Mid cap fund - An open-ended equity scheme predominantly investing in mid cap stocks

Mid cap fund - An open-ended equity scheme predominantly investing in mid cap stocks

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

| Industrial Products | 14.25 | |

| Supreme Industries Limited | 5.40 | |

| Schaeffler India Ltd | 3.66 | |

| SKF India Ltd | 2.64 | |

| Cummins India Ltd. | 2.44 | |

| Finolex Cables Ltd. | 0.11 | |

| Consumer Durables | 11.28 | |

| Sheela Foam Ltd | 2.30 | |

| Kajaria Ceramics Ltd. | 2.18 | |

| Voltas Ltd. | 1.95 | |

| Bata India Ltd. | 1.90 | |

| Amber Enterprises India Ltd. | 1.24 | |

| V-Guard Industries Ltd. | 0.92 | |

| Blue Star Ltd. | 0.79 | |

| Banks | 7.57 | |

| AU Small Finance Bank Ltd. | 1.66 | |

| ICICI Bank Ltd. | 1.51 | |

| State Bank Of India | 1.39 | |

| Federal Bank Ltd. | 1.31 | |

| City Union Bank Ltd. | 0.71 | |

| Axis Bank Ltd. | 0.63 | |

| RBL Bank Ltd | 0.36 | |

| Chemicals | 7.13 | |

| Atul Ltd. | 2.44 | |

| Solar Industries India Limited | 2.39 | |

| SRF Ltd. | 2.30 | |

| Pharmaceuticals | 6.14 | |

| Torrent Pharmaceuticals Ltd. | 1.78 | |

| Cadila Healthcare Ltd | 1.32 | |

| Ipca Laboratories Ltd. | 1.11 | |

| Laurus Labs Ltd | 0.75 | |

| Alkem Laboratories Ltd. | 0.73 | |

| Eris Lifesciences Ltd. | 0.39 | |

| Gland Pharma Limited | 0.06 | |

| Cement & Cement Products | 5.79 | |

| The Ramco Cements Ltd | 2.61 | |

| JK Cement Ltd. | 2.51 | |

| Shree Cement Ltd. | 0.67 | |

| Auto Ancillaries | 4.91 | |

| Balkrishna Industries Ltd. | 1.27 | |

| MRF Limited | 1.02 | |

| Motherson Sumi Systems Ltd. | 0.91 | |

| Exide Industries Ltd | 0.76 | |

| Amara Raja Batteries Ltd. | 0.64 | |

| WABCO India Ltd. | 0.31 | |

| Ferrous Metals | 4.33 | |

| APL Apollo Tubes Ltd. | 1.53 | |

| Ratnamani Metals & Tubes Ltd. | 1.41 | |

| Jindal Steel & Power Ltd. | 1.39 | |

| Software | 4.09 | |

| Persistent Systems Limited | 4.09 | |

| Consumer Non Durables | 3.70 | |

| Emami Ltd. | 1.81 | |

| Tata Consumer Products Ltd | 1.13 | |

| Godrej Agrovet Ltd. | 0.76 | |

| Construction | 3.49 | |

| Oberoi Realty Ltd | 3.01 | |

| PNC Infratech Ltd | 0.48 | |

| Finance | 3.35 | |

| Sundaram Finance Ltd. | 1.49 | |

| Mahindra & Mahindra Financial Services Ltd. | 1.07 | |

| Shriram City Union Finance Ltd. | 0.79 | |

| Textile Products | 3.18 | |

| Lux Industries Limited | 1.60 | |

| Page Industries Ltd | 1.38 | |

| Kewal Kiran Clothing Limited. | 0.20 | |

| Fertilisers | 3.11 | |

| Coromandel International Ltd. | 3.11 | |

| Industrial Capital Goods | 2.80 | |

| Thermax Ltd. | 2.58 | |

| BEML Ltd. | 0.22 | |

| Pesticides | 2.66 | |

| P I Industries Ltd | 2.66 | |

| Aerospace & Defense | 2.33 | |

| Bharat Electronics Ltd. | 2.33 | |

| Healthcare Services | 1.53 | |

| Apollo Hospitals Enterprises Ltd. | 1.53 | |

| Insurance | 1.46 | |

| Max Financial Services Ltd. | 1.46 | |

| Gas | 1.34 | |

| Gujarat State Petronet Ltd. | 0.69 | |

| Gujarat Gas Ltd. | 0.65 | |

| Petroleum Products | 0.73 | |

| Hindustan Petroleum Corporation Ltd | 0.73 | |

| Household Appliances | 0.66 | |

| Hawkins Cooker Ltd | 0.66 | |

| Power | 0.41 | |

| Kalpataru Power Transmission Ltd. | 0.41 | |

| Printing & Publication | 0.07 | |

| Navneet Education Ltd. | 0.07 | |

| Capital Markets | 0.01 | |

| Aditya Birla Sun Life AMC Ltd | 0.01 | |

| Equity & Equity Related - Total | 96.32 | |

| Triparty Repo | 4.00 | |

| Net Current Assets/(Liabilities) | -0.32 | |

| Grand Total | 100.00 | |

Note: Large Cap, Midcap, Small cap and Debt and Money Market stocks as a % age of Net Assets: 10.93%, 70.39%, 15.00% & 3.68.

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (Rs) | 17,50,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Sep 30, 2021 (Rs) | 78,45,252 | 38,23,406 | 17,38,049 | 10,80,897 | 6,16,764 | 1,56,726 |

| Scheme Returns (%) | 18.64 | 21.94 | 20.41 | 23.78 | 38.33 | 61.39 |

| Nifty Midcap 100 (TRI) Returns (%) | 16.21 | 18.61 | 18.80 | 22.42 | 39.04 | 72.08 |

| Alpha | 2.43 | 3.33 | 1.61 | 1.36 | -0.72 | -10.69 |

| Nifty Midcap 100 (TRI) (Rs)# | 63,85,346 | 31,93,784 | 16,41,074 | 10,45,981 | 6,22,470 | 1,62,664 |

| Nifty 50 (TRI) (Rs)^ | 52,45,963 | 27,76,321 | 15,57,857 | 10,01,039 | 5,45,837 | 1,49,745 |

| Nifty 50 (TRI) Returns (%) | 13.87 | 16.01 | 17.34 | 20.60 | 29.02 | 49.08 |

TRI – Total Return Index, In terms of SEBI circular dated January 4, 2018, the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI).

Alpha is difference of scheme return with benchmark return

| Reg-Plan-IDCW | Rs38.8270 |

| Dir-Plan-IDCW | Rs46.6750 |

| Growth option | Rs70.6950 |

| Direct Growth option | Rs78.3400 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Pankaj Tibrewal* |

| Benchmark | Nifty Midcap 100 TRI |

| Allotment date | March 30, 2007 |

| AAUM | Rs16,199.15 crs |

| AUM | Rs16,318.43 crs |

| Folio count | 6,81,739 |

Trustee's Discretion

| Portfolio Turnover | 7.54% |

| $Beta | 0.88 |

| $Sharpe ## | 0.94 |

| $Standard Deviation | 24.26% |

| (P/E) | 32.62 |

| P/BV | 4.71 |

| IDCW Yield | 0.68 |

Initial Investment: Rs5000 and in multiple of

Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in

multiples of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

Regular: 1.80%; Direct: 0.55%

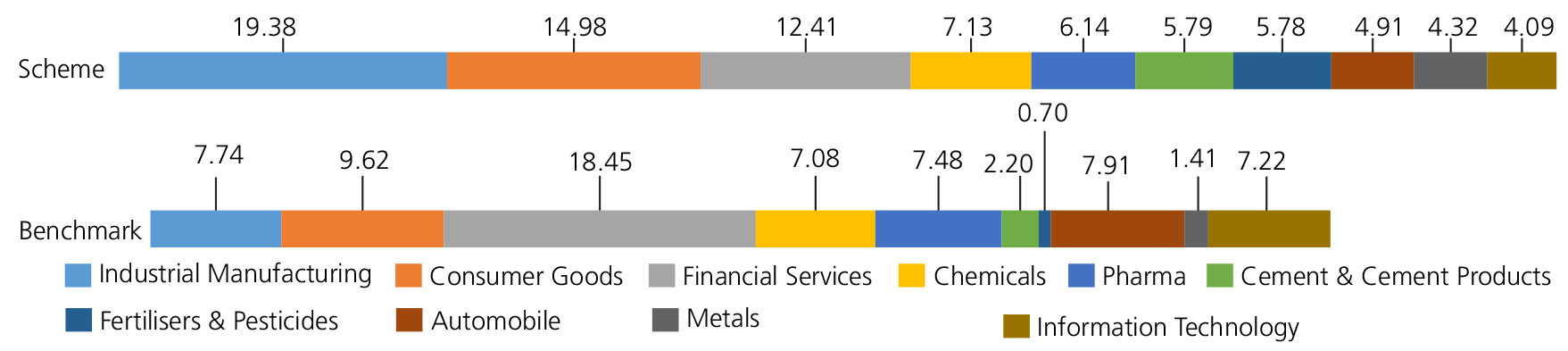

Benchmark

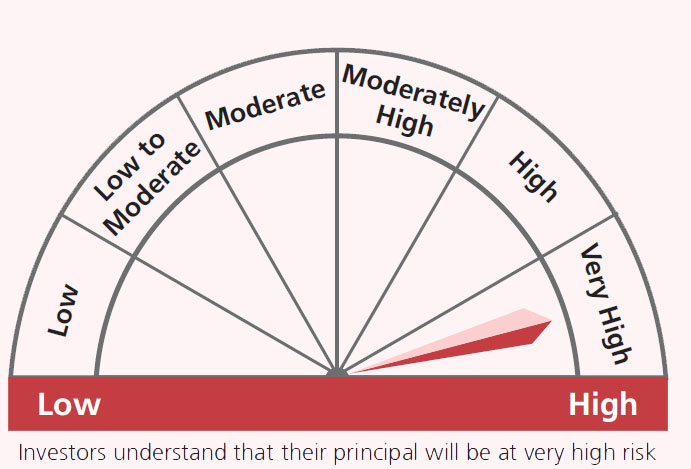

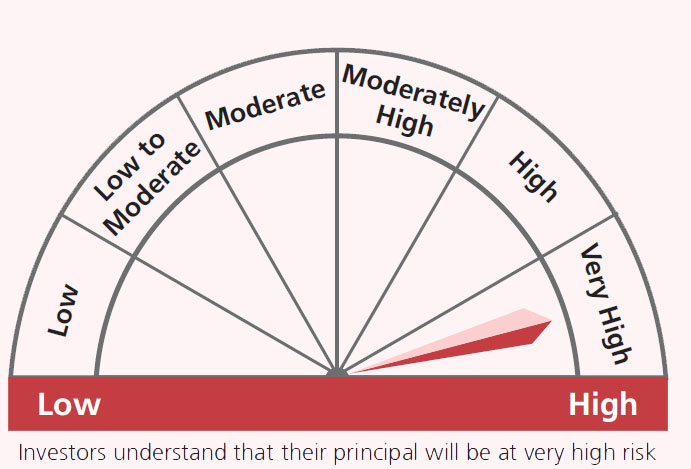

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity & equity related securities predominantly in mid cap companies.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'