9 Oct 2025

Tiny Metals, Massive Impact

Did you know the smartphone in your pocket relies on minuscule amounts of special metallic elements? Without them, your screen wouldn’t light up, your speakers wouldn’t sound right, and even the vibration function wouldn’t work.

These elements are used in a wide range of modern hi-tech products, be it your electric vehicles, wind turbines, satellites, MRI machines, guidance systems, lasers, and advanced alloys in the defense sector, aircraft components or other consumer electronics, all depend on a group of critical materials known as Rare Earth Elements (REEs).

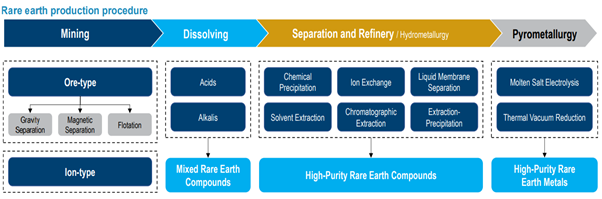

Despite their name, REEs are not especially rare in the Earth’s crust; rather, their “rarity” comes from the difficulty and cost of extracting and refining them into usable forms.

A single wind turbine can contain up to 600 kilograms of REE-based magnets — that’s nearly the weight of a grand piano, all dedicated to converting wind into clean energy.

Source: USGS

The Depth of Rare Earth Minerals

Rare earth minerals (REMs) are composed of rare earth elements (REEs), a set of 17 metallic elements, known for their unique electronic, magnetic, and optical properties, typically divided into two groups: Light rare earth elements (LREEs) and Heavy rare earth elements (HREEs).

| Light Rare Earth Elements |

Heavy Rare Earth Elements |

| Scandium (Sc) |

Terbium (Tb) |

|

Lanthanum (La) |

Dysprosium (Dy) |

|

Cerium (Ce) |

Holmium (Ho) |

|

Praseodymium (Pr) |

Erbium (Er) |

|

Neodymium (Nd) |

Thulium (Tm) |

|

Promethium (Pm) |

Ytterbium (Yb) |

|

Samarium (Sm) |

Lutetium (Lu) |

|

Europium (Eu) |

Yttrium (Y) |

| Gadolinium (Gd)* |

* (* Sometimes treated as Heavy Ree)

LREEs have lower atomic weights and mainly extracted from deposits such as Bayan Obo (China) and Mountain Pass (U.S.).

HREEs have higher atomic weights, are rarer and more valuable, sourced chiefly from ion-adsorption clays in southern China. Their higher melting points make them ideal for specialized high-temperature applications.

Source: Daiwa Research

What Makes Rare Earths Special?

The properties of REEs include—Silvery-white lustre, high density, malleability, unique magnetic, luminescent and catalytic behaviour, making them indispensable for a wide range of advanced technologies. Their similar chemical characteristics due to their electronic configurations make them difficult to separate during processing. REEs are soft and malleable, highly reactive (especially at elevated temperatures), and possess high melting and boiling points.

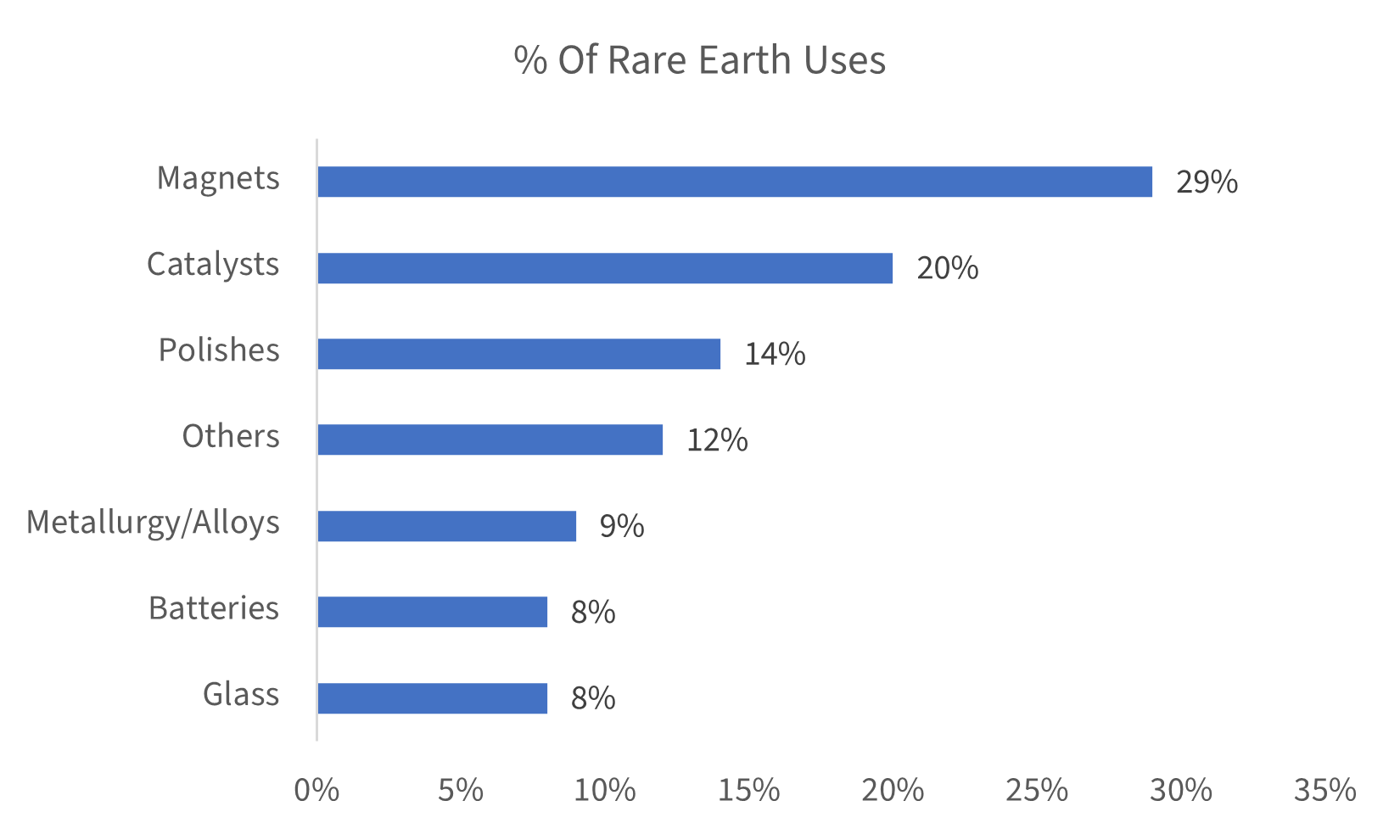

Rare earths with these electrochemical characteristics, are essentially used in a wide array of high-tech applications including:

Source: geology.com

Why the World Needs Rare Earths (RE)?

They may not glitter like gold, but rare earth elements are the quiet force behind the world’s clean energy and technological future. Hidden deep within the earth, metals such as neodymium and praseodymium power electric vehicles, wind turbines, and the digital devices that define our daily lives.

As the world moves away from fossil fuels, it enters a new era powered by rare earth elements that are vital to achieving global climate goals under the Paris Agreement. The goal of limiting warming to below 2°C is becoming increasingly difficult and reaching it will require a rapid shift to cleaner, mineral-intensive technologies such as electric vehicles, solar panels, and batteries.

Beyond green tech, they’re equally vital for defence, aerospace, and critical infrastructure. Yet their supply remains fragile, concentrated in a handful of nations. With demand projected to rise more than 50 percent by 2040, the race to secure sustainable, diversified sources is accelerating.

Invisible to most, rare earths are quietly powering the shift toward cleaner energy, stronger economies, and a smarter, more sustainable world.

Where in the world are these located?

Although Rare Earth Elements (REEs) are found globally, economically viable deposits are concentrated in a few key regions. China’s dominance in rare earth production continues to overshadow efforts across the globe.

In terms of production/mining, China accounts for 69% of global REE mining, followed by the United States at 12% — figures that far exceed their respective shares in global reserves (China: 40%, US: ~2%). Countries like Brazil (19% of reserves, 0.02% of mining), India (6% reserves, 0.7% mining), and Russia (9% reserves, 0.7% mining) have significant untapped potential.

Due to their high levels of exploitation, both China and the US are actively seeking to expand control over REE-rich territories. It’s important to distinguish between reserves, which represent the potential availability of REEs, and production, which reflects current extraction levels.

While China dominates both, other nations are increasingly investing in exploration and development to diversify the global supply chain.

World Mine Production and Reserves of Rare Earth Minerals

| Country | % of Global Refining | % of Global Mining | Shares of Global Reserves (%) |

| China | 90% | 69% | 40% |

| United States | <5% | 12% | 1.6% |

| India | <1% | <1% | 6.3% |

| Australia | 5% | 5% | 5.2% |

| Brazil | Negligible | 0.02% | 19% |

| Russia | Negligible | 0.70% | 9% |

Source: EY Economy watch report, Dezerv

The Rare Earth Race

For a brief period in the late 20th century, the U.S. dominated rare earth production through its Mountain Pass mine in California. But tighter environmental rules and soaring costs caused output to collapse. China seized the opportunity. As Deng Xiaoping declared in 1992, “The Middle East has oil; China has rare earths.” With vast reserves, cheap labour, and lax regulations, China invested heavily in refining—and by the 2010s, supplied over 90% of the world’s refined rare earths.

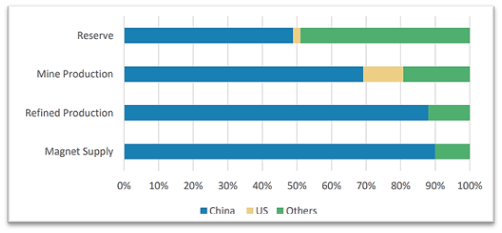

Today, China holds nearly half of global reserves, 70% of mining output, and over 90% of refining capacity. Its dominance rests on decades of state backing, cost advantages, and unmatched technical know-how. Beyond economics, China wields rare earths as a geopolitical tool—from halting shipments to Japan in 2010 to imposing export bans on gallium, germanium, and antimony in 2025.

While the U.S., Australia, and Myanmar contribute modestly, China still controls most mining, refining, and high-performance magnet production—critical for EVs, wind turbines, and defence systems. To counter this, countries are rebuilding supply chains: the U.S. is reviving Mountain Pass, Australia’s Lynas is expanding, and India, Canada, and others are launching new projects despite high costs and strict regulations.

Non-Chinese production is up to three times costlier, whereas Beijing continues securing global deposits. As demand for clean energy and advanced tech surges, the rare earth race is intensifying—and China, for now, keeps its edge.

Market Share Across Rare Earth Supply Chain

Source: USGS, WoodMac, Morgan Stanley Research

India’s Rare Earth Opportunity

India is actively seeking rare earth sources beyond China and developing domestic processing capabilities to mitigate future supply chain risks. India remains resilient amidst geopolitical turbulence, poised to be the fastest-growing economy.

With significant reserves and a new policy push under the National Critical Mineral Mission (2025), India aims to boost domestic exploration, mining, and processing of REEs.

India is ramping up rare earth recycling with a new Production Linked Incentive scheme. The removal of IREL(India) Limited from the US export control list is set to strengthen India’s critical mineral supply chain. IREL’s new plant in Visakhapatnam will produce samarium-cobalt magnets using homegrown tech. Initiatives like KABIL (Khanij Bidesh India Limited), joining the US-led Mineral Security Partnership, and updates to the MMDR (Mines and Minerals (Development and Regulation) Act are boosting India’s rare earth ambitions.

The government is therefore focusing on reducing import dependency, developing processing technology & promoting PLI schemes. State-wise, India’s REE deposits are spread across Kerala, Tamil Nadu, Odisha, Andhra Pradesh, Maharashtra, Gujarat, Jharkhand, West Bengal, and Chhattisgarh. The challenge now is to accelerate extraction and processing, invest in R&D, and leverage strategic partnerships to become a significant player in the global REE value chain.

Road Ahead

Demand for rare earth elements (REEs) will surge as the world shifts to clean energy and digital technologies, with usage projected to rise 300–700% by 2040. China’s share is expected to fall from 69% to 51% in mining and 90% to 76% in refining by 2030, according to the IEA. This trend reflects a broader international effort to develop more balanced and resilient supply chains. Diversifying supply is slow and costly but vital for growth and security. Global collaboration and innovation are essential to build a secure, resilient REE supply chain.

Sources: USGS, Deloitte, Morgan Stanley, EY, Daiwa Capital Markets, CareEdge, ET

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s). These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.