14 Jan 2026

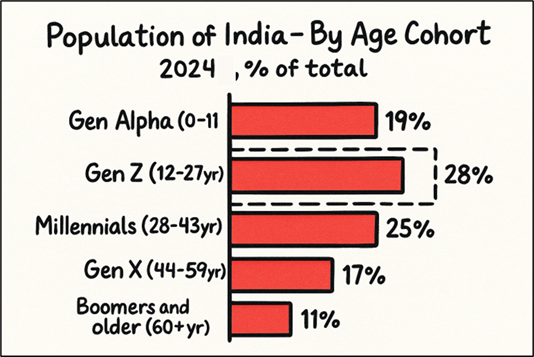

The global consumption landscape is transforming, led by Generation Z, a cohort born between the late 1990s and early 2010s and now one of the world’s largest consumer group. With 2.5 billion individuals worldwide and nearly 28% of India’s population, Gen Z blends digital nativity, value-driven choices and a demand for authenticity and innovation.

| Metric | Global Gen Z | India Gen Z (Est.) |

|---|---|---|

| Population | 2.5 billion | ~400 million |

| Share of Population | ~32% | 28% |

| Smartphone Ownership | 95%+ | 93% |

| Urbanization | — | 40% by 2030 |

Source: UN, McKinsey, BCG, Bloomberg, 2025

Source: United Nations World Population Prospectus 2024, Expert Interviews, Redseer Research And Analysis | Note: Gen Z is considered to be those born between 1997 and 2012

Globally, Gen Z is the first generation to grow up entirely online. Their relationship with technology is not just functional but foundational with over 95% own smartphones and social media is their primary source of influence and information. Yet, contrary to the stereotype of the “digital-only” consumer, Gen Z values physical retail experiences. In the US, nearly 80% of Gen Z prefers in-store shopping for apparel, with tactile experience and instant gratification cited as key reasons. This trend is mirrored in India, where the physical store remains a vital touchpoint, even as digital channels proliferate.

(Source: Bloomberg)

In India, the Gen Z effect is amplified by the country’s unique demographic and economic context. By 2029, over 50% of Indians will be Gen Alpha and Gen Z and more than 40% of households will be upper middle class or above (annual income over $9,600/household). This demographic dividend is reshaping Indian consumption, driving a shift from mass-market products to premium, personalized and experience-driven offerings.

(Source: United Nations World Population Prospectus 2024, Redseer Research)

Gen Z is reshaping consumption through convenience and aspiration. Seamless experiences powered by online discovery, quick commerce, AR (Augmented Reality) try-ons and phygital pop-ups, are now the norm. At the same time, brand storytelling and influencer culture are driving demand for mid-premium products that blend functionality with social currency. For Gen Z, the journey matters as much as the purchase.

The influence of Gen Z on consumption is perhaps most visible in the way they have upended traditional marketing and brand loyalty. Unlike previous generations, Gen Z is quick to abandon legacy brands in favour of startups that offer personalization, authenticity and social value. They seek brands with personality, rough edges and values that align with their own. Brand loyalty, once driven by inertia, is now replaced by a search for meaning and trust. Peer recommendations, micro-influencers and creator-led content have overtaken celebrity endorsements and traditional advertising. The creator economy, now valued at $250 billion globally, is a primary channel for product discovery and brand engagement.

| Brand Loyalty Metric | Millennials | Gen Z |

|---|---|---|

| Willing to switch brands | 56% | 72% |

| Influenced by social media | 48% | 67% |

Source: BCG, McKinsey, 2025

Even legacy brands are evolving. They’re moving away from traditional, top-down messaging and embracing ingredient-forward Gen Z-centric narratives. In beauty, the ritual has become a badge of identity, with Gen Z favouring brands that offer quick, trendy launches, quirky packaging and ingredient-forward messaging. Peer recommendations trump celebrity endorsements and inclusivity is a baseline expectation.

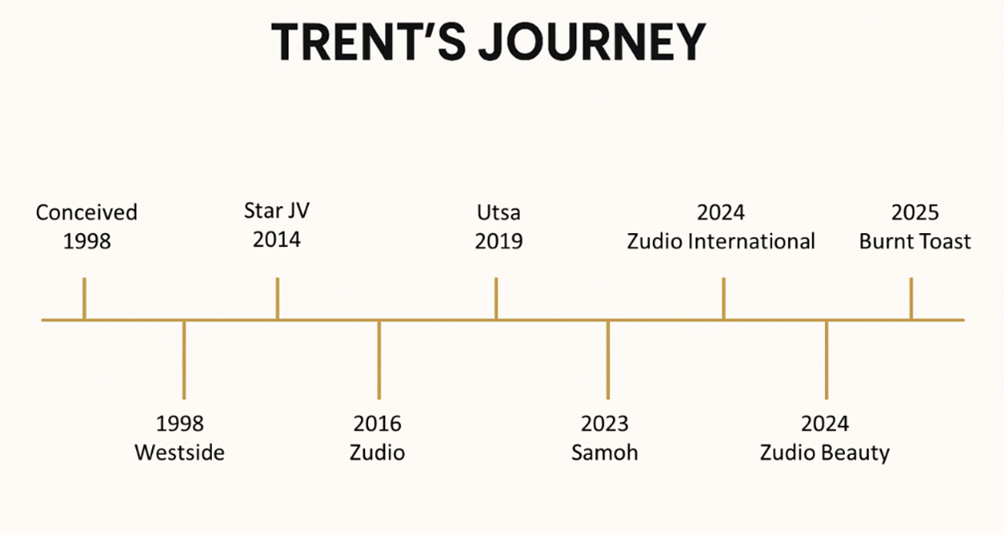

Category disruption is evident across fashion and beyond. In fashion, Gen Z is abandoning mass-market brands like Zara and H&M (Hennes & Mauritz) for youth-focused Indian brands such as Zudio, Burnt Toast, Ownd, Intune, Yousta, etc. They seek uniqueness, community and self-expression over price alone.

| Brand | Store Count (2025) | Revenue CAGR | Key Gen Z Strategy |

|---|---|---|---|

| Zudio | 824 | 20%+ | Fast expansion, affordable pricing, trend-led collections |

| OWND! (ABFRL) | 59 | 43% YoY | Gen Z-focused positioning, 30+ new stores per year |

| Burnt Toast | — | — | Community building, self-expression, indie brand appeal |

Source: Aditya Birla Fashion Retail Ltd (ABFRL), Trent Ltd

Source: Trent Ltd

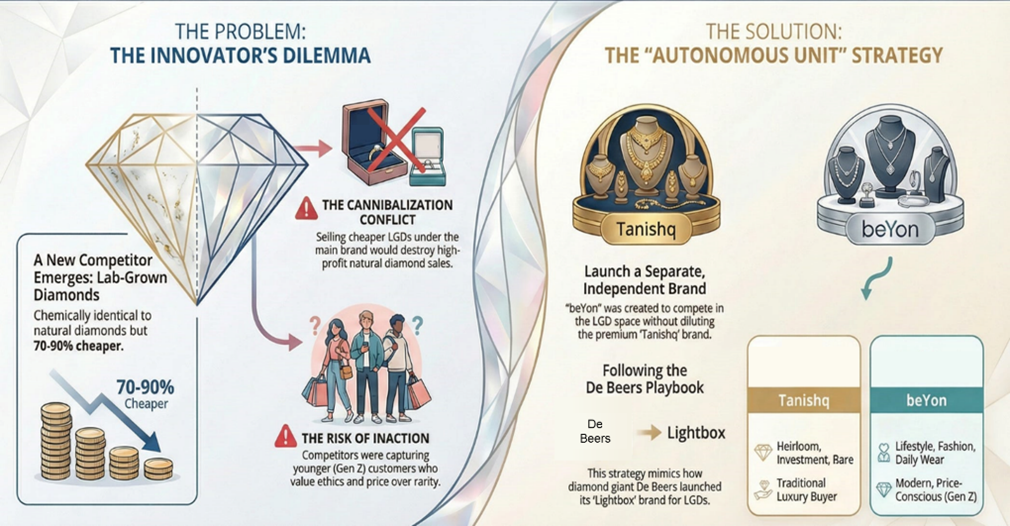

The jewellery sector offers another lens into Gen Z’s impact. Bluestone, the second largest player in lifestyle retail jewellery in India, has grown its revenue market share from 17.7% in FY19 to 24.6% in FY25, driven by an accelerated pace of store addition and a focus on design-led, daily-wear categories. The lifestyle jewellery market, which caters to daily wear and occasion-led segments, is expected to grow at a 16–18% CAGR over 2024–2029, outpacing the wedding jewellery segment. Gen Z’s preference for affordable, better-designed, lightweight studded jewellery and rising working women participation are key drivers of this growth. Brands like Titan’s beYon are targeting Gen Z with lab-grown diamonds, transparent pricing and daily-wear designs, moving away from traditional wedding jewellery to everyday adornment.

| Brand | Stores (2025) | Market Share* | Key Gen Z Trends |

|---|---|---|---|

| Bluestone | 321 | 24.6% | Design-led collections, daily-wear focus, strong omnichannel presence |

| CaratLane | 323 | 58.3% | Digital-first strategy, light jewellery, tech-enabled buying journey |

| Titan beYon | — | — | Lab-grown diamonds, transparent pricing, sustainability-led appeal |

Source: Bloomberg, Titan Industries, Bluestone Jewellery | *Market share in new jewellery

Titan’s Diamond Dilemma: A Textbook Strategy

Source: https://betatoalpha.substack.com/p/how-titan-is-solving-the-innovators; LGD stands for Lab Grown Diamonds

There is a shift from ownership to experience, with spending moving from material goods to travel, gaming, immersive entertainment and pop-up events.

Customization and collectibles are on the rise, with brands like Lenskart turning eyewear into customizable, collectible experiences that blend utility with fandom and social signalling.

Community and co-creation are now at the heart of Gen Z’s expectations, with brands increasingly called upon to foster genuine connections, enable collaborative creation and support causes that matter to this generation. Consumption patterns are fast-paced and trend-driven, where virality and novelty often dictate what’s in demand. Limited-edition drops, pop-up shops and “Instagrammable” campaigns have become essential strategies for capturing Gen Z’s attention.

Social media virality is a powerful force shaping what Gen Z buys and talks about. Products like Labubu collectibles, matcha tea, Stanley cups and even GLP-1 (Glucagon-like peptide-1) drugs (such as Ozempic) have surged in popularity, propelled by trends on TikTok and Instagram.

The success of the Quencher has helped Stanley grow its annual revenue from $70 million to more than $750 million in four years. The Instagram-friendly pastels helped the Quencher be seen as less of a utilitarian product and more as a fashion accessory.

Source: CNBC

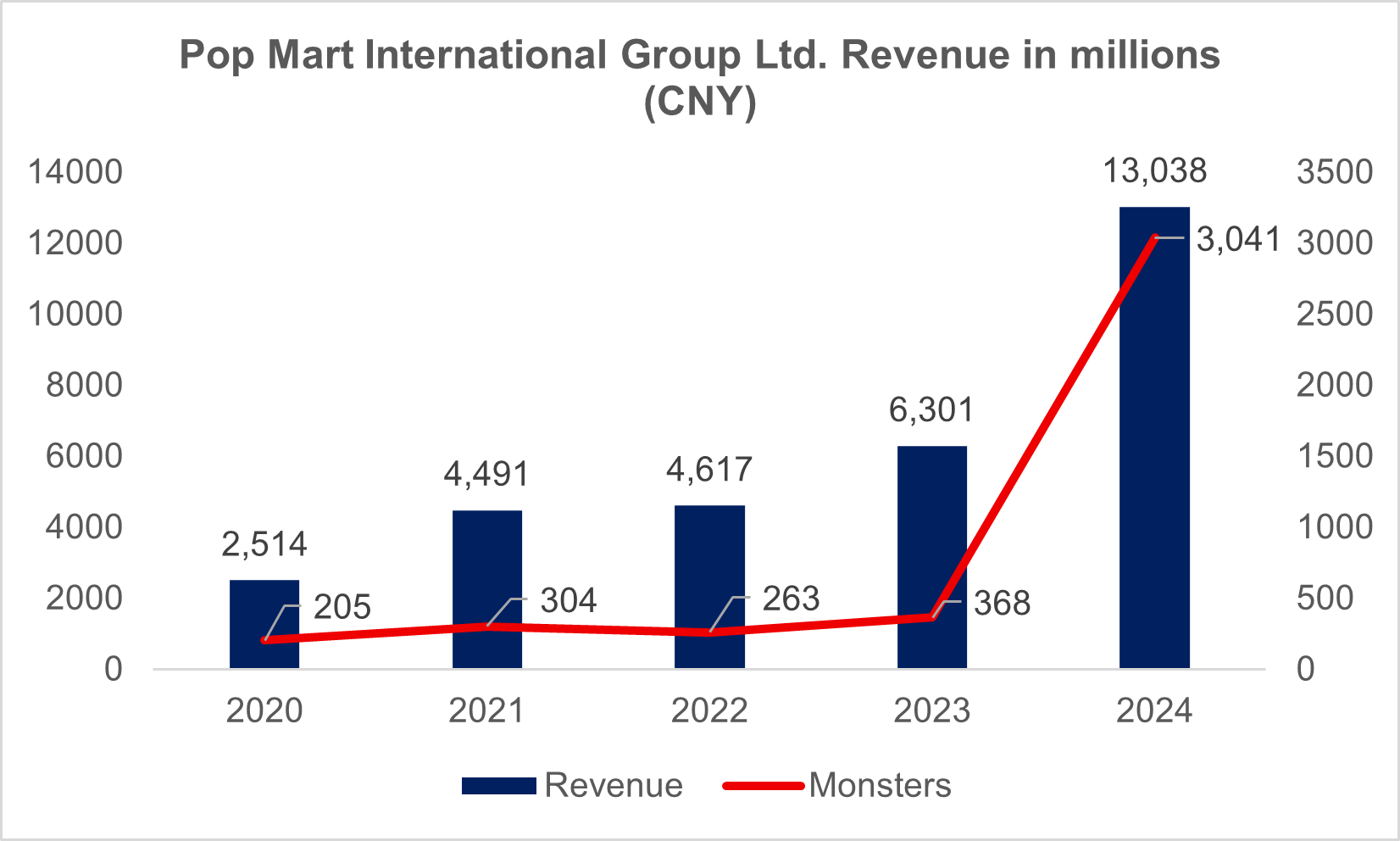

In 2019, Chinese toy retailer Pop Mart acquired rights and relaunched Labubu (Monsters) in their signature "blind box" format (sealed packaging where buyers don't know which variant they get, encouraging multiple purchases for rares/hidden editions). TikTok unboxing videos, collector hauls and styling posts exploded the demand. Blind-box scarcity led to long lines, store rushes and even fights. Pop Mart capitalized this with limited drops, plush versions and themed series (e.g., "Big Into Energy" in 2025), creating FOMO (fear of missing out). By 2025, Labubu became Pop Mart's flagship IP, driving global expansion with flagship stores in Bangkok, London, Los Angeles and more. In 2024, the monsters (LABUBU series) gained immense global popularity with revenue touching RMB 3.04 bn with a YOY growth of 726.6%.

Source: Pop Mart Annual Reports, Bloomberg, As per latest data available, CNY – Chinese Yuan

These items transformed into cultural phenomena not through traditional advertising, but through creator content, viral challenges and peer recommendations. For Gen Z, discovery happens in the feed, what’s trending online quickly becomes what’s trending offline.

The payment and shopping behaviour of Gen Z further underscores their distinctiveness. While the Reserve Bank of India (RBI) does not segment card usage data by age, industry studies show that Gen Z prefers UPI and debit cards for everyday transactions, with cautious adoption of credit cards for rewards. They value instant, mobile-first payments and are early adopters of Buy Now, Pay Later (BNPL) solutions. Despite being digital natives, 80% of Indian Gen Z still prefer in-store shopping for apparel, expecting seamless integration between online and offline touchpoints.

Overall, most consumption categories have seen a shift due to Gen Z:-

| Category | Growth Driver | Gen Z Impact |

|---|---|---|

| Fashion | Uniqueness, community-led consumption | Zudio, Burnt Toast, Pop Mart, Lenskart collaborations |

| Beauty | Ingredient-forward products, ritual-based usage | Clean beauty, gender-neutral products, peer-led reviews |

| Jewellery | Daily-wear adoption, transparency in pricing | Lab-grown diamonds, Bluestone, Titan beYon |

| Food & Q-commerce | Health consciousness, convenience | Plant-based food, quick commerce, on-demand delivery |

| Tech & Experiences | AR/VR, gaming, experiential spending | Shift from goods ownership to immersive experiences |

Source: Bloomberg, Titan Industries, Bluestone Jewellery, Aditya Birla Fashion Retail

Looking ahead, the Gen Z effect on consumption will only intensify. As this cohort enters its peak earning and spending years, their influence will reshape industries, redefine brand strategies and set new standards for innovation, sustainability and social impact. For businesses, adapting to this paradigm is not optional, it is existential. The future of consumption, in India and globally, will be shaped by Gen Z’s relentless quest for meaning, authenticity and innovation.

Devender Singhal, Executive Vice President, Fund Manager, states that, “Gen Z—2.5 billion globally and 400 million in India—is redefining consumption with digital‑first habits and a demand for authenticity. Despite 95%+ smartphone penetration, majority still prefer in-store apparel, blending online discovery with offline experiences. By 2029, over half of India will be Gen Alpha + Gen Z, driving a shift from mass to premium and from ownership to experiences. Brand loyalty is getting fluid powered by a $250B creator economy and social-first influence. The winners will deliver seamless phygital journeys quick commerce, AR try‑ons, pop‑ups and design‑led innovation.”

Companies and brands mentioned don’t constitute any recommendation/affiliation. The names are used for understanding and conceptual purposes and shall not be treated otherwise. The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s). These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.