What is a Smart SIP ?

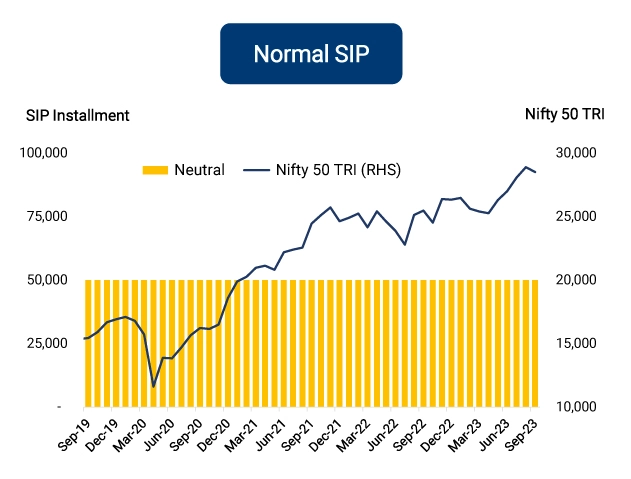

In a Normal SIP, an investor invests a fixed amount in a mutual fund scheme at regular intervals

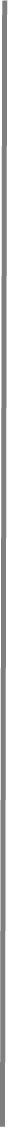

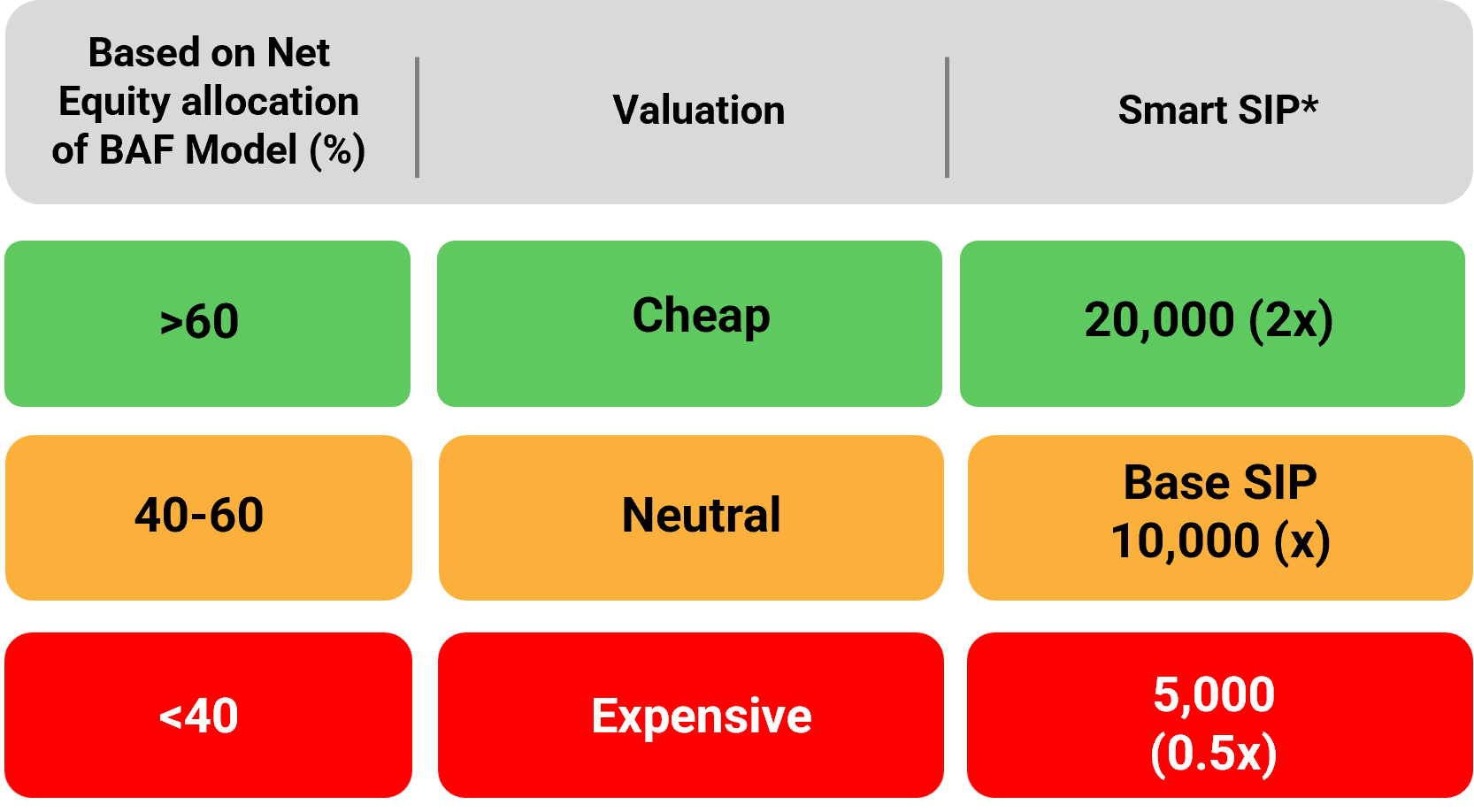

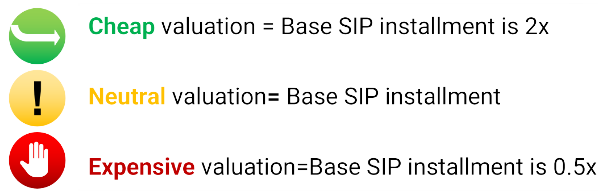

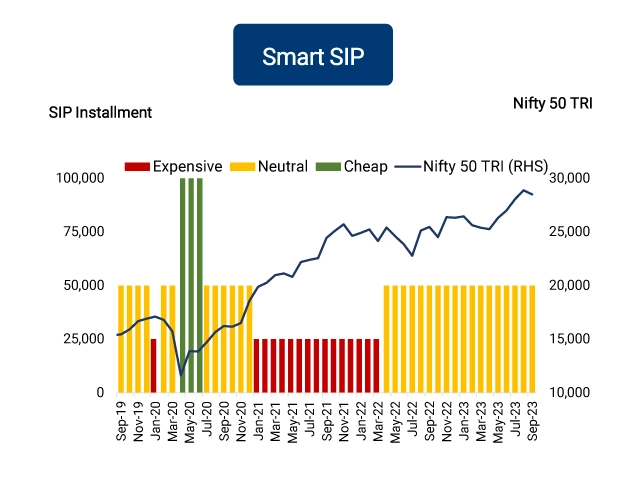

In a Smart SIP, the SIP installment varies based on market valuations

How does a smart SIP work ?

You SIP more when the valuations DIP more

*Investors also have an option to choose the Minimum and Maximum SIP Installment. Incase the investor does not indicate the choice of option then the fund will consider it under the Default Smart SIP option.

The above Investment is for illustrative purpose only and should not be construed as a promise on minimum returns and safeguard of capital. KMAMC is not guaranteeing or promising or forecasting any returns. SIP does not guarantee of any profit/loss in declining/ upward markets. Actual returns may vary.

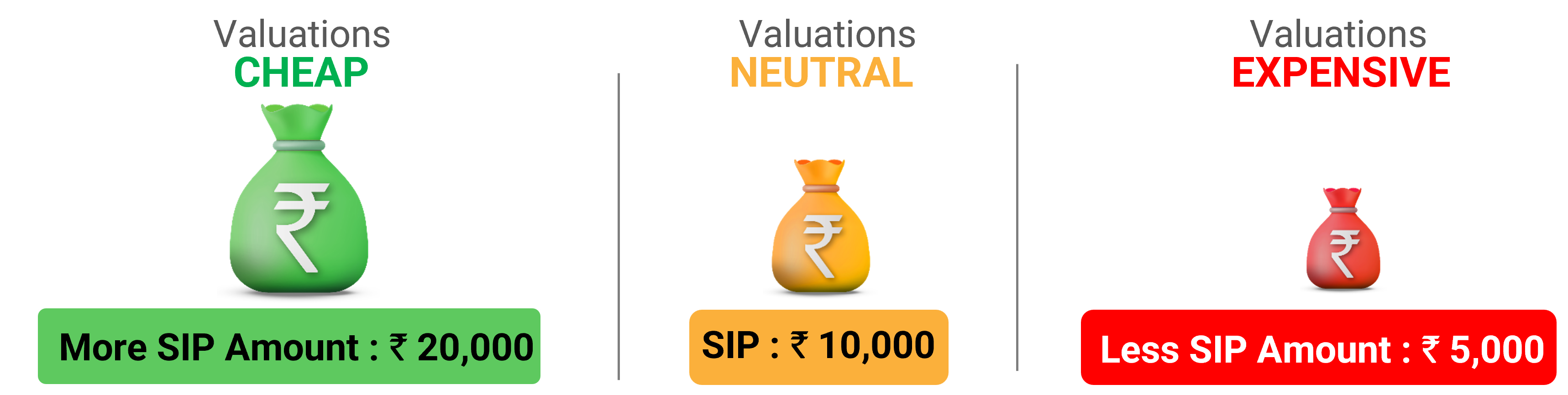

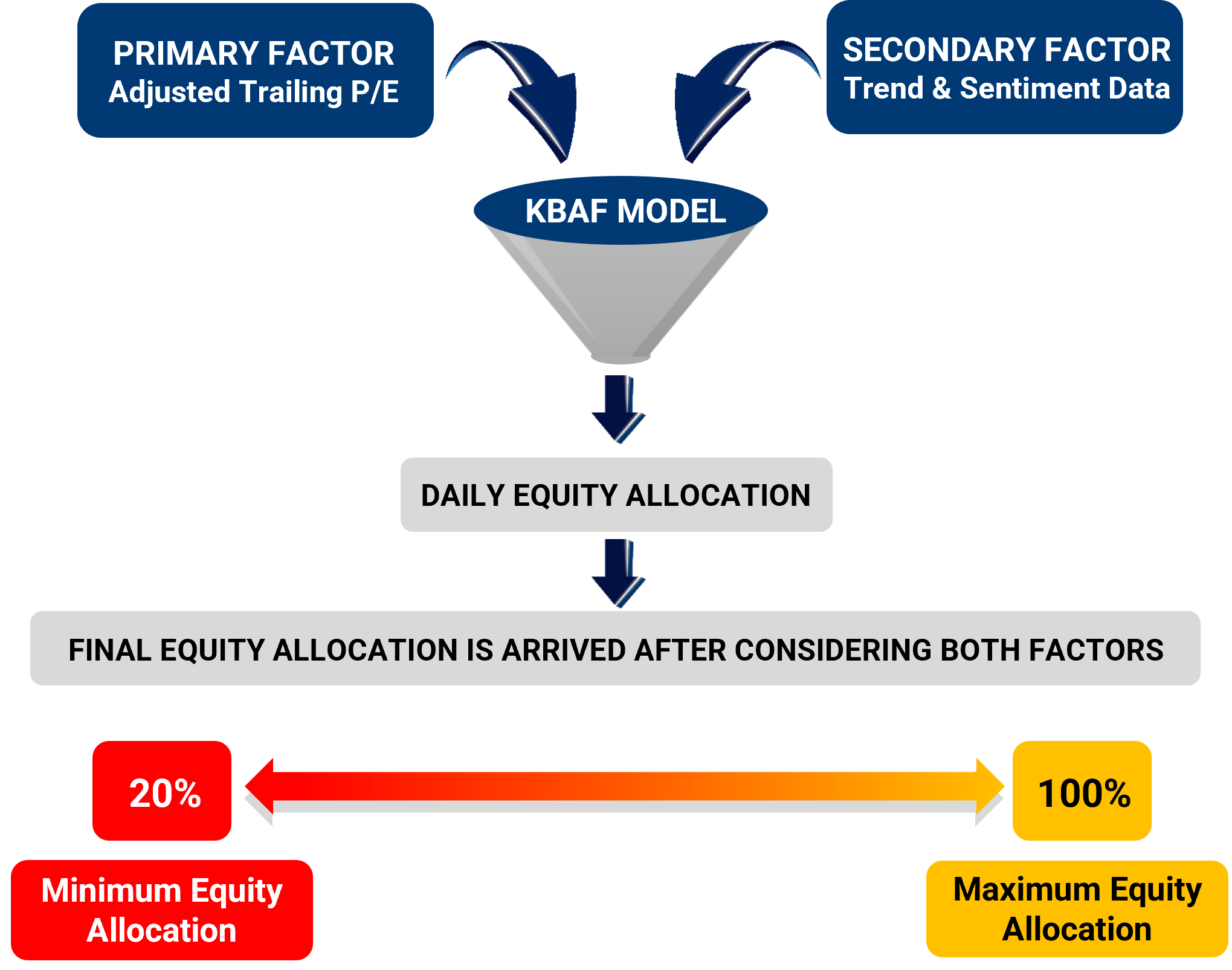

How do we decide Valuation ?

This should not be construed as a promise on minimum returns and safeguard of capital. KMAMC is not guaranteeing or promising or forecasting any returns. SIP does not guarantee of any profit/loss in declining/ upward markets. Actual returns may vary. KBAF model is the inhouse model used to determine the net % of equity allocation for Kotak balanced advantage fund

How is it different from Normal SIP ?

Source: Internal Research KMAMC. Data Period: 1st Aug 2018 - 29th Sep 2023. For illustration purpose, the above details showcases the scenario of how a Normal SIP and Smart SIP would have worked. We have assumed an SIP amount of Rs. 50,000 and then increase and decrease based on net equity allocation of KBAF. The above Investment is for illustrative purpose only and should not be construed as a promise on minimum returns and safeguard of capital. KMAMC is not guaranteeing or promising or forecasting any returns. SIP does not guarantee of any profit/loss in declining/upward markets. Actual returns may vary.

Benefits of Smart SIP

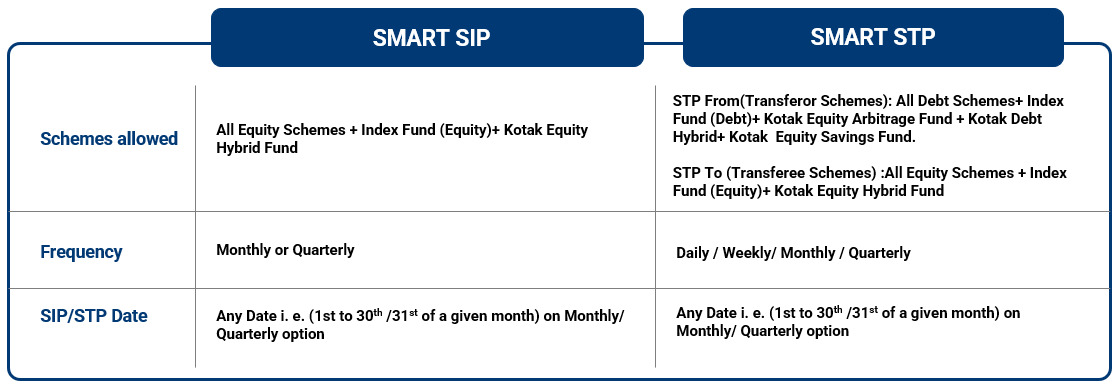

Features of Smart Facility

Also Available for Systematic Transfer Plan (STP)

Other Points

- Smart Facility is applicable only for growth option

- Minimum SIP/STP instalment will be as per scheme SID

- The first Smart SIP/STP instalment will be processed as per the Regular Smart SIP/STP instalment

- If Investor has specified Minimum/ Maximum amount as well as ticked the option for Default Smart SIP, then trigger will be as per the Default Smart SIP/STP Amount