12 Jan 2026

A contra fund is a type of open-ended equity scheme that follows a contrarian investment strategy focusing on stocks that are currently undervalued or temporarily out of favour in the market. Unlike traditional equity funds that typically invest in trending or high performing stocks, contra funds aim to capitalize on market inefficiencies by identifying opportunities where the stock’s market price does not reflect its intrinsic value. The core principle is simple, buy when others are selling and sell when others are buying. This approach allows investors to potentially achieve long term capital appreciation while diversifying their equity portfolio

Key Takeaways

- Contra funds follow a contrarian investment approach focusing on stocks that are undervalued or currently out of favour in the market

- They require a long term investment horizon to realize potential capital appreciation

- These funds may offer high risk, potentially high reward opportunities and can contribute to portfolio diversification.

- Comparing contra funds with value funds can help investors understand differences in investment strategy and approach

- Taxation for contra funds follows standard equity mutual fund rules in India including short term and long term capital gains provisions

- Contra funds are generally suitable for long term, risk tolerant investors and may not be suitable for those seeking regular income or short term gains

What is a Contra Fund?

A contra fund is a type of equity mutual fund that invests against prevailing market trends. It selects stocks that are currently underperforming or temporarily unpopular but have the potential for long term growth. The basic principle is to buy when others are selling and sell when others are buying.

Contra funds are sometimes referred to as contrarian mutual funds because they go against market sentiment. The goal is to take advantage of pricing inefficiencies where a stock’s market value does not accurately reflect its intrinsic value.

Key Points

- Invests in undervalued or unpopular stocks

- Seeks long term capital appreciation

- Suitable for investors with a higher risk appetite

- Requires patience as returns may take time to materialize

How Do Contra Funds Work?

Contra funds follow a contrarian investment philosophy. Fund managers analyze market trends, company fundamentals and valuation metrics to identify stocks with strong potential but currently low market sentiment

Investment Process

- Stock Selection Focuses on companies with temporary setbacks, undervalued assets or underappreciated potential

- Portfolio Construction Diversifies across sectors and industries to minimize risk while maintaining possible high growth potential

- Active Management Fund managers actively monitor and rebalance holdings based on market shifts and company performance

- Long term Horizon Contra strategies require a longer investment period to allow undervalued stocks to realize their possible potential

This approach contrasts with conventional equity funds which typically follow market trends and invest in already performing or highly popular stocks

Key Features of Contra Funds

Contra funds have distinct characteristics that differentiate them from other equity funds. Understanding these features is essential before investing.

- Contrarian Approach Invests against prevailing market trends to capitalize on undervalued stocks

- Risk & Reward Since the fund invests in temporarily underperforming stocks the risk is higher but the possible potential returns can also be substantial, subject to market risks.

- Equity Oriented Must invest a minimum of 65% of total assets in equities or equity related instruments as per SEBI regulations

- Diversification Typically maintains a diversified portfolio across sectors to reduce risk

- Active Management Fund managers actively select and monitor stocks unlike passive funds that track indices

- Long Term Focus Requires patience, short-term volatility is common

Contra Fund vs Value Fund

While contra funds share some similarities with value funds there are notable differences

| Feature | Contra Fund | Value Fund |

|---|---|---|

| Investment Strategy | Invests in undervalued or unpopular stocks with possible potential recovery | Invests in undervalued stocks with strong fundamentals but not necessarily unpopular |

| Market Approach | Contrarian approach that goes against prevailing market trends | Focuses on intrinsic value regardless of market sentiment |

| Risk | Higher risk due to the contrarian investment approach | Moderate risk, generally more stable than contra funds |

| Potential Returns | High potential returns if chosen stocks recover | Moderate to high returns over the long term |

The main distinction lies in the contrarian philosophy - contra funds deliberately target temporarily unpopular stocks while value funds focus solely on undervalued stocks with good fundamentals. For a deeper look at how these two strategies compare and which may suit your portfolio, check out Contra vs Value Fund.

Benefits of Investing in Contra Funds

Contra funds offer several advantages for investors willing to embrace a long term, contrarian approach:

- Potential for High Returns By investing in undervalued stocks, contra funds can offer capital appreciation when the market recognizes the true value

- Diversification Adds a different investment approach to your portfolio, reducing correlation with traditional equity funds

- Professional Management Fund managers conduct rigorous research and analysis to select high potential stocks

- Long Term Growth Suitable for investors seeking wealth accumulation over a period of 3+ years or more

- Opportunity in Market Downturns Contra funds often invest in stocks that have been temporarily affected by market corrections providing potential upside during recoveries

Risks Involved in Contra Funds

Despite their potential contra funds come with inherent risks

- Market Volatility Contra funds invest in stocks that are currently underperforming which can be volatile

- Delayed Returns The contrarian approach requires patience, short term performance may lag

- High Risk Exposure Not suitable for conservative investors or those seeking stable income

- Fund Manager Dependency Success depends heavily on the fund manager’s skill in identifying opportunities

Investors should carefully evaluate their risk tolerance and investment horizon before choosing a contra fund

Who Should Invest in Contra Funds?

Contra funds are suitable for:

- Long term investors willing to stay invested for 3+ years

- Investors with a high risk appetite seeking capital appreciation

- Portfolio diversifiers who want a contrarian strategy alongside traditional equity funds

- Knowledgeable investors who understand market trends and contrarian investing

Contra funds are not suitable for short term investors or those seeking regular income as the strategy may involve holding underperforming stocks until recovery.

Taxation of Contra Mutual Funds in India

The tax treatment depends on the holding period. Equity funds are taxed differently with short term gains taxed higher than long term gains. Investors should also account for exit load while planning redemptions.

As mutual fund taxation is subject to periodic changes through government and regulatory updates, investors are advised to refer to the latest Kotak Mutual Fund Tax Reckoner for detailed and up to date information.

How to Choose the Right Contra Fund?

Choosing the right contra fund is an important step for investors who want to benefit from a contrarian investment approach

1. Fund Performance Across Market Cycles

A fund’s performance should be analyzed not only during bullish markets but also during downturns. Consistent performance across different market phases indicates that the fund manager is capable of navigating both volatile and stable market conditions. Look for funds that have delivered steady returns over multiple years which demonstrates resilience and strong management practices

2. Expertise and Track Record of the Fund Manager

The success of a contra fund largely depends on the fund manager’s ability to identify undervalued opportunities and predict market recoveries. Experienced fund managers with a proven track record in contrarian investing bring the necessary skills to select high potential stocks

3. Expense Ratio and Investment Costs

The cost of investing including the expense ratio which directly affects net returns. A lower expense ratio ensures that more of the investor’s money remains invested allowing compounding to work effectively over the long term. While choosing a fund, compare expense ratios of similar contra funds to select a cost efficient option without compromising on the quality of management or strategy

4. Portfolio Strategy and Asset Allocation

Understanding how a fund constructs its portfolio is crucial. A well diversified allocation across sectors and stocks reduces concentration risk while maintaining possible potential for growth. Investors should evaluate the fund’s investment philosophy, sector focus, stock selection methodology and the balance between high risk and stable investments. This ensures the fund aligns with individual investment objectives and risk appetite

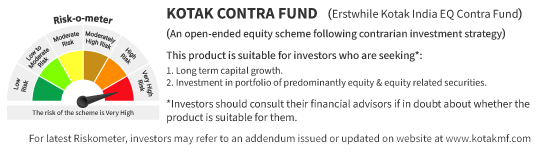

For investors seeking a contrarian strategy Kotak Contra Fund is a notable choice. The fund focuses on undervalued stocks with strong growth potential, balancing risk through diversification and active management. It follows SEBI guidelines and maintains transparency in investment strategy and portfolio composition.

Conclusion

Contra funds offer a distinct investment strategy for investors willing to adopt a contrarian approach in the equity market. These funds invest in undervalued or temporarily unpopular stocks with the aim of generating possible long term capital appreciation while contributing to portfolio diversification.

While contra funds have the potential to deliver attractive returns they also involve higher market risk and volatility. Therefore, they are generally suitable for investors with a long term investment horizon and a moderate to high risk appetite.

Investors considering contra funds should conduct thorough research, understand the fund’s investment strategy, review the fund manager’s track record and remain patient to allow the strategy to work effectively. Careful planning and disciplined investment can help integrate contra funds as a complementary component of a well diversified equity portfolio

FAQs

1. What is a contra fund?

A contra fund is an equity mutual fund that invests in stocks currently unpopular or underperforming but with potential for future growth.

2. How does a contra fund differ from a value fund?

Contra funds invest against market trends while value funds focus on undervalued stocks regardless of market sentiment.

3. Are contra funds risky?

Yes, they carry higher risk due to their investment in temporarily underperforming stocks.

4. What is the suitable investment horizon for contra funds?

A minimum of 3+ years is recommended to realize the full potential of the investment.

5. Can beginners invest in contra funds?

Beginners can invest but they should understand the higher risk and long term nature of these funds.

Disclaimers

Kotak Contra Fund

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.