21 Nov 2025

On a humid evening in Mumbai, a street vendor taps his soundbox a voice announces that fifteen rupees have been credited to his account. No coins change hands, no fumbling for change. For the customer, it’s a quick tap on a mobile screen. For the vendor, it’s instant reassurance that the money is safe in his bank. Scenes like this are so common today that they barely draw attention. But nine years ago, India ran on cash. What changed between 2016 and 2025 is one of the most dramatic economic transformations in modern India — a shift catalysed by demonetisation and powered by the Unified Payments Interface (UPI).

This Blog traces that Journey of UPI: from Disruption to Digital Dominance.

The Shock That Sparked a Revolution: November 2016

When the government Demonetised ₹500 and ₹1,000 notes on November 8, 2016, the immediate impact was chaos. ATMs ran dry, queues snaked around banks, and cash-dependent commerce struggled. But the disruption triggered something larger.

India urgently needed a digital alternative.

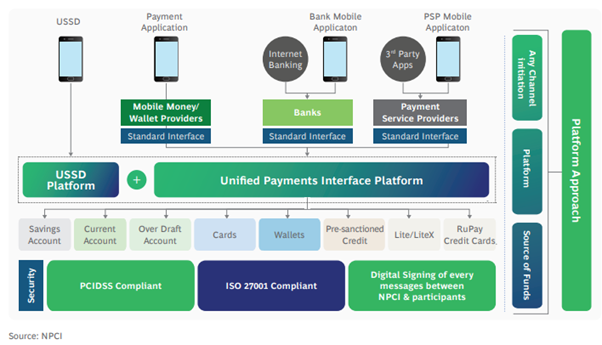

In the background, NPCI had already launched UPI in April 2016 under the guidance of the Reserve Bank of India, that has transformed the way Indians transact. The BHIM app followed in December, giving India its first unified, interoperable payment rail built for instant bank-to-bank transfers using a mobile app and a Virtual Payment Address, eliminating the need to share sensitive details.

The Vision was bold:

- One UPI ID

- Multiple Bank Accounts

- Real-time Payments

- Merchant and Bank interoperability

- Zero Wallet friction

This foundation would soon reshape how India transacted.

Built on open architecture and open-source tools, UPI enables scalability and rapid innovation. Its failure rate is just 0.6%, far lower than the 4% average for card payments. APIs allow fintech’s to integrate services like Credit Card, Insurance, and Investments, creating an ecosystem that goes far beyond payments.

Source: The Economic Times, Business Standard, PwC India, BCG & NPCI, EPRA International Journal

UPI’s Rise: Milestones That Matter (2016–2025)

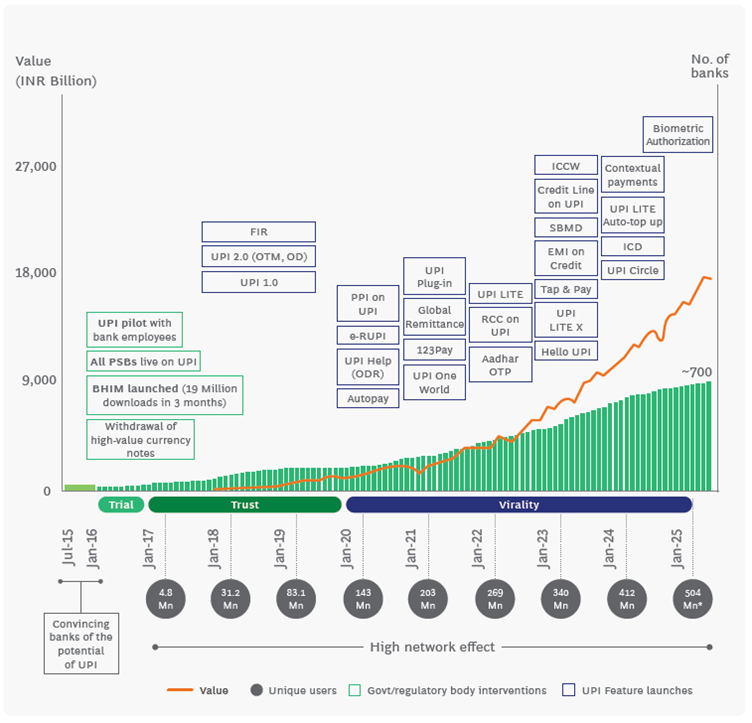

*as of August 2025, Mn = Million - Source: UPI Product booklet; UPI circulars by NPCI; Reserve Bank of India–Press releases; Press search

The backend Infra in UPI:

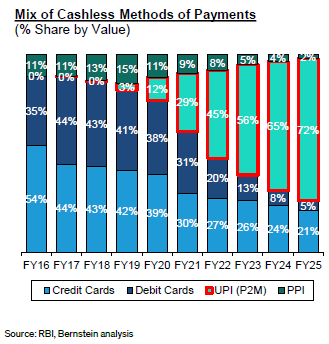

UPI’s rise was driven by policy and convenience. Since January 2020, merchants pay zero Merchant Discount Rate, unlike the 1–3% charged on card transactions. The government treats payments as essential infrastructure, not a revenue source. Combined with initiatives like Aadhaar and Jan Dhan Yojana, this policy helped UPI scale rapidly. From 1,079 crore transactions in 2019 to 17,221 cr. in 2024, and from ₹18.4 lakh cr. in value to ₹246.8 lakh cr., the growth has been staggering. In August 2025 alone, UPI processed over 20 billion transactions worth ₹24.85 lakh cr. Today, UPI accounts for 85% (by volume) of all digital retail payments in India. This is not just a statistic—it shows how deeply UPI is woven into daily life, from vegetable vendors in small towns to women entrepreneurs in rural markets.

Source: The Economic Times, Mint, Business Standard, RBI, PwC India, BCG & NPCI

Why UPI Won: The 4 Key Drivers

1. Interoperability & Ease

UPI eliminated wallets, card dependency, and even the need to know bank details. QR codes democratized merchant payments — from kiranas to street vendors.

2. Customer-First Experience

One-tap payments, instant settlement, intuitive interfaces, and near-zero failure rates (0.6%) built trust.

3. Government & Regulatory Vision

Zero MDR for merchants, bank incentives, DBT integration, Jan Dhan accounts, and public digital infrastructure accelerated adoption.

4. Smartphone + Aadhaar + Jan Dhan Trinity

This trio made UPI accessible from rural households to urban enterprises.

Digital India in Motion: Transformational Impact

UPI is more than convenience; it is empowerment. The chai seller in Mumbai trusts his digital earnings as much as hard cash. A domestic worker in Surat sends money home instantly without standing in queues. A farmer in Madhya Pradesh accepts payments directly into his bank account, reducing dependence on middlemen. More than 89% of adults in India now have bank accounts, many linked to UPI.

The impact on businesses, especially MSMEs, has been transformative. For women entrepreneurs, UPI has become a trusted tool, with Aadhaar-enabled banking and QR-based payments improving access to formal credit. MSMEs now leverage UPI’s digital footprint to secure loans, expand market reach, and formalize operations. This shift reduces entry barriers and fosters inclusive growth, aligning with India’s vision of a $5 trillion economy.

UPI has also changed the government’s approach to welfare delivery. Direct Benefit Transfers now reach beneficiaries instantly, reducing leakages and corruption. Subsidies for LPG, pensions, and rural employment wages are credited directly into accounts linked to UPI, ensuring transparency. Tax compliance has improved as UPI creates a digital trail, making informal transactions traceable. While UPI itself is not taxed, business transactions through UPI are subject to GST and income tax, reinforcing formalization.

Source: RBI, Women’s World Banking, ETGovernment Blog, CareEdge

UPI Steps Onto the World Stage

The story doesn’t end at India’s borders. UPI is now live in seven countries, including Singapore, UAE, France, Mauritius, Sri Lanka, Bhutan, and Nepal. Indian tourists can pay at the Eiffel Tower or in Dubai malls using UPI. NPCI International is working on expansion to Qatar, the UK, and Southeast Asia. Partnerships with Eurobank Cyprus and Razorpay Curlec in Malaysia signal UPI’s growing global footprint. For decades, global finance was defined by Western institutions and card networks. Today, an Indian-built public digital platform is being showcased as an export, carrying India’s reputation for innovation and scale.

The future promises even more. From September 2025, UPI’s transaction limit for verified merchant categories rose to ₹10 lakh per day, enabling high-value digital payments for insurance, travel, and capital markets. Credit on UPI is set to revolutionize lending by linking pre-approved credit lines and RuPay credit cards directly to UPI apps. This will allow instant borrowing and repayment through familiar interfaces, empowering millions of first-time borrowers and MSMEs. NPCI is also piloting a Unified Lending Interface to leverage UPI transaction data for real-time credit scoring. Other innovations include UPI Lite+ for offline payments, voice-enabled transactions for rural users, and tap-to-pay features for faster checkouts. Global interoperability projects like BIS’s Nexus aim to make UPI part of a multilateral cross-border payment network.

Challenges remain

Fraud cases have surged alongside adoption, with phishing, fake QR codes, and impersonation scams becoming common. In FY 2024–25 alone, UPI-related fraud losses crossed ₹485 crore. NPCI and banks are responding with stricter KYC norms, beneficiary name verification, and AI-driven fraud detection. Financial literacy programs are also critical, as studies show that while UPI adoption is high, understanding of digital safety and budgeting remains low in rural areas. Government and industry initiatives are focusing on awareness campaigns to ensure secure and responsible usage. MDR is absorbed by the government. If the government stops subsidizing it, UPI volumes and penetration will be affected.

Source: ET Now, Paytm Blog, ABP News, Razorpay

From India’s Daily Routine to an International Benchmark

UPI is not just a payment system. It is India’s digital public infrastructure, admired globally for scale, security, and inclusivity. From street vendors in Delhi to tourists in Paris, UPI has become a symbol of India’s innovation—a quiet revolution that changed how the world sees digital payments. As India moves toward becoming a $5 trillion economy, UPI will remain at the heart of this transformation, driving financial inclusion, powering MSMEs, and showcasing India’s leadership in digital finance.

Mr. Umang Shah, Vice President, Equity Research at Kotak AMC, adds: Since its launch in 2016, UPI has altered India's digital payment landscape in a way one couldn't imagine. It has not only provided convenience to consumers but also empowered small businesses and has helped further agenda of financial inclusion. It has opened up new avenues of growth and allowed small businesses to scale. With UPI, India's technological prowess in the payments space has got recognition on the global stage. As India strengthens its growth dominance in the world, UPI will have a pivotal role to play in this journey as its flywheel effect starts playing out.

Mr. Jay Kotak, Co. Head & Executive Vice President Kotak Mahindra Bank adds: UPI is fast becoming a cornerstone of India’s cultural fabric. The movement of money has become frictionless - whether for a dairy milk at the Kirana store, a Diwali tip or even a hospital bill – UPI can do it all. Soon, international money remittances, larger ticket corporate transfers and more will see the magic of UPI! It is another example of India’s ability to produce a scalable, technology powered solution to improve the lives of all her citizens!

Click Here to Watch our Weekly Blog in the Audio Visual Format.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.