23 Oct 2025

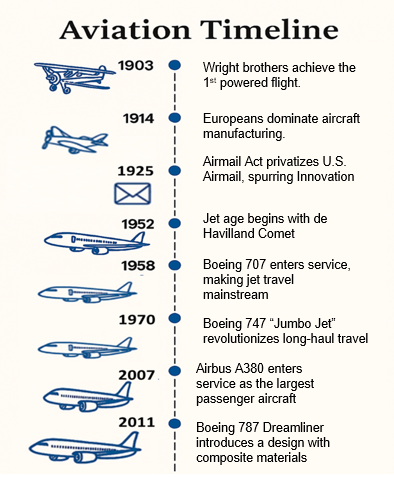

In 1903, a 12-second flight by the Wright brothers sparked an industry that now moves nearly 9 billion passengers a year. The aviation industry is a story of human ambition and relentless pursuit of the skies. In 1914, Europeans dominated aircraft manufacturing. By the outbreak of World War I, French firms had built over 2,000 aircraft, German firms about 1,000, and Britain slightly fewer. Across the Atlantic, American firms had produced fewer than a hundred, mostly one-off designs.

The Airmail Act of 1925 (Kelly Act) allowed the U.S. Postmaster General to contract private firms for mail delivery, paving the way for a privatized system that spurred aircraft innovation and laid the foundation for modern U.S. airlines. Airmail contracts in the 1920s funded hundreds of small companies, eventually leading to passenger services and the development of larger aircraft capable of carrying more people and cargo over long distances.

Source: Business Standard, Technofunc, Wikipedia | As per latest data available

Both World Wars accelerated advancements in aircraft design and production. After WWII, the jet age began with the de Havilland Comet in 1952 and Boeing 707 in 1958, making air travel faster, more comfortable, and accessible to the masses.

Source: https://robertwilkosaviationscholarship.com/aviation-history-milestones-and-innovators/, https://airandspace.si.edu/explore/stories/jet-age, Wikipedia, Boeing, Airbus.com, aeromorning.com, As per latest data available

Today, aviation manufacturing relies on advanced composites and precision engineering to build everything from small planes to massive long-haul airliners. But who builds these marvels? Behind every flight is a machine, and behind every machine is a manufacturer. And in this arena, a few giants dominate the skies.

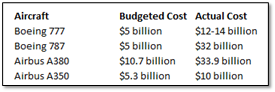

At the top are airframers, Boeing and Airbus, who assemble the final aircraft and certify it for flight. Together, both commands more than 90% market share. The dominance of Boeing and Airbus in the global aircraft manufacturing industry is no accident. The astronomical costs of designing, testing, and certifying a commercial airliner often running into tens of billions of dollars.

Source: https://simpleflying.com/how-airbus-boeing-production-changed-over-past-decade/

Source: https://www.construction-physics.com/p/a-cycle-of-misery-the-business-of

Developing a single aircraft model requires decades of engineering expertise, massive supply chains, and regulatory approvals across multiple continents. These giants don’t just build planes; they orchestrate complex ecosystems of suppliers, engineers, and technologies to keep the skies humming. But the airframe, the body of the plane, is not the only part of the story. There is a vast tiered supply chain.

If the airframe is the skeleton of an aircraft, the engines are its muscles. Modern jet engines are also marvels of engineering, capable of generating tens of thousands of pounds of thrust while operating in extreme temperatures exceeding 1,500°C and altitudes above 40,000 feet. The engine market is as concentrated as the airframe market, with 3 major players dominating:

Source: Wikipedia

General Electric (GE) Aerospace (U.S.)

Rolls-Royce (U.K.)

Pratt & Whitney (a division of RTX Corporation, U.S.)

These companies supply engines to both Boeing and Airbus, and their products often define an aircraft’s performance, fuel efficiency, and operational costs.

While Boeing and Airbus dominate airframe production, GE, Rolls-Royce, and Pratt & Whitney lead in engines, the aviation manufacturing ecosystem is far broader. Thousands of suppliers worldwide contribute critical components: fuselages, wings, avionics systems, and even the tiny fasteners that hold it all together. Companies like Spirit AeroSystems (U.S.) and Safran (France) play pivotal roles in supplying airframes and landing gear, respectively. Meanwhile, Honeywell and Collins Aerospace provide advanced avionics and systems that make modern aircraft smarter and safer.

|

Aircraft Manufacturing Tiered Supply Chain |

Examples |

|

Aircraft Manufacturers |

Boeing, Airbus, COMAC, Embraer, Irkut |

|

Engine Manufacturers (OEMs) |

GE Aerospace, Rolls Royce, Pratt & Whitney, CFM International (GE-Safran JV) |

|

Tier 1 Suppliers |

Avionics: Honeywell, Collins |

| Tier 2/3 Suppliers |

Suppliers of components, forgings, castings, wiring, and raw materials like aluminium, titanium, and composites. |

Once an aircraft enters service, the supply chain doesn’t end, it shifts to MRO (Maintenance, Repair, and Overhaul). To ensure safety, reliability, and efficiency, aircrafts require regular maintenance, repairs, and overhauls. MRO is a lifeline for airlines, as even a single day of downtime can cost millions in lost revenue. This work is performed by a mix of airline in-house teams, independent MRO providers, and original equipment manufacturers (OEMs) like GE, Rolls-Royce, and even Boeing and Airbus themselves.

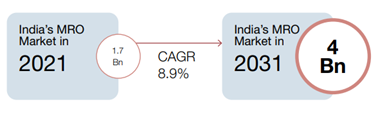

India doesn’t yet build large commercial aircraft, but it’s betting big on Maintenance, Repair, and Overhaul (MRO). Today, most heavy maintenance is outsourced to hubs in Singapore and the Middle East. With a rapidly growing fleet, the government is focused on building a domestic MRO industry that can capture this opportunity. The Indian MRO market is expected to become a $4 billion industry by 2031.

Source: DGCA, Kearney estimate

To boost competitiveness, the government has implemented the following:

- GST on MRO reduced from 18% to 5% with full Input Tax Credit (effective April 2020).

- Transactions sub-contracted by foreign OEMs to Indian MROs treated as exports with zero-rated GST.

- 100% FDI permitted via the automatic route for MRO.

- Uniform 5% IGST on imports of aircraft parts, components, testing equipment, tools, and toolkits, regardless of HSN classification.

- Customs duty exemptions on tools and toolkits, plus simplified clearance processes.

- Extended timelines: Export of goods imported for repairs extended from 6 months to 1 year; re-import under warranty extended from 3 to 5 years.

- New MRO guidelines (Sept 2021) abolished royalties and introduced transparency in land allotments at AAI airports

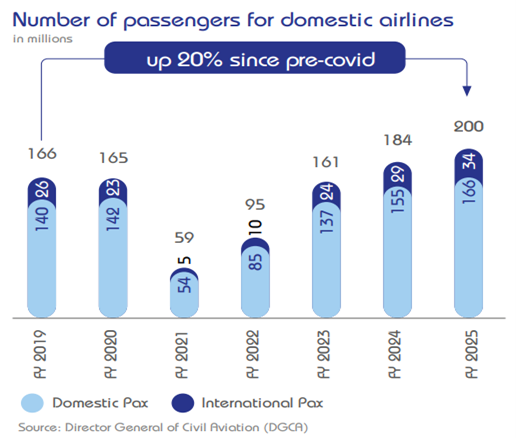

India’s push to build a strong MRO ecosystem is no accident, it’s powered by the country’s booming airline market. With one of the fastest-growing fleets in the world and over 1,700 aircraft on order across all carriers, India’s skies are a battleground for airlines competing in a notoriously tough business.

Source: thehindubusinessline.com, PIB

India is currently the third largest domestic aviation market in the world supported by rising disposable incomes, urbanisation, and increasing preference for air travel.

Often seen as glamorous, but the economics are unforgiving. Since 1978, over 100 U.S. airlines have gone bankrupt. Airlines face razor-thin margins, high fixed costs (aircraft leases, salaries, airport charges), and volatile fuel prices.

Source: Wikipedia, KMAMC Internal

India’s skies tell a similar story. Airlines like Kingfisher, Jet Airways, and Sahara once promised to change the game, but couldn’t survive the brutal economics. Today, the market is dominated by a few large players like Indigo, Air India (under Tata Group) and a few others, and the barriers to entry and survival are higher than ever.

The lesson?

In aviation, scale, cost discipline, and relentless execution aren’t just advantages, they’re necessities. The graveyard of failed airlines is a reminder that in this business, optimism alone doesn’t keep you flying. IndiGo holds the largest domestic market share in India's passenger aviation market, with figures ~63% in 2025.

Source: statista.com

IndiGo’s success is built on relentless cost control, operational discipline, and a single-type fleet strategy. It operates as a pure low-cost carrier, focusing on affordable, no-frills travel. It eliminates non-essential services like complimentary meals and luxury lounges, keeping operational expenses low and passing those savings to passengers. This simplicity is a core reason for its profitability, even as full-service rivals struggle. It’s single-type fleet strategy reduces maintenance costs, pilot training expenses, and spare parts inventory. The result: significant annual savings (estimated at ₹850 crore/year), operational efficiency, and easier scheduling.

Source: visaverge.com

While IndiGo’s disciplined playbook has set the benchmark for profitability and resilience, the broader Indian airline industry’s growth story is powered by a unique set of structural drivers. Understanding these forces helps explain why, despite the industry’s brutal economics, India’s skies remain full of opportunity.

The country’s domestic air traffic has grown at a blistering pace, fuelled by a young, digitally connected population, rising disposable incomes, and a growing middle class eager to travel.

Yet, India remains underpenetrated: only about 8.7% of Indians have passports, and international seats per capita lag far behind developed markets, signalling massive headroom for growth. Government initiatives like the UDAN scheme for regional connectivity, record airport infrastructure investments, and a push for domestic MRO and aircraft leasing are expanding access and affordability. Meanwhile, the surge in e-commerce is driving air cargo, and India’s 35-million-strong diaspora is boosting international and connecting traffic. With over 1,000 aircrafts on order and a focus on widebody expansion, India is poised to be a global aviation hub.

Source: Indigo Annual Report FY2025

With these growth engines in place, India’s skies are set for a new era of expansion and opportunity. However, winners will be those who can turn surging demand and new infrastructure into sustainable, profitable growth while mastering the cost discipline that has grounded so many before.

The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s). The usage of names of the companies does not indicate any affiliation with KMAMC. The blog is for Informational purposes only.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.