16 Oct 2025

Every spring, when H1B lottery results come out, something shifts in Bengaluru and Hyderabad.

Phones go quiet. Coffee cups pause mid-air. Team leads check shortlists with a mix of hope and backup plans.

For years, the H1B visa wasn’t just paperwork. It was the bridge between India’s tech talent and America’s need for engineers.

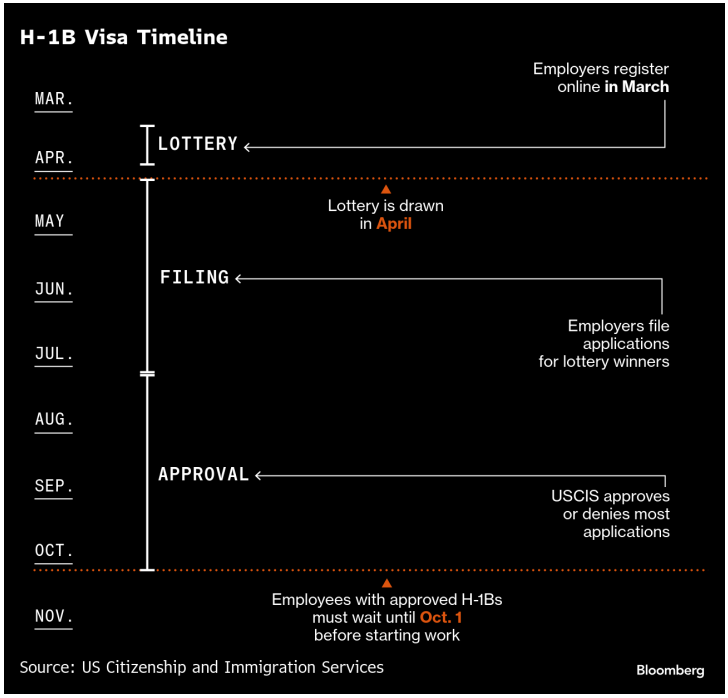

H1B: At a glance (timeline)

Source: US Citizenship and Immigration Services, Bloomberg

In 2025, that bridge shook.

A sudden rule change pushed the H1B filing fee to $100,000 per application, up from just a few thousand.

No warning. Huge cost jump was implemented without prior notice. Companies had to rethink fast.

But here’s the twist: Indian IT has already changed.

More work now happens from India. Fewer people need to go onsite. Many roles in the U.S. are filled locally.

So, while the fee hike hurts, it hits a system that’s already moving away from visa dependence.

The question now isn’t who goes onsite, but what still needs to.

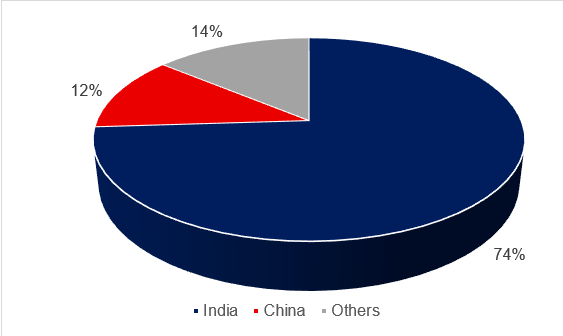

The H1B footprint: still big, still changing

In FY2024, 399,395 H1B petitions were approved.

India made up 74% of them.

That’s shaped how people study, work and plan careers—for decades.

Source: USCIS

Indian IT mastered a rhythm: get close to clients for planning, scale up from India for delivery. This model relied heavily on people moving across borders. But now, the balance has shifted—less travel, more remote execution.

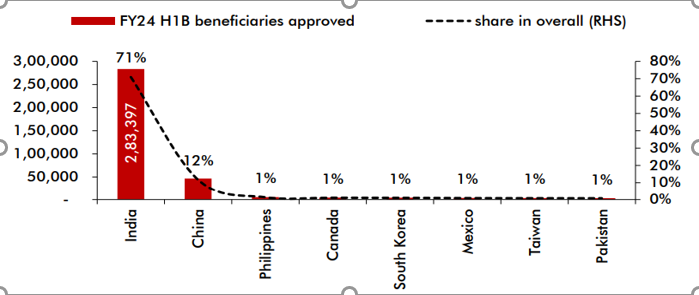

India accounted for ~71% of the H-1B visas issued

Source: USCIS, Ambit Capital research

Over the past decade, Indian IT firms have steadily shifted their delivery model. Earlier, a significant chunk of project work was done onsite in the U.S., but post-COVID, the balance has tipped dramatically in favour of offshore execution from India.

Take Infosys as an example: In FY2015, about 71% of their project effort was handled offshore. By FY2025, this had climbed to 76%. (Source: CLSA, Kotak Institutional Equities, JP Morgan, Avendus Spark Research) This isn’t just a one-off. Across Tier 1 providers, the offshore mix has consistently increased, reflecting a broader industry trend.

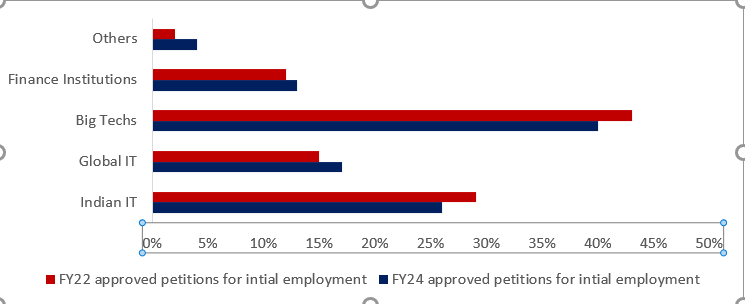

Gradual Decline in H-1B Reliance by Indian IT Service Firms

Source: USCIS, NFAP, MOFSL Research

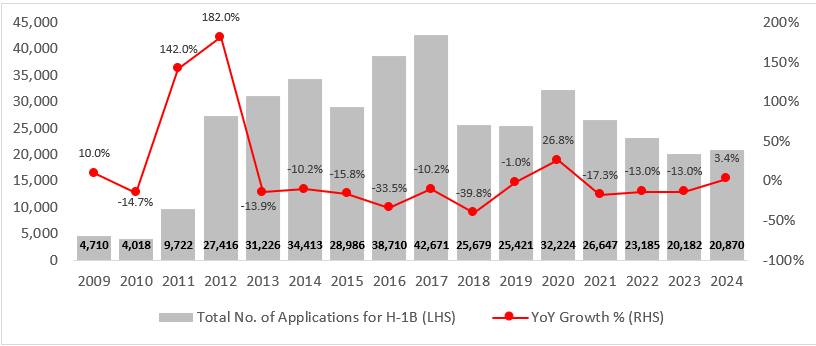

The landscape has been a roller coaster since 2017. Applications peaked, then dropped as companies localized hiring and clients embraced remote collaboration. The chart below shows how H1B filings have trended lower, mirroring the industry’s pivot away from visa dependency.

Applications for H-1B visas witnessed a decline from the highs of 2017

Source: USCIS, MOFSL Research

In practical terms, H1B holders today are only ~3–5% of a typical Indian IT vendor’s total workforce. Why? Because just ~20% of staff are onsite and within that, a minority carry H1Bs. So when a policy shock hits, it hits a slimmer slice, not the whole.

Indian IT vendors have consciously reduced their reliance on H1Bs over the past decade.

Even when you look at initial approvals among the top 30 employers from 2015 to 2025, the balance has clearly shifted.

Firms are diversifying delivery models and localizing talent.

So, why the shift?

- Remote work boom: The pandemic made clients comfortable with distributed teams.

- Visa uncertainty: H1B approvals became unpredictable and expensive, prompting firms to double down on offshore delivery.

- Cost efficiency: Offshore work is simply more cost-effective for most roles.

The $100,000 fee: sticker shock, strategic shuffle

Here’s the pivot point. Overnight, the cost of a new H1B petition becomes $100,000 (plus the integrity fee and existing charges). That’s not a tweak; it’s a deterrent. It pushes sponsors to ask: “do we really need a visa for this role now”?

Onsite work already costs more (wages, benefits, compliance). The sudden fee compresses margins and nudges delivery upstream: reserve visas for mission‑critical, client‑mandated, senior roles; move everything else offshore or nearshore; hire locally where feasible.

Business continuity is the mantra.

Thankfully, large providers have contingency plans to reduce redundancy, multiple hubs across India, U.S., Canada, Mexico and hardened processes to rebalance work quickly if a visa plan changes.

Who’s actually filing the most H1Bs?

A useful myth‑buster: Big Techs (Amazon, Google, Microsoft, Meta, etc.) now account for a larger share of fresh H1B applications than Indian IT pure‑plays today.

The league table below tells its own story:

Top Employers by H1B Approvals (FY2024)

| Company | Approvals |

Major Occupations |

| Amazon |

9,265 |

Software Dev, Data Engineer |

|

Infosys |

8,140 |

Programmer Analyst, Consultant |

|

Cognizant |

6,321 |

Systems Analyst, DevOps |

|

TCS |

5,274 |

Engineer, Architect |

|

4,650 |

ML Engineer, Research Scientist |

|

|

HCL America |

2,953 |

Technical Lead, IT Specialist |

|

Microsoft |

2,540 |

Software Engineer |

|

Capgemini |

2,420 |

Programmer Analyst |

|

Meta |

1,880 |

Data Scientist |

|

Accenture |

1,760 |

Cloud Consultant |

Source: USCIS

The $100,000 fee isn’t just a cost. It’s a catalyst. It forces firms to rethink how and where work gets done. And when visas tighten, work doesn’t disappear. It moves.

Adaptation Strategies: how the IT industry is responding

| Strategy | Examples | Benefit |

| Localization |

Infosys 'Reskill America', TCS U.S. grads |

Reduces visa risk |

|

Nearshore hubs |

Mexico, Costa Rica, Canada centres |

Same time zone, lower cost |

|

Automation / AI tools |

GenAI in project delivery |

Lower onsite headcount |

|

Hybrid delivery |

Onsite lead + offshore execution |

Maintains client intimacy |

|

GCC Partnerships |

Setting up GCCs in U.S. |

Long-term client stickiness |

Source: NASSCOM, JP Morgan, KIE, CLSA, Avendus Spark Research

The ripple effect: students, remittances and leadership

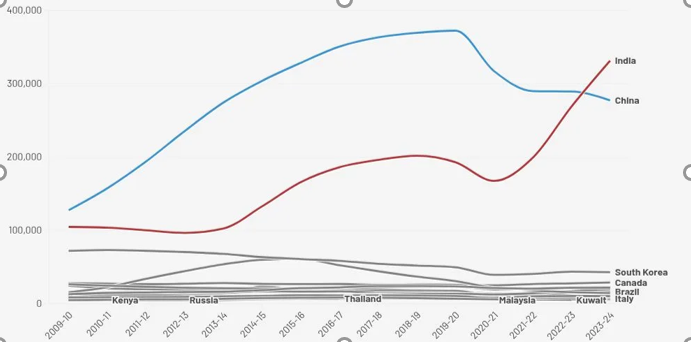

Indian students are one of the largest international groups in U.S. universities. Many use the OPT program to work after graduation and later move into H1B roles.

Higher visa costs don’t close the door, but they make it harder for employers to justify the spend.

Still, Indian talent remains central to U.S. tech through direct jobs and offshore services. In 2024, Indians received over 207,000 H1B visas and Indian firms made up 20% of approvals. 1 in 4 international students in U.S. universities is Indian.

Over time, many rise to leadership. Just look at the Indian origin CEOs at Google, IBM, Adobe and Microsoft.

Country-wise number of international students

Source: USCIS, CLSA, JP Morgan, Kotak, Avendus Spark, Ambit Capital research

Remittances tell you how personal this all is. In FY25, $135 billion flowed into India with more than a quarter coming from the U.S. supporting household budgets, EMIs and parental retirements. Behind every visa approval is a family plan. (Source: RBI)

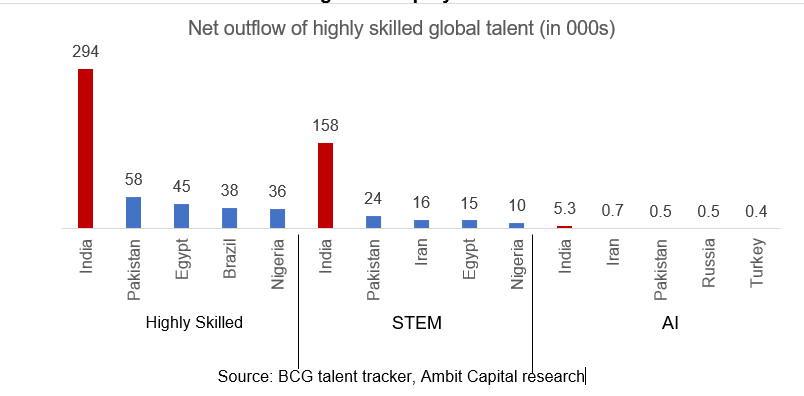

As U.S. visa costs rise and approvals tighten, Indian talent is exploring new destinations. Canada, Germany and Australia are now seen as friendlier, faster-moving options. At the same time, India itself is becoming stickier. Many professionals are choosing to return, drawn by opportunity, family or stability.

India has the world’s largest outflow of skilled talent making it a key hiring ground for global employers

Source: BCG talent tracker, Ambit Capital research

The recent hike in the H1B visa fee to $100,000 has made it much more expensive for Indian IT companies to send employees to the U.S.

But here’s the context: most Indian IT work already happens from India. According to brokerage consensus:

- 80% of employees work offshore from India*

- 15% are onsite in the U.S. but not on H1B visas*

- Only 5% are onsite on H1B visas

So, while the fee is a challenge, it hits a small slice of the workforce. And Indian IT firms are adapting fast using strategies backed by leading brokerage research.

*Source: CLSA, JP Morgan, Kotak, Avendus Spark, and Ambit Capital Research

When visas tighten, work finds a new path

Work doesn’t stop when an H1B is denied, it simply moves. Studies show a near 1:1 offshoring substitution if a visa isn’t approved, the job often gets done offshore, especially in India.

It’s a built-in feature of global delivery if talent can’t come to the U.S., the work goes to the talent.

Nearshore hubs like Canada and Mexico have grown stronger, offering U.S. time zone coverage with less visa hassle. Add Europe and Australia and you get a flexible network, not just one bridge.

At the same time, local hiring in the U.S. is growing. Indian IT firms are steadily building talent pipelines through U.S. campuses, helping cushion policy shocks.

The next few years will likely cement three themes:

- Selective visas for niche, senior, or client‑mandated roles; everything else shifts to distributed delivery.

- Local talent pipelines in the U.S. deepen (campus hiring, reskilling), while Canada/Mexico carry near‑site load.

- Automation + AI trim the onsite headcount footprint, raise productivity offshore and tilt vendors further up the value chain.

The cycle has always been policy > response > redesign.

Indian IT has already done the heavy lifting on redesign. The fee hike is a curveball, but the playbook is in place.

Talent, projects and delivery models are finding new paths, some nearer, some smarter, many more distributed.

For Indian IT, this isn’t a reset. It’s a re-optimization.

For the U.S., it’s a reminder. Innovation follows talent and talent flows where routes remain open.

The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s).

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.