13 Nov 2025

Investors often face the dilemma of where to park their surplus funds should they aim for slightly higher returns with moderate risk or prioritize stability and liquidity. Gilt funds and liquid funds are two popular debt mutual fund options that serve different purposes. While gilt funds primarily invest in government securities offering long term potential, liquid funds focus on short term instruments to provide relative stability and quick access to cash. Understanding their differences, benefits and suitability can help you make informed investment decisions.

Key Takeaways

Gilt Funds

- Invest mainly in government securities and state development loans

- Suitable for medium to long term goals (3+ years)

- Low credit risk but sensitive to interest rate fluctuations so NAV can be volatile

- Helps diversify an equity heavy portfolio and provides exposure to government bonds

Liquid Funds

- Liquid funds invest in Debt and money market securities with maturity of upto 91 days only

- Invest in short term, high quality debt instruments like T-bills, CPs, CDs and CBLOs

- Suitable for short term parking of funds typically 7 days to a month

- Very low interest rate risk, NAV may be largely stable and highly liquid

Choosing the Right Fund

- Use Gilt Funds for long term growth and exposure to government securities

- Use Liquid Funds for emergency funds or short term liquidity needs

Taxation

- Both funds are subject to capital gains tax depending on holding period

- Always refer to the latest Kotak Mutual Fund Tax Reckoner for accurate tax information

What are Gilt Funds?

Gilt Funds are debt mutual funds that invest predominantly in government securities (G-Secs) and State Development Loans (SDLs). They are among one of the most utilised forms of debt investments because they carry a sovereign guarantee meaning there is a lesser chance of credit risk. However their returns can fluctuate in the short term because they are sensitive to interest rate movements

- Must invest at least 80% of the corpus in G-Secs and SDLs

- Backed by the central or state government eliminating default risk

- NAVs fluctuate with changes in interest rates, prices rise when rates fall and vice versa

- Fund managers track the interest rate cycle to optimize returns

- Offers an easy way to invest in government bonds without needing a large ticket size

Investors can consider the Kotak Gilt Fund for a professionally managed approach to invest in government securities with risk-adjusted returns

What Are Liquid Funds?

A Liquid Fund is a type of debt mutual fund that invests in short term low risk debt instruments such as Treasury Bills (T-bills), Commercial Papers (CPs), Certificates of Deposit (CDs) and Collateralized Borrowing and Lending Obligations (CBLO). These funds invest only in securities with a maturity period of up to 91 days which makes them highly liquid, less volatile and suitable for capital preservation

- Liquid Funds are suitable for investors who wish to park surplus money for a short duration without locking it in or taking on significant market risk. They are designed to provide stability, quick access to funds and returns that may offer better returns than traditional savings accounts, but not guaranteed.Invest in high quality, short term debt instruments minimizing default risk

- Securities mature within 91 days reducing exposure to interest rate fluctuations

- Returns are relatively predictable and steady

- Investors can withdraw funds anytime without exit load (after 7 days as per SEBI rules)

For a professionally managed option you can consider the Kotak Liquid Fund, which combines liquidity, relative safety and consistent returns, subject to market risks.

Gilt Fund vs Liquid Fund- Key Differences

| Aspect |

Gilt Fund |

Liquid Fund |

|

Primary Investment |

Invests at least 80% of the corpus in Government Securities and State Development Loans |

Invests in short term instruments like T-bills, CPs, CDs and CBLOs with maturity up to 91 days |

|

Risk Profile |

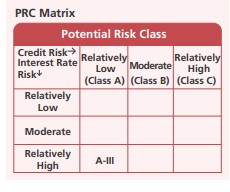

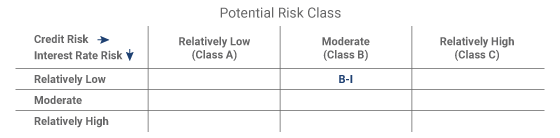

A relatively high interest rate risk and relatively low credit risk |

A relatively low interest rate risk and moderate credit risk |

|

Investment Horizon |

Suitable for medium to long term investors (3 years or more) |

Suitable for very short term parking of funds 7 days to a month) |

| Liquidity |

High but value may vary with interest rate movements |

Very high, NAV remains largely stable |

|

Returns |

Can be volatile in the short term may a full interest rate cycle |

Relatively steady and predictable |

|

Lock In Period |

No lock |

No lock in, small exit load only if redeemed within 7 days |

|

Who Should Invest |

Suitable for investors seeking, long term exposure to government bonds and willing to accept NAV volatility |

Suitable for investors looking for quick access to funds with minimal risk |

Benefits of Gilt Funds

- No Default Risk - These funds invest in government securities backed by the central or state government ensuring near zero credit risk

- Good for Long Term Goals - They may deliver attractive returns over time especially when interest rates decline

- Portfolio Diversification - Gilt funds can bring stability to portfolios that are heavily tilted toward equities by reducing overall risk

Benefits of Liquid Funds

- Possible safety and relatively Stable Option - They invest in high quality, short term debt instruments, minimizing credit and interest rate risk

- Quick Liquidity - Investors can usually redeem their investments and receive the money in one business day (T+1) making them a good option for emergencies or short term needs

- Potentially Higher Returns than Savings Accounts - They typically offer better returns than a regular savings bank account while keeping risk low

Who Should Choose Which?

Gilt Funds are suitable if:

- You have a medium to long term investment horizon (3 years or more).

- You are comfortable with NAV fluctuations and understand the impact of interest rate changes

- You want indirect exposure to government securities without investing directly in bonds

Liquid Funds are suitable if:

- You are looking for a place to park surplus cash for a short period.

- You need quick access to funds with redemptions usually processed within T+1 business day

- You are building an emergency fund or managing short term liquidity requirements

Taxation Overview

Mutual fund taxation is subject to the latest provisions under applicable income tax laws. For the most accurate and updated information, please refer to the latest Kotak Mutual Fund Tax Reckoner.

FAQs

1. Can I use Gilt Funds for short term goals?

Gilt funds are better suited for medium to long term goals (3+ years). For short term needs liquid funds are a more appropriate choice

2. How quickly can I redeem my investment?

Liquid fund redemptions are usually processed within T+1 business day. Gilt funds are highly liquid but may fluctuate in value due to interest rate changes.

3. Are Gilt and Liquid Funds subject to tax?

Capital gains from both fund types are taxed according to holding period and prevailing income tax laws. Refer to the latest Kotak Mutual Fund Tax Reckoner for updated rules.

4. Can I combine both in my portfolio?

Combining gilt and liquid funds can help balance risk and liquidity, liquid funds for emergencies and short term needs, gilt funds for longer term government bond exposure

5. Can interest rate cycles impact my returns in Gilt Funds?

Gilt fund returns are sensitive to interest rate movements, NAV rises when rates fall and falls when rates rise so tracking interest rate trends is important

6. What is the recommended investment horizon for Liquid Funds?

Liquid funds are suitable for very short term goals, typically 7 days to a month making them suitable for parking surplus cash or building an emergency fund

Kotak Liquid Fund

An Open Ended Liquid Scheme. A relatively low interest rate risk and moderate risk rate

Kotak Gilt Fund

An open ended debt scheme investing in government securities across maturity. A relatively highly interest rate risk and relatively low credit risk.

Disclaimers

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.