19 Dec 2023

In the last few years, the Mutual Fund Industry has grown significantly. As we (Kotak Mutual Fund) turned 25 years, let's look back at the history of mutual funds in India and our journey so far.

The history of mutual funds in India dates back to the mid-1960s. India’s first mutual fund was established in 1963, namely, Unit Trust of India (UTI), by an Act of Parliament and functioned under Reserve Bank of India (RBI).

In 1987, public sector banks and Life Insurance Corporation of India (LIC) and General Insurance Corporation of India (GIC) were allowed to set up mutual funds.

The Indian securities market gained greater importance with the establishment of SEBI in April 1992 to protect the interests of the investors in securities market.

In 1993, the private sector entered the mutual fund industry with the launch of Kothari Pioneer Mutual Fund, which was later acquired by Franklin Templeton Mutual Fund.

After five years, in 1998, Kotak Mahindra Mutual Fund launched 2 funds- Kotak Gilt Long term fund (which is called Kotak Gilt Fund now), Kotak Gilt Savings short term fund (which is now called Kotak Banking PSU Debt Fund). Both the funds were allotted on 29th December, 1998. (Source: KAMC Fact sheet)

Our first branch was started in April 1998 in Mumbai’s Bakhtawar building, Nariman point area with approx. 15 employees. Today we have 100 branches across the country catering to over 28,000 pin codes with over 700 employees. (Source: KAMC Internal)

We had a modest start with Asset under Management (AUM) of 91 Crore and over 500 investor folios in 1998. (Source: KAMC Internal)

In 5 years, we reached AUM of nearly 3000 Crore in March 2003 with over 93,000 investor folios. (Source: KAMC Internal)

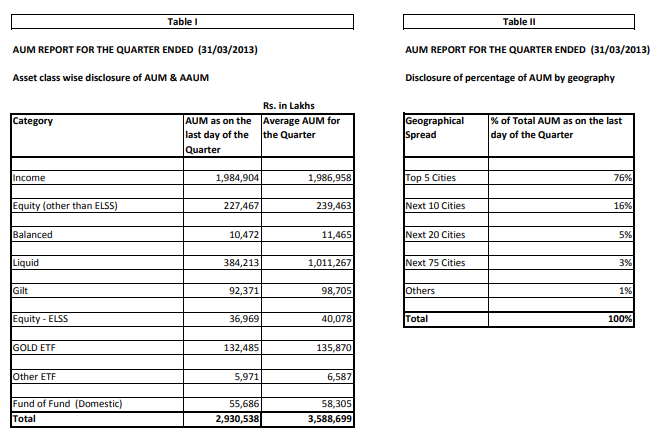

And in next 10 years, the AUM size had grown to 29,000 Crore in March 2013 with over 22 Lakh investor count. (Source: KAMC website disclosure)

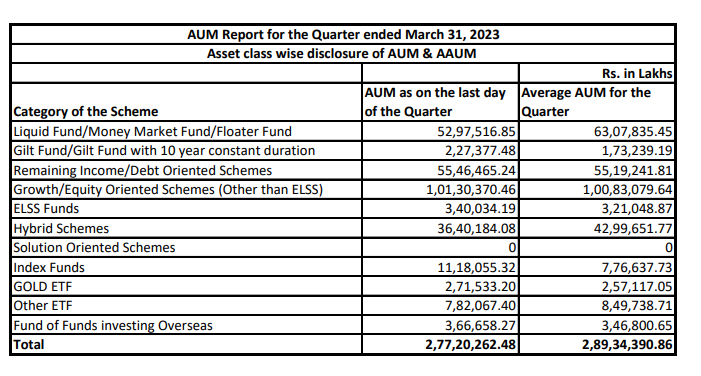

The AUM went on to reach 2.7 Lakh Crore in March 2023- over 11 fold growth in the last 10 years. (Source: KAMC website disclosure)

Fast forward to today, we manage an AUM of over 3.3 Lakh Crore as on Sep, 2023 (Source: AMFI, KAMC Website disclosure)

We are ranked as the 5th largest Mutual Fund company, based on quarterly average AUM as of September 2023. We were at 9th position in the same quarter 10 years ago in 2013. (Source: AMFI - https://www.amfiindia.com/research-information/aum-data/average-aum)

Well, MF Distributors have been providing the much needed last mile connect with investors, particularly in tier II and tier III cities. We at Kotak, started with 32 distributors back in December 1998. Today we have over 79,000 distributors all over India. (Source: KAMC Internal)

Mutual funds have become a popular investment choice among retail investors. The industry's AUM reached the milestone of 10 Trillion (10 Lakh Crore) for the first time on May 31, 2014. Currently, the overall size of the Indian MF Industry is ₹ 49.05 trillion- 6 fold growth in 10 years and the no. of investor folios is 16.18 Crore as on 30-Nov-2023. In April 2016, the no. of SIP accounts has crossed 1 Crore mark and as on 30th November 2023 the total no. of SIP Accounts are at 7.44 Crore. (Source: AMFI)

However, there is a huge untapped market. About 18 Crore Indians are venturing into crypto-currencies, 2 Crore into high-risk Ponzi schemes, and nearly 10 Crore are engaged in online gaming platforms, which lack investor protection and ignores the transparent and well regulated nature of mutual fund industry. (Source: FICCI - https://ficci-capam.com/CAPAM-Compendium-of-Articles.pdf)

Mutual Fund Industry’s AUM-to-GDP ratio stands at 16%, well below the global average, indicating vast growth potential. Despite increased internet usage, Mutual Fund’s main business is still concentrated in top cities. There is growing interest from middle-income earners, yet only 2% of Indians invest in mutual funds. (Source: FICCI)

As Indians are steadily moving towards investing in financial assets, participate in your wealth creation journey through Mutual Funds.

Disclaimer

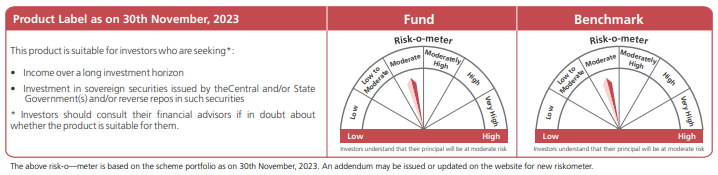

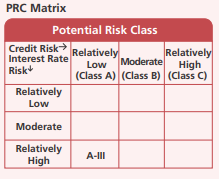

KOTAK GILT FUND

An open ended debt scheme investing in government securities across maturity. A relatively high interest rate risk and relatively low credit risk.

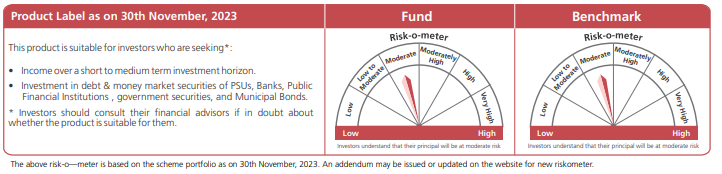

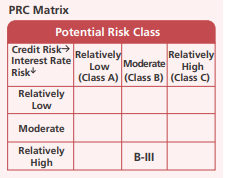

KOTAK BANKING AND PSU DEBT FUND

An open ended debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds. A relatively high interest rate risk and moderate credit risk.

The document is not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

The document may include statements/opinions which contain words or phrases such as "will", "believe", "expect" and similar expressions or variations of such expressions that are forward looking statements. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with the statements mentioned with respect to but not limited to exposure to market risks, general economic and political conditions in India and other countries globally, which may have an impact on services and/or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc.

Past performance may or may not be sustained in future. Investors may consult their financial advisors and /or tax advisors before making any investment decisions. Kotak Mahindra Asset Management Company Limited (KMAMC)/ Kotak Mutual Fund (KMF) is not guaranteeing or promising or forecasting any returns/future performance.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.