11 Aug 2025

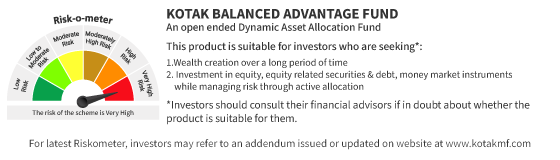

Balanced Advantage Funds (BAFs), also known as Dynamic Asset Allocation Funds, are hybrid category of Scheme that invest in both equity and debt, with the flexibility to dynamically adjust their allocation based on market conditions. Unlike fixed-allocation hybrid funds, BAFs normally increase equity exposure in bullish markets and shift towards debt during volatility to manage risk and aim to enhance returns.

Key benefits include risk control, tax efficiency (with ≥65% equity exposure), professional fund management, and more stable returns than pure equity funds. These funds are suitable for long-term investors seeking a hands-off, diversified investment option.

However, BAFs still carry risks such as market volatility, interest rate fluctuations, and potential underperformance in strong bull markets. Their reliance on valuation models also introduces model risk.

Key Takeaways

- Balanced Advantage Funds dynamically adjust their investments between equity and debt to balance risk and returns according to market conditions.

- They combine professional management, reduced volatility, tax benefits (when equity exposure is sufficient), and diversified portfolios.

- These funds offer risk management but still carry risks like market fluctuations and model limitations.

- They are suitable for long-term investors seeking a hands-off, balanced investment approach and can be accessed through various investment platforms via lump sum or systematic plans. To learn more about the broader category of such investments, you can explore What are Hybrid Funds.

What are Balanced Advantage Fund?

A Balanced Advantage Fund is a type of hybrid mutual fund that invests in both equity and debt but with a key difference it doesn't follow a fixed allocation. Instead, the fund manager has the flexibility to dynamically shift between equity and debt depending on current market trends and economic conditions.

These funds are also known as Dynamic Asset Allocation Funds because they adjust their investment mix proactively. For instance, during bullish markets, the fund may increase its equity exposure to benefit from growth opportunities.

Conversely, when markets are uncertain or declining, it can reduce equity holdings and move towards more comparatively stable debt instruments. This dynamic approach helps balance risk and return, making Balanced Advantage Funds suitable for investors looking for a more adaptive investment strategy.

How Does a Balanced Advantage Fund Work?

Balanced Advantage Funds (BAFs) dynamically shift between equity and debt based on market conditions. When markets are rising, they increase equity exposure to capture growth. In volatile or falling markets, they reduce equity exposure and move towards debt or arbitrage to manage risk.

To maintain tax efficiency, most BAFs keep at least 65% in equity or equity-like instruments (like arbitrage positions). This ensures equity taxation while managing volatility.

Fund managers use valuation models or algorithms to decide the asset mix, aiming to deliver better risk-adjusted returns without the need for investors to time the market.

Key Features of Balanced Advantage Funds

1. Dynamic Asset Allocation

These funds actively adjust their investment mix between equity and debt based on market conditions, aiming for optimal risk-reward balance.

2. Reduced Volatility

By diversifying across asset classes, they offer more stability than pure equity funds, helping to cushion against market fluctuations.

3. Expert Management

Investment decisions are made by experienced fund managers who use data-driven strategies to navigate different market cycles.

4. Tax Efficiency

If equity exposure remains at or above 65%, the fund qualifies for equity taxation.

5. Diversified Investments

These funds spread investments across equities and fixed-income instruments, helping to reduce risk from any single asset class.

Benefits of Investing in Balanced Advantage Funds

1. Risk Control

Investors don’t need to time the market as the fund adjusts exposure based on conditions.

2. Tax Savings

Eligible for equity tax treatment, which can be more advantageous than debt fund taxation.

3. Expert Oversight

Professional fund managers continuously monitor and adjust the portfolio for optimal performance.

4. Simplified Diversification

Offers a convenient way for investors to access both equity and debt within a single fund.

Risks & Considerations Before You Invest

1. Market Risk

Equity exposure means the fund is still subject to stock market fluctuations and potential losses.

2. Model Risk

Asset allocation decisions rely on valuation models that may sometimes misjudge market conditions.

3. Interest Rate & Credit Risk

Debt investments carry risks related to interest rate changes and borrower defaults.

4. Potential Underperformance

In strong bull markets, these funds may lag pure equity funds due to conservative allocation.

Taxation of Balanced Advantage Funds in India (FY 2025 Rules)

Tax treatment of Balanced Advantage Funds depends on their equity allocation. Funds classified as equity oriented(typically holding ≥65% in equity instruments) are taxed similarly to equity mutual funds.

- Short-Term Capital Gains (STCG): Applicable if units are held for less than 12 months.

- Long-Term Capital Gains (LTCG): Applicable if units are held for more than 12 months.

For the latest applicable rates and conditions, investors are advised to refer to the Kotak Mutual Fund Tax Reckoner 2025–26.

Who Should Consider Balanced Advantage Funds?

Balanced Advantage Funds are suitable for investors who:

- Prefer Dynamic Allocation - Appreciate professional management that adjusts equity and debt based on market conditions.

- Are Long-Term Investors - Looking for growth with some capital protection over time.

- Want Tax Efficiency - Interested in equity taxation benefits through dynamic equity exposure.

- Lack Time or Expertise - Prefer a hands-off approach to asset allocation without market timing stress.

How to Invest in Kotak Balanced Advantage Fund?

- Visit the official Kotak Balanced Advantage Fund page.

- Select either a lump sum investment or a Systematic Investment Plan (SIP).

- Enter the investment amount and choose between SIP or lump sum.

- Complete your transaction securely using your bank details.

FAQs

1)What is the minimum investment for a Balanced Advantage Fund?

Kotak Balanced Advantage Fund allows investments starting at just ₹100 for both lump sum and SIP.

2)How is a Balanced Advantage Fund different from an Aggressive Hybrid or Equity Savings Fund?

- Balanced Advantage Fund: Dynamically adjusts equity and debt allocation based on market conditions. Focuses on managing risk and optimizing returns.

- Aggressive Hybrid Fund: Primarily equity-focused with a fixed high equity allocation (usually 65-80%) and the rest in debt. Less flexibility in asset allocation compared to Balanced Advantage Funds.

- Equity Savings Fund: Invests mainly in equity, arbitrage opportunities, and debt instruments to generate stable returns with low volatility. Typically aims for lower risk than pure equity funds but less dynamic than Balanced Advantage Funds.

- Key difference: Balanced Advantage Funds actively shift equity debt mix; Aggressive Hybrid Funds have a fixed high equity allocation; Equity Savings Funds focus on arbitrage and debt for steady, low volatility returns.

Disclaimers:

Kotak Balanced Advantage Fund

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision. This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Asset Management Company or its employees. The company makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Article. The information contained in this Article is sourced from empaneled external experts for the benefit of the customers and it does not constitute legal advice from the Bank. The Company, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein. Tax laws are subject to amendment from time to time. The above information is for general understanding and reference. This is not legal advice or tax advice, and users are advised to consult their tax advisors before making any decision or taking any action. These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.