED | 3 | |

| Consumer Durables | 5.94 | |

| AMBER ENTERPRISES INDIA LTD. | 3.44 | |

| Dixon Technologies India Ltd. | 1.72 | |

| PG ELECTROPLAST LTD | 0.78 | |

| Financial Technology (Fintech) | 5.88 | |

| ONE 97 COMMUNICATIONS LTD. | 5.44 | |

| PB FINTECH LTD. | 0.44 | |

| Automobiles | 5.61 | |

| Eicher Motors Ltd. | 1.64 | |

| TVS Motors Company Ltd | 1.41 | |

| Maruti Suzuki India Limited | 1.29 | |

| Mahindra & Mahindra Ltd. | 1.27 | |

| Industrial Manufacturing | 3.56 | |

| KAYNES TECHNOLOGY INDIA LTD. | 1.92 | |

| MAZAGOAN DOCK SHIPBUILDERS LTD | 1.64 | |

| Cigarettes and Tobacco Products | 3.40 | |

| Godfrey Phillips India Ltd. | 3.40 | |

| Fertilizers and Agrochemicals | 3.30 | |

| Coromandel International Ltd. | 1.84 | |

| UPL Ltd | 1.46 | |

| IT - Software | 3.17 | |

| COFORGE LIMITED | 2.57 | |

| PERSISTENT SYSTEMS LIMITED | 0.60 | |

| Insurance | 3.04 | |

| Max Financial Services Ltd. | 2.65 | |

| HDFC Life Insurance Company Ltd. | 0.39 | |

| Power | 3.00 | |

| RELIANCE POWER LTD | 3.00 | |

| Aerospace and Defense | 2.75 | |

| Bharat Electronics Ltd. | 1.81 | |

| BHARAT DYNAMICS LTD | 0.94 | |

| Chemicals and Petrochemicals | 1.79 | |

| SOLAR INDUSTRIES INDIA LIMITED | 1.79 | |

| Retailing | 1.77 | |

| ETERNAL LIMITED | 1.77 | |

| Auto Components | 1.53 | |

| Bosch Ltd. | 1.53 | |

| Banks | 1.49 | |

| RBL Bank Ltd | 1.49 | |

| Leisure Services | 1.46 | |

| INDIAN HOTELS COMPANY LTD. | 1.46 | |

| Telecom - Services | 1.42 | |

| Bharti Airtel Ltd | 1.42 | |

| Commercial Services and Supplies | 1.27 | |

| Redington India Ltd | 1.27 | |

| Transport Services | 1.22 | |

| Inter Globe Aviation Ltd | 1.22 | |

| Equity & Equity related - Total | 100.91 | |

| Triparty Repo | 1.47 | |

| Net Current Assets/(Liabilities) | -2.38 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs9.8997 | Rs9.9116 |

| IDCW | Rs9.8996 | Rs9.9115 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout

and Reinvestment)

| Fund Manager* | Mr. Devender Singhal, Mr. Satish Dondapati & Mr. Abhishek Bisen |

| Benchmark | Nifty Alpha 50 Index TRI |

| Allotment date | August 19, 2025 |

| AAUM | Rs12.17 crs |

| AUM | Rs13.63 crs |

| Folio count | 5,670 |

| Portfolio Turnover | 40.37% |

| Tracking Error | 0.32% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Trustee's Discretion

Entry Load:

NIL. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

| Regular Plan: | 0.94% |

| Direct Plan: | 0.35% |

Folio Count data as on 30th September 2025.

Fund

Benchmark :Nifty Alpha 50 Index TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Return that corresponds to the performance of Nifty Alpha 50 Index, subject to tracking error.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made. An addendum may be issued or updated on the website for new riskometer.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

Total Expense Ratio includes applicable GST

The scheme has not completed 6 month since inception For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'