31 Jan 2026

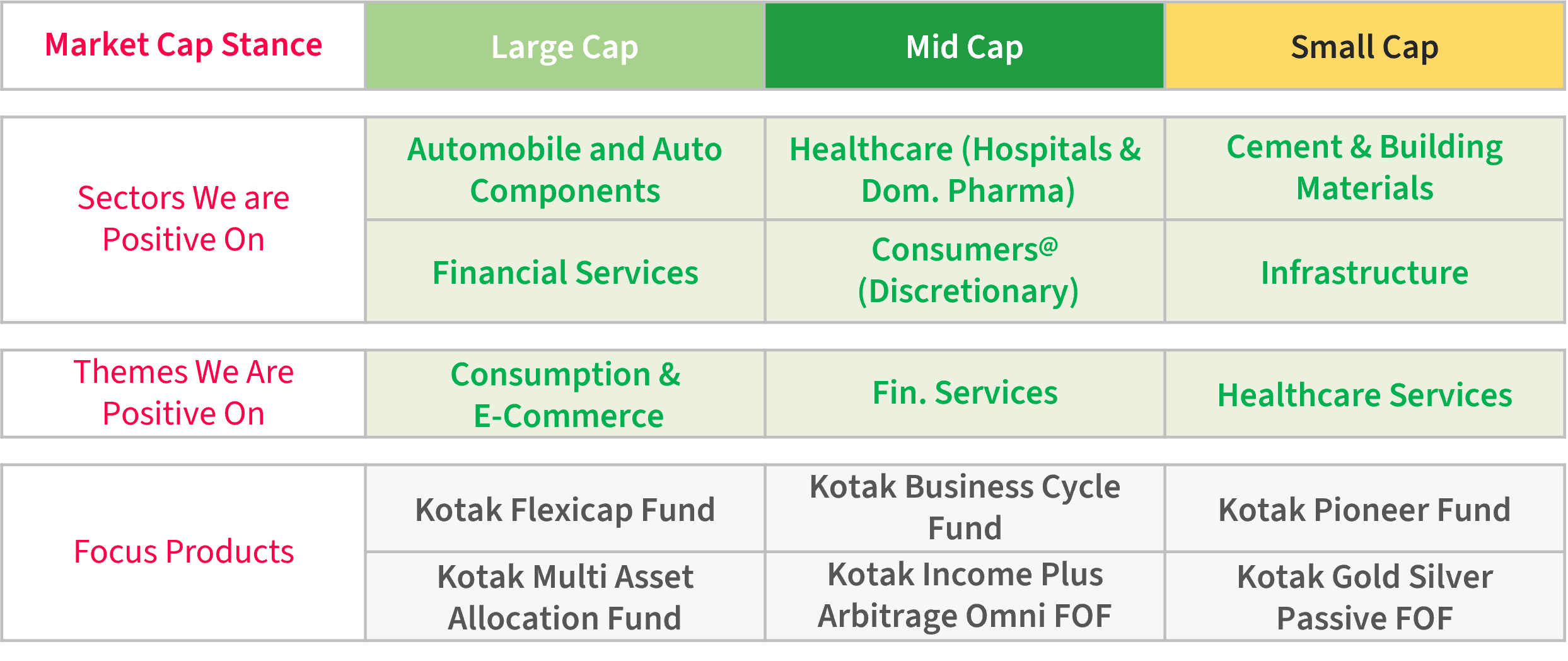

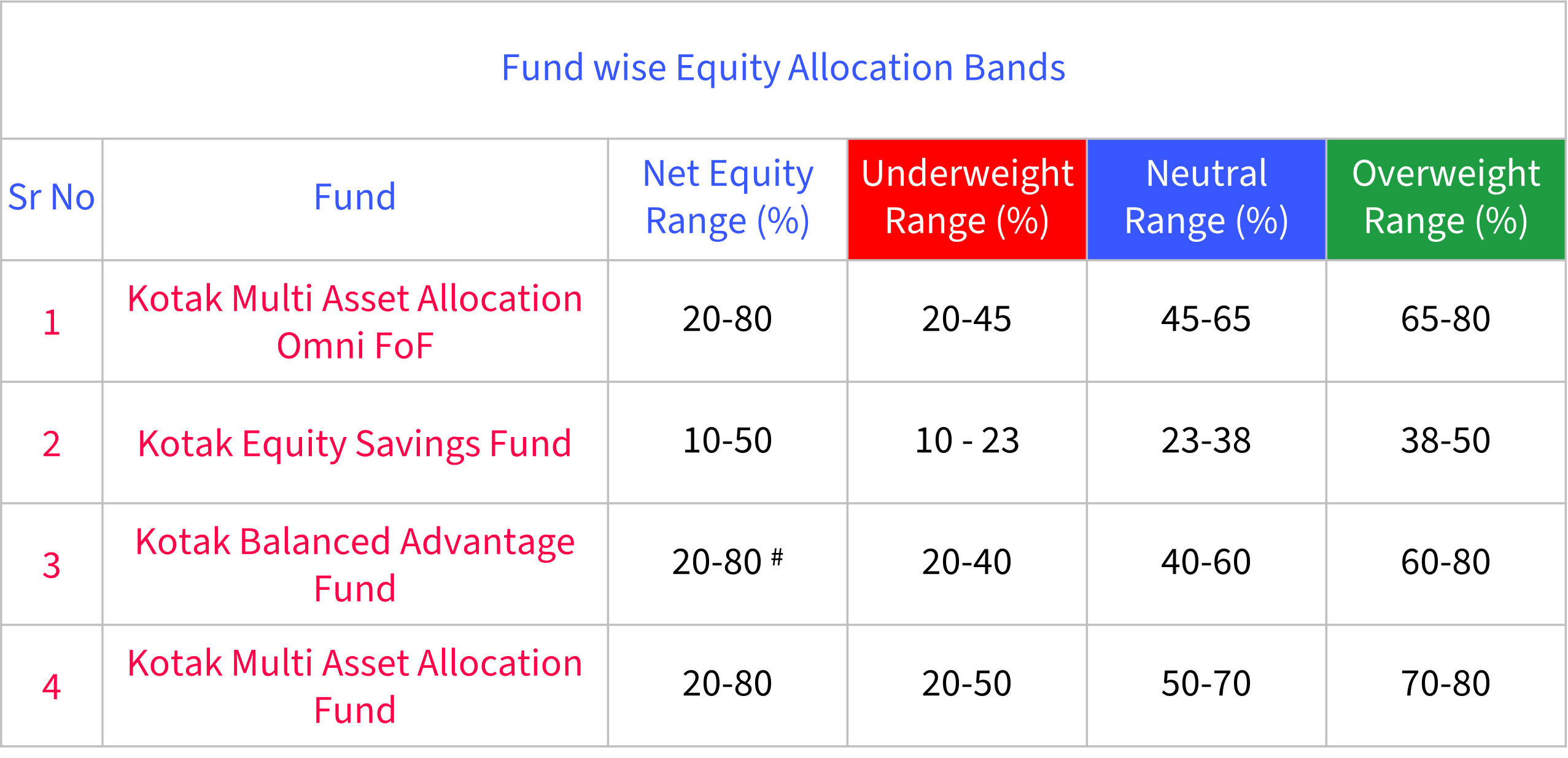

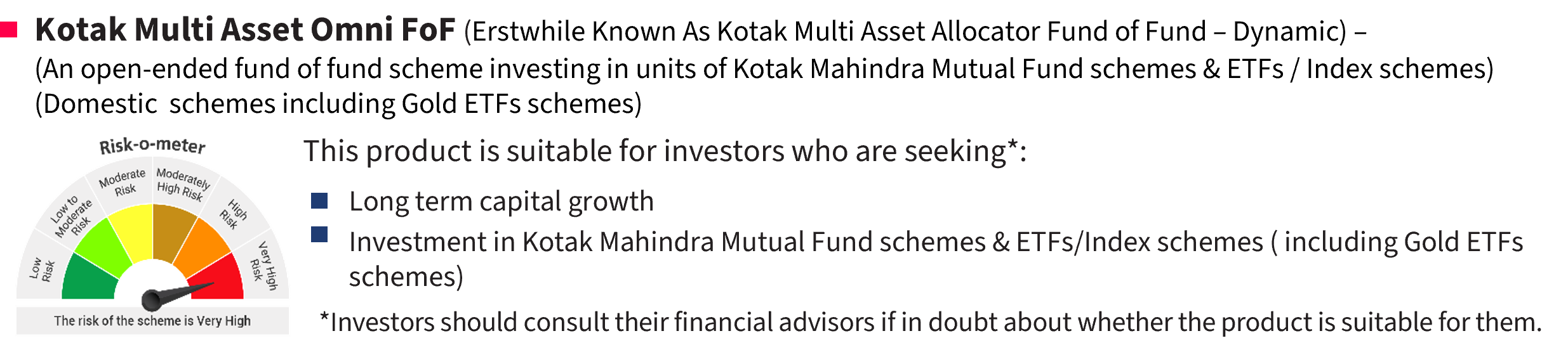

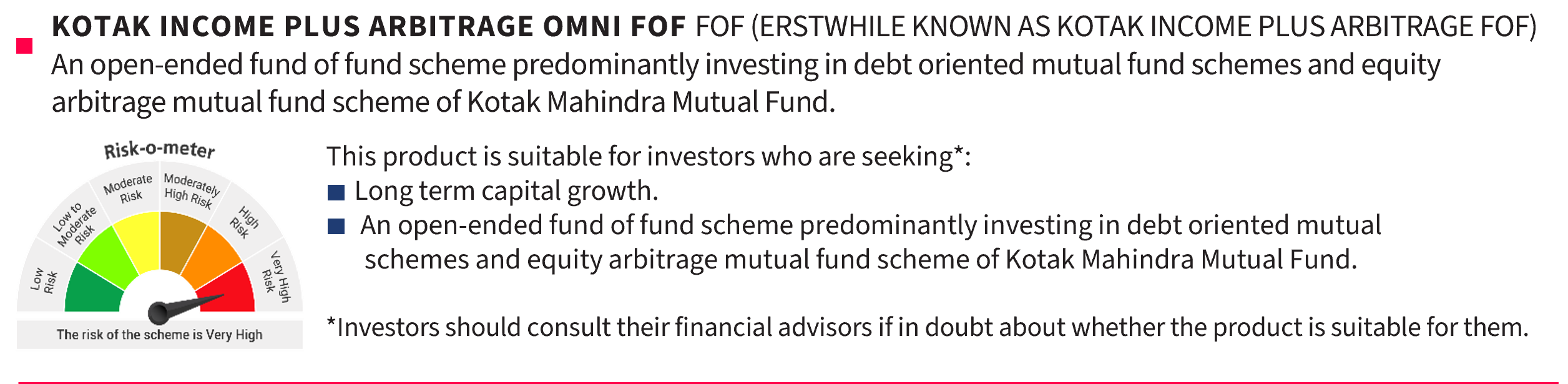

Source : KMAMC Internal Research. Data as on 31st Jan 2026. Net Equity Range As per Scheme information documents of the respective scheme. The net equity exposure is calculated net of stock futures and options (Notional Exposure).The portfolio of the scheme(s) are subject to changes within the provisions of the Scheme Information documents (SID) of the scheme(s) mentioned and as per the fund manager's view, in the best interest of the investors. Please refer to the SID for investment strategy , risk factors, the complete asset allocation details which will be as per SID. Net Equity range for Kotak Multi Asset Allocation Fund is 19.5 to 80%, rounded off here to 20-80%. For more details visit www.kotakmf.com For detailed portfolio and related disclosures for the scheme(s) please refer our website https://www.kotakmf.com/Information/forms-and-downloads. The portfolio and its composition is subject to change, and the same position may or may not be sustained in future. The fund manager may make the changes, as per different market conditions as per the provisions of the SID of the scheme and in the best interest of the investors. ($) For Kotak Multi Asset Omni FoF (Erstwhile Known As Kotak Multi Asset Allocator Fund of Fund – Dynamic), investment in Equity schemes including Equity ETF/ Index schemes is considered. The exposure % is rounded off to closest integer. For more details on asset allocation pattern of schemes refer respective SID available on https://www.kotakmf.com/. OW stands for overweight in Equity and UW stands for underweight in allocation. Current Asset Allocation Tilt does not imply any futuristic outlook for the fund. For Kotak Gold Silver Passive FOF, allocation to Gold / Silver above 50% is considered as overweight, below50% is considered as underweight. ^ In comparison with respective benchmark. * Includes Gold and Silver Both. # For Kotak Balanced Advantage Fund, the SID allows equity exposure up to 100%. However, we intend to limit Net Equity allocation to 80%. More details on the equity allocation stance for each fund are available under Resources tab, Kotak Asset Allocation View on Kotakmf.com. ^^Others includes InvIT.@includes sectors Fast Moving Consumer Goods, Consumer Durables & Consumer Services Source for Market Cap Stance, Sectors & Themes: KMAMC Internal Research. Data as on 31st Jan 2026. Views expressed are based on portfolio data as of 31 December 2025 and are subject to change based on change in market and other conditions. The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s). Kotak Mahindra Asset Management Company Limited (KAMAMC) is not guaranteeing or promising any returns/futuristic returns.

# For Kotak Balanced Advantage Fund, Scheme Information Document allows Net Equity Exposure up to 100%. However, we intend to limit net equity allocation to 80%

For complete details regarding Asset Allocation, please refer the scheme information document on www.kotakmf.com

Disclaimers and Disclosures

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.