18 Sep 2025

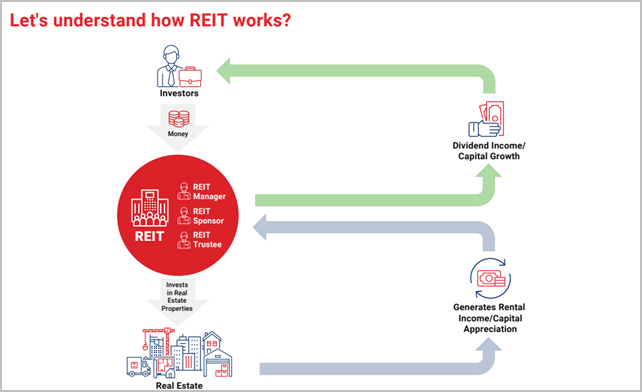

Real Estate Investment Trusts (REITs) are companies or trusts that own, operate, or finance income-producing real estate. Think of a REIT as a portfolio of properties – like office buildings, shopping malls, apartments, warehouses, or hotels – that you can invest in by purchasing units.Much like a mutual fund pools money to buy stocks or bonds, a REIT pools investors’ capital to buy and manage real estate assets. In return, investors receive a portion of the income those properties generate (primarily rents), typically through regular distributions.

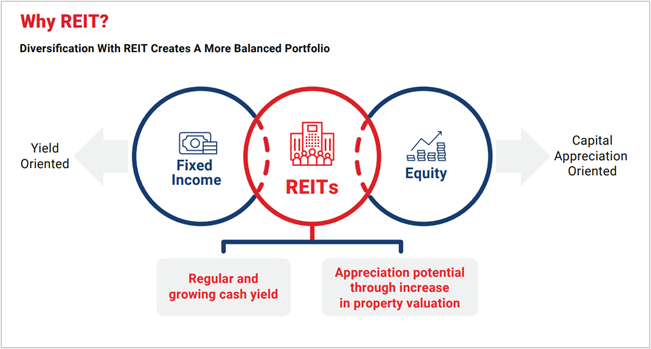

REIT offers a dual advantage: they provide regular income like fixed-income instruments through distributions, while also offering the potential for capital appreciation as their market prices rise due to price appreciation of assets—offering capital gain like equities.

Beyond this dual advantage, REITs stand out across several dimensions. they can be traded on stock exchanges just like stocks. They also enhance portfolio diversification, thanks to their low correlation with traditional asset classes such as equities and bonds. Investors benefit from a high degree of transparency, as REITs are regulated, audited, and required to publicly disclose their financials. Perhaps most importantly, REITs make real estate investments highly accessible, allowing individuals to invest in real estate with relatively modest capital—often just a few hundred rupees.

REITS can be of multiple types:-

1. Office REITs

Invest in commercial office buildings; generate income from long-term leases with corporate tenants.

2. Retail REITs

Own shopping malls, high-street retail, and large-format stores; income depends on consumer footfall and retail health.

3. Industrial REITs

Focus on warehouses, logistics parks, and distribution centres, benefit from e-commerce and supply chain growth.

4. Residential REITs

Invest in apartment complexes and rental housing, common in markets with strong urban rental demand.

5. Hospitality REITs

Own hotels and resorts; income is variable and linked to tourism and business travel.

6. Healthcare REITs

Invest in hospitals, senior living facilities, and medical offices; often have long leases and stable tenants.

7. Data Centre & Infrastructure REITs

Own digital infrastructure like data centres, cell towers, and fibre networks; benefit from tech and cloud growth.

Having understood the appeal of REITs as an investment offering both income and growth—it’s worth exploring how this asset class is evolving, especially in India.

India’s REIT journey began in 2019 with the listing of Embassy Office Parks REIT. Currently, India has five listed REITs: Embassy Office Parks REIT, Mindspace Business Parks REIT, Brookfield India REIT, Nexus Select Trust (India’s 1st Retail Focused REIT) and Knowledge Realty Trust.

The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s).

Majority of the REITs are focussed on Grade A office spaces, especially in IT and BFSI hubs. In fact, India is one of the leading Office Market in the world. Grade A office spaces are premium commercial properties located in prime areas, built to high specifications, and managed professionally, typically leased by top-tier corporate tenants.

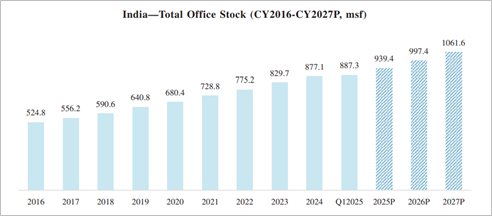

Since the early 2000s, office stock has grown by more than 35 times from approximately 25 msf in CY2000 to approximately 887 msf as of March 31, 2025, and is concentrated in the Top 7 cities. Indian real estate has emerged as a preferred investment asset class due to various factors such as the healthy growth of the economy, favourable demand-supply fundamentals, investor-friendly policies, rental growth opportunities, strong demographic profile and increased transparency.

Source: Knowledge Realty Trust DRHP, Msf – Million square feet

Source: CBRE; as of March 31, 2025; Area mentioned is Gross Floor Area; Includes Top 7 Cities (Bengaluru, MMR (Mumbai), Delhi- NCR, Hyderabad, Chennai, Pune and Kolkata) + GIFT City, Ahmedabad; Refer to disclaimers on forecasts and assumptions on page 88 of this “Industry Overview” section. | P refers to projected

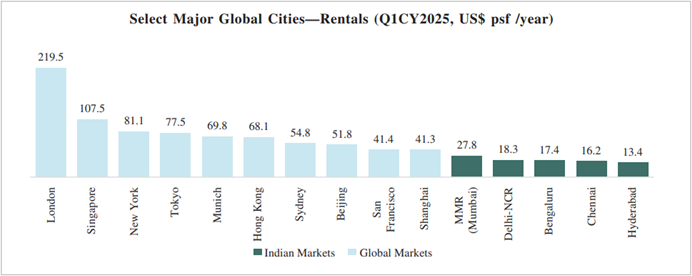

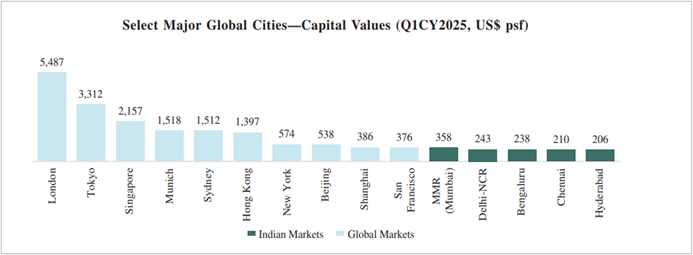

India’s key office markets continue to offer significantly lower rentals and capital values compared to assets of similar scale and quality in global commercial hubs. This pricing advantage makes Indian commercial real estate highly attractive for investors, especially when combined with strong demand fundamentals and institutional-grade asset quality.

Source: CBRE, As of 31 March 2025, As per latest data available; Note: Class A rentals used for US; APAC markets include Effective Grade A rental values while prime rentals have been used for European markets

Source: CBRE, As of 31 March 2025, As per latest data available; Capital values of European markets include prime values; US markets include all grades, while APAC markets include Grade A values

India’s REIT market, while still young and relatively small, is on a strong growth trajectory. Sustained corporate expansion across diverse sectors such technology, BFSI, life sciences, semiconductors, etc is poised to stimulate multi- sectoral office space leasing activity further nationwide. With only a handful of listed trusts—primarily focused on office assets—there is significant room for expansion into new property types such as warehouses, hospitals, and data centres, etc.

Logistics REITs: Riding the Manufacturing Wave

India’s manufacturing sector is evolving from low-value to high-value goods, driving demand for advanced storage and distribution infrastructure. Warehouses are no longer just storage hubs—they’re becoming tech-enabled logistics centres, integrated with automation, cold chain systems, and last-mile connectivity. This transformation makes logistics assets ripe for REIT inclusion.

Retail REITs: Reinventing the Store

The role of physical retail is changing. Stores are no longer just transactional spaces—they’re becoming experience centres, blending offline and online channels. With rising consumption and organized retail expansion, retail REITs can offer exposure to high-footfall malls and lifestyle destinations, backed by long-term leases and stable tenants.

Data Centre REITs: Powering the Digital Backbone

As India accelerates its transition into a digital-first economy, driven by the growth of IT, telecom, and cloud infrastructure, demand for data centres is expected to surge. These assets offer long-term contracts, high operating margins, and strong tenant stickiness—making them a promising frontier for future REIT expansion in India.

Source: Reit.com, expresscomputer.in , CBRE, KMAMC Internal

India’s REIT market, while still in its early stages, is expanding rapidly driven by sustained corporate growth, urbanization, and sectoral diversification. But this story doesn’t exist in isolation. It’s unfolding against the backdrop of a global REIT landscape that’s entering a favourable cycle, especially as central banks begin to ease interest rates.

Globally, REITs are a major force in real estate investing. They own over USD 4.5 trillion worth of properties - more than 535,000 buildings across offices, malls, warehouses and more. First introduced in the U.S. in 1960, REITs have grown into a mainstream asset class, now active in over 40 countries with a combined market value of USD 2 trillion+.

Source: www.reit.com

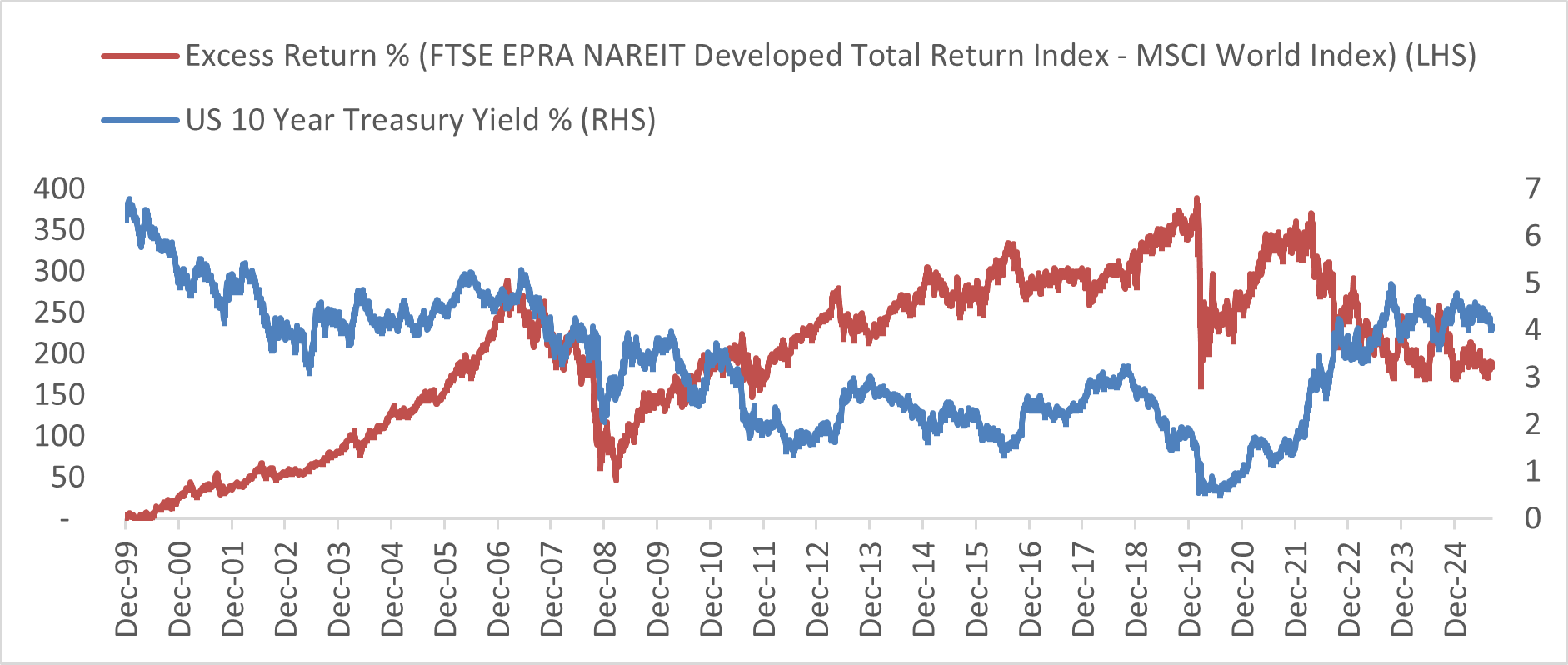

Historically, REIT returns move in the opposite direction of long-term rates, as lower rates reduce borrowing costs and make REIT distribution more attractive compared to bonds.

Global REITS Relative to Global Equities against the 10-Year Treasury Yield

Source: Bloomberg, As per latest data available. Past performance may or may not be sustained in future.

What makes global REITs particularly interesting now is the macro backdrop. As major central banks pivot toward rate cuts after an aggressive tightening cycle. For example: In September 2025, the U.S. Federal Reserve cut rates for the first time this year, Real estate, an interest rate sensitive sector is entering a potentially favourable phase. Lower borrowing costs can boost property valuations and improve REIT earnings, while steady distribution payouts continue to attract income-seeking investors.

Global REITs offer far broader exposure than India’s current REIT landscape. While India focuses mainly on office and retail assets, global REITs span diverse sectors:

- Data Centres & Digital Infra – Fuelled by AI, cloud, and 5G.

- Healthcare & Life Sciences – Backed by aging populations and biotech.

- Industrial & Logistics – Driven by e-commerce and supply chain shifts.

- Residential & Student Housing – Linked to urban growth and demographics.

- Hospitality & Leisure – Riding the wave of global travel recovery.

The U.S. leads the global REIT market, followed by Japan, Australia, Singapore and Europe. Asia-Pacific REITs are gaining ground, offering access to fast-growing economies and niche property themes.

REITs are no longer niche. They’re mainstream, resilient and income-generating. Whether you're a millennial investor or a retiree seeking passive income, REITs offer a smart way to tap into real estate without the hassle. REITs bring real estate investing to everyone - making it as easy as buying a stock, but as rewarding as owning a property.

The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s).

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.