25 Aug 2025

Mutual funds remain a favoured investment avenue for Indian investors due to their potential for long term wealth creation, diversification, and professional fund management. However, understanding mutual fund taxation is equally important to make informed investment decisions and improve post tax returns.

Whether you’re investing in equity, debt, or hybrid schemes or through SIPs taxation plays a crucial role in your overall investment outcome. This blog will help you decode the latest mutual fund tax rules as per Union Budget 2024, including INCOME DISTRIBUTION CUM CAPITAL WITHDRAWAL (IDCW) taxation, capital gains, and TDS implications.

Key Takeaways

- Post Budget 2024, equity LTCG is 12.5%, STCG is 20%.

- Debt fund gains are taxed at slab rates (no indexation).

- Holding period for FOFs and international equity is now 24 months.

- SIPs are taxed per installment, based on their individual holding periods.

- Plan investments strategically to manage tax on mutual funds efficiently.

What is Tax on Mutual Funds?

Tax on mutual funds is the amount levied by the government on your earnings from mutual fund investments. These earnings are classified into two broad types:

- Income distribution cum capital withdrawal (IDCW) - Income received from the mutual fund company.

- Capital Gains - Profit earned when you sell your mutual fund units at a higher NAV (Net Asset Value) than the purchase price.

Both these income streams are subject to specific taxation rules, which depend on the type of mutual fund and holding period.

Variables Determining the Taxation for Mutual Funds

The taxation of mutual funds depends on several variables:

- Type of fund (Equity, Debt, Hybrid, Fund of Funds)

- Holding period (Short term vs Long term)

- Mode of investment (Lump sum or SIP)

- Resident status of the investor

Understanding these elements is crucial for effective tax planning and knowing how to save tax on mutual funds through the right mix of products and holding strategies

How Do You Earn Returns in Mutual Funds?

Returns from mutual funds come in two ways:

- Income distribution cum capital withdrawal (IDCW) - Periodic payouts by the AMC (if opted).

- Capital Gains - Accrued by appreciation in the fund’s NAV.

- Both are taxed differently and are vital to understand mutual fund taxation with example to see how your investments are affected.

TAX IMPLICATION ON INCOME DISTRIBUTION CUM CAPITAL WITHDRAWAL (IDCW) RECEIVED BY UNIT HOLDERS

From FY 2020–21 onwards, INCOME DISTRIBUTION CUM CAPITAL WITHDRAWALS (IDCWs) are taxed in the hands of the investor as per their applicable income tax slab rate. There is no income distribution cum capital withdrawal (IDCW) Distribution Tax (DDT) at the AMC level.

Resident:

|

Categories of Unit Holders |

Threshold |

TDS Rate |

Taxation Rate |

|

Resident Unit Holders |

Rs. 10,000 (w.e.f 1st April, 2025) |

10% |

As per applicable slab rates plus applicable surcharge and cess |

Non-Resident:

| Categories of Unit Holders |

Threshold |

TDS Rate | Taxation Rate |

|

Non Resident Unit Holders (subject to DTAA benefits, in case applicable) |

|||

| (1) FII/FPI | NILs | 20% plus applicable surcharge and cess | 20% plus applicable surcharge and cess |

| (2) Foreign company/corporates | |||

|

Purchase in Indian Rupees |

NILs |

20% plus applicable surcharge and cess |

35% plus applicable surcharge and cess |

|

Purchase in Foreign Currency |

NILs | 20% plus applicable surcharge and cess | 20% plus applicable surcharge and cess |

| (3) Others | |||

| Purchase in Indian Rupees | NILs | 20% plus applicable surcharge and cess | At slab rates applicable plus applicable surcharge and cess |

| Purchase in Foreign Currency | NILs | 20% plus applicable surcharge and cess | 20% plus applicable surcharge and cess |

Taxation of Capital Gains Offered by Mutual Funds

Capital gains are taxed based on the type of fund and the holding period:

- Short Term Capital Gains (STCG) - Gains on selling units before a specified period.

- Long Term Capital Gains (LTCG) - Gains on selling units after the specified period.

Understanding how long and short term capital gains are taxed can significantly impact your investment strategy. Here’s a helpful comparison of short term vs long term capital gains to guide your decisions.

Taxation on Mutual Funds Post Union Budget 2024

The Union Budget 2024 introduced several key changes in mutual fund taxation:

For FY 2024 25 onwards:

- LTCG on equity schemes revised to 12.5% from 10%.

- STCG on domestic equity schemes increased to 20% from 15%.

- International equity and FOFs now require 24 months of holding to qualify for LTCG (12.5% flat).

- Unlisted Hybrid funds (with >35% and <65% equity) now attract 12.5% LTCG with a 24 month holding period.

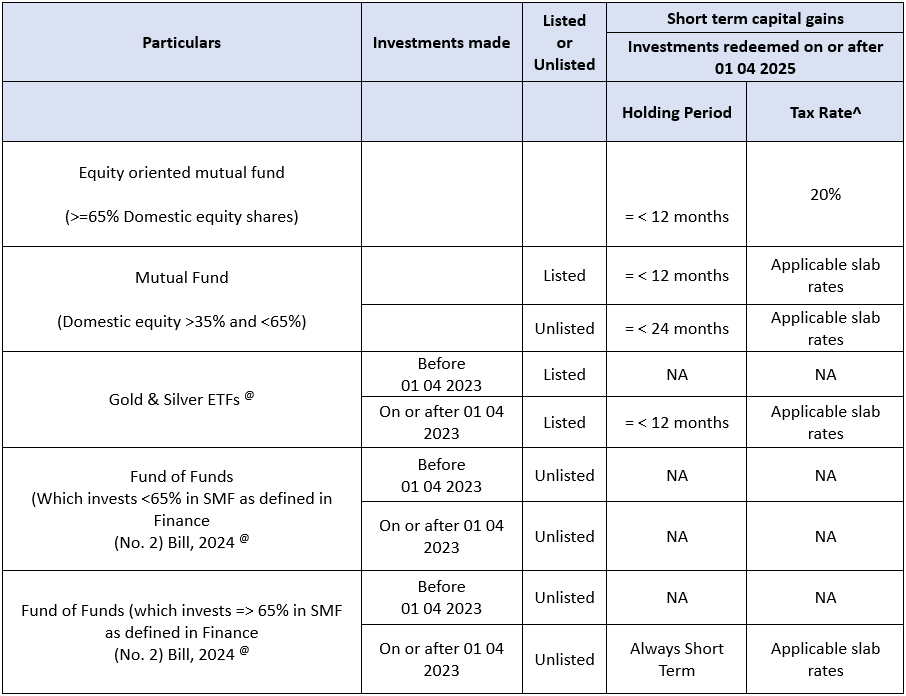

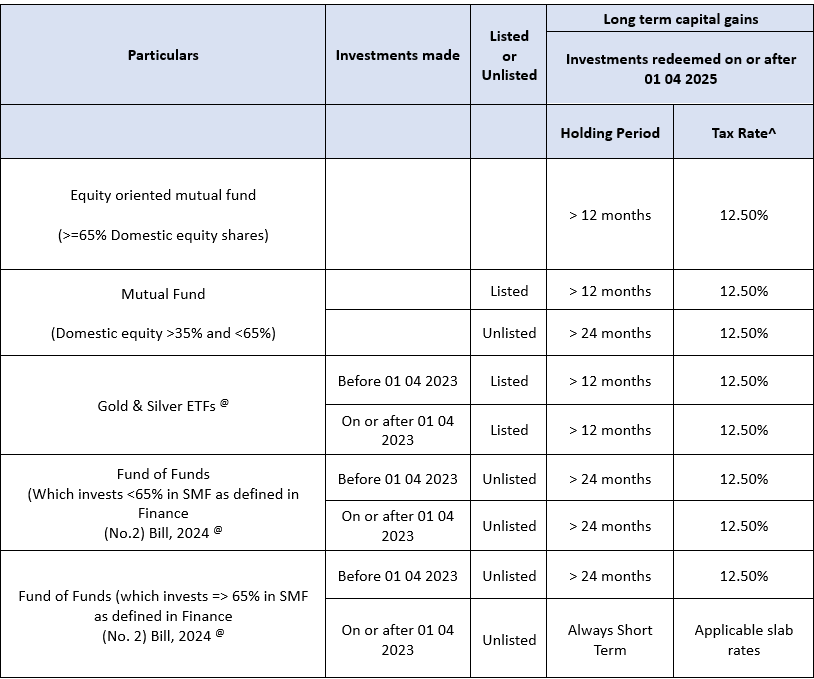

Taxation of Capital Gains of Equity Funds(Investments redeemed on or after 01 04 2025)

Capital gains are taxed differently based on fund category, listing status, and holding period.

SHORT TERM CAPITAL GAIN TAXATION RATES RESIDENT INDIVIDUAL, HUF, DOMESTIC CORPORATE, NRI$

$ Subject to NRI having Permanent Account Number (PAN) in India. The TDS deductible in case of NRI shall also be increased by applicable surcharge as per Note 1 and 4% health and education cess. In case of NRI, if PAN is not available and specified declaration is not provided as specified under Rule 37BC, TDS @ higher of 20% or rates calculated as above will be deducted. The tax rates are subject to DTAA benefits available to NRI's. As per the Finance Act 2013, submission of tax residency certificate (“TRC”) will be necessary for granting Double Taxation Avoidance Agreement (“DTAA”) benefits to non residents. A Taxpayer claiming DTAA benefit shall furnish a TRC of his residence obtained by him from the Government of that country or specified territory. Further, in addition to the TRC, the non resident shall also provide electronically filed Form 10F and such other documents /information, as may be prescribed by the Indian Tax Authorities and Kotak Mahindra Mutual Fund or Kotak Mahindra Asset Management Company Ltd. Further investor needs to certify in its No PE declaration that the one of the principle purpose of investment is not to avail the treaty benefits & the investment asset & investment income are beneficial hold by the investor claiming DTAA benefits.

@ For FY 2024 25, Specified Mutual Fund is defined as where not more than thirty five per cent of its total proceeds is invested in the equity shares of domestic companies. However, Finance (No 2) Bill, 2024 has amended the definition of Specified Mutual Fund w.e.f. FY 2025 26 as a Mutual Fund by whatever name called, which invests more than sixty five per cent of its total proceeds in debt and money market instruments; or a fund which invests sixty five per cent or more of its total proceeds in units of a fund mentioned in clause (i) ^ Tax rates for resident and non residents shall be increased by applicable surcharge as per Note 1 and 4% Health & Education Cess.

LONG TERM CAPITAL GAIN TAXATION RATES RESIDENT INDIVIDUAL, HUF, DOMESTIC CORPORATE, NRI$

$ The TDS deductible in case of NRI shall also be increased by applicable surcharge as per Note 1 and 4% health and education cess. In case of NRI, if PAN is not available and specified declaration is not provided as specified under Rule 37BC, TDS @ higher of 20% or rates calculated as above will be deducted. The tax rates are subject to DTAA benefits available to NRI's. As per the Finance Act 2013, submission of tax residency certificate (“TRC”) will be necessary for granting Double Taxation Avoidance Agreement (“DTAA”) benefits to non residents. A Taxpayer claiming DTAA benefit shall furnish a TRC of his residence obtained by him from the Government of that country or specified territory. Further, in addition to the TRC, the non resident shall also provide electronically filed Form 10F and such other documents /information, as may be prescribed by the Indian Tax Authorities and Kotak Mahindra Mutual Fund or Kotak Mahindra Asset Management Company Ltd. Further investor needs to certify in its No PE declaration that the one of the principle purpose of investment is not to avail the treaty benefits & the investment asset & investment income are beneficial hold by the investor claiming DTAA benefits.

@ For FY 2024 25, Specified Mutual Fund is defined as where not more than thirty five per cent of its total proceeds is invested in the equity shares of domestic companies. However, Finance (No 2) Bill, 2024 has amended the definition of Specified Mutual Fund w.e.f. FY 2025 26 as a Mutual Fund by whatever name called, which invests more than sixty five per cent of its total proceeds in debt and money market instruments; or a fund which invests sixty five per cent or more of its total proceeds in units of a fund mentioned in clause (i) ^ Tax rates for resident and non residents shall be increased by applicable surcharge and health and education cess.

Taxation of Capital Gains When Invested Through SIPs

Each SIP instalment is treated as a separate investment for tax purposes. That means:

- If SIPs run for 12 months and are redeemed in the 13th month, only the first installment qualifies for LTCG; others may be STCG.

- This makes tracking individual units essential.

Explore the benefits of SIP investment to understand how regular contributions not only offer compounding benefits but can also reduce overall tax liability. If you’re planning ELSS through SIP, it’s also helpful to read why should you invest in elss mutual funds to know how this approach aligns with your tax goals.

Securities Transaction Tax (STT)

Securities Transaction Tax (STT) is levied at the time of purchase or sale of equity oriented mutual funds (including ELSS and ETFs) on stock exchanges. The current STT rate is 0.001% and is applicable only to equity oriented schemes transacted on exchange platforms. Debt funds and FOFs are exempt.

- Applicability (only equity oriented schemes)

- Rate (0.001%)

- Exclusion of debt and FOF

Conclusion

Understanding mutual fund taxation is crucial for maximizing returns and effective financial planning. While the Union Budget 2024 has brought some shifts particularly around holding periods and LTCG rates careful selection of fund type and investment horizon can still help investors optimize post tax returns.

Whether it’s choosing between equity or debt funds, or structuring your investments through SIPs, knowing the rules can go a long way in achieving your financial goals with minimal tax leakage.

Frequently Asked Questions

Q1. How much mutual fund investment is tax free?

Up to ₹1.25 lakh of long term capital gains on equity funds in a financial year is tax free.

Q2. How do I avoid tax on mutual funds?

Invest in ELSS to avail tax benefits under Section 80C. Additionally, holding funds for longer than the LTCG threshold period can help reduce tax.

Q3. Is it possible to avoid the capital gains tax?

While total avoidance isn't feasible, you can reduce it by staying invested longer, using ELSS, or harvesting gains smartly.

Q4. Can mutual fund investments help me get a rebate on income tax?

Yes, ELSS Mutual Fund investments qualify for deductions up to ₹1.5 lakh under Section 80C (Old Tax Regime).

Disclaimers

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision. This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Asset Management Company or its employees. The company makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Article. The information contained in this Article is sourced from empaneled external experts for the benefit of the customers and it does not constitute legal advice from the Bank. The Company, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein. Tax laws are subject to amendment from time to time. The above information is for general understanding and reference. This is not legal advice or tax advice, and users are advised to consult their tax advisors before making any decision or taking any action.These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.