11 Sep 2025

Aggressive Hybrid Mutual Funds are open ended hybrid schemes classified by SEBI that invest predominantly in equity and equity related instruments, while also maintaining an allocation to debt instruments. As per SEBI’s prescribed asset allocation norms, these funds are required to invest 65% to 80% of their total assets in equity and equity related instruments and 20% to 35% in debt instruments. This combination aims to balance the long term growth potential of equities with the relative stability of debt. These funds may be suitable for investors with a moderately high risk appetite, seeking capital appreciation with some risk mitigation through fixed income exposure.

Key Takeaways:

- Aggressive Hybrid Funds invest 65%–80% in equity and the remainder in debt instruments, as per SEBI’s Categorization of Mutual Fund Schemes.

- These funds aim to offer a balance between capital growth and relative stability, making them suitable for moderately aggressive investors.

- They are actively managed and periodically rebalanced to maintain the prescribed equity debt ratio.

- Investors can start with SIP, lumpsum, or STP, depending on their investment preference and goals.

- Taxation is as per equity mutual fund norms, provided equity allocation remains above the required threshold.

- Consider factors like Sharpe ratio, expense ratio, and exit load before investing.

What is an Aggressive Hybrid Mutual Fund?

An Aggressive Hybrid Mutual Fund is a type of equity oriented hybrid fund that invests primarily in a combination of equity and debt instruments, with the goal of balancing growth potential and relative stability. As per SEBI’s asset allocation norms, these funds must invest 65% to 80% of their total assets in equity and equity related instruments, and 20% to 35% in debt instruments.

The equity portion aims to deliver long term capital appreciation, while the debt allocation helps cushion the portfolio against short term volatility. This makes aggressive hybrid funds suitable for investors who are seeking growth, but also value a degree of downside protection.

SEBI Rules on Asset Allocation (65–80% Equity)

Aggressive Hybrid Mutual Funds are governed by specific asset allocation norms prescribed by the Securities and Exchange Board of India (SEBI). As per these guidelines, such funds must allocate:

- A minimum of 65% and up to 80% of their total assets to equity and equity related instruments

- The remaining 20% to 35% must be invested in debt instruments such as government bonds, corporate debt, or money market securities

This allocation structure ensures that these funds maintain a predominantly equity oriented profile while still retaining a portion of relatively stable fixed income instruments.

Because the equity exposure is maintained at or above 65%, aggressive hybrid funds are typically classified as equity oriented funds for taxation purposes.

How Aggressive Hybrid Funds Work?

Aggressive hybrid mutual funds are required by SEBI to maintain minimum 65% to 80% of their assets in equity and the rest in debt instruments.

- To manage this, fund managers actively monitor and rebalance the portfolio. When equity markets rise sharply and the equity allocation exceeds 80%, the fund trims equity exposure and reallocates to debt.

- Similarly, during market corrections, the fund may increase equity investments when valuations are more attractive, ensuring the equity level stays above the 65% minimum.

This dynamic rebalancing helps maintain portfolio discipline, manage downside risk, and improve return consistency across market cycles.

The effectiveness of this strategy is often evaluated using the Sharpe ratio a measure that indicates how much excess return a fund delivers for the level of risk it takes. A higher Sharpe ratio reflects a more efficient risk adjusted performance, making it a useful metric for investors comparing similar hybrid schemes.

Benefits & Key Risks

1. Key Benefits

- Balanced Growth Potential: Aggressive hybrid funds invest between 65% to 80% in equity and the rest in debt instruments, as per SEBI guidelines. This asset mix aims to capture equity led growth while maintaining some portfolio stability through debt exposure.

- Built in Diversification: By combining equity and debt in a single portfolio, these funds help reduce concentration risk and provide relatively smoother performance across market cycles. This aligns with the principle of diversification in mutual funds.

- Ease of Investing: These funds allow investors to access both equity and debt through a single scheme, without the need for manual asset allocation or rebalancing.

- Suitable for SIPs: Investors can use Systematic Investment Plans (SIPs) to invest regularly in aggressive hybrid funds, which supports disciplined, long term investing.

2. Key Risks

- Market Risk: The equity component is subject to market volatility. A fall in stock markets can adversely impact the fund's NAV. To understand how NAVs work, refer to NAV in mutual fund.

- Interest Rate Risk: Debt instruments in the portfolio may be affected by fluctuations in interest rates, impacting their value.

- Expense Ratio: Aggressive hybrid funds are actively managed, and thus may have a moderately higher expense ratio.

- Exit Load: Some schemes may charge an exit load if you redeem your units within a certain time period.

Where Do Aggressive Hybrid Mutual Funds Invest?

These funds must invest 65% to 80% of their total assets in equity and equity related instruments, with the remaining 20% to 35% in debt instruments. This ensures they are classified as equity oriented for regulatory and tax purposes.

Typical Allocation Breakdown:

1. Equity Instruments (65 to 80%)

These may include large cap, mid cap, or diversified equity stocks, selected to target capital appreciation over the long term. The equity portion drives growth and market participation.

2. Debt Instruments (20 to 35%)

These include corporate bonds, government securities (G Secs), and short term debt papers. The debt component helps reduce volatility and offers income stability, especially during equity market corrections.

How Should You Invest in an Aggressive Mutual Fund?

Aggressive hybrid funds offer flexible investment options to suit different investor needs. You can choose one or a combination of the following methods based on your financial situation and market view:

1. SIP (Systematic Investment Plan)

A SIP allows you to invest a fixed amount at regular intervals (monthly or quarterly), helping you average the cost of investment over time and instil disciplined investing habits. SIPs are suitable for long term goals like retirement or child education.

2. Lumpsum Investment

You may choose to invest a lumpsum amount during market dips or when you have a long investment horizon. This strategy may benefit from potential capital appreciation if the equity market performs well over time.

3. STP (Systematic Transfer Plan)

STP enables you to transfer a fixed amount from one mutual fund (typically a liquid or low risk debt fund) to an aggressive hybrid fund at regular intervals. This method is useful if you have a lumpsum amount but want to avoid timing the equity market directly.

Why Should You Invest in Aggressive Mutual Fund?

Aggressive hybrid mutual funds invest between 65% and 80% of their total assets in equity and equity related instruments, with the remaining in debt and money market instruments, as per SEBI's regulatory framework.

Reasons to Consider:

- Balanced Risk Return Profile: The equity component provides scope for capital appreciation, while the debt allocation helps reduce overall volatility.

- Built in Diversification: Investors gain exposure to two asset classes equity and debt within a single scheme, reducing the need for separate allocation management.

- Professional Rebalancing: Fund managers adjust the portfolio based on market conditions, keeping it within SEBI mandated limits.

- Suitable for SIP and STP: A Systematic Investment Plan (SIP) allows regular investing to average market fluctuations.

- Simplified Investing: These funds offer a solution for investors seeking a professionally managed hybrid portfolio.

They strike a balance between equity growth and debt cushioning, with professional rebalancing. For example, the Kotak Aggressive Hybrid Fund applies this strategy with strong governance and clear communication

Taxation Rules of Aggressive Mutual Funds

Aggressive hybrid mutual funds are generally taxed as equity oriented schemes, provided they maintain the required minimum allocation to equity as per SEBI guidelines.

- Short Term Capital Gains (STCG) Apply when mutual fund units (equity oriented) are sold within 12 months of investment.

- Long Term Capital Gains (LTCG) Apply when mutual fund units are held for more than 12 months, as per equity taxation rules.

For the latest tax provisions and applicability, investors are advised to consult a tax advisor or refer to the Kotak Tax Reckoner.

Conclusion

Aggressive Hybrid Mutual Funds offer a structured investment option for individuals looking to participate in equity markets with a built in cushion of debt. Governed by SEBI’s asset allocation norms, these funds are suitable for investors who seek long term growth without taking on full equity market risk. With flexibility in investment methods (SIP, lumpsum, or STP), built in diversification, and professional portfolio management, they present an accessible route for both new and seasoned investors.

However, as with any market linked product, it's important to evaluate the scheme’s risk factors, read the Scheme Information Document (SID) carefully, and assess whether it aligns with your personal financial goals and investment horizon. For taxation and allocation guidance, referring to resources like the Kotak Tax Reckoner or a professional advisor is recommended.

Frequently Asked Questions

1. What is an aggressive hybrid mutual fund?

A hybrid mutual fund that invests 65–80% in equity and equity related instruments the rest in debt as per the Schemes investment objective.

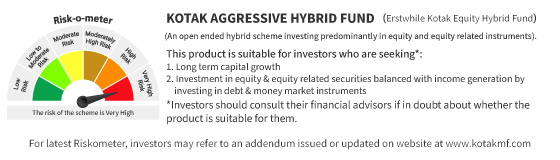

2. Is an aggressive hybrid fund high risk?

The risk level of an Aggressive Hybrid Fund depends on its underlying asset allocation and may vary from one scheme to another. As per SEBI regulations, every mutual fund scheme must disclose its risk level using the Risk o Meter, which reflects the scheme’s current portfolio. Investors should refer to the Risk o Meter, available in the Scheme Information Document (SID) and fund factsheet, to assess whether the fund aligns with their risk appetite and investment goals.

3. Are aggressive hybrid funds safe?

Aggressive Hybrid Funds invest 65% to 80% in equity and the remainder in debt instruments. Risk level of each scheme depends on its portfolio and is disclosed through the SEBI mandated Risk o Meter. Investors are advised to refer to the Risk o Meter and Scheme Information Document (SID) to understand the scheme’s risk profile and evaluate if it aligns with their investment objectives and risk tolerance.

4. Who should invest in aggressive hybrid funds?

Aggressive Hybrid Funds may be suitable for investors who are comfortable with the volatility of equity markets and seek capital appreciation along with a measure of stability through debt exposure. These funds can also be considered by individuals looking for simplified diversification within a single scheme. As with any mutual fund investment, it is important to review the Scheme Information Document (SID) and check the fund’s Risk o Meter to ensure it aligns with your financial goals and risk appetite.

5. Can I start a SIP in an aggressive hybrid fund?

Yes, SIPs are widely available and help with disciplined investing.

6. How are aggressive hybrid funds taxed?

Aggressive Hybrid Funds are taxed as equity oriented schemes, as they maintain at least 65% allocation to equity.

Short term capital gains (STCG) apply if units are redeemed within the minimum holding period defined under equity taxation rules.

Long term capital gains (LTCG) apply if units are held beyond this period.

For exact definitions and applicable rates, investors are advised to refer to the Kotak Tax Reckoner.

7. How do aggressive hybrid and balanced advantage funds differ?

Aggressive Hybrid Funds maintain a defined equity allocation between 65% and 80% of total assets, as mandated by SEBI.

In contrast, Balanced Advantage Funds (BAFs) have no fixed equity debt ratio. Their asset allocation is dynamically managed based on market conditions, valuation models, or internal algorithms.

8. What is the difference between aggressive funds and equity funds?

Aggressive hybrid funds invest 65%–80% in equity and the rest in debt, which may reduce overall volatility compared to pure equity funds. However, the risk level depends on the fund’s actual asset allocation and should be assessed using the Riskometer provided in the Scheme Information Document (SID), as per SEBI guidelines.

9. For how long do I need to stay invested in aggressive funds?

Aggressive hybrid mutual funds are suitable for investors with a medium to long term investment horizon, suitable three years or more, to potentially benefit from equity market participation.

As per SEBI guidelines, the suitability of the fund should be evaluated by referring to the fund’s Riskometer, Scheme Information Document (SID), and aligning it with the investor’s risk profile and financial goals.

Disclaimers:

Kotak Aggressive Hybrid Fund

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision. This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Asset Management Company or its employees. The company makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Article. The information contained in this Article is sourced from empanelled external experts for the benefit of the customers and it does not constitute legal advice from the Bank. The Company, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein. Tax laws are subject to amendment from time to time. The above information is for general understanding and reference. This is not legal advice or tax advice, and users are advised to consult their tax advisors before making any decision or taking any action.These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.