11 Dec 2025

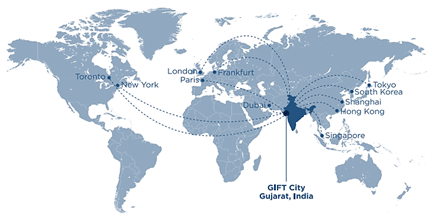

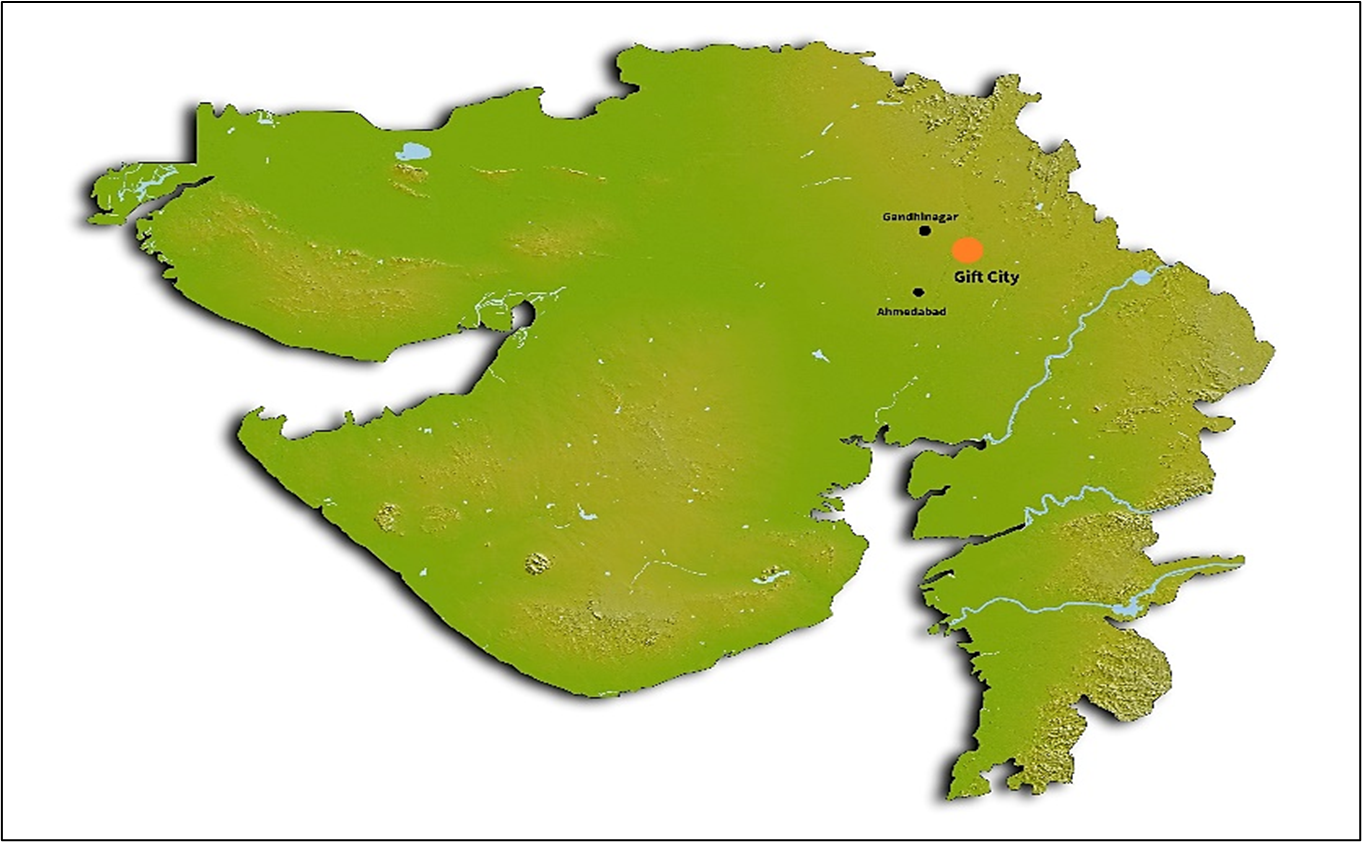

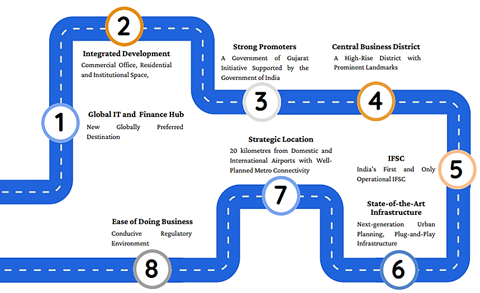

Imagine a city designed from the ground up to be the beating heart of India’s financial ambitions, a place where cutting-edge technology, world-class infrastructure, and global capital converge. Welcome to Gujarat International Finance Tec-City, better known as GIFT City. Nestled between Ahmedabad and Gandhinagar, GIFT City is not just India’s first operational greenfield smart city, but also its pioneering international financial services centre (IFSC). It is a liberalised regime for financial transactions in foreign currency.

In just a few years, it has transformed from a bold vision into a vibrant reality, rapidly climbing the ranks among one of the world’s emerging financial hubs.

GIFT City was envisioned as a world-class financial hub to rival Singapore and Dubai*, and today it stands as a thriving district with modern towers, advanced infrastructure, and a growing business community. More than offices, it offers a complete live-work-play ecosystem with homes, schools, hospitals, foreign Universities and hotels all in one place.

Source: IFSCA GIC Digital. This map is for pictorial representation purpose only and with no depiction of boundaries approved by Government of India, *Timesnow

The International Financial Services Centres Authority (IFSCA) is the unified regulator for GIFT IFSC, combining the scope of the four premier financial services regulators in the country – the Reserve Bank of India (RBI), the Securities & Exchange Board of India (SEBI), the Pension Fund Regulatory and Development Authority (PFRDA), and the Insurance Regulatory and Development Authority of India (IRDAI), thereby enabling the dynamic nature of businesses in the GIFT IFSC.

International Financial Services Centre (IFSC) in Gift City, Gujarat

This map is for pictorial representation purpose only and with no depiction of boundaries approved by Government of India

Diverse Sectors Fuelling GIFT City’s Growth

GIFT IFSC is becoming the destination of choice for sectors including Banking, Insurance and Capital Markets, Funds, Global Inhouse Centres, Fintech, Aircraft Leasing, Foreign Universities, Finance companies, Funds Industry, Ship Leasing, and Ancillary Services. With a robust uptick in the number of international and domestic businesses setting up operations in GIFT IFSC, the smart city is transforming into a development hub as envisioned by the Hon’ble Prime Minister of India.

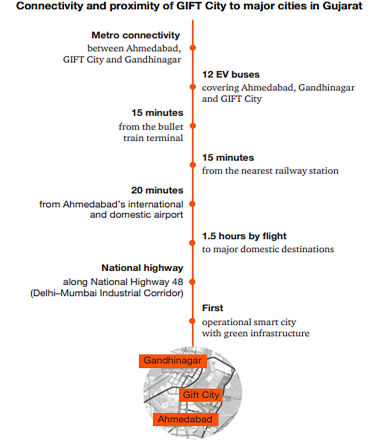

Seamless Access: Where Opportunity Meets Infrastructure

GIFT City’s strategic link to Ahmedabad and Gandhinagar creates a strong tricity corridor, leveraging shared infrastructure and talent. The upcoming Mumbai–Ahmedabad high-speed rail will cut travel time to Mumbai, improving accessibility and reducing isolation concerns. This enhanced connectivity will strengthen ties between India’s current financial hub and its emerging global business center, unlocking new opportunities for growth and investment.

Source: pwc

Smart, Sustainable, and Tech-Driven

What sets GIFT City apart is its focus on technology and sustainability. The city boasts features like automated waste collection, underground utility tunnels, and a district cooling system to keep buildings energy-efficient. Its digital backbone is robust, with high-speed internet, advanced data centers, and a city-wide command center that keeps everything running smoothly. For businesses, this means possibly lower costs and potentially higher efficiency. For residents, it means a better quality of life, with clean streets, reliable services, and plenty of green spaces.

City also hosts first of its kind loT-based City Command and control Center(C-4), which allows monitoring and management of city infrastructure from a single place.

A Preferred Business Destination for Domestic and Global IT / ITeS Companies (Information Technology Enabled Services)

Source: IFSCA GIC Digital

A Magnet for Global and Domestic Enterprises

As India advances toward its $7 trillion economic goal, GIFT IFSC is driving the country’s global financial ambitions. It enables companies to transact in foreign currencies and connect directly with international markets, bringing financial flows back to India and creating jobs and investment opportunities. Today, GIFT City hosts over 1034 firms, including global leaders like JPMorgan Chase & Co. , Morgan Stanley, Tata Consultancy Services Limited, and Infosys Ltd. It is also home to India’s first international bullion exchange and is emerging as a hub for aircraft and ship leasing*

*Source:Outlook Business

For businesses with a long-term vision, setting up early in GIFT City offers a strong first-mover advantage. A leading U.S. investment bank illustrates this well—it started operations in 2019 with a global business service center and has since expanded to nearly 400,000 sq. ft. of office space, employing over 3,000 people. The bank credits GIFT City’s ease of doing business as a key factor, showcasing the city’s appeal for global institutions entering India’s financial ecosystem.

Companies benefit from a single-window clearance system, reduced taxes, and a regulatory authority (IFSCA) that brings together India’s key financial authorities.

Tax incentives and supportive regulatory policies

Financial Services products within the IFSC are governed and regulated by the International Financial Services Centres Authority (IFSCA), which was established in 2020. The following are tax benefits provided to businesses, i.e. units set up in the IFSC:

Source: pwc, PIB

Who Is Eligible to Invest?

- Resident Individuals

Residents can invest via the Liberalised Remittance Scheme (LRS), which permits up to USD 250,000 per financial year.

Residents can also open a Foreign Currency Account (FCA) with IFSC-registered banks. These FCAs allow access to IFSC products and can also be used for overseas remittances. However, they cannot be used for domestic payments within India.

- Non-Resident Investors

NRIs and foreign nationals can easily open bank and investment accounts in GIFT City with minimal onboarding formalities. Since all trading happens in foreign currencies, non-residents enjoy a major advantage — they can invest in India without converting their foreign currency into INR.

Growth by the Numbers: GIFT City’s Rapid Rise

The numbers tell a story of explosive growth. In just five years, the number of IFSC firms has jumped from 82 to over 1000. More than 25,000 people work in GIFT City today, with projections to grow to 150,000 over 5 years in fintech/tech roles. Gift City is home to 150+ capital market intermediaries, 35 banks, 52 insurance firms, 133 fintech/techfin & ancillary entities, 194 Fund Management Entities, 310 schemes , and 30+ lessors in 2025. As on September 2025, the IFSC aircraft leasing ecosystem recorded a total of 303 assets, comprising 134 aircrafts, 84 engines, and 85 APUs (Auxiliary Power Units), reflecting expansion in aircraft and engine leasing activity within the IFSC. The city’s financial markets are booming, with the GIFT Nifty monthly turnover crossing $100 billion in Sept 2025, and total transaction volumes nearing $1 trillion. GIFT City’s IFSC continues to scale rapidly, with 35 banks together holding $100.14 billion in assets.

Source: IFSCA bulletin

A Launchpad for Innovation

GIFT City is emerging as a key wealth management hub, offering HNIs and family offices global market access, tax benefits, and simplified compliance as an IFSC.

The city’s regulatory framework is designed to promote innovation and competitiveness. It includes regulatory sandboxes that allow fintech and techfin companies to test new products in a controlled setting, reducing risk while encouraging creativity. Additionally, GIFT City offers incentives for global in-house centers (GICs) and fund managers, making it cost-effective for international firms to set up and manage cross-border investments. Together, these factors position GIFT City as a modern financial hub aligned with global standards.

Looking Ahead

GIFT City faces challenges as it strives to compete with mature global financial hubs, currently ranked 43rd in Global Financial Centres Index (GFCI). Key areas for improvement include infrastructure upgrades, better last-mile connectivity, seamless digital onboarding for investors, attracting top talent, and building deeper market liquidity. The next few years will be crucial. Continued investment in infrastructure, talent, and regulatory reforms will determine whether GIFT City can truly rival the likes of Singapore and Dubai. But if its recent growth is any indication, the future looks bright.

Mr. Maulik Tejani, Head of GIFT City IBU, Kotak Mahindra Bank Ltd adds: GIFT City is emerging as India’s international gateway, offering world-class infrastructure, a progressive IFSC framework, and ease of doing business that facilitates global participation. Seamless connectivity, a liberalized and internationally aligned policy environment, and direct access to global markets are unlocking significant opportunities. This presents a once-in-a-generation chance for enterprises and investors to scale with global currencies, talent, and capital.

Sources: IFSCA bulletin, IFSCA Digital, Indian Embassy Bern, Business Standard, PWC India, Long Finance, Economic Times, PIB

Companies mentioned don’t constitute recommendations, brand name affiliation disclaimer & companies mentioned for illustrative purpose only. The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s). These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.