6 Nov 2025

For over 5,000 years, gold has been a part of human life. The ancient Egyptians believed it was the “flesh of the gods,” while the Romans used it to build their power and wealth. Across time, gold has stood for beauty, faith, and prosperity. It decorated temples and treasures and inspired people to explore new lands in search of its shines.

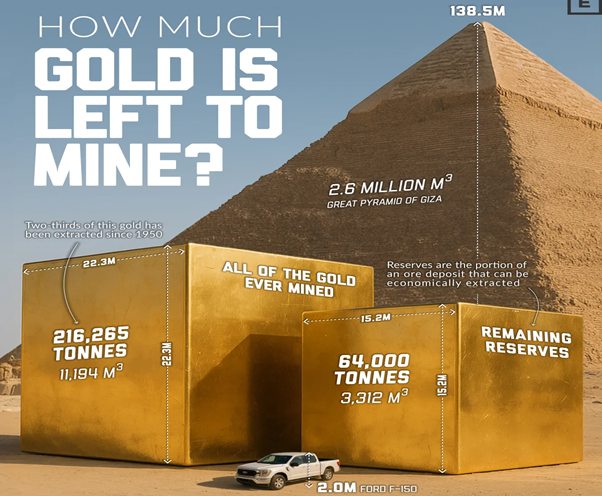

Gold is found naturally in pure form, which made it one of the first metals ever mined. What once began with simple tools and riverbeds has now become a global industry. So far, people have mined about 216,265 tonnes of gold, small enough to fit inside a cube just 22 meters wide, tall, and deep.

Even today, gold holds deep meaning. In India, it is part of every celebration and family tradition. The story of gold mining is really the story of humanity’s endless fascination with something rare, beautiful, and everlasting.

Source: world gold council

Gold Mining and Techniques

Gold is not easy to extract. It’s often locked inside rocks, scattered in rivers, or mixed with other minerals, making mining a complex process. Gold mining is the method of taking gold from the earth by locating deposits, evaluating their potential, and refining the metal to its pure form.

Modern mining blends technology and sustainability to ensure safe, responsible, and efficient operations. It focuses not only on profit but also on protecting the environment and supporting nearby communities.

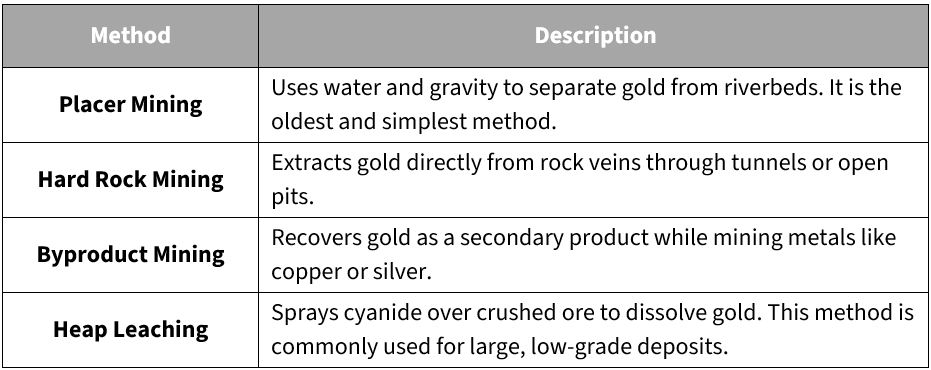

Below are the key methods of gold mining practiced globally, each suited to different geological and economic conditions.

Where the World’s Gold Lies Hidden

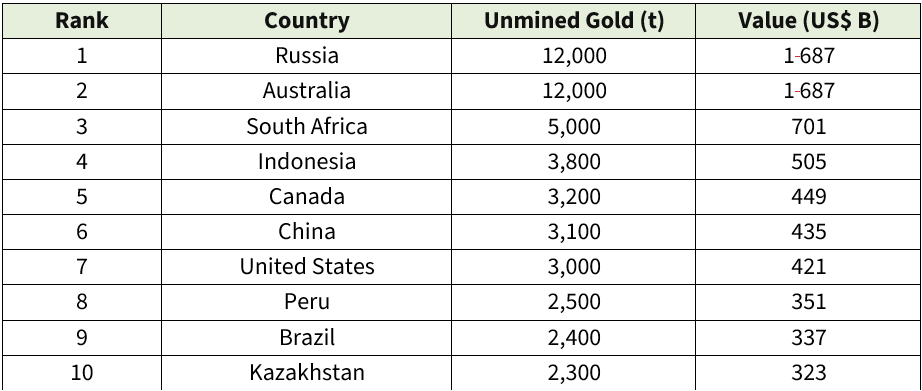

According to the U.S. Geological Survey, global gold reserves total around 64,000 metric tons. Russia and Australia top the list with 12,000 tonnes each, worth about $1.7 trillion apiece.

Top 10 Countries with the Largest Gold Reserves.

Source: U.S Geological survey January 2025, Visual Capitalist, investingnews.com, as per latest data available.

Even after centuries of mining, vast gold-rich zones remain underexplored. The Ife–Ilesha Belt in Nigeria shows high gold potential, Australia’s northern Victorian region could hold millions of ounces still undiscovered, and India’s North Singhbhum and Rengali belts reveal geological signs of hidden reserves.

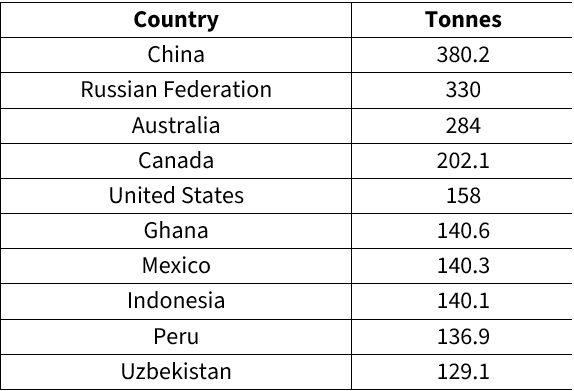

Global Gold Production by country

Gold mining is a global business with operations on every continent, except Antarctica. At a country level, China was the largest producer in the world in 2024 and accounted for around 10 per cent of total global production.

Below are the top 10 gold producing countries in the world.

Source: Metals Focus; World Gold Council, Data as of 31 Dec 2024, Production volumes for 2024, as per latest data available.

How Much Gold Exists and How Much Is Left

Nearly three-quarters of all known gold has already been mined. As major discoveries become rare and mining costs rise, the industry’s focus is shifting toward gold recycling and urban mining, extracting gold from discarded electronics and old jewellery. This approach is fast becoming part of sustainable gold mining, helping meet demand while reducing environmental impact.

Source: Visual Capitalist, World Gold Council, Data as of Dec 2024, as per latest data available.

Use of the company brand names does not imply any affiliation with or endorsement by them or any of its holding companies, subsidiaries or affiliates and are used for illustrative purpose only.

Gold Mining in India: From Kolar’s Past to Hutti’s Present.

India shines when it comes to buying gold, but not when it comes to mining it. Our mines produce only a tiny share of the gold we consume.

For over a century, the Kolar Gold Fields in Karnataka were a global legend among the deepest mines on Earth. They closed in 2001, leaving behind a rich legacy and silent shafts. Today, only the Hutti Gold Mine in Raichur still operates at scale, contributing most of India’s mined gold.

So why don’t we produce more? The old mines are deep and costly, and newer exploration has been slow. Yet, things are changing. The government’s mining reforms, exploration auctions, and projects like Ganajur and Jonnagiri show that India is reopening its golden doors. If successful, these efforts could reduce import dependence and revive forgotten mining towns.

Future is Golden: Opportunities Transforming the Mining World

The gold mining industry is standing at an important phase of change of growth and innovation. With gold prices near record highs and global demand surging, miners have the perfect opportunity to expand and modernize.

Emerging Opportunities

- Technology & AI: Automation, data analytics, and satellite exploration help locate deposits faster and cut costs.

- Sustainable Mining: Renewable energy, eco-friendly leaching, and better waste management are reducing environmental footprints.

- New Frontiers: Africa, Asia, and Latin America offer vast untapped potential, with global majors partnering local miners to share capital and expertise.

- Gold Recycling: Urban mining involves extracting gold from discarded electronics. It is creating a sustainable secondary supply.

- Ethical Sourcing: Transparent, traceable supply chains attract investors and consumers who value responsible gold.

By embracing technology, sustainability, and collaboration, the industry can ensure long-term growth and a cleaner, fairer future.

Economic and financial Challenges

Gold mining remains a high-cost, high-risk business. Profitability depends on All-In Sustaining Costs (AISC), efficient mines thrive even during price dips, while high-cost ones struggle.

When prices crash, as in 2013, many miners cut spending or closed unprofitable sites.

Developing a modern mine often costs billions of dollars and success depends on rich ore and operational excellence.

Key Challenges

- Price Volatility: Rapid swings test even strong balance sheets.

- Declining Gold Yield: Gold grades have dropped over 30% since the 1990s, and today a tonne of ore yields just 1–5 grams, driving up mining costs and lowering efficiency.

- ESG Pressures: Clean water use, safe waste handling, and community engagement raise costs but build trust.

- Environmental Impact: Each ounce of gold leaves behind roughly 20 tonnes of waste.

- Political Risks: Tax disputes and policy changes — like Acacia Mining’s case in Tanzania can disrupt operations.

In the end, success in mining isn’t just about finding gold. — Iit’s about mastering the economics, ethics, and politics around it.

Source: earthworks.org

Creating Gold in the Lab: Fascinating but Far from Practical

For thousands of years, alchemists searched for a way to turn base metals into gold. In modern times, science has achieved it, though not quite the way they imagined.

By firing neutrons at metals such as platinum or mercury, scientists can change their atomic structure and create small amounts of gold. It is real gold, but with a big problem: it is radioactive and extremely costly to make.

Producing even a few milligrams of artificial gold requires a nuclear reactor and complex chemical purification. The process is so expensive that the gold costs far more to create than it is worth. After a few days, much of it even decays back into other elements.

So, while lab-grown gold exists, it is neither practical nor safe for commercial use. In the future, scientists might find a way to make gold safely and affordably. Until then, real gold remains one of Earth’s most precious treasures, best mined, not made.

The Road Ahead

Gold mining is evolving fast. High prices and demand offer promise, but challenges like rising costs, tighter rules, and environmental scrutiny — are real.

To thrive, miners must:

- Embrace innovation and clean technology

- Partner with local communities

- Maintain financial discipline

- Commit to transparency and responsible mining

Large new gold finds are rare, so mergers, recycling, and smarter operations are key to growth. Nations like Australia and Canada lead in green mining, while India is strengthening its recycling ecosystem.

Ultimately, the future belongs to miners who can balance profit with purpose, — protecting people, the planet, and the enduring allure of gold.

Arijit Dutta, Vice President at Kotak AMC, adds - Gold is much more just than a store of wealth. Unlike currency, no single government can devalue it, making it a stable form of wealth. It is also a financial stabilizer, a place for wealth in other forms can be transferred in times of economic turbulence, thanks to its high liquidity. Although high liquidity, gold is scarce and this scarcity has contributed to its preciousness.

Source: Visual Capitalist, World Gold Council, Metals Focus, E&Y, xtb.com, U.S Geological survey January 2025, investingnews.com, as per latest data available

The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s). These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.