| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related | ||

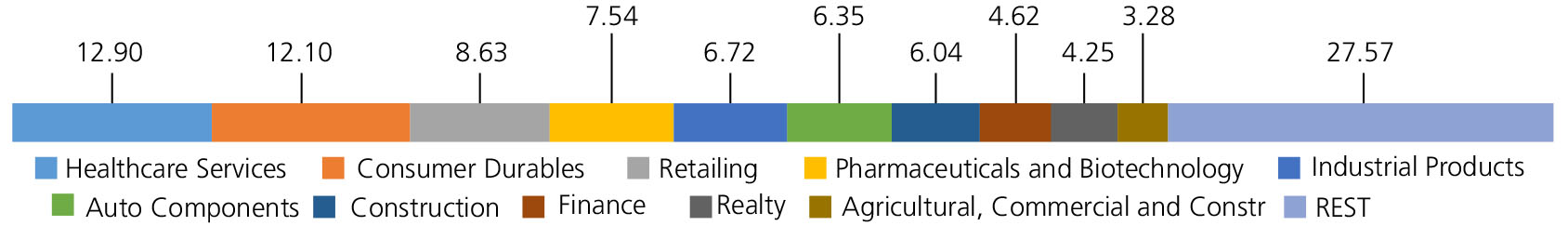

| Healthcare Services | 12.90 | |

| ASTER DM HEALTHCARE LTD | 4.42 | |

| KRISHNA INSTITUTE OF MEDICAL | 3.38 | |

| VIJAYA DIAGNOSTIC CENTRE PVT | 2.97 | |

| Metropolis Healthcare Ltd. | 1.36 | |

| SURAKSHA DIAGNOSTIC LTD | 0.54 | |

| JUPITER LIFELINE HOSPITALS LTD | 0.23 | |

| Consumer Durables | 12.10 | |

| Century Plyboards (India) Ltd. | 2.77 | |

| BLUE STAR LTD. | 1.62 | |

| V-Guard Industries Ltd. | 1.61 | |

| Crompton Greaves Consumer Electricals Ltd | 1.30 | |

| CELLO WORLD LTD. | 1.13 | |

| Hawkins Cooker Ltd | 0.87 | |

| Sheela Foam Ltd | 0.75 | |

| Orient Electric Ltd. | 0.73 | |

| SOMANY CERAMICS LTD. | 0.72 | |

| Nilkamal Ltd | 0.60 | |

| Retailing | 8.63 | |

| VISHAL MEGA MART LIMITED | 2.07 | |

| V-Mart Retail Ltd. | 1.61 | |

| Medplus Health Services Ltd. | 1.51 | |

| AVENUE SUPERMARTS LTD. | 1.37 | |

| Shoppers Stop Ltd. | 1.22 | |

| SWIGGY LTD | 0.85 | |

| Pharmaceuticals and Biotechnology | 7.54 | |

| Alembic Pharmaceuticals Ltd. | 1.71 | |

| Ajanta Pharma Ltd. | 1.67 | |

| JB CHEMICALS & PHARMACEUTICALS LTD. | 1.21 | |

| MANKIND PHARMA LTD | 1.05 | |

| ANTHEM BIOSCIENCES LTD | 0.98 | |

| Torrent Pharmaceuticals Ltd. | 0.92 | |

| Industrial Products | 6.72 | |

| Carborundum Universal Ltd. | 1.31 | |

| Ratnamani Metals & Tubes Ltd. | 1.27 | |

| KEI INDUSTRIES LTD. | 0.93 | |

| HAPPY FORGINGS LTD | 0.91 | |

| BANSAL WIRE INDUSTRIES LIMITED | 0.78 | |

| R R KABEL LTD | 0.78 | |

| WPIL LTD | 0.48 | |

| Apollo Pipes Ltd. | 0.26 | |

| Auto Components | 6.35 | |

| Sansera Engineering Ltd. | 2.20 | |

| MINDA CORPORATION LIMITED | 1.63 | |

| Schaeffler India Ltd | 1.14 | |

| ROLEX RINGS LTD. | 0.83 | |

| Sandhar Technologies Ltd. | 0.55 | |

| Construction | 6.04 | |

| TECHNO ELECTRIC & ENGINEERING COMPANY LIMITED | 2.67 | |

| KALPATARU PROJECTS INTERNATIONAL LIMITED | 2.49 | |

| G R Infraprojects Limited | 0.88 | |

| Finance | 4.62 | |

| APTUS VALUE HOUSING FINANCE | 1.42 | |

| FIVE STAR BUSINESS FINANCE LTD | 1.34 | |

| SHRIRAM FINANCE LTD. | 1.03 | |

| HOME FIRST FINANCE CO INDIA | 0.83 | |

| Realty | 4.25 | |

| BRIGADE ENTERPRISES LIMITED | 2.37 | |

| Mahindra Lifespace Developers Ltd | 1.26 | |

| MAX ESTATES LIMITED | 0.62 | |

| Agricultural, Commercial and Construction Vehicles | 3.28 | |

| BEML Ltd. | 1.78 | |

| V.S.T Tillers Tractors Ltd | 1.50 | |

| IT - Services | 3.26 | |

| CYIENT LTD. | 2.14 | |

| SAGILITY INDIA LTD. | 1.12 | |

| Banks | 3.05 | |

| Axis Bank Ltd. | 1.26 | |

| ICICI Bank Ltd. | 1.02 | |

| KARUR VYSYA BANK LTD. | 0.77 | |

| Transport Services | 2.77 | |

| Blue Dart Express Ltd. | 1.54 | |

| Great Eastern Shipping Company Ltd | 1.23 | |

| Textiles and Apparels | 2.27 | |

| Garware Technical Fibres Ltd. | 2.01 | |

| Kewal Kiran Clothing Limited. | 0.26 | |

| Insurance | 1.93 | |

| ICICI Lombard General Insurance Company Ltd | 1.33 | |

| MEDI ASSIST HEALTHCARE SERVICES LIMITED | 0.60 | |

| Chemicals and Petrochemicals | 1.87 | |

| JUBILANT INGREVIA LTD | 1.39 | |

| Atul Ltd. | 0.48 | |

| Electrical Equipment | 1.62 | |

| GE VERNOVA T&D INDIA LIMITED | 1.62 | |

| Telecom - Services | 1.45 | |

| BHARTI HEXACOM LTD. | 1.45 | |

| Capital Markets | 1.31 | |

| KFIN TECHNOLOGIES LTD. | 1.16 | |

| ANAND RATHI SHARE AND STOCK BROKERS LIMITED | 0.15 | |

| Commercial Services and Supplies | 1.18 | |

| CMS INFO SYSTEMS LTD | 1.18 | |

| Leisure Services | 1.15 | |

| DEVYANI INTERNATIONAL LIMITED | 1.15 | |

| Agricultural Food and other Product | 1.11 | |

| Balrampur Chini Mills Ltd. | 1.11 | |

| Cement and Cement Products | 1.08 | |

| JK Cement Ltd. | 1.08 | |

| Fertilizers and Agrochemicals | 1.02 | |

| Dhanuka Agritech Ltd. | 1.02 | |

| Entertainment | 0.65 | |

| PVR INOX LIMITED | 0.65 | |

| IT - Software | 0.53 | |

| HEXAWARE TECHNOLOGIES LTD. | 0.53 | |

| Equity & Equity related - Total | 98.68 | |

| Triparty Repo | 1.61 | |

| Net Current Assets/(Liabilities) | -0.29 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 24,90,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Oct 31, 2025 (₹) | 1,93,36,292 | 32,51,853 | 18,16,069 | 8,95,937 | 4,36,832 | 1,23,094 |

| Scheme Returns (%) | 17.03 | 18.94 | 21.64 | 16.04 | 12.97 | 4.83 |

| NIFTY Smallcap 250 (TRI) Returns (%) | NA | 18.72 | 23.63 | 20.90 | 18.69 | 10.88 |

| Alpha* | NA | 0.21 | -1.99 | -4.86 | -5.72 | -6.05 |

| NIFTY Smallcap 250 (TRI) (₹)# | NA | 32,14,571 | 19,48,935 | 10,08,756 | 4,73,893 | 1,26,915 |

| Nifty Smallcap 100 (TRI) Returns (%) | 13.50 | 16.96 | 21.88 | 19.92 | 19.73 | 11.47 |

| Alpha* | 3.54 | 1.98 | -0.24 | -3.88 | -6.75 | -6.65 |

| Nifty Smallcap 100 (TRI) (₹)# | 1,22,39,437 | 29,22,894 | 18,31,402 | 9,85,038 | 4,80,848 | 1,27,286 |

| Nifty 50 (TRI) (₹)^ | 1,16,58,182 | 25,78,095 | 14,55,661 | 8,49,868 | 4,40,594 | 1,29,199 |

| Nifty 50 (TRI) Returns (%) | 13.12 | 14.62 | 15.43 | 13.89 | 13.57 | 14.55 |

| Regular | Direct | |

| Growth | Rs260.9488 | Rs307.1672 |

| IDCW | Rs113.8434 | Rs134.9173 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Harish Bihani |

| Benchmark*** | NIFTY Smallcap 250 TRI (Tier 1), NIFTY Smallcap 100 TRI (Tier 2) |

| Allotment date | February 24, 2005 |

| AAUM | Rs17,880.87 crs |

| AUM | Rs18,023.96 crs |

| Folio count | 10,11,368 |

Trustee's Discretion

| Portfolio Turnover | 26.07% |

| $Beta | 0.80 |

| $Sharpe ## | 0.67 |

| $Standard Deviation | 16.58% |

| ^^(P/E) | 39.36 |

| ^^P/BV | 4.52 |

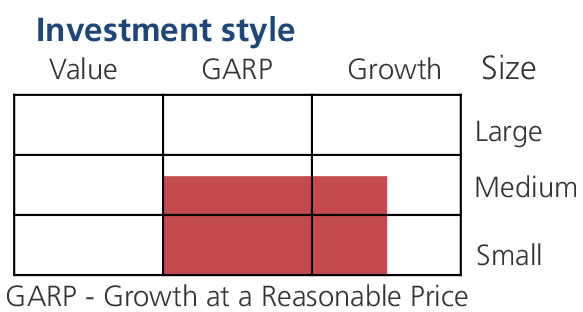

| Large Cap | 6.65% |

| Mid Cap | 15.27% |

| Small Cap | 76.76% |

| Debt & Money Market | 1.32% |

*% of Net Asset

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

• If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

• If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL.

| Regular Plan: | 1.64% |

| Direct Plan: | 0.53% |

Folio Count data as on 30th September 2025.

Benchmark - Tier 1 : NIFTY Smallcap 250 TRI

Benchmark - Tier 2 : Nifty Smallcap 100 TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity & equity related securities predominantly in small cap Stocks.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

***As per para 1.9 of of SEBI Master circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024 The first tier benchmark is reflective of the category of the scheme and the second tier benchmark is demonstrative of the investment style / strategy of the Fund Manager within the category.

## Risk rate assumed to be 5.69% (FBIL Overnight MIBOR rate as on 31st Oct 2025). **Total Expense Ratio includes applicable GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'