28 Jan 2026

As the global energy transition accelerates, one challenge is becoming increasingly clear: power systems must deliver both decarbonisation and reliability at scale. While renewable energy capacity is expanding rapidly, the need for stable, round-the-clock electricity is bringing nuclear power back into policy and investment discussions. After decades of technological refinement, nuclear energy is re-emerging as a critical pillar in the future electricity mix—globally and in India.

Nuclear energy is a form of energy released from the nucleus of an atom. In today’s power systems, it is produced mainly through a process called nuclear fission, where atoms of uranium are split in a controlled environment inside a nuclear reactor. This heat is used to generate steam, which drives turbines to produce electricity. Unlike fossil Fuels, Nuclear power does not emit carbon dioxide during generation and provides continuous and round the clock power.

Uranium: The Backbone of Nuclear Energy

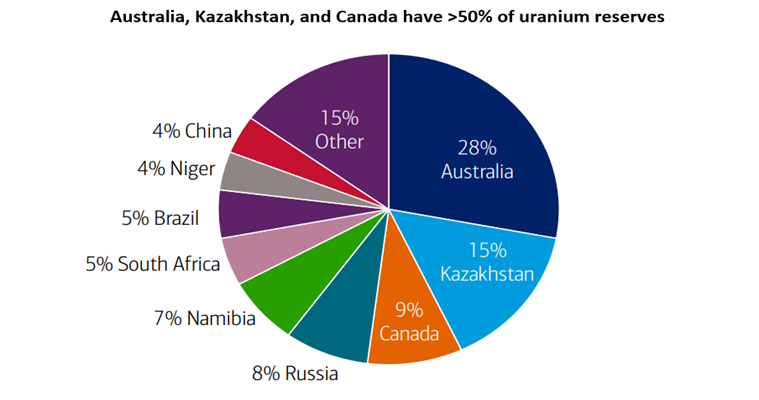

Uranium is the core fuel for nuclear power, with an estimated 35 trillion tons present in the Earth’s crust, though unevenly distributed. Nearly two-thirds of global production comes from Kazakhstan, Canada, and Australia, with Australia alone holding 1.7 million tons, or ~28% of known reserves. The US imports about 64% of its uranium from these countries.

Almost 99% of mined uranium is used for nuclear energy, which generates around 10% of global electricity. Looking ahead, rising global power demand is expected to drive uranium consumption higher, while supply constraints point to a tightening market over the coming decade.

Uranium resources by country:

Source: BofA Global Research report dated 12th Jan 2026

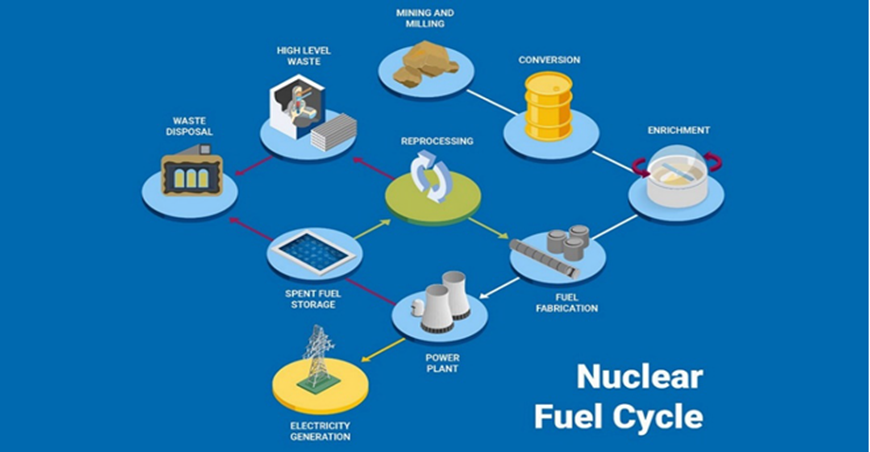

The nuclear fuel cycle

Uranium goes through several steps before it can generate electricity. It starts with mining and milling, producing yellowcake, which is then converted into uranium hexafluoride (UF₆) gas. Natural uranium contains just 0.7% U-235, so it must be enriched to 3–5% for standard reactors (LEU) or up to 20% for advanced reactors (HALEU).

The enriched uranium is made into fuel rods, loaded into reactors, and split through fission, releasing heat that drives turbines and produces power. After use, the fuel becomes highly radioactive spent fuel, some can be reprocessed, but long-term storage and disposal remain one of nuclear energy’s biggest challenges.

Uranium must go through several steps before it can be used in nuclear power plants

Source: IAEA, BofA Global Research report dated 12th Jan 2026, Low-enriched uranium (LEU), high-assay low-enriched uranium (HALEU).

Small Modular Reactors (SMRs): The Next Wave in Nuclear Power

Small Modular Reactors, or SMRs, are compact nuclear power plants that produce up to 300 MW of electricity per unit, much smaller than traditional reactors that often exceed 1,000 MW. What makes SMRs exciting is their modular design: major components are factory-built and then shipped to the site for assembly, speeding up construction and cutting costs compared with conventional plants.

Globally, more than 80 SMR designs are in development across 18 countries, led by the US (22 designs), Russia (17), China (10), Canada (5), and the UK (4). Their flexibility means SMRs can power remote communities, industrial hubs, or mini grids that large plants cannot easily serve.

SMRs offer several advantages. They produce 24/7 low-carbon power, helping cut greenhouse gas emissions and support climate goals. Construction times can shrink to 3–5 years, much faster than traditional reactors’ 8–15 years. Many designs include passive safety features and smaller cores, which can reduce accident risk and improve public trust. Refuelling intervals are longer—often every 3–7 years, with some designs operating up to 20 years without refuelling.

However, challenges remain. Upfront costs for an SMR still range roughly $300 million to $2 billion, and regulatory hurdles and public concerns about nuclear waste and safety could slow adoption. Still, as countries seek reliable, carbon-free power, SMRs are gaining attention as a flexible complement to renewables, with potential to expand nuclear’ s reach in the clean energy transition.

Source: carboncredits.com, data as of Sep 2025, as per latest data available

Why Nuclear Power Stands Out?

Reliable power: Electric grids need constant baseload power. Nuclear plants are among the most reliable energy sources, operating about 93% of the time (capacity factor). This far exceeds wind (35%), and solar (25%). Because nuclear runs continuously, it provides stable electricity, unlike wind and solar which depend on weather and require storage or backup power.

Cost over time: While nuclear plants are expensive to build, they are highly economical over their long operating lives. Once online, they generate large volumes of power for decades. When system-level costs such as storage, transmission, and efficiency losses are included, nuclear ranks among the lowest-cost energy sources and delivers a strong energy return on investment (EROI), higher than coal and natural gas.

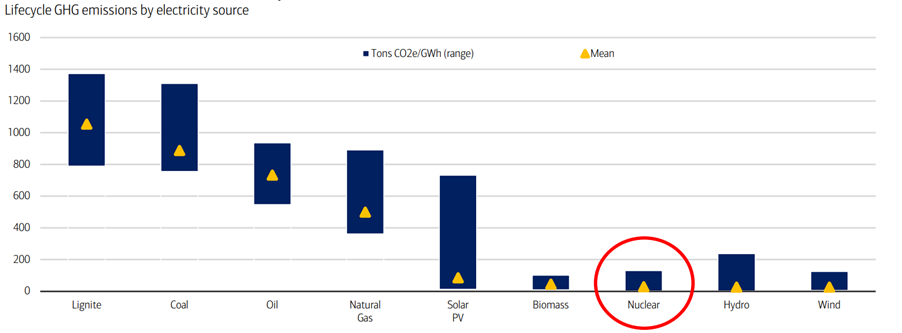

Low emissions: Across its full lifecycle—including construction, fuel use, and decommissioning—nuclear power produces very low greenhouse gas emissions, comparable to wind and far lower than fossil fuels.

Efficient land and material use: To produce 1 TWh (Terawatt – Hour) of electricity, nuclear requires about 900 tons of materials, versus over 16,000 tons for solar. A 1,000 MW nuclear plant occupies just 1.3 square miles, far less land than solar or wind.

Long life and safety: Nuclear plants can operate 40–100 years with maintenance. Modern designs are highly safe, producing only 3 cubic meters of high-level waste per year per 1,000 MW plant, much of which can already be safely managed.

Safety: Advances in engineering and containment have made nuclear power much safer. A 1,000 MW nuclear plant produces only 3 cubic meters of high-level radioactive waste per year when recycling is used. While disposal remains a challenge, about 90% of this waste can already be managed safely, as nuclear power expands, waste-handling solutions are expected to improve further.

Source: BofA Global Research report dated 12th Jan 2026

Nuclear is cleaner than most other power sources

Source: World Nuclear Association, BofA Global Research

Why Nuclear Energy Is Back in the Global Spotlight?

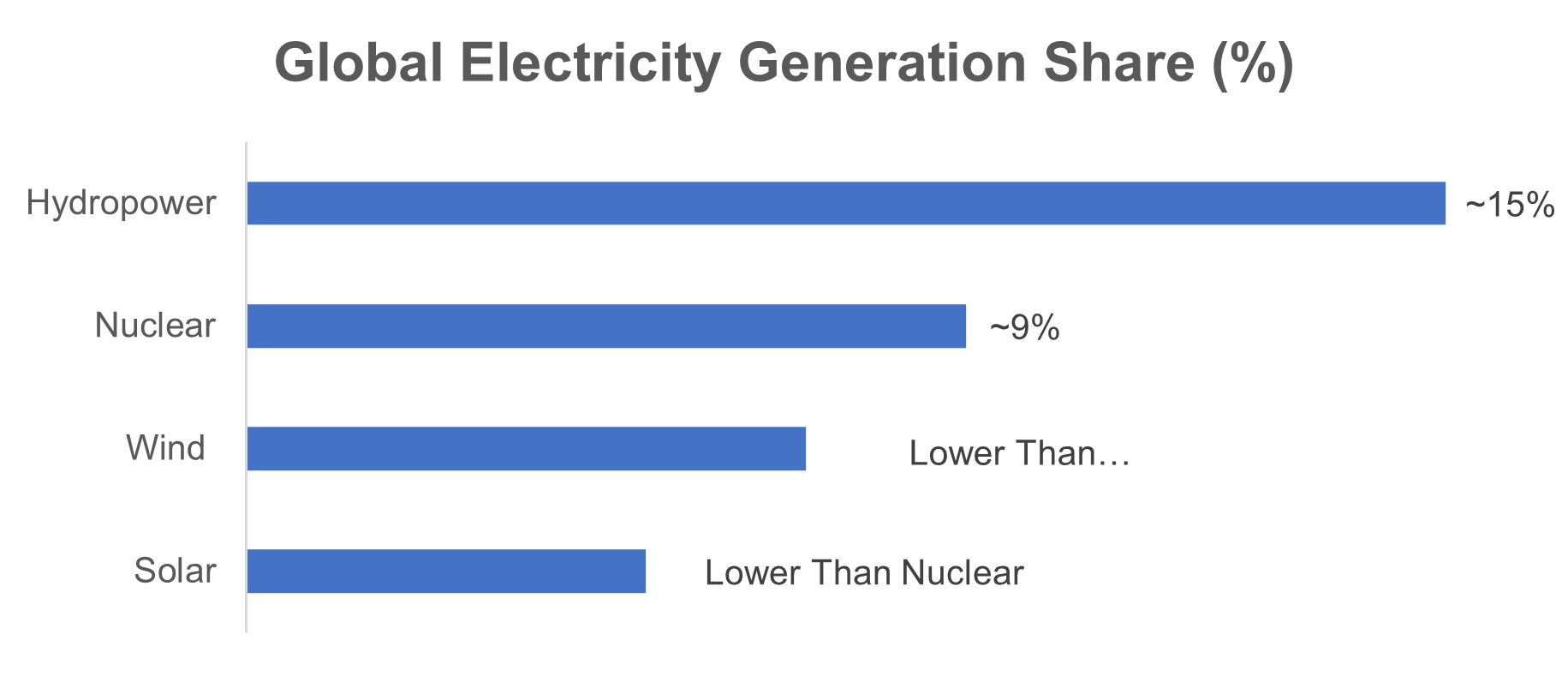

Nuclear power supplies about 9% of global electricity, making it the second-largest low-emission energy source after hydropower. While many countries use nuclear energy, output is concentrated among a few leaders. The US accounts for ~30% of global nuclear generation, followed by China (~15%) and Russia (~8%) (Source: World Nuclear Association).

For years, nuclear investment slowed due to safety concerns and high costs. That is now changing. Electricity demand is rising fast, driven by industrial growth, electrification, data centres, and AI.

As a result, governments are reassessing nuclear power as it delivers stable, low-carbon electricity at scale. Energy security, climate goals, and the need for 24/7 power in a digital economy are pushing nuclear energy into a new phase of growth.

Source: International Energy Agency; Goldman Sachs Global Institute, as per latest data available

Global Trends in Nuclear Investment

Global investment in nuclear energy is picking up as countries look for clean, reliable, 24/7 power. The US Department of Energy has committed $3.2 billion to next-generation nuclear technologies, including Small Modular Reactors (SMRs) and Advanced Nuclear Reactors (ANRs). Of this, $1.2 billion supports the Advanced Reactor Demonstration Program, which aims to have two advanced reactors operating by the late 2020s.

Other countries are following suit. Canada is investing $970 million in an SMR project via its Strategic Innovation Fund, while the UK has committed £1.7 billion ($2.1 billion) to Rolls-Royce SMRs.

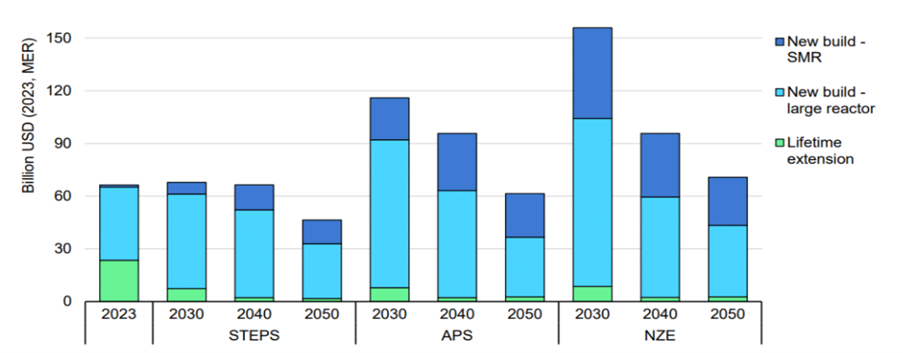

Globally, nuclear investment is around $65 billion per year today. Under current policies, this could rise to $70 billion by 2030, with nuclear capacity growing 50% to ~650 GW by 2050. With net zero emissions by 2050 scenario, investment could reach $120–150 billion by 2030, and capacity could exceed 1,000 GW by 2050.

SMRs are a key growth area. Investment in SMRs could jump from $5 billion today to $25 billion by 2030, with over 1,000 SMRs (120 GW) deployed by 2050. If costs fall further, SMR capacity could reach 190 GW, unlocking up to $900 billion in global investment.

Global investment in nuclear energy by scenario and type, 2023-2050

Notes: MER = market exchange rate; SMR = small modular reactor; STEPS = Stated Policies Scenario; APS = Announced Pledges Scenario; NZE = Net Zero Emissions by 2050 Scenario. Source: IEA (2024), World Energy Outlook 2024.”

China, India and Russia to Reshape the Next Phase of Nuclear Power

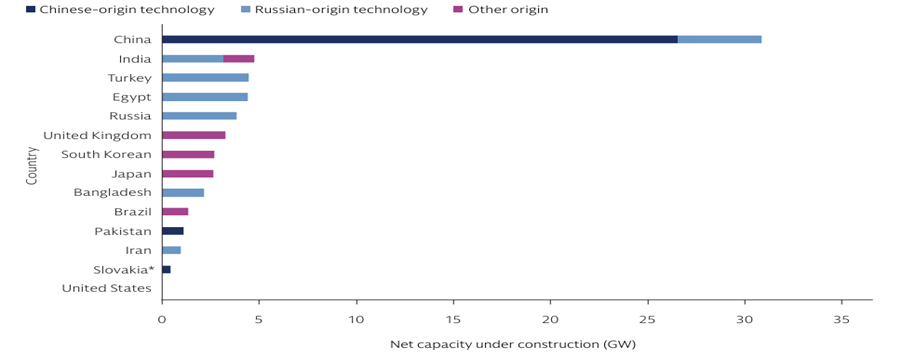

The biggest change in nuclear energy today is where new plants are being built and who supplies the technology. Most nuclear capacity currently under construction is in emerging economies, not advanced markets. China leads global additions, with a large share based on home-grown Chinese reactor technology.

Outside China, new projects in India, Turkiye, Egypt, and Bangladesh rely largely on Russian reactor technology, showing that nuclear supply is concentrated among a small number of players. In contrast, advanced economies have limited new construction and are mostly extending the life of existing reactors or cautiously returning with new designs.

Overall, this marks a structural shift in global nuclear growth—capacity expansion is being driven by emerging markets, while technology supply remains highly concentrated. India stands out as a key country shaping the next phase of nuclear expansion, both as a major growth market and part of the evolving global nuclear landscape.

Nuclear reactor capacity under construction and national origin of technology

Note: * Russian Reactor Design, Source: JAEA PRIS Database and World Nuclear Industry Status Report; Goldman Sachs Global Institute, as on September 2025. Note: SMRs Are Excluded From this dataset

India’s Nuclear Energy Goals

India is not starting from scratch. The country already operates a young nuclear fleet and has several reactors under construction. Under the National Electricity Plan 2023, India plans to add around 13 GW (Gigawatt) new nuclear capacity by 2032, reinforcing nuclear power as a key source for future electricity needs.

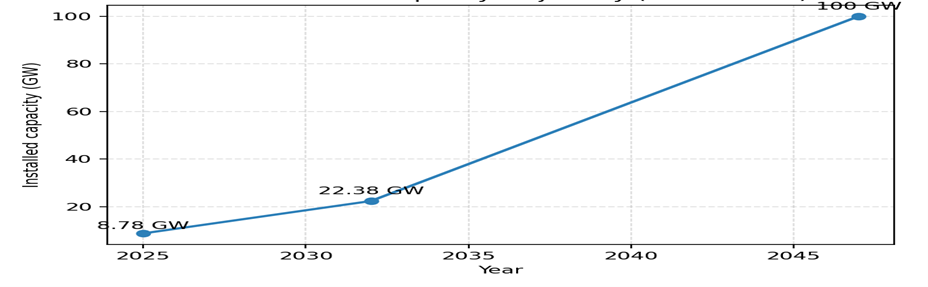

Looking further ahead, India has set an ambitious long-term goal of 100 GW of installed nuclear capacity by 2047, positioning nuclear energy as a strategic pillar for energy security and grid stability. As of 2025, India’s operating nuclear capacity stands at about 8.8 GW, with projects under construction expected to raise this to roughly 22.4 GW by 2031–32. This reflects a shift from incremental growth to meaningful scale expansion.

The policy framework also encourages indigenous capability development, reducing dependence on imported reactors and fostering domestic design, engineering, and manufacturing. This aligns with broader goals like Atmanirbhar Bharat, strengthening India’s technological self-reliance.

Momentum has been boosted by the Nuclear Energy Mission announced in the Union Budget 2025–26, which allocates ₹20,000 crore for research, design, and deployment of Small Modular Reactors (SMRs). The plan includes developing at least five indigenously designed SMRs by 2033, signalling a strategic shift toward home-grown innovation.

Together, these policies explain why India is prominent in global nuclear growth projections. As electricity demand rises and grid stability becomes more critical, nuclear energy is set to remain a core component of India’s power mix, complementing renewables while anchoring reliability, resilience, and energy security.

India: Nuclear capacity trajectory (2025 to 2047)

Source: Press Information Bureau (PIB); Central Electricity Authority (CEA). Note:2032 are Expected Numbers and 2047 figure reflects stated government aspiration, not a projection.

Key Challenges in Nuclear Power

Nuclear power delivers clean and reliable electricity, but several hurdles slow its growth. The biggest is long construction timelines. Globally, large nuclear plants take about 7 years to build, but in India this often extends to 10 years or more. Delays linked to land acquisition and public opposition can be severe—Kudankulam took nearly 16 years.

Safety perception is another challenge. While modern reactors are far safer, events like Fukushima still influence public opinion. This results in stricter regulations, longer approvals, and local resistance.

Fuel dependence also matters. Many countries rely on uranium imports, and supply is highly concentrated. Kazakhstan supplies ~43% of global uranium, followed by Canada at ~15%, creating supply-chain risks.

Finally, economics remain tough. Nuclear projects often face cost overruns, especially for first-of-a-kind designs. Even SMRs, despite their promise, have seen 2–4× cost increases and 10+ year development timelines. Together, long timelines, cost overruns, safety concerns, and fuel risks remain key barriers to faster nuclear expansion.

Source: Bernstein Research Oct 2025, as per latest data available

Conclusion: Poised to Power the Next Era

Nuclear energy is entering a revival phase, driven by rising electricity demand, climate commitments, and the limits of intermittent renewable power. Global nuclear capacity is projected to grow from 442 GW today to about 683 GW by 2040, as countries look for reliable baseload electricity. Nuclear is being “rediscovered” as electrification accelerates across transport, industry, and digital infrastructure—especially with the surge in AI and data-centre power demand.

China and USA are expected to lead new reactor additions, while emerging markets such as India, Türkiye, and Egypt are expanding capacity with support from global technology partners. Small Modular Reactors (SMRs) add long-term promise through factory-built designs and smaller land footprints, though they are likely to scale meaningfully only post-2035 due to high initial costs and long development timelines.

Policy momentum is strengthening. In India, the Nuclear Energy Mission and the SHANTI Bill set a target of 100 GW of nuclear capacity by 2047 and enable private-sector participation for the first time. This positions nuclear power at the intersection of energy security, low-carbon growth, and grid stability.

Overall, nuclear energy is set to become a critical backbone of the future energy mix—delivering clean, reliable, round-the-clock power in an increasingly electrified and digital world.

Source: BofA Global Research report dated 12th Jan 2026

Arijit Dutta, Fund Management - Equity Research & Vice President at Kotak AMC, adds - Nuclear being the only non-polluting, reliable and 24/7 generation alternative to fossil powered power plants. Safety measures taken by the nuclear power plants in India is higher vs global peers and therefore the risks are minimal vs feared.

Dhananjay Tikariha, Fund Manager & Senior Vice President at Kotak AMC adds - As the world accelerates toward a cleaner future, nuclear energy stands out as the rare power source that may deliver what humanity needs most — reliability, scale, and near‑zero emissions. With advances like SMRs and decades of proven performance, nuclear power is emerging not just as an alternative, but as the backbone of a stable, sustainable, and electrified tomorrow.

KMAMC is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sectors/stocks mentioned in this slide do not constitute any recommendation and Kotak Mahindra Mutual Fund may or may not have any future position in these sectors/stocks. Companies mentioned don’t constitute recommendation, brand name affiliation disclaimer & companies mentioned for illustrative purpose only.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.