| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Government Dated Securities | ||

| 4.62% Central Government | SOV | 51.67 |

| 6.64% Central Government | SOV | 6.66 |

| 7.88% State Government(^)-Chattisgarh | SOV | 6.02 |

| 4.59% Central Government | SOV | 4.24 |

| 7.62% State Government-Andhra Pradesh | SOV | 2.98 |

| 7.42% State Government-West Bengal | SOV | 1.78 |

| 7.92% State Government-West Bengal | SOV | 1.51 |

| 7.80% State Government-Kerala | SOV | 1.50 |

| 7.74% State Government-Tamil Nadu | SOV | 1.50 |

| 7.59% State Government-Gujarat | SOV | 1.49 |

| GS CG 22 Aug 2029 - (STRIPS) | SOV | 1.30 |

| GS CG 22 Feb 2029 - (STRIPS) | SOV | 1.17 |

| 7.17% State Government-Gujarat | SOV | 1.17 |

| GS CG 22 Feb 2028 - (STRIPS) | SOV | 1.07 |

| GS CG 22 Feb 2027 - (STRIPS) | SOV | 0.95 |

| GS CG 22 Aug 2027 - (STRIPS) | SOV | 0.91 |

| 7.80% State Government-Jharkhand | SOV | 0.90 |

| GS CG 22 Aug 2028 - (STRIPS) | SOV | 0.67 |

| 7.85% State Government-Rajasthan | SOV | 0.60 |

| GS CG 22/02/2026 - (STRIPS) | SOV | 0.59 |

| 6.75% State Government-Bihar | SOV | 0.57 |

| 6.67% Central Government | SOV | 0.56 |

| GS CG 17 Jun 2027 - (STRIPS) | SOV | 0.40 |

| GS CG 17/12/2027 - (STRIPS) | SOV | 0.38 |

| GS CG 17/06/2028 - (STRIPS) | SOV | 0.37 |

| GS CG 17/12/2028 - (STRIPS) | SOV | 0.36 |

| GS CG 17/06/2029 - (STRIPS) | SOV | 0.34 |

| GS 6.76% CG 22/02/2061 - (STRIPS) | SOV | 0.34 |

| GS CG 22 Feb 2030 - (STRIPS) | SOV | 0.28 |

| GS CG 22 Aug 2030 - (STRIPS) | SOV | 0.27 |

| 8.43% State Government-Tamil Nadu | SOV | 0.22 |

| GS CG 22 Feb 2022 - (STRIPS) | SOV | 0.19 |

| GS CG 22 Feb 2036 - (STRIPS) | SOV | 0.18 |

| GS CG 22 Feb 2023 - (STRIPS) | SOV | 0.18 |

| GS CG 22 Aug 2022 - (STRIPS) | SOV | 0.18 |

| GS CG 22 Feb 2024 - (STRIPS) | SOV | 0.17 |

| GS CG 22 Aug 2036 - (STRIPS) | SOV | 0.17 |

| GS CG 22 Aug 2023 - (STRIPS) | SOV | 0.17 |

| GS CG 22 Feb 2037 - (STRIPS) | SOV | 0.16 |

| GS CG 22 Feb 2025 - (STRIPS) | SOV | 0.16 |

| GS CG 22 Aug 2024 - (STRIPS) | SOV | 0.16 |

| GS CG 22 Aug 2025 - (STRIPS) | SOV | 0.15 |

| GS CG 22 Aug 2026 - (STRIPS) | SOV | 0.14 |

| 6.72% State Government-Kerala | SOV | 0.14 |

| 6.57% State Government-Andhra Pradesh | SOV | 0.14 |

| GS CG 23/12/2025 - (STRIPS) | SOV | 0.13 |

| GS CG 22 Feb 2032 - (STRIPS) | SOV | 0.10 |

| GS CG 22 Feb 2031 - (STRIPS) | SOV | 0.10 |

| GS CG 22 Aug 2031 - (STRIPS) | SOV | 0.10 |

| GS CG 22 Feb 2033 - (STRIPS) | SOV | 0.09 |

| GS CG 22 Aug 2033 - (STRIPS) | SOV | 0.09 |

| GS CG 22 Aug 2032 - (STRIPS) | SOV | 0.09 |

| 6.68% State Government-Haryana | SOV | 0.09 |

| GS CG 22 Feb 2035 - (STRIPS) | SOV | 0.08 |

| GS CG 22 Feb 2034 - (STRIPS) | SOV | 0.08 |

| GS CG 22 Aug 2034 - (STRIPS) | SOV | 0.08 |

| GS CG 22 Aug 2035 - (STRIPS) | SOV | 0.07 |

| GS CG 22 Feb 2039 - (STRIPS) | SOV | 0.06 |

| GS CG 22 Feb 2038 - (STRIPS) | SOV | 0.06 |

| GS CG 22 Aug 2039 - (STRIPS) | SOV | 0.06 |

| GS CG 22 Aug 2038 - (STRIPS) | SOV | 0.06 |

| GS CG 22 Aug 2037 - (STRIPS) | SOV | 0.06 |

| GS CG 22 Feb 2042 - (STRIPS) | SOV | 0.05 |

| GS CG 22 Aug 2040 - (STRIPS) | SOV | 0.05 |

| 6.78% State Government-Karnataka | SOV | 0.05 |

| GS CG 22 Feb 2045 - (STRIPS) | SOV | 0.04 |

| GS CG 22 Feb 2044 - (STRIPS) | SOV | 0.04 |

| GS CG 22 Feb 2043 - (STRIPS) | SOV | 0.04 |

| GS CG 22 Aug 2045 - (STRIPS) | SOV | 0.04 |

| GS CG 22 Aug 2044 - (STRIPS) | SOV | 0.04 |

| GS CG 22 Aug 2043 - (STRIPS) | SOV | 0.04 |

| GS CG 22 Aug 2042 - (STRIPS) | SOV | 0.04 |

| GS CG 22 Feb 2050 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Feb 2049 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Feb 2048 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Feb 2047 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Feb 2046 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Aug 2049 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Aug 2048 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Aug 2047 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Aug 2046 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Feb 2057 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Feb 2055 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Feb 2054 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Feb 2053 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Feb 2052 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Feb 2051 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Aug 2056 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Aug 2055 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Aug 2054 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Aug 2053 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Aug 2052 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Feb 2056 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Aug 2051 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Aug 2050 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Feb 2061 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2060 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2059 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2058 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2060 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2059 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2058 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Aug 2057 - (STRIPS) | SOV | 0.01 |

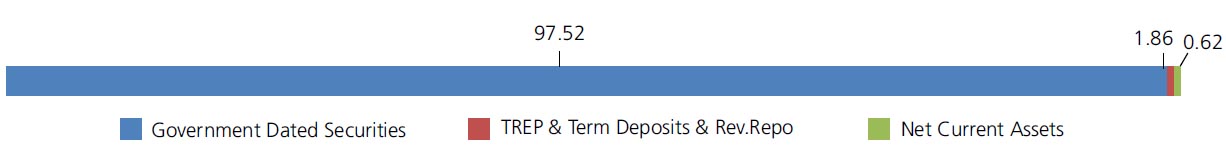

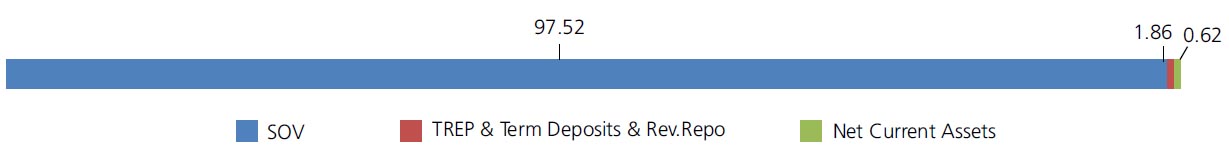

| Government Dated Securities - Total | 97.52 | |

| Triparty Repo | 1.86 | |

| Net Current Assets/(Liabilities) | 0.62 | |

| Grand Total | 100.00 | |

| Regular-Growth | Rs78.5207 |

| Regular-Growth-Direct | Rs85.6836 |

| PF & Trust-Growth | Rs80.3315 |

| PF & Trust-Growth Direct | Rs87.7530 |

| PF & Trust-Quarterly-Reg-Plan-IDCW | Rs11.9702 |

| Quarterly-Reg-Plan-IDCW | Rs15.3431 |

| Quarterly-Dir-Plan-IDCW | Rs19.3511 |

A) Regular Non Direct Plan,

B) PF & Trust Non Direct Plan,

C) Regular Direct Plan,

D) PF & Trust Direct Plan.

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Abhishek Bisen* |

| Benchmark | Nifty All Duration G-Sec Index |

| Allotment date | Regular Plan -

December 29, 1998; PF & Trust Plan - November 11, 2003 |

| AAUM | Rs1,686.27 crs |

| AUM | Rs1,788.67 crs |

| Folio count | 4,918 |

Quarterly (20th of Mar/Jun/Sep/Dec)

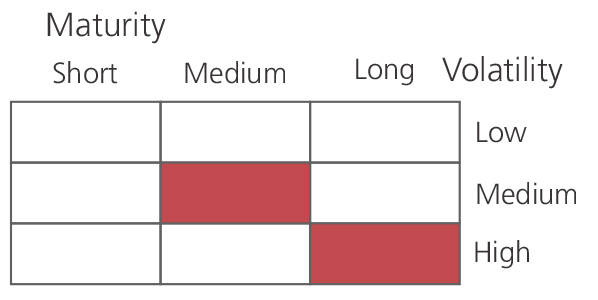

| Portfolio Average Maturity | 10.05 yrs |

| IRS Average Maturity* | -0.05 yrs |

| Net Average Maturity | 10.01 yrs |

| Portfolio Modified Duration | 3.05 yrs |

| IRS Modified Duration* | -0.05 yrs |

| Net Modified Duration | 3.01 yrs |

| Portfolio Macaulay Duration | 3.15 yrs |

| IRS Macaulay Duration* | -0.05 yrs |

| Net Macaulay Duration | 3.10 yrs |

| YTM | 5.29% |

| $Standard Deviation (A) Reg. Plan (B) PF Trust Plan | 3.51% |

Initial Investment: Rs5000 and in multiple

of Rs1 for purchase and for Rs0.01 for

switches

Additional Investment: Rs1000 & in multiples

of Rs1

Ideal Investments Horizon: 2-3 years

Entry Load: (a) Regular Plan - Entry: Nil. (b) PF &

Trust Plan - Entry: Nil. (applicable for all plans)

Exit Load: (a) Regular Plan - Exit: Nil. (b)

PF&Trust Plan - Exit: Nil. (applicable for all

plans)

Regular: 1.46%; Direct: 0.48%

Fund

Benchmark

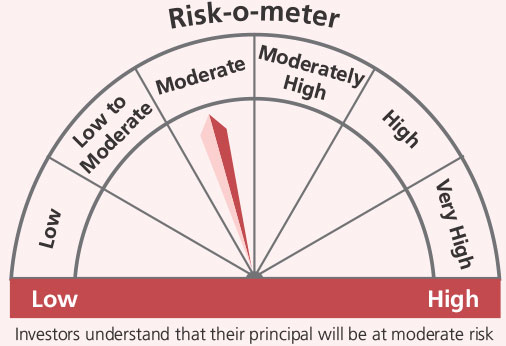

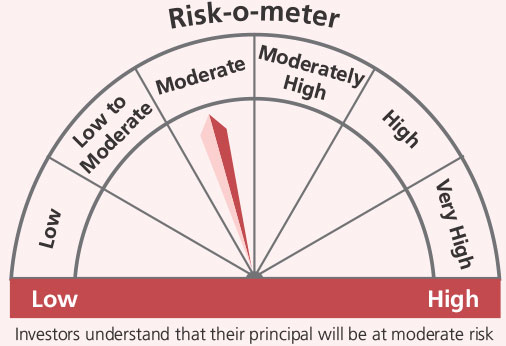

This product is suitable for investors who are seeking*:

- Income over a long investment horizon

- Investment in sovereign securities issued by the Central and/or State Government(s) and/or reverse repos in such securities

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

**Total Expense Ratio includes applicable B30 fee and GST

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'