27 Nov 2025

India’s creator economy isn’t just growing, it’s exploding. What started as a niche space led by YouTubers and lifestyle bloggers has transformed into a multi-billion-dollar ecosystem spanning finance, gaming, beauty, food, fitness and comedy. With a young digital-first audience and affordable data, creators now shape consumer choices more directly than traditional advertising ever could. Influencer collaborations have shifted from being trend-led experiments to high-ROI, measurable marketing strategies at the heart of brand communication.

In this attention-scarce world, content has become the new currency. As audiences increasingly prefer short, snackable videos over long formats, platforms are evolving to match these behaviours. Creators who can capture attention in seconds have become invaluable to brands seeking precise, high-impact reach turning influence into one of India’s most powerful marketing forces today.

Did You Know?

YouTube’s creator influence is extremely concentrated:

90% of subscriptions come from

<5% of channels

Source: Citi

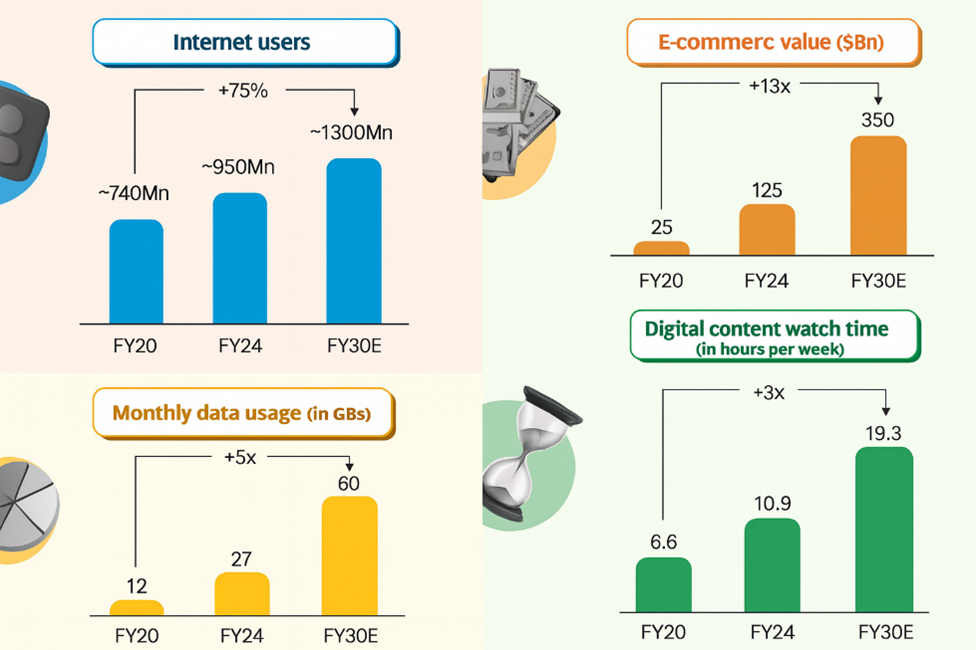

The Digital Advantage

India has crossed a defining milestone with over 100 million creators, making it one of the world’s largest and fastest-growing influencer ecosystems. And it’s not the mega-stars driving this wave, it’s micro and nano-creators whose relatability and deeply engaged communities are reshaping how brands communicate. As traditional advertising loses impact, businesses across FMCG, fashion, electronics, fintech, real estate and even BFSI are shifting budgets toward creators who deliver authenticity, trust and targeted performance.

With 900 million internet users, smartphone-led access and supportive digital policies, India’s creator economy is scaling at record speed. Entertainment has shifted from centrally produced content to niche, creator-led storytelling where small communities drive big impact. In today’s digital-first world, creators aren’t just influencers; they are the backbone of brand discovery, storytelling and commerce. India has a strong starting position for uptake of creator economy with the supporting infrastructure in place.

(Source: BusinessRemedies)

Source: TRAI Annual Report, Economic Survey FY24, BCG Analyst

How are Indian influencers doing:

It is surprising that only 8–10% of creators in India are able to monetize their content today, compared to 40% or more in mature markets. That’s a huge gap and an even bigger opportunity as the ecosystem matures.

| Metric | Value |

|---|---|

| Internet users | ~950 million |

| Total creators | 100+ million |

| Active creators > 1k followers | 2–2.5 million |

| Monetised creators from Active | 8–10% |

Source: TRAI, BCG, EY

This imbalance has become a catalyst for bold moves by tech giants and government alike. The government is stepping in with supportive initiatives and social media giants are doubling down on investments. Meta has pledged USD 1 billion for creator programs, upskilled over 250,000 creators and even launched a knowledge hub to help creators master the art of content. YouTube rolled out its USD 100 million Shorts Fund, fuelling the short-form content boom globally. Meanwhile, Snap is tapping into India’s vibrant regional music scene with its India-focused creator fund for independent artists.

These moves have unlocked unprecedented opportunities but it’s not all smooth sailing. Economic, operational and regulatory hurdles still loom large.

(Source: Ikigai Law)

The Influence of Influencers

Around 17-20% of India’s $2000 Bn consumption expenditure is influenced by creators on social media generating $20-25 Bn in value for the participants in the economy. This 350-400 Bn pie is expected to grow to over $1000 Bn by 2030.

Source: BCG, May 2025

How do influencers monetize their content?

Influencers monetize their content through multiple revenue streams. They earn ad revenue from platforms like YouTube or Instagram, collaborate on brand deals and sponsored posts and offer subscriptions/ membership for exclusive content. Many also drive income through affiliate marketing, direct product sales and even launching their own merchandise or digital products. These strategies allow creators to turn engagement into sustainable income across diverse channels.

Creators are no longer just advertisers. They are becoming retail channels. They are turning into digital storefronts, creating entire commerce journeys from awareness to purchase.

Source: Company websites, News articles. Companies mentioned don’t constitute recommendation, brand name affiliation disclaimer & companies mentioned for illustrative purpose only

Why Does Influencer Content Feel So Authentic?

Influencer content isn’t just another scripted ad, it’s a slice of real life. When influencers create content on similar categories as the brands that they collaborate with, their voice carries authority and credibility. The influencer marketing approach adopts the “Prove Instead of Preach” approach in influencer marketing. It’s all about building genuine connections with consumers by showcasing real experiences, not hollow claims.

Behind the Scenes of Like Share and Subscribe

In the creator world, the real boss is the algorithm. Social media algorithms aren’t random; they’re built to keep users hooked. For brands and creators, cracking the code means more reach and engagement. Here are the key drivers:

Engagement Is King: Likes, comments, shares and saves tell the algorithm your content matters. Interactive posts, polls, questions, quizzes boost engagement and organic reach.

Relevance Wins: Algorithms prioritize content users love. Tailor posts to audience interests for higher visibility and stronger connections.

Timing Counts: Fresh content gets priority. Post consistently and at peak activity times to maximize reach before engagement fades.

Videos Triumph: Short-form videos rule platforms like TikTok and Instagram Reels. High watch time on long form videos and engagement push your content to the top.

Content Trends of Tomorrow:

India’s creator economy is being reshaped by five big forces: authenticity-driven UGC (User Generated Content), the explosive rise of live and social commerce, AI-powered creation tools and immersive AR/VR experiences. UGC is now a global multibillion-dollar trust engine; live and social commerce are turning creators into real-time sellers; AI is becoming every creator’s silent co-worker; and AR/VR (Augmented Reality & Virtual Reality) is transforming content into full-blown experiences. Together, these trends show how creativity, technology and commerce are merging to redefine how India discovers, decides and shops online.

It is amazing to witness the evolution of storytelling in the last two decades from stories told by your grandparents, weekly-comic books, movies and web-series to the current avatar. India’s creator economy is not a passing digital trend. It is a structural shift in how India consumes information, makes choices and spends money.

Creators influence culture but also influence consumption. They drive conversations but also drive commerce. They entertain but more importantly, they build trust at scale. In a country as young, digital and culturally diverse as India, creators are emerging as the most effective economic intermediaries turning content into commerce, one scroll at a time.

Sudheer Guntupalli, Vice President, Equity Research at Kotak AMC, adds: “India’s creator economy is rapidly expanding, driven by over 100 million creators and 950 million internet users. Micro and nano-influencers, not just mega-stars, are reshaping brand communication with authentic, relatable content. Despite only 8–10% of creators monetizing their work, the sector influences $350–400 billion in annual consumption, expected to surpass $1 trillion by 2030. Creators earn through ads, brand deals, subscriptions, and direct sales, evolving into digital storefronts. Key trends include user-generated content, social commerce, AI-powered creativity, and immersive AR/VR, making creators vital economic intermediaries who build trust and drive commerce in India.”

Disclaimers

Companies mentioned don’t constitute recommendation, brand name affiliation disclaimer & companies mentioned for illustrative purpose only

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.