7 Oct 2022

Let’s talk about target maturity index funds today.

What are these?

These are a type of debt fund, managed passively, and intend to replicate an index by investing in the constituents of the underlying index.

These funds have a fixed maturity date, and the bonds held in the scheme are held till maturity. At maturity, investors get back their investment proceeds.

Who can consider investing in this fund? This fund can be suitable for investors looking for–

- Low Cost: This fund has a low expense ratio given that it is passively managed.

- Relatively Safer: State development loans and AAA-rated PSU bonds follow closely on the heels of the central-government-issued Gilts.

- Fixed Income Securities: The fund will invest in instruments which have fixed maturity.

- Tax Efficiency: The fund provides the benefit of indexation, which can lead to lower tax implications.

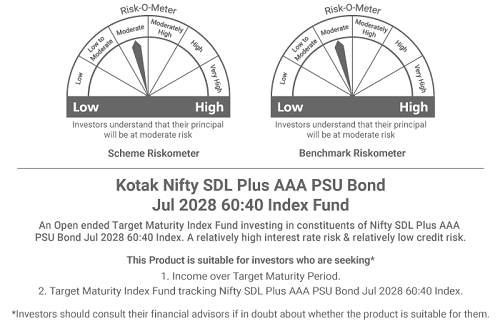

The Kotak Nifty SDL Plus AAA PSU Bond Jul 2028 60:40 Index Fund is benchmarked against the Nifty SDL Plus AAA PSU Bond Jul 2028 60:40 Index, and will be managed by fund manager Mr. Abhishek Bisen.

Its investment objective is to track its benchmark by investing in SDLs and PSU Bonds, maturing on or before Jul 2028, subject to tracking differences.*

A portion of its portfolio may also be invested in Cash & Debt/ Money Market instruments maturing on or before the maturity date of the Scheme. ^

This NFO is currently open for subscription, and will remain open until Oct 10, 2022. Invest Now!

*There is no assurance or guarantee that the investment objective of the scheme will be achieved.

^Source: Scheme Information Document (“SID”), Kotak Nifty SDL Plus AAA PSU Bond Jul 2028 60:40 Index Fund. Refer SID for complete and detailed asset allocation details.

This is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of it, in certain jurisdictions, may be restricted or totally prohibited and accordingly, persons who come into possession of this material are required to inform themselves about and observe any such restrictions.

Our Funds

Our Funds  SIP

SIP  Plan Now

Plan Now  Insights

Insights  Services

Services