22 Jan 2026

For a long time, silver quietly lived in the shadow of gold. It was the familiar metal found in jewelry, coins, old photographs and traditional crafts. People admired it, people traded it, and people stored it. Yet silver rarely received the spotlight or the respect gold enjoyed. It was always seen as its cheaper, humbler cousin. But the world has changed, and silver’s place in the global economy has changed with it. The story of silver today is completely different from the one told even a decade ago.

Silver’s journey from a traditional metal to a modern necessity has been shaped by new technologies, new tensions between countries, and new pressures on global supply chains. If someone thinks silver is still a simple commodity, they are missing the biggest story unfolding in the metal world today.

From Precious Metal to Strategic Asset

Silver has quietly stepped into a new role as one of the most critical materials of the modern era. Its extraordinary electrical and thermal properties make it a silent force behind renewable energy, digital communication and intelligent machines. When a solar panel converts sunlight into usable power or when a high‑performance chip processes millions of calculations, silver is doing heavy lifting.

This dependence is reshaping how the world views silver. It is no longer just a precious metal measured by shine or purity. It is now a strategic asset that influences national energy goals, industrial growth and technological leadership. Countries with strong access to silver gain an edge in building cleaner, smarter and more resilient systems.

The world is shifting toward electrification and automation, and silver has become the metal that makes this shift possible. As supply struggles to keep up with growing demand, its importance rises even further. Silver has moved from display cabinets to the front lines of modern progress, earning a place among the most strategic materials of the future.

Why Silver Matters More Than Ever?

Industrial use now dominates silver demand, accounting for nearly two-thirds of total consumption.

- Solar Energy has been the biggest incremental driver over the past decade. Global installations reached around 655 GW in 2025, growing about 10% year-on-year. While manufacturers are reducing silver content per panel through efficiency gains, the sheer scale of solar deployment keeps baseline demand structurally high.

- Electronics and Electrical Applications form the backbone of silver consumption. Silver is central to semiconductors, power electronics, smart grids, EV components, AI hardware, and data centers—providing a strong medium-term demand tailwind.

- EVs, Aerospace, and Brazing Alloys add steady long-term demand, though these segments remain sensitive to price spikes.

- Jewellery Demand softened globally in 2025 due to high prices, but India remained resilient as consumers increasingly substituted silver for expensive gold.

Silver today sits at the intersection of energy transition, digital infrastructure, and industrial growth—a position few metals occupy.

Source: HSBC – 2026 Silver Outlook

The Silver Supply Squeeze

Silver demand is exploding, but the world cannot produce enough to match it. This has created a supply squeeze that many experts believe will last for years. The problem starts with how silver is mined. Most of it does not come from silver‑only mines. It comes as a bonus metal while mining copper, zinc or gold. So even if silver prices rise, mining companies cannot increase output easily unless those other metals are also mined more.

Ore quality is dropping as well. Older mines now produce less silver from the same amount of rock. New mines take more than a decade to build because of approvals, costs and environmental checks. Recycling offers some relief, but much of the silver used in solar panels, electronics and batteries is too hard to recover quickly.

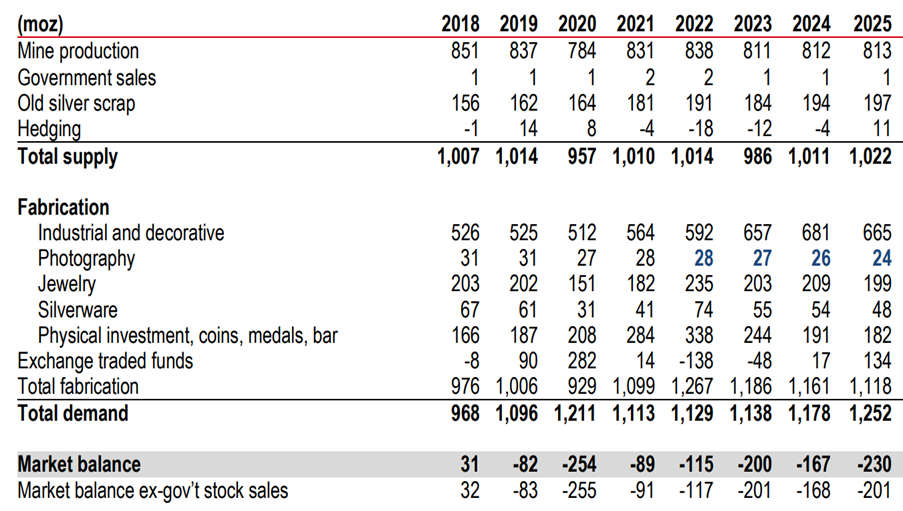

This slow and limited supply growth is happening at the same time silver demand is hitting record highs. Solar energy, electric cars and AI infrastructure consume huge amounts of silver every year. The gap between what the world needs and what the world can produce keeps widening. silver markets have been running persistent deficits. In 2025 alone, the global shortfall was estimated at around 230 million ounces This is why the silver supply squeeze is not a short‑term issue and it’s a structural problem.

Source: HSBC – 2026 Silver Outlook

Silver Supply & Demand

Source: Silver Institute, Gold Fields Mineral Services, London Stock Exchange Group, HSBC forecasts.

Silver Is Everywhere, Yet Hard to Get

Silver seems to be everywhere around you, yet the world is facing one of the tightest supply periods in years.

- Mining can’t keep pace: Despite being widely distributed in the earth, production can’t respond quickly. Analysts projected a 2025 deficit of ~230 million oz, driven by soaring industrial needs.

- Trapped in major vaults: Large stockpiles sit in London and New York, but they aren’t easily movable. COMEX reported 526 million oz in storage, while London saw inventories fall so sharply that spot prices traded far above futures and lease rates spiked toward 39%, reflecting extreme scarcity.

- Competing industries consume more each year: Green energy, electronics, and AI hardware have intensified the squeeze, with strong ETF investor inflows lifting global silver holdings close to record levels.

Source: Morgan Stanley, HSBC – 2026 Silver Outlook, Comex - Commodity Exchange, Inc.

Top Silver Producing Countries in 2025

| Country | Estimated Silver Production (tonnes) | Global Share (%) |

|---|---|---|

| Mexico | 6,000 | 22% |

| Peru | 4,200 | 15% |

| China | 3,500 | 12% |

| Russia | 2,000 | 7% |

| Poland | 1,200 | 4% |

| Other Countries | 10,100 | 40% |

Source: farmonaut.com

China’s Big Move - What China’s export controls really change

China’s decision to tighten silver export controls from January 1, 2026 marks a significant shift in global commodity strategy. By placing silver under an approval-based export licensing regime, like rare earths, Beijing has effectively elevated it from a widely traded industrial metal to a strategic resource.

Under the new framework, all silver exports require government approval. Only 44 companies have been authorized to export silver during 2026–27, concentrating exports among large, well-capitalized players. Exporters must meet strict criteria, including minimum annual production of ~80 tonnes and strong financial capacity, sidelining smaller refiners.

Silver’s strategic importance lies in its central role across modern industries. Although China accounts for only ~13% of global mined silver, it dominates 60–70% of global refining, giving it outsized influence over downstream supply chains.

China is also a major net exporter. During January–November 2025, it exported around 4,600 tonnes of silver, compared with imports of just ~220 tonnes, reinforcing its importance to global supply.

For governments and industries reliant on imported critical minerals, the message is clear: diversifying supply, investing in recycling, and developing alternative sources are no longer optional—they are economic and security imperatives.

Source: moneycontrol.com

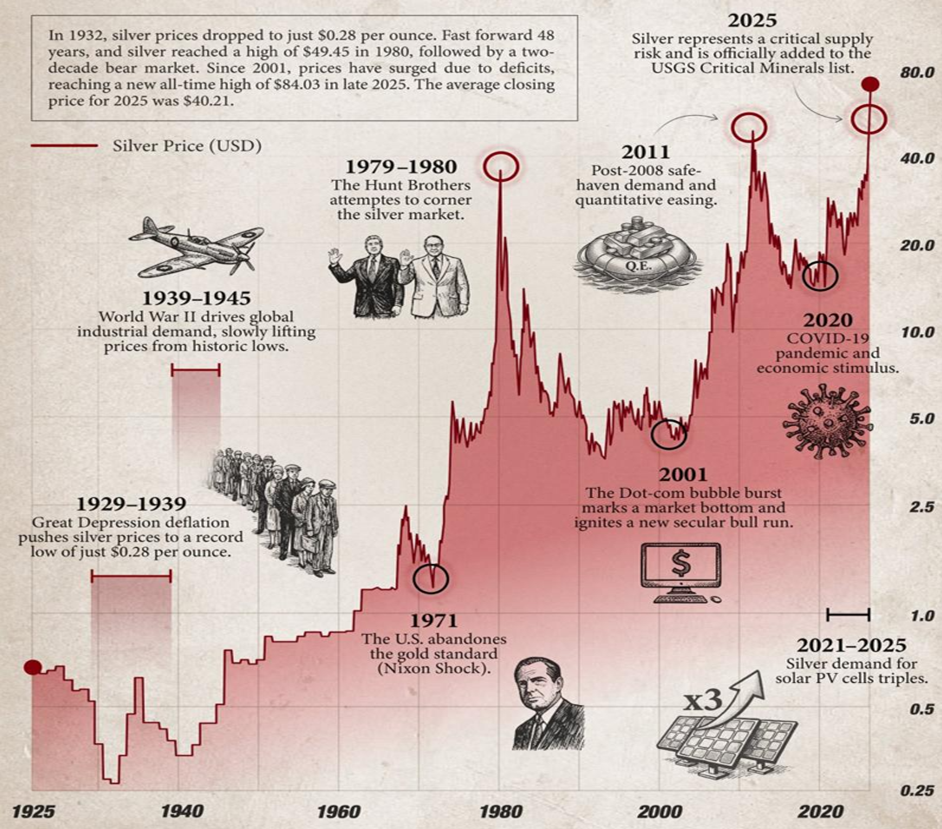

Why Silver Prices Suddenly Exploded in 2025

Silver’s price action in 2025 was historic. The metal surged 138%, its strongest annual gain since the 1979 Hunt Brothers squeeze, with prices peaking at USD 83.60/oz in December before retracing. Volatility was extreme as markets swung between physical shortages and sharp liquidations, driven by rapidly depleting London inventories.

This was not a speculative rally. Silver faced a rare combination of a structural supply squeeze and a geopolitical shock. According to Goldman Sachs, the turning point came from a liquidity crunch in London, the global benchmark for physical silver. Large volumes, tens of millions of ounces were shifted from London to COMEX vaults in New York in early 2025 amid tariff fears, leaving London stocks critically thin.

The squeeze was amplified by investment flows. Physically backed silver ETFs absorbed 134 million ounces in 2025, further draining available supply.

Source: Goldman Sachs, Comex - Commodity Exchange, Inc.

Significant events that shaped silver prices / 100 years

Source: silver price data from macrotrends.in, ELORO resources Ltd. as of Jan 2026

India’s Silver demand Surge Amid Global Tightness

India’s silver market witnessed a dramatic surge in 2025 amid a tightening global supply and rising industrial demand. According to reports, India became the world’s largest importer of refined silver, with imports estimated at about USD 9.2 billion for the year, marking roughly a 44% increase over 2024 despite sharply higher prices. Silver prices in India nearly tripled in rupee terms, climbing from around ₹80,000-85,000 per kg early in 2025 to above ₹2.43 lakh per kg by January 2026. Silver demand rose due to high gold prices, Diwali‑driven buying, expanding solar and electronics manufacturing, and jewellery switching from gold to silver.

Source: Macquarie

Conclusion: A Metal at the Heart of the Future

Silver has moved far beyond its traditional role and is now a strategic metal shaping the global energy transition, AI infrastructure, and digital industries. Demand is rising everywhere, but supply remains structurally constrained mines cannot ramp up fast enough, ore grades are falling, and China’s export controls are tightening global flows. London vaults saw severe depletion through 2025, lease rates spiked, and ETF inflows drained available metal even further.

Amid this global squeeze, India emerged as the world’s largest and most influential physical silver market in 2025, reshaping international demand dynamics. India imported USD 9.2 billion worth of silver in 2025, a 44% jump over 2024, despite prices nearly tripling domestically—from ₹80,000–85,000/kg in early 2025 to above ₹2.43 lakh/kg by January 2026.

This surge was driven by a combination of powerful trends: substitution away from expensive gold, booming festive and jewellery demand, fast‑growing solar and electronics manufacturing, and a deep cultural preference for physical metals. Even with high premiums, India’s appetite remained resilient.

The world is entering a new era, one where silver is not just valuable, but indispensable. Nations and industries that secure long‑term access to this metal will be better positioned to lead in clean energy, advanced computing, and next‑generation manufacturing. In this evolving landscape, silver’s importance will only continue to grow.

Source: HSBC, Goldman Sachs, Citi

Mr. Jeetu Valecha, Fund Manager & Associate Vice President, Kotak Mahindra AMC adds, Silver is the new rare earth, no longer confined to the vaults of tradition or the sparkle of jewellery, but elevated to the status of a strategic resource. It is the critical conductor at the heart of clean energy, the silent force behind solar panels, electric vehicles, and next‑generation electronics. As rare earths fuelled the digital revolution, silver now powers the green transformation, becoming the indispensable metal of progress, sustainability, and technological destiny. Yet this ascent comes with urgency: global demand is surging into a supply deficit, while China’s growing control over mining and refining raises geopolitical stakes. Silver is not just a commodity; it is the contested lifeblood of the green future.

Mr. Siddharth Kothari Economist at Sunidhi Securities & Finance Ltd adds: Silver is increasingly being used as a proxy hedge for gold, despite lacking gold’s structural safe-haven characteristics. Its price action is currently being driven more by macro positioning than by underlying demand–supply fundamentals, making it a relatively inefficient hedge against geopolitical risk. As risk premia fade, silver historically exhibits a faster and sharper mean reversion than gold, with prices quickly gravitating back towards fundamental anchors.

Disclaimers

KMAMC is not guaranteeing/offering/communicating any indicative yield/returns on investments. The stocks/sectors mentioned in this slide do not constitute any recommendation and Kotak Mahindra Mutual Fund may or may not have any future position in these sectors/stocks. These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.