5 Sep 2025

Goods and Service Tax (GST) Council has approved the rationalisation of GST rates in India in its meeting held on 3rd September 2025. The same will be implemented from 22nd September 2025. In this article we have provided the insights on GST implementation in 2017 and changes proposed now.

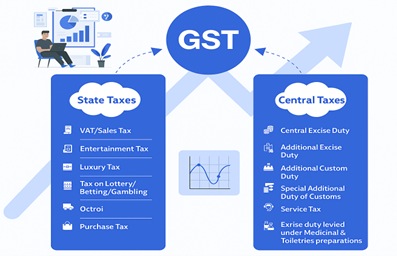

India’s pre-GST tax system was a puzzle of excise, VAT, service tax, entry tax and more, causing double taxation and compliance challenges. GST, launched on July 1, 2017 as “One Nation, One Tax”, replaced this fragmented structure with a unified framework of Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST) and Integrated Goods and Services Tax (IGST), creating a more integrated economy. Though classification disputes emerged such as popcorn being taxed at 5%, 12%, or 18% depending on its form—GST has still delivered clear benefits.

Here’s how GST delivered: -

- Unified Taxes: Replaced 17 taxes (e.g., VAT, excise) with one, cutting product costs by 5–10%

Source: Ministry of Information and Broadcasting, PIB

- Input Tax Credit (ITC): Before GST, input taxes couldn’t be offset against output taxes, causing cascading costs. GST unified this system, enabling businesses to claim ITC and lower their tax liability.

- Cheaper Essentials: As per a study by the Finance Ministry, 5% GST on food and helped households save at least 4% on monthly expenses in total.

- Boost to Logistics & Movement of Goods: The e-way bill system and removal of state checkpoints have improved supply chain efficiency, cutting transit times by ~20%.

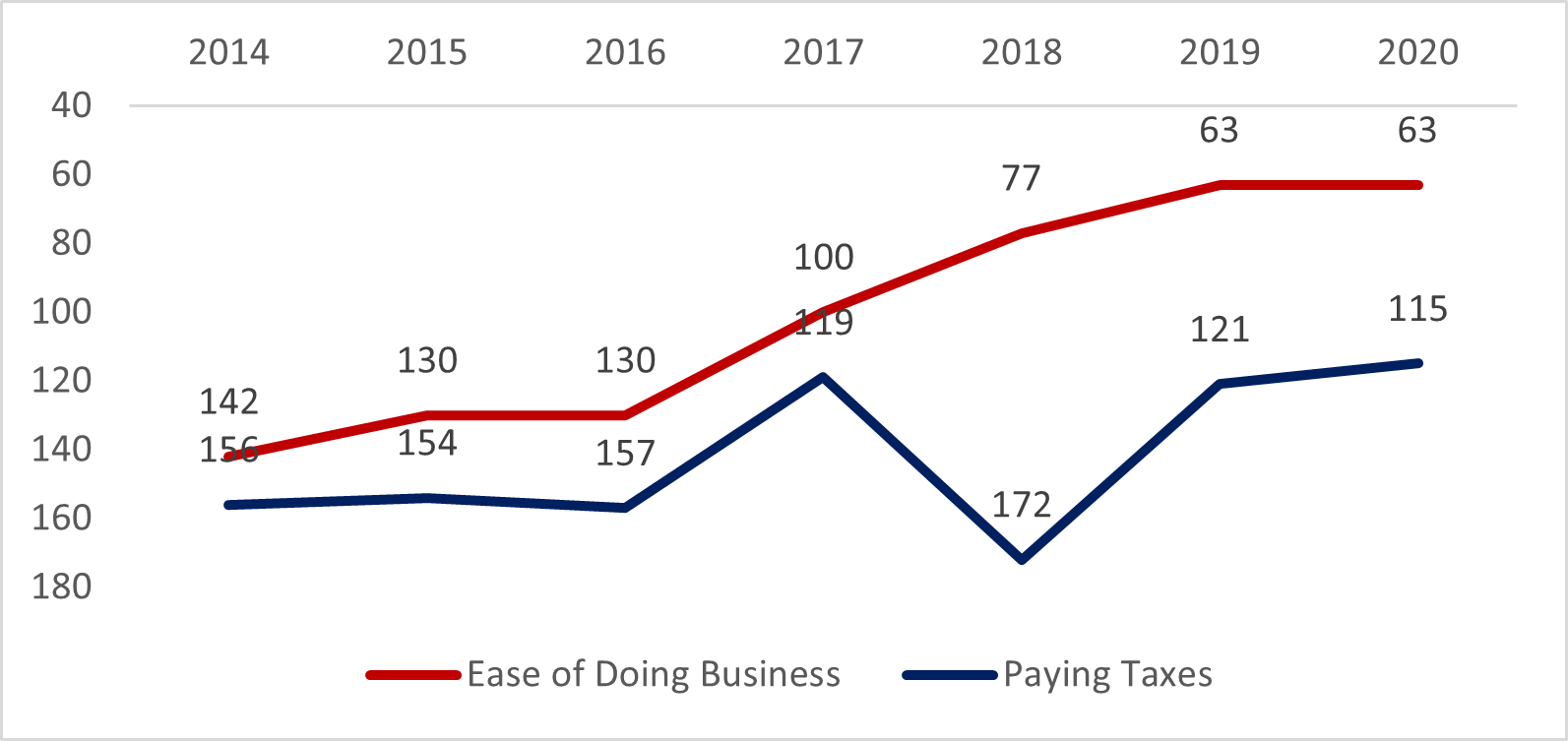

- Ease of Doing Business: India's ranking in the World Bank’s Ease of Doing Business Index improved significantly from 130 in 2017, before the introduction of GST, to 63 in 2020, reflecting a jump of 67 places within three years.

- GST collections have risen to ₹22.08 lakh crore collected in 2024–25, nearly double from ₹11.37 lakh crore in 2020–21.

Source: World Bank, Doing Business Report 2020, As per latest data available

GST 2.0: Diwali 2025 Reforms – A Game-Changer for Consumption?

The government has announced a major overhaul in the GST system, aimed at simplifying tax rates. The new GST structure will reduce the number of tax slabs to just two — 5% and 18% — replacing the current multi-tier system.

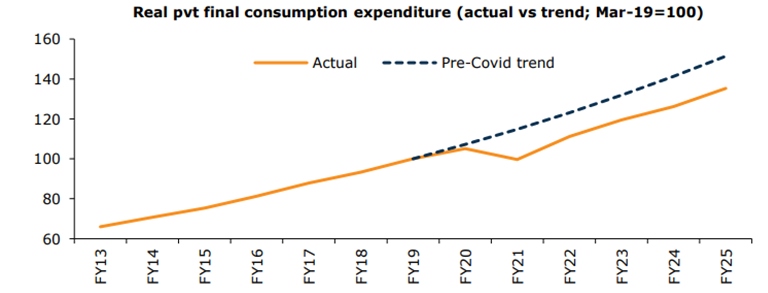

This announcement comes at a time when private consumption remains below pre-Covid trends, as highlighted by recent data.

Source: CEIC, Emkay Research, KMAMC Internal

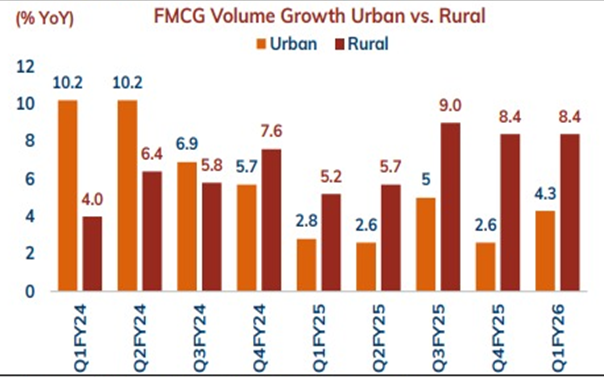

Despite early signs of recovery in rural demand during FY25, overall consumption growth remains subdued. FMCG growth has been muted in recent years, with rural demand showing signs of recovery in FY25 after a weak FY24. Meanwhile, urban consumption has softened, weighed down by inflation and sluggish income growth.

Source: Nielsen IQ, ICICI Bank Research

With GST 2.0 to be rolled out on 22nd September 2025, the reform could reshape consumer dynamics - promising lower prices on essentials, electronics, and automobiles.

According to a study by NIPFP, GST rate cuts have a higher fiscal multiplier (-1.08) compared to personal income tax (-1.01) and corporate tax (-1.02). This means that reducing GST rates has a stronger impact on boosting demand and economic activity, making it a more effective tool for stimulating consumption-led growth.

Below are the GST Slab Changes announced by the Government

The GST Council on September 3, 2025 has announced rationalisation of GST slab structure by abolishing 12% and 28% tax slabs and introducing 40% tax rate primarily for luxury and sin goods. With this rationalisation in rates, key goods that would benefit include several FMCG and consumer durable products.

Key items to move from 28% slab to 18% slab:

| Category |

Product |

| Auto | Diesel vehicles<1500 cc Petrol vehicles<1200cc Motorcycles<350cc Three-wheelers |

| Cement | Cement |

|

Sin goods |

Bidi wrapper leaves |

|

Household appliances |

White goods: ACs, dishwashers, TV sets>32 inches, monitors, projectors |

Source: GST Document

Key items to move from 18% slab to 5% slab:

| Category | Product |

|

FMCG Goods |

Chocolates, Hair Oil, Shampoo, Soaps, Oral Care, Biscuits, Mineral Water |

|

Medical instruments |

Thermometers Instruments and apparatus |

|

Fertilizer inputs |

Sulphuric acid, Nitric acid, Ammonia |

|

Tractor inputs |

Tyres, Agriculture diesel engine Bumpers, brakes, gearboxes etc. |

| Footwear |

Sale value > Rs. 2500 per pair |

| Services |

Some beauty/physical well-being services moved to 5% |

Source: GST Document

Key items to move to 40% slab; compensation cess done away with for most:

|

Category |

Product |

| Auto |

Diesel/Petrol motor vehicles with engines over 1500/1200 cc or length over 4000 mm |

|

Non-alcoholic beverages |

Non-alcoholic beer, Fruit juice |

|

Aerated drinks and beverages |

Carbonated drinks; Aerated waters; Caffeinated drinks |

|

Sin goods |

Pan masala, Cigarettes and tobacco |

|

Luxury goods |

Yachts; Personal use aircrafts Revolvers and pistols; Smoking pipes |

|

Lottery and gambling |

Casinos, horse races |

Source: GST Document

Key items to be exempt from tax:

| Category | Product | From | To |

| FMCG |

Chena or paneer, Pizza bread, Khakhra, chapati or roti |

5% |

Nil |

|

Education |

Erasers | 5% | Nil |

|

All items except Mathematical boxes, geometry boxes and colour boxes |

12% |

Nil | |

|

Healthcare |

Certain Life Saving Drugs |

5% or 12% |

Nil |

|

Insurance |

Individual Health & Life Insurance |

18% with ITC |

Nil |

|

Defence |

Military transport aircrafts, Ship launched missiles, Sonobuoys for naval air assets, Rockets with calibre more than 1000 mm, Remote piloted aircraft for military use |

18% IGST |

Nil |

Source: GST Document

Others not specified in the tables above:

- All drugs/ medicines have been prescribed a concessional rate of GST of 5%, except those specified at nil rate.

- Compensation cess on all products will be scrapped from September 22 except pan masala, gutkha, cigarettes, chewing tobacco products like zarda, unmanufactured tobacco and bidi where applicable, till loan and interest payment obligations under the compensation cess account are completely discharged (the same is likely to happen before Dec’25)

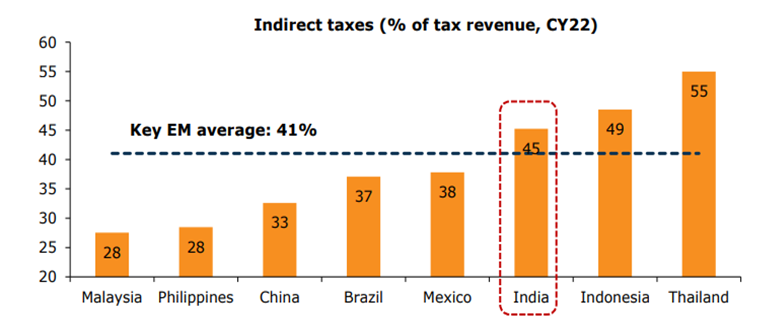

However, the proposed rate rationalisation is likely to have fiscal implications. GST plays a crucial role in the fiscal framework. Among emerging markets, India has a high indirect tax contribution. This underscores the strategic importance of GST.

India has one of the highest indirect tax/tax revenue ratios among key Emerging Markets

Source: World Bank, Emkay Research, KMAMC Internal

Revenue foregone due to reduction in GST rate is estimated to be ~₹93,000 crore. Revenue due to increase of GST from 28% to 40% is estimated to be ~₹45,000 crore. Thus, the GST rate cuts could lead to a revenue loss of ~₹48,000 crore (on the FY23-24 consumption base), as per the Finance Ministry. This impact may be lower due to tax buoyancy, better compliance and increase in consumer spending.

As states face slower revenue growth in FY26, many have raised property and alcohol taxes to boost collections. Haryana has increased liquor taxes across categories, Maharashtra has hiked Indian-made foreign liquor duty by ~50%, and Kerala raised land tax by ~50%. Karnataka has added a 10% excise duty on beer. Property tax hikes of 25-30% were also implemented in Karnataka during 1QFY26. (Source: Media Articles, Ambit Capital research)

Against this backdrop, the sectoral impact of GST 2.0 is expected to unfold in varied ways across industries. Here's a closer look at how key sectors may respond post-implementation.

| Sector | Impact |

| Consumer Staples |

Cuts for packaged foods and personal care items may boost demand and pricing power. Increase is dairy consumption is expected. |

|

Consumer Discretionary |

Mid-premium brands & private labels to benefit; QSR margins to increase as cost of paneer and cheese is set to reduce; Impact on luxury apparel to be mildly negative but offset by rising disposable income. |

| Consumer Durables | May drive premiumization for durables like AC, TV, dishwasher, etc.; may aid in shift towards organised market share of kitchen appliances. |

| Healthcare | Cut on kits and reagents may lower material costs, offering margin boost for diagnostics players |

|

Insurance |

Health: Lower costs to aid affordability; ITC loss may hit margins short-term, but volumes and pricing may help offset. Life: Long-term growth seems intact; margin pressure may need product and cost tweaks. |

| Auto |

Cuts to make two-wheelers, small cars, CVs, tractors and auto parts cheaper thereby boosting demand; EVs stay unchanged. |

| Apparel |

Apparel segment above ₹2,500 may benefit from this cut |

|

Hotel |

To boost accommodation for hotels below Average Room Rent of Rs7,500 |

Source: KMAMC Internal

The rollout of GST 2.0 on 22nd September 2025 marks a time-bound reform push. Many affected segments hold high inventory bought under older, higher GST rates. As a result, dealers may delay passing on the full benefit to consumers, softening the immediate impact on retail prices.

As India pursues its ambition of becoming a USD 5 trillion* economy soon, GST 2.0 could be a pivotal step toward unlocking consumption-led growth. The rate cuts boost purchasing power and demand across FMCG, durables, and autos—especially in rural areas. They also narrow price gaps, shifting demand from unorganized to organized sectors. The challenge lies in balancing affordability with fiscal sustainability, ensuring benefits reach both consumers and the broader economy.

*Source: pib.gov.in, as per latest available data

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.