1 Dec 2025

A midcap fund is an equity mutual fund that primarily invests in medium sized companies as defined by SEBI which ranks midcap companies between 101st and 250th in terms of full market capitalization. These funds are required to invest at least 65% of their total assets in midcap companies. Midcap companies are generally established businesses that have moved beyond the early growth phase but still may offer significant potential for expansion. By providing exposure to companies in the growth and expansion stage midcap funds can contribute to long term wealth creation, help diversify equity portfolios and support long term financial goals

Key Takeaways

- Midcap funds invest primarily in companies ranked 101–250 by market capitalization

- They may offer a balance between risk and relative growth potential, higher than large cap funds but generally less risky than small cap funds

- Active fund management and research are crucial in identifying growth oriented midcap companies

- Midcap funds help diversify equity portfolios potentially enhancing overall returns and reducing concentrated risk

- Investors should have a long term perspective as midcap stocks can be volatile and may experience sharper fluctuations during market corrections

- Choosing the right fund involves reviewing long term performance, fund manager expertise, expense ratios and portfolio diversification

What is a Midcap Fund?

A mid cap fund is an equity mutual fund that invests mainly in mid sized companies as classified by SEBI. According to SEBI’s definition mid cap companies are those ranked between 101st and 250th by full market capitalization. These funds are required to invest at least 65% of their total assets in such mid cap stocks. Mid cap companies are typically established businesses that have moved beyond the early growth phase but still offer considerable potential for expansion. This makes mid cap funds a good choice for investors seeking a balance between the stability of large caps and relative growth potential of small caps.

How a Midcap Fund Works?

A midcap fund pools money from multiple investors to invest in medium sized companies usually ranked between large cap and small cap based on market capitalization. Professional fund managers select stocks after analysing each company’s financial health, growth prospects, management quality and valuation. The fund’s portfolio is regularly monitored and rebalanced because companies can move between market cap categories as stock prices change. As these mid sized companies grow and expand the fund’s Net Asset Value (NAV) may rise helping investors achieve long term wealth creation. While midcap funds carry higher risk than large cap funds they also offer the potential for significant growth over time

SEBI Category & What Midcap Means in India?

According to SEBI midcap companies are those ranked from 101st to 250th based on their full market capitalization. This clear classification helps ensure that all midcap funds follow a standardized investment framework making it easier for investors to compare different funds and choose one that aligns with their investment goals

Features of Midcap Fund

- Mandatory Allocation - At least 65% of the fund is invested in midcap stocks following SEBI guidelines

- Possible Growth Potential - Provides access to companies in the growth and expansion stage of their business lifecycle

- Moderate Risk - Has a higher risk than large cap funds but is generally less risky than small cap funds

- Diversification - Spreads investments across various sectors and industries to reduce overall risk

- Active Management - Fund managers continuously monitor and rebalance the portfolio to optimize performance

Benefits of Investing in Midcap Mutual Funds

- Relative Growth Potential: Midcap companies are still in the growth and expansion phase. Over time they may expand their business and gain greater visibility in the market

- Balanced Risk and Reward: Midcap funds provide a middle ground between the stability of large cap funds and the relative potential growth of small cap funds giving investors a moderate risk reward profile

- Portfolio Diversification: Investing in midcap funds spreads your portfolio across multiple companies and sectors helping to reduce overall risk and enhance potential returns

- Active Professional Management: Experienced fund managers like those managing the Kotak Midcap Fund conduct research and analysis to identify strong growth prospects.

- Goal Oriented Wealth Creation: These funds are suitable for long term financial goals like retirement planning, children’s education or building wealth over time

- Early Investment Opportunity: By investing in midcap companies investors can participate in their growth journey

Who Should Consider a Midcap Fund?

- Midcap funds are designed for investors who are comfortable with market risk and understand that stock prices can fluctuate in the short term

- These funds are suited for those with long term financial goals such as wealth creation or funding future needs as midcap companies typically take time to grow and realize their potential

- Investors looking to diversify their equity portfolio beyond large cap stocks may benefit from midcap funds as they provide exposure to companies with higher growth potential helping balance risk and opportunity within a portfolio

Why Should You Invest in Midcap Funds?

Midcap funds provide a balanced approach between risk and relative growth potential. They allow investors to participate in medium sized companies that have established business operations while still offering room for expansion.

For investors with a long term perspective these funds can play an important role in a diversified equity portfolio supporting the overall growth of investments over time

Risks to Know

- Market Volatility - Midcap stocks can be more sensitive to market movements causing the fund’s NAV to fluctuate more than large cap funds over time

- Liquidity Risk - Some midcap stocks may trade less frequently making buying or selling more challenging

- Drawdowns - During market corrections midcap stocks may experience sharper declines requiring investors to remain patient

- Sector Concentration - Funds with higher exposure to a few sectors may face increased risk if those sectors underperform

How to Choose the Best Midcap Fund?

- Assess Long Term Performance - Look beyond short term returns and evaluate whether the fund has consistently performed well compared to its benchmark across different market cycles

- Consider Fund Manager Expertise - An experienced fund manager with a strong understanding of midcap companies can add significant value to the fund

- Check Expense Ratios - Lower expense ratios can help enhance the net returns for investors over time

- Review Portfolio Diversification - Ensure the fund invests across multiple sectors and companies in a way that aligns with your investment objectives

Conclusion

Midcap funds can be an essential part of a diversified investment strategy offering exposure to medium sized companies with relative growth potential. They provide a balanced approach between risk and reward combining the stability of established businesses with opportunities for expansion. While they carry higher short term volatility than large cap funds disciplined investing through long term holding and systematic investment plans (SIPs) can help investors benefit from their growth potential. By carefully selecting a fund based on performance history, fund management and portfolio diversification investors can use midcap funds to achieve long term wealth creation and meet their financial goals

FAQs

1. Is it riskier than large cap?

Midcap funds generally carry higher risk than large cap funds because their stock prices can be more volatile. However this higher volatility comes with the potential for greater long term growth making them suitable for investors with a high risk appetite and a long term perspective.

2. What is the investment time horizon for a Mid Cap Mutual Fund?

Midcap funds are best suited for long term investment goals. Investors should stay invested for long term to benefit from compounding and to ride out short term market fluctuations. A long term horizon allows the relative growth potential of medium sized companies to materialize.

Systematic Investment Plans (SIPs) are generally preferred for midcap funds. SIPs allow investors to spread their investments over time, averaging the purchase cost and reducing the impact of market volatility. Lumpsum investments are also possible but may be more affected by short term market swings.

3. What does a Mid Cap mutual fund invest in?

Midcap mutual funds primarily invest in companies ranked between 101st and 250th in terms of market capitalization, as per SEBI guidelines. These companies are usually in the growth and expansion phase offering potential for long term capital appreciation.

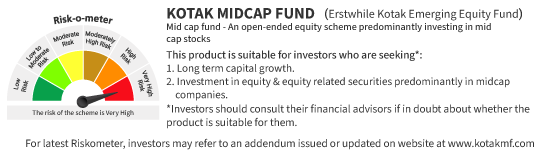

Kotak Midcap Fund

An Open Ended Equity Scheme predominantly investing in mid cap stocks

Disclaimers

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.