21 Aug 2025

Small cap mutual funds are equity oriented mutual funds schemes that primarily invest in shares of small cap companies defined by SEBI as those ranked beyond the 250th in terms of full market capitalisation. These funds aim to capitalise on the growth potential of emerging businesses that are still in the early stages of development. While they offer the opportunity for higher long term returns, they also carry higher risk and volatility.

What is Small Cap Fund?

A Small Cap Fund is an open ended equity mutual fund scheme that, in accordance with SEBI guidelines, invests a minimum of 65% of its total assets in equity and equity related instruments of small cap companies. As per the guidelines provided by the Securities and Exchange Board of India (SEBI), small cap companies are those that are ranked beyond 250th in terms of full market capitalisation, based on market capitalisation data provided from recognised stock exchanges. These funds aim to generate capital appreciation by investing in emerging companies that may have high long term growth potential. However, due to their small size and limited operating history, these investments may experience higher volatility and are generally considered suitable for investors with long term investment horizon and higher risk tolerance.

Key Features of Small Cap Mutual Funds

- Regulatory Classification - Small Cap Mutual Funds are classified under equity schemes and as per SEBI guidelines are required to invest a minimum of 65% of their total assets in equity and equity related instruments of small cap companies. These are companies ranked 251st and below in terms of market capitalisation.

- Focus on Early Stage Companies - These funds typically invest in companies that are in the early phases of their business cycle, offering higher growth potential as they expand and scale operations.

- Higher Risk and Volatility - Due to the relatively smaller size and limited operational history of small cap companies, these funds are more volatile and carry higher risk compared to large and mid cap funds.

- Long Term Investment Orientation - Small cap funds are generally suited for investors with a long term investment horizon, to absorb short term market fluctuations.

- Suitable for Aggressive Investors - These funds are best suited for investors who have a higher risk appetite, are comfortable with interim volatility, and are looking for long term growth opportunities.

Advantages of Investing in Small Cap Funds

1. Higher Growth Potential

Small cap companies are typically in the early stages of their business cycle, which provides greater scope for expansion. With efficient management and favourable economic conditions, these companies may deliver significant long term capital appreciation.

2. Portfolio Diversification

Small cap funds invest across a broad universe of companies from different sectors. This helps in diversifying the investor's equity portfolio, thereby reducing reliance on large-cap or mid-cap segments.

3. Access to Emerging Opportunities

Many small-cap stocks are less tracked by market analysts, offering fund managers the opportunity to invest in businesses with relative potential before they are widely recognised. This bottom up approach can help capture early stage growth stories.

4. Possibility of Better Long-Term Returns

Over longer investment horizons, small cap funds have historically demonstrated the potential to outperform larger cap funds, primarily due to their exposure to growth oriented companies. However, such performance is not guaranteed and may vary across market cycles.

5. Opportunity to Discover Emerging Companies

Small-cap funds give retail investors a chance to invest in companies that may be tomorrow’s industry leaders. A notable example is the Kotak Small Cap Fund, which focuses on growth oriented businesses within the small-cap segment.

What are the Risks Involved in Small Cap Mutual Funds?

- High Volatility: Small-cap stocks often experience sharp price fluctuations due to lower market capitalization and sensitivity to economic or sectoral changes.

- Liquidity Concerns: These stocks may be thinly traded, making it difficult to buy or sell large quantities without impacting the price significantly.

- Market Risk: Small-cap companies are more vulnerable during market downturns and economic uncertainties, which can lead to underperformance compared to large cap peers.

Characteristics of Small Cap Mutual Funds

- High Growth Potential - These funds invest in companies that are often in the early stages of growth. With the right business environment and execution, such companies may offer long term capital appreciation.

- Higher Volatility - Small cap stocks are generally more sensitive to market movements, which can lead to frequent price fluctuations. This makes small cap funds more volatile compared to large or mid cap funds.

- Lower Liquidity - Due to lower trading volumes in small cap stocks, entering or exiting positions may take longer, especially during periods of market stress. This can impact the ease of transactions for the fund.

- Possibility of Mispricing - Small cap companies are less frequently tracked by analysts, which can result in inefficient pricing. This gives fund managers the opportunity to identify undervalued businesses with strong fundamentals.

- Suitable for Long Term Investors - Small cap mutual funds are suited for investors with a long investment horizon and higher risk tolerance. Short term market volatility may affect performance, but a long term approach can help smooth out returns over time.

How Does a Small Cap Mutual Fund Work?

A small cap mutual fund pools money from investors to invest as per scheme’s investment objective in small cap companies. The fund can be actively or passively managed, aiming to capitalize on the growth potential of these companies. While the potential for higher returns exists, the fund also comes with greater risk and volatility. Investors earn returns through capital gains or dividends and pay management fees or expense ratios for the fund’s operation.

To evaluate the performance of the fund, you can monitor the Net Asset Value (NAV), which reflects how the fund is performing in real time. NAV is crucial for understanding the value of your investment and making informed decisions.

Why Should You Invest in a Small Cap Fund?

Small cap mutual funds provide investors with the opportunity to invest in emerging businesses that have the potential for substantial long term growth:

- These companies are typically in the early stages of their development and may grow into future market leaders if managed well and supported by favourable economic conditions.

- For investors with a long term investment horizon and a higher risk tolerance, small cap funds can be a useful tool for capital appreciation.

- By participating early in the growth cycle of such companies, investors may benefit from value creation over time.

However, small cap funds are also more volatile and may experience sharp fluctuations in the short term. Therefore, they are suited for investors who can withstand interim market movements and are focused on long-term wealth building.

Who Should Invest in Small Cap Mutual Funds?

Small cap mutual funds are suitable for investors who have the capacity to withstand higher short term volatility and are focused on long term capital growth. These funds are suited for:

1. Investors with a Long Term Horizon

Individuals who can remain invested for long term, allowing time for the portfolio companies to grow and for market cycles to play out.

2. Investors with a Higher Risk Appetite

Small cap funds can experience significant fluctuations in the short term. Hence, they are appropriate for those who are comfortable with market volatility and do not require immediate liquidity.

3. Those Looking to Diversify Their Equity Portfolio

Small cap funds can complement large and mid cap holdings by adding exposure to emerging businesses with high growth potential, thereby enhancing overall diversification.

How to Invest in Small Cap Mutual Funds?

- Assess Suitability: Small cap funds are volatile. Invest only if you have a long term horizon and high risk appetite.

- Research Schemes: Compare funds based on their objective, past performance, risk, and costs.

- Choose Investment Type: Decide between SIP (Systematic Investment Plan) or lump sum, based on your financial plan.

- Complete KYC: KYC compliance is mandatory before investing in mutual funds.

- Track Periodically: Monitor performance against your goals. Avoid reacting to short term movements.

- Know Charges & Taxes: Understand the expense ratio, exit load, and capital gains tax applicable.

Taxation Rules of Small Cap Mutual Funds

Small cap mutual funds are treated as equity oriented mutual funds for taxation purposes. The applicable tax depends on the holding period:

- Short-Term Capital Gains (STCG) - Applies when units are redeemed within 12 months.

- Long-Term Capital Gains (LTCG) - Applies when units are held for more than 12 months.

Tax treatment is subject to change as per applicable laws. Investors are advised to refer to the latest Kotak Tax Reckoner for updated guidance.

Conclusion

Small cap mutual funds offer investors access to high growth potential companies that are still in the early stages of their business journey. Backed by SEBI’s clear classification norms and investment regulations, these funds are well structured to help long term investors participate in India’s growth story through emerging businesses. However, given their inherent volatility, these funds are suited for investors who can tolerate short term market fluctuations and have a long term investment horizon. A disciplined approach, supported by proper research, risk assessment, and alignment with financial goals, is essential before allocating capital to this category.

Frequently Asked Questions

1. What is small cap mutual funds meaning?

Small cap mutual funds invest in stocks of companies ranked below the top 250 by market capitalization. These are typically newer, smaller businesses with relatively high growth potential but also carry higher risk.

2. What are the main advantages of investing in small cap mutual funds?

The key benefits include higher growth potential, portfolio diversification, access to undiscovered companies, and the chance to invest early in emerging market leaders.

3. What is the major risk of investing in a small cap fund?

The primary risk is high volatility. Small cap stocks can experience dramatic price swings and are more vulnerable to market downturns and liquidity issues.

4. Who can invest in small cap mutual funds?

Anyone with a high risk appetite, a long term investment horizon, and the patience to handle market fluctuations can consider small cap mutual funds. They are suitable for young professionals or investors looking to diversify aggressively.

Disclaimers:

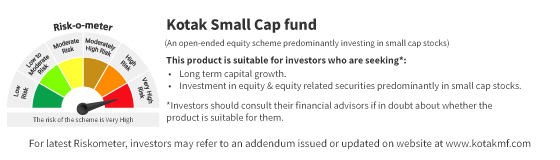

Kotak Small Cap Fund

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.