6 Jan 2026

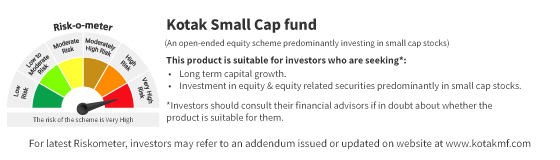

Kotak Small Cap Fund is designed for investors seeking long term wealth creation by participating in the growth potential of small cap companies. Small caps are businesses that are still in their expansion phase. The fund follows a well defined investment strategy and maintains a disciplined asset allocation framework as specified in its Scheme Information Document (SID). With a blend of equity exposure, diversification across sectors, selective debt investments and prudent risk controls, the fund seeks to participate in the long term growth opportunities that small cap companies may offer.

Key Takeaways

- Kotak Small Cap Fund invests at least 65% in small cap companies following SEBI Categorization and Rationalization of schemes.

- The fund prefers businesses with proven products, strong earnings growth and undervalued long term potential

- It diversifies across sectors and may invest selectively in debt, money market instruments and IPOs

- Up to 35% of assets can be invested in overseas securities including ADRs, GDRs, foreign equities and international funds.

- Internal exposure limits ensure a disciplined and risk aware investment approach

- The fund is suitable for investors with a long term horizon who have an understanding of small cap fund volatility and want exposure to India’s dynamic small-cap segment

Investment Strategy

Kotak Small Cap Fund mainly invests (at least 65%) in shares of small cap companies. These are businesses that are still growing and have the potential to become much bigger in the future. For safety and liquidity, the fund may also invest a portion of its money in debt and money market instruments

To reduce risk the fund builds a diversified portfolio meaning it invests across different sectors instead of focusing on only a few industries:

1) What kind of companies does the fund look for?

The fund typically prefers companies that

- Proven products and services

- Record of above average earnings growth and have potential to sustain such growth

- Stock prices that appear to undervalue their growth prospects

- Companies, which are in their early and more dynamic stage of the life cycle, but are no more considered new or emerging

2) Investing in Debt & Money Market Instruments

The fund may invest in

- Listed or unlisted debt securities

- Rated or unrated debt and money market instruments

Such investments will always follow the limits defined in the fund’s asset allocation.

If the fund wants to buy an unrated debt security it will do so only after getting approval from the AMC Board and Trustee Board, as required.

3) Investing in IPOs

The fund may also invest in companies coming out with the IPO and whose post issue market cap (based on

the issue price) would fall under criteria mentioned in SID. Investors should refer to SID for full details about the same.

4) Investing in Other Mutual Funds

The Scheme may invest in other mutual fund schemes (from Kotak Mutual Fund or other fund houses) without charging extra fees. However all such investments put together cannot exceed 5% of the total net asset value of Kotak Mahindra Mutual Fund.

5) Use of Derivatives

The fund may use exchange traded derivatives for:

- Hedging (reducing risk)

- Portfolio rebalancing

- Other purposes permitted by SEBI

This may help the fund manager manage risk more efficiently.

Portfolio Allocation - How the Scheme Invests Your Money

Kotak Small Cap Fund mainly invests in small cap companies but it also has the flexibility to invest in other equity segments, debt, money market instruments, REITs/InvITs and overseas securities. The allocation is defined clearly in the Scheme Information Document (SID)

Asset Allocation Breakdown

| Instruments | Minimum (% of total assets) | Maximum (% of total assets) |

|---|---|---|

| Equity and equity related instruments | 65 | 100 |

| Investments in equity and equity related securities of small cap companies | 65 | 100 |

| Investments in equity and equity related securities of companies other than small cap companies | 0 | 35 |

| Debt and Money Market Securities | 0 | 35 |

| Units issued by REITs & InvITs | 0 | 10 |

Small Cap Definition (as per SEBI/AMFI)

Small cap companies are those ranked 251st onwards in terms of full market capitalization. This definition forms the core of how a Small Cap Mutual Fund like Kotak Small Cap Fund constructs its portfolio.

Debt & Money Market Investments

- Debt includes corporate bonds, government securities and securitized debt (except foreign securitized debt)

- Investment in securitized debt will not exceed 50% of total debt & money market instruments.

Money market instruments include:

- Commercial papers

- Certificates of deposit

- Treasury bills

- Government securities up to 1 year maturity

- Call/notice money

- Bills of exchange

- Any other RBI approved short term instrument

Overseas Investments - Up to 35%

The fund can invest up to 35% of its net assets in foreign securities as permitted under the SEBI Master Circular & RBI guidelines.

These can include:

- GDRs (Global Depository Receipts)

- ADRs (American Depository Receipts)

- Overseas equities

- Foreign bonds

- International mutual funds

- Other instruments allowed in future regulations

Use of Derivatives

To manage risk and rebalance the portfolio, the fund may use derivatives (like index futures & options) as permitted under SEBI rules.

Securities Lending

The fund is allowed to lend a portion of the securities it holds to earn additional income.

Maximum lending allowed

- 50% of net assets of the scheme

- 50% to any single counterparty

Currently only lending is permitted (short selling is not allowed).

Corporate Bond Repo Participation

The scheme may take part in repo transactions in corporate debt (borrowing/lending against corporate bonds)

- Maximum exposure - 10% of net assets of the scheme.

Internal Risk Controls

Apart from SEBI rules the fund also follows internal limits for exposure to

- Individual stocks

- Sectors

- Themes

- These internal norms are monitored and revised periodically to maintain risk discipline

Conclusion

Kotak Small Cap Fund follows a structured and transparent approach to investing in possibly high potential small cap companies while ensuring prudent risk management through diversification, selective debt exposure use of derivatives, and strict internal limits. Its ability to invest across sectors, participate in IPOs, allocate internationally and lend securities strategically gives the fund a wide operational frame while staying aligned to SEBI’s small cap mandate.

For investors with a long term horizon and a higher risk appetite this fund offers an opportunity to benefit from fast growing small cap ecosystem. Understanding the small cap fund meaning further helps investors see how such funds tap into early stage growth potential while managing inherent volatility.

FAQs

1. Who should consider investing in Kotak Small Cap Fund?

Investors with a long-term horizon (5+ years) and higher risk appetite can considered this fund

2. How risky are small cap funds?

Small caps can be more volatile in the short term but may offer long term growth potential. The fund manages risk through diversification and strict investment guidelines.

3. Does the fund invest only in small caps?

No. While 65%–100% must be in small caps the fund can invest up to 35% in companies outside the small cap category and in debt/money market instruments

4. Can the fund invest in IPOs?

Yes, as long as the company qualifies as a small cap based on its post issue market cap under SEBI rules

5. Does the fund invest internationally?

Yes. Up to 35% of the net assets can be invested in overseas securities such as GDRs, ADRs, foreign equities, bonds and international mutual funds.

For more information investors should refer to SID or visit the website.

6. How does the fund manage risk?

Risk is managed using

- Sector diversification

- Internal exposure limits

- Use of derivatives (for hedging/rebalancing)

- Securities lending

- Monitoring credit quality for debt investments

7. Are derivatives used for speculation?

No. Derivatives are used only for hedging, portfolio balancing or purposes allowed under SEBI regulations

Disclaimers

Kotak Small Cap Fund

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.