1 Jan 2026

Your breakfast was cooked this morning. Your vehicle carried you to the office. Yet rarely do we pause to consider where the gas in our kitchens or the petrol in our vehicles actually comes from. The cooking gas in your home may have begun its journey at a well in the UAE, while the fuel in your car could have originated from a reservoir deep beneath the sea near Russia. Long before these fuels reached your stove or fuel tank, they travelled thousands of kilometres across continents and oceans. Along the way, energy companies moved them through pipelines for steady overland transport, across oceans in massive tankers, by rail over long inland routes, and finally by trucks for last-mile delivery. Oil and gas are not simply extracted and consumed; they are discovered, engineered, financed, transported, transformed, regulated, priced, and delivered through a tightly interlinked global network that powers everyday life. This blog explores not only how oil is extracted, distributed, and consumed, but also why each step matters, where risks and bottlenecks emerge, and how oil continues to shape the global economy, markets, and geopolitics.

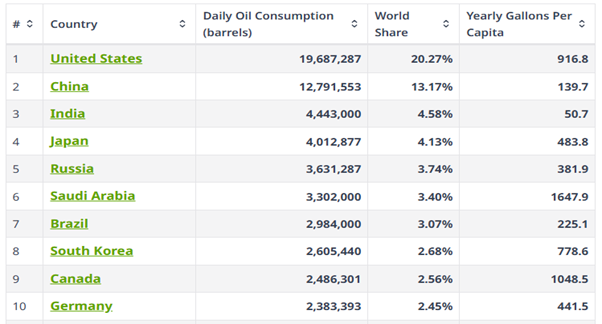

Understanding the Dynamics of Crude Oil-Country Wise

Source: www.worldometers.info | as per latest available data

Global crude oil demand is concentrated among a few large economies. The United States is the world’s largest oil consumer, with demand driven primarily by road transport, aviation, and petrochemicals. China follows, supported by manufacturing activity, freight movement, and a steadily expanding middle class. India is among the fastest-growing oil consumers, as urbanisation, rising vehicle penetration, and infrastructure development continue to lift demand. Other major consuming regions include Europe, Japan, and the Middle East, where oil usage reflects a combination of industrial needs, transportation patterns, and national energy policies.

On the supply side, oil reserves are unevenly distributed across the world. The Middle East holds the largest share, led by Saudi Arabia, Iran, Iraq, and the UAE. Venezuela and Canada possess substantial reserves, largely in the form of heavy crude and oil sands, while Russia and the United States hold significant conventional and shale resources. This uneven distribution gives a small group of producers outsized influence over global supply conditions.(Source: U.S. Energy Information Administration (EIA)

Oil prices are shaped by the interaction between supply decisions and demand trends. Production policies by major producers and alliances such as OPEC (Organization of the Petroleum Exporting Countries) and OPEC+ could tighten or loosen markets, often leading to sharp price movements. Geopolitical disruptions add another layer of uncertainty. At the same time, global economic growth, seasonal consumption patterns, and gains in energy efficiency influence demand, while currency movements, positioning in futures markets, and geopolitical risk premiums amplify price volatility.

The United States plays a critical role in the balance of the crude price dynamics, as it is both the world’s largest consumer and one of the largest producers of crude oil. With consumption around 20 million barrels per day, even modest shifts in US demand can influence global price expectations. On the supply side, flexible shale production, particularly from regions such as the Permian Basin, allows output to respond quickly to price signals. Strong production growth tends to add to global supply and weigh on prices, while slower growth or declines provide price support. Despite high output, the US continues to import heavier crude grades while exporting refined products and some crude, shaping global trade flows and influencing key international benchmarks.

(Source: The U.S. Energy Information Administration (EIA))

In the domestic front, India’s role in the oil market is increasingly demand-driven. The country produces only about 13% of the oil it consumes, making it highly dependent on imports. Oil demand is expected to rise rapidly through 2030, supported by urban growth, industrial activity, rising incomes, mobility needs, tourism, and wider access to clean cooking fuels. India is expected to account for roughly one-third of global oil demand growth, adding around 1.2 million barrels per day to reach about 6.6 million barrels per day by 2030. Diesel and gasoil dominate this increase, contributing nearly half of India’s demand growth, while jet fuel demand is projected to grow strongly from a low base. To support this growth, India’s refiners are adding around 1 million barrels per day of new capacity over seven years, the largest expansion outside China, with additional projects under review.

(Source: International Energy Agency )

Importance of oil for transportation, electricity, and industrial use.

The oil and gas industry is a vital component of the global economy, generating trillions of dollars in revenue each year. Oil plays a central role in transportation, electricity generation, and industrial production, making the industry indispensable to modern life and economic activity. Broadly, the industry is divided into three main segments: upstream, which focuses on exploration and production; midstream, which handles transportation and storage; and downstream, which involves refining crude oil and distributing finished products to consumers.

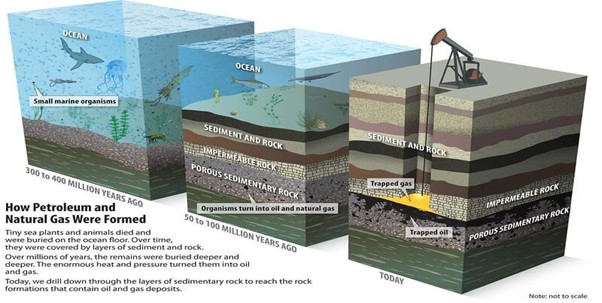

Step 1: Deposition and Burial

Millions of years ago, tiny marine plants and animals lived in oceans and seas. After dying, their remains were buried on the ocean floor under layers of sediment. With little oxygen present, the organic material was preserved, forming the raw material for oil.

Step 2: Kerogen Formation

As sediment layers built up, the buried organic material experienced increasing heat and pressure, gradually transforming into a waxy solid called kerogen, an intermediate stage and the primary source of oil and gas.

Step 3: Oil and Gas Generation

With deeper burial, temperatures rise further, generally between 60°C and 150°C, known as the oil window. Within this range, kerogen breaks down into liquid and gaseous hydrocarbons, forming crude oil and natural gas. At higher temperatures, more gas and less oil are produced.

Step 4: Migration

Once formed, oil and gas migrate upward because they are lighter than surrounding rocks and water, moving through tiny pores and fractures in porous rocks like sandstone over long distances and time.

Step 5: Trapping and Accumulation

As oil and gas migrate upward, they are trapped beneath an impermeable cap rock, accumulating in porous reservoir rocks to form oil or gas fields that can later be discovered and produced.

This entire geological process, from dead organisms to trapped oil, takes millions of years, making petroleum a fossil fuel.

Source: PMFIAS

Oil Exploration Process:

Upstream Operations: Exploration and Production

The upstream sector is the first and most technically challenging phase. It focuses on finding and extracting crude oil and natural gas from the earth.

a. Exploration

Exploration starts with geological and geophysical studies, including seismic surveys and geochemical analysis, to identify potential oil or gas areas. If results are promising, exploratory wells are drilled to confirm commercial viability.

b. Drilling Operations

Once a site is confirmed, drilling operations begin as engineers design wells to safely reach hydrocarbon-bearing formations. Drilling occurs either onshore, which is easier to set up, or offshore, which requires rigs or platforms to operate in deeper and more complex ocean conditions.

c. Production and Extraction

After a well is drilled, it begins producing oil or gas. Engineers manage flow, pressure, and safety, and use enhanced recovery methods such as gas injection, steam flooding, or chemicals to increase extraction.

Midstream Operations: Transportation and Storage

The midstream sector connects producers to refiners and markets. It involves transporting, processing, and storing raw hydrocarbons safely and efficiently.

a. Transportation

Hydrocarbons are transported through multiple systems depending on distance and destination. Pipelines are the safest and most cost-effective option for moving crude oil and gas across land. Tankers and barges are used for offshore and international routes where large volumes must cross seas. Rail and truck fleets support regional movement and provide flexibility during supply gaps or emergencies. Midstream companies maintain the integrity of these networks through continuous monitoring, leak detection, and flow management using advanced digital tools.

b. Storage

Before refining or market distribution, oil and gas are stored in different types of facilities based on their form and safety needs. Crude oil is kept in large storage tanks designed to handle significant volumes. Natural gas is held in underground reservoirs that help manage pressure and maintain stable supply. Liquefied Natural Gas is stored at specialized LNG terminals built to handle extremely low temperatures. Effective storage management supports steady supply during demand shifts and maintains overall operational safety.

Downstream Operations: Refining and Marketing

The downstream sector refines crude oil and natural gas into usable products and delivers them to consumers.

a. Refining Process

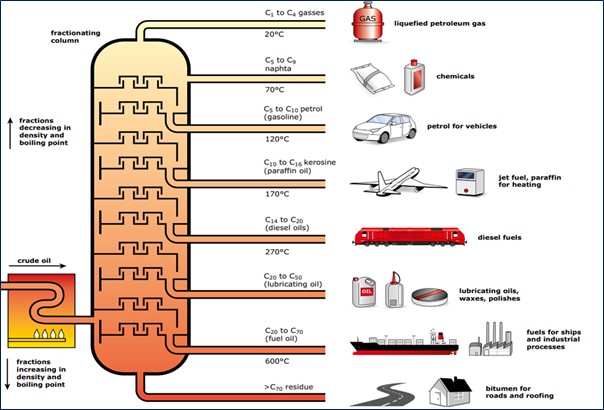

Refineries convert crude oil into useful products needed for transport, industry, and households. They separate and process the crude to produce gasoline for vehicles, diesel for heavier transport, jet fuel for aviation, lubricants for machinery, and petrochemical feedstocks such as ethylene and propylene that support plastics and chemical manufacturing.

Key refining operations work together to turn crude oil into high‑quality fuels and chemical products. The process begins with distillation, where crude oil is heated so its components separate based on different boiling points. Cracking follows, breaking large hydrocarbon molecules into smaller, more useful ones. Reforming then improves fuel quality by increasing the octane number. Hydrotreating finishes the process by removing sulphur and other impurities to meet safety and environmental standards.

Refineries process crude oil through distillation and chemical conversion to produce different forms:

Source: energyeducation.ca

b. Product Distribution and Marketing

For bulk movement of petroleum products across the country (e.g., from refineries to storage depots or petrol pumps), different methods are used, and the times are much longer.

- Road transport: Road transport through tanker trucks can take anywhere from a day to several days depending on the distance. Short intrastate movements usually take one to three days. Longer interstate trips generally take three to seven days. In some cases, especially for very long routes such as Mumbai to Delhi, the journey may extend to one or even two weeks. Travel time varies based on distance, road conditions, chosen route, and delays related to paperwork or checkpoints.

- Pipelines: This is the most common and efficient method for moving crude oil and refined products over long distances on land. The flow is continuous, and while the initial infrastructure takes time to build, the transit time once operational is fast and consistent.

- Sea Freight (Coastal Tankers): When moving between major ports, transit times can range from several days to a couple of weeks, depending on the specific origin and destination ports.

- Rail Freight: An alternative to road transport for land-based bulk shipping, typically taking longer than road for short distances but suitable for specific long-distance routes, with transit times varying widely.

Oil marketing companies handle branding, pricing, retail management, and customer engagement through fuel stations and distribution networks.

Technology Trends Shaping Exploration and Distribution

Advances in drilling technologies mark the most important developments in the discipline of petroleum engineering. Phenomenal strides have been made in both accuracy and speed of a drilling process. The most recent “revolution” in unconventional oil and gas production has been triggered by advancement in original well drilling as well as sophisticated managed drilling, including underbalance drilling, mudcap drilling, casing drilling, and others. Equally phenomenal progress has been made in offshore drilling, for which innovative technologies have been used.

Ever since horizontal drilling commenced in the 1980s, one landmark has been the length of the horizontal well drilled. In the beginning, a kilometer long well was considered to be a technological marvel. Today, neither length nor accuracy of the well placement is considered to be difficult task. Challenges still persist, along with predictability, but drilling deep ocean wells with many lateral offshoots is something drillers can undertake on a routine basis.

Most underground wells that are drilled for water, oil, or natural gas are vertical. This means the length of the well is the true vertical depth. The necessity to be able to control where a well is drilled was determined, and directional drilling was established. Directional drilling is a technological breakthrough that has revolutionized shale gas production. The technology behind horizontal oil wells represents a significant advancement in the oil and gas industry. By improving access to extensive and dispersed hydrocarbon reserves, horizontal drilling enhances production efficiency, reduces environmental impact, and drives economic benefits, solidifying its role as a key innovation in energy extraction. Horizontal drilling, combined with hydraulic fracturing, revolutionized shale production by dramatically increasing contact with tight rock formations, allowing for significantly higher oil and gas recovery, improved well economics, and reduced surface footprint by accessing more reservoir from fewer pads, effectively unlocking vast unconventional resources.

The oil and gas sector is undergoing a digital and sustainable transformation, driven by advanced technologies and efficiency-focused solutions. AI and machine learning are optimizing exploration, production, and predictive maintenance, while IioT (the industrial internet of things), cloud, and edge computing enable real-time analytics and remote monitoring. Carbon capture and storage helps reduce emissions, renewable integration reshapes the energy mix, advanced drilling and imaging improve efficiency, and cybersecurity protects digital infrastructure. The global AI in oil and gas market is projected to reach USD 25.24 billion by 2034, growing at a 14.2% CAGR from 2024 to 2034, supported by rapid digital adoption. AI enhances seismic analysis, well planning, reservoir simulation, and pipeline monitoring, reducing downtime and costs.

(Source: StartUs insights)

From the moment crude is discovered deep below the earth to the point it reaches your stove or fuel tank, every stage involves precision, engineering, and constant innovation. You now know the journey is long, complex, and built on science, technology, and global coordination. As the world moves toward cleaner and smarter energy systems, this industry continues to adapt with digital tools, efficient extraction methods, and safer transportation networks. The next time you cook a meal or start your vehicle, you’ll know the path that energy took to reach you and the immense effort behind every drop.

What next after fossil fuels?

Renewables offer clear advantages over fossil fuels. They rely on natural processes that replenish, so they do not run out. They create very low emissions once built. Solar electricity produces far less carbon than coal across its full life cycle. Costs are falling fast. Solar PV prices dropped sharply between 2010 and 2020, making renewables cheaper than fossil fuels in many regions. Fossil fuels still benefit from long‑standing infrastructure and steady output. Pipelines, refineries and power plants are already in place. Coal and gas plants could operate consistently without depending on weather. Storage technology is improving quickly. Governments are adopting stronger policies that support clean energy. As storage expands and renewable systems scale, the advantages of fossil fuels may fade over time. Renewables will meet more of the world’s energy needs at lower environmental and economic cost.

Mr. Mandar Pawar, Senior Vice President & Fund Manager at Kotak AMC adds: “Trends in oil & gas market is very critical for Indian economy despite India not being a major producer of oil, less than 1% of global production. In consumption, India accounts for ~6% of global oil consumption at present but alongwith China, it is largest contributor of incremental global oil demand. Since India relies on imports for ~88% of its oil requirement, developments in global oil trade has a huge bearing on India’s trade balance and balance of payments (BoP) position, oil & gas being the largest import category. High oil costs widen the merchandise trade gap, requiring foreign currency, and when coupled with a weak rupee, increase import costs, forcing reliance on foreign investment or drawing down India's forex reserves, impacting overall BoP stability.

Oil prices are shaped by the interaction between supply decisions and demand trends. This market underwent notable dynamic changes on demand as well as supply side in last 15-20 years. Emerging economies like India and China are shaping demand dynamics more than traditional major consumers like US and Organisation for Economic Co-operation and Development nations. OPEC bloc and its production decision can drive oil price but US has emerged as the largest producer with advancements in production technology, matching its influence. The energy transition is reshaping investment decisions as world is shifting towards renewables. These tectonic shifts in energy market could continue in coming years which will not only make it interesting times to come but also open up new investment opportunities.”

(Source: BP statistical review of world energy)

Mr. Siddharth Kothari, Economist at Sunidhi Securities & Finance Ltd adds: “The energy transition is reshaping investment priorities, but AI allows oil and gas to remain investable—by improving productivity, reducing costs, and supporting a lower-carbon operational footprint alongside rising renewable energy deployment.”

The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s). These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.