4 Dec 2025

On November 21, 2025, the Indian economy underwent a quiet but transformative shift. The government operationalized four new Labour Codes, consolidating 29 fragmented central labour laws into four unified statutes. For decades, India’s labour market operated on a "patchwork" system, a maze of laws dating back to the 1920s and 1940s, filled with complexity and exclusion. Now, that maze has been bulldozed and replaced with a new blueprint impacting an estimated ~643 million workers. This isn't just legal jargon. It fundamentally restructures your salary slip, your job security, and the very definition of who counts as a "worker." Whether you are a CEO, a factory manager, a software engineer, or a delivery partner, the rules of engagement have just changed.

Source: Ministry of Labour & Employment, PIB, RBI

Result Of Rationalizing Labour Laws That Made It Broader and Simplified

| Particular | Before Rationalization | After Rationalization |

|---|---|---|

| Number of Laws | 29 separate labour laws | 4 comprehensive Labour Codes |

| Rules | 1436 | 351 |

| Compliance Framework | Multiple registrations, licenses, and returns | Single registration, single license, single return |

| Returns | 31 | Single (electronic) |

| Forms | 181 | 73 |

| Registers | 84 | 8 |

| Coverage | Limited to specific sectors/scheduled employments | Universal coverage for all workers |

| Organized Sector Workers | Covered under multiple laws | Unified coverage under 4 codes |

| Unorganized Workers | Limited coverage | Comprehensive social security |

| Gig/Platform Workers | No specific provisions | Dedicated definitions and coverage |

| Women Workers | Restricted night work and occupations | Equal opportunities with safety measures |

| Migrant Workers | Limited interstate protections | Comprehensive coverage and portability |

Let’s Dive into New Machinery Powering Indian Workforce and Discover What has Changed:

The Salary Structure Shake-Up (The 50% Rule)

The most immediate impact for the salaried class lies in the Code on Wages, 2019. To understand this, we need to look at how Indian salaries were traditionally designed. Think of your salary (CTC) as a pizza. Previously, employers could slice this pizza however they wanted. Often, the "Basic Pay" slice was kept small (30-40%), while "Allowances" (HRA, conveyance, special allowances) made up the bulk. Why? To keep the "social security liability" (PF and Gratuity) low, as these are calculated on Basic Pay. The New Rule: The Code mandates that Basic Pay must be at least 50% of the total remuneration. If allowances exceed 50%, the excess is automatically reclassified as "wages" for statutory calculations.

Source: Code on Wages, 2019

The Result:

| Particular | CTC ₹10,00,000 | CTC ₹20,00,000 | CTC ₹30,00,000 |

|---|---|---|---|

| Before Nov 21, 2025 | |||

| Basic Salary (40% of CTC) | 4,00,000 | 8,00,000 | 12,00,000 |

| PF (24%) | 96,000 | 1,92,000 | 2,88,000 |

| Gratuity (4.81%) | 19,240 | 38,480 | 57,720 |

| NPS (14%) | 56,000 | 1,12,000 | 1,68,000 |

| In Hand | 8,28,760 | 16,57,520 | 24,86,280 |

| After Nov 21, 2025 | |||

| Basic Salary (50% of CTC) | 5,00,000 | 10,00,000 | 15,00,000 |

| PF (24%) | 1,20,000 | 2,40,000 | 3,60,000 |

| Gratuity (4.81%) | 24,050 | 48,100 | 72,150 |

| NPS (14%) | 70,000 | 1,40,000 | 2,10,000 |

| In Hand | 7,85,950 | 15,71,900 | 23,57,850 |

| Difference | |||

| Difference Yearly | 42,810 | 85,620 | 1,28,430 |

| Difference Per Month | 3,568 | 7,135 | 10,703 |

Did You Know?

The "Gratuity Bump"

While your monthly cash-in-hand might dip, you are leaving with a significantly larger golden handshake.

- Context: Gratuity is calculated on Basic Pay. Since the new codes force Basic Pay up to 50% of CTC, the gratuity liability for companies is estimated to rise by approximately 25%.

- Verification: This structural shift effectively transfers money from your "current consumption" pocket to your "future retirement" pocket, aligning India's savings rate with higher global standards for social security.

Making the Invisible Visible (The Gig Economy)

For the first time in independent India's history, the law "sees" the gig worker. (A gig worker is someone who earns by doing short-term or freelance jobs, often via digital platforms.)

Think of the gig economy (Cab drivers, Food delivery Partners, etc) as a ghost city—millions of people working, but legally invisible to the social security net. The new code now allows for the creation of a universal database for unorganised workers; wherein central and state governments both would frame welfare schemes funded via contributions.

The Code on Social Security, 2020 changes this. It introduces a legal definition for "gig worker" and "platform worker". But it goes beyond definitions; it creates a funding mechanism.

- The Aggregator Levy: "Aggregators" (digital platforms like ridesharing and food delivery apps) must now contribute 1-2% of their annual turnover to a new Social Security Fund.

- The Cap: This contribution is capped at 5% of the amount paid to workers.

- The Benefit: This fund will finance life and disability cover, health benefits, and accident insurance for an estimated 23.5 million gig workers (projected by 2029-30).

Source: Code on Social Security, 2020; NITI Aayog Gig Economy Report

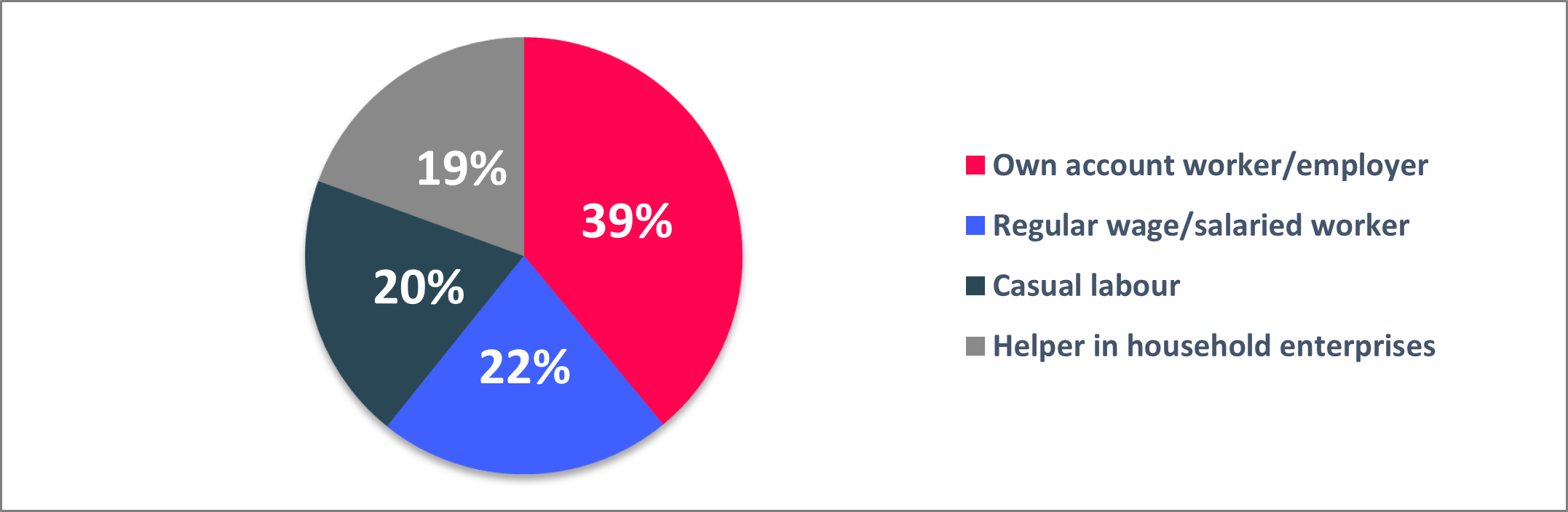

India's workforce by employment category

Source: Annual Report, Periodic Labour Force Survey (PLFS), 2023-24 (MOSPI) and Nomura Global Economics

Pre and Post Labour Reform At Glance:

| Category | Pre Labour Reforms | Post Labour Reforms |

|---|---|---|

| Formalisation of Employment | No mandatory appointment letters | Mandatory appointment letters to all workers. |

| Social Security Coverage | Limited Social Security Coverage | All workers — including gig & platform workers |

| Minimum Wages | Minimum wages applied only to scheduled industries; large segments remained uncovered | Under Code on Wages, 2019, all workers receive a statutory right to minimum wage payment. |

| Preventive Healthcare | No legal requirement for employers to provide free annual health check-ups | Employers must provide all workers above 40 years a free annual health check-up. |

| Timely Wages | No mandatory compliance for timely payment of wages | Mandatory for employers to provide timely wages (by 7th of every month). |

| Women Workforce Participation | Women restricted from night shifts and certain occupations. | Women allowed to work at night and in all types of work; 26 weeks paid maternity leave in unorganised sector. |

|

Employees' State Insurance Corporation (ESIC) Coverage |

ESIC coverage limited; units with <10 employees generally excluded | Pan-India coverage; voluntary for <10 employees; mandatory for hazardous processes. |

| Compliance Burden | Multiple registrations, licences, returns | Single registration, PAN-India licence, single return |

| Gratuity Eligibility | 5 years continuous service | 1 year (for fixed-term employment) |

| Working Hours | Varied across sectors | 8–12 hrs/day, 48 hrs/week; overtime at double wage |

| Layoffs / Retrenchment Approvals | Government permission required | Up to 299 workers: fewer approvals |

| Full & Final Settlement | 30–60 days (even 90 days) | Within 2 working days |

The "Hire & Fire" Debate: Flexibility vs. Security

The Industrial Relations Code, 2020 brings the most controversial change, altering the balance of power between employers and employees.

The Threshold Shift:

Previously, factories with 100 or more workers needed government permission to lay off staff or close down. This "permission Raj" often discouraged companies from scaling up.

- The New Rule: The threshold has been raised to 300 workers.

- The Implication: Establishments with up to 299 workers can now retrench staff without prior government approval, provided they pay severance.

Myth Buster: "Contract Labour is Always Cheaper"

- The Myth: Companies will always prefer contract labour to avoid giving benefits.

- The Reality: The new codes might actually kill the traditional "temp" model incentives.

- The Reason: The code introduces Fixed-Term Employment (FTE). These workers are now entitled to the same social security benefits as permanent employees.

- The Kicker: Fixed-term employees now qualify for Gratuity after just 1 year of service, rather than the standard 5 years. However, this reduced tenure applies exclusively to fixed-term employment contracts. For permanent employees, the 5-year continuous service requirement continues to apply. This targeted reform removes the financial incentive to keep workers on endless "temp" loops to deny them long-term benefits while maintaining the traditional gratuity framework for permanent staff.

Source: Code on Social Security, 2020; Industrial Relations Code, 2020

From "Inspector Raj" to "Facilitator"

A massive complaint from Indian industry has been the burden of compliance. The Occupational Safety, Health and Working Conditions (OSH) Code, 2020 attempts to digitize and declutter this.

- The Philosophy Change: The old "Inspector" who focused on punishment is replaced by an "Inspector-cum-Facilitator." Their role shifts to advising on compliance, with web-based, algorithm-driven inspections replacing discretionary visits.

Why does this structural overhaul matter to you?

1. For Women: The OSH Code legalizes night shifts (7 PM - 6 AM) for women in all sectors, provided consent is given and safety measures (GPS transport, lighting) are in place. This removes archaic barriers to female employment in manufacturing and IT.

2. For the Workplace: The standard work week is capped at 48 hours. However, flexibility is introduced: companies can opt for a 4-day work week, provided the daily shift is 12 hours, balancing the total weekly hours.

3. For Compliance: Penalties for non-compliance have spiked. The fine for a first-time offence under the OSH code can reach ₹5 lakh, but the system also introduces "compounding" (paying a fine to avoid court) to reduce litigation.

What These Changes Are For Broad Indian Landscape:

The newly implemented labour codes aim to modernise India’s labour market, expand social protection, and accelerate formalisation across sectors. A key reform is the creation of a national database of unorganised workers, designed to map skills, facilitate job matching, and ensure that social-security benefits can reach workers more efficiently.

The framework also strengthens worker representation by introducing formal norms for trade union recognition and faster dispute resolution mechanisms through streamlined Industrial Tribunals. Together, these measures are expected to reduce friction in industrial relations and support smoother business operations.

According to an SBI research report, the impact of these reforms could be transformative. The implementation of the labour codes is estimated to reduce unemployment by up to 1.3%, potentially generating 77 lakh additional jobs. Formalisation of the workforce could rise sharply—from 60.4% to 75.5%, an increase of at least 15 percentage points. Social-security coverage is also projected to expand to 85%, significantly strengthening India’s labour ecosystem.

India currently has about 44 crore unorganised workers (Economic Survey 2021-22). As per the latest data, 31 crore workers are registered on the e-Shram portal. With the transition under the new codes, the country’s social-security net is expected to reach 80–85% of workers within the next 2–3 years.

Source: e-Shram Portal, MOSPI

From an economic standpoint, higher formalisation and wider coverage can meaningfully lift household savings and spending. SBI estimates that with a 30% savings rate, the reforms could drive an additional ₹75,000 crore of consumption over the medium term, giving a strong boost to domestic demand and overall growth.

The reforms also aim to make India a more attractive investment destination. A simplified compliance regime, coupled with measures such as fixed-term employment, a mandatory 14-day notice before strikes or lockouts, and the removal of prior government approval for layoffs or closure in establishments with up to 300 workers, provides companies with greater flexibility. These steps help signal the government’s intent to improve ease of doing business, draw in more FDI—especially in manufacturing—and better integrate India into global value chains.

With stronger worker representation through designated negotiating unions and a more predictable industrial framework, the reforms collectively seek to promote labour-market stability, business confidence, and long-term economic competitiveness.

The Reality Check:

While the Centre notified these codes on November 21, 2025, labour is a Concurrent List subject. This means every State must notify its own rules. As of late 2025, while 24+ states have pre-published drafts, key states like West Bengal have resisted, and Tamil Nadu has not published draft rules specifically for the Social Security Code due to concerns about its impact on the state's existing welfare boards for unorganised workers.

We are currently in a transition period where new codes are "effective," but dual compliance regimes may exist until state rules are fully harmonized. The architecture is built; now the machinery must start moving.

Source: Ministry of Labour & Employment, PIB

Mr. Govindprasad Gaonkar, Senior Executive Vice President & Head - Human Resource at Kotak AMC adds: The New Labour Code 2025 marks a major advance for labour welfare in India: it simplifies labour laws and extends security to more workers, including gig and platform workers. The revised wage definition brings significant changes for employers, who must revisit their current compensation structures. For employees, understanding the new salary components is crucial, as these changes affect both net pay and retirement savings. Ultimately, success will depend on effective implementation, robust enforcement, and inclusive outreach.

Mr. Mandar Pawar, Senior Vice President & Fund Manager at Kotak AMC adds: India’s labour reforms is rewriting the social contract for a new generation of workers. From gig workers to CEOs, the new codes redraw the boundaries of security, flexibility, and opportunity for all; thus enabling a regulatory environment to create a more formal, fair, and future-ready workforce. Alongwith simplification and fewer forms, it targets stricter compliance, broader coverage and recognizing rights of every worker.

Mr. Churchil H Bhatt, Executive Vice President & Debt Fund Manager at Kotak Mahindra Life Insurance Company Ltd, adds: The new labour code is an important and long-awaited reform. It simplifies complex regulations, making compliance easier, while strengthening social security, workplace safety, and gender equality. Importantly, these benefits now extend beyond the traditional formal sector to include gig and platform workers. These are not just legislative changes — they show great foresight and will benefit employers and workers across all levels.

Disclaimers

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.