18 Dec 2025

The Indian rupee recently breached the ₹ 90 per US dollar mark, hitting an all-time low marking over 5.1% depreciation year-to-date. This slide is driven by a mix of global headwinds, like the US tariff hikes under Trump policies, and foreign portfolio investor (FPI) outflows and domestic pressures such as a record trade deficit, surging gold imports, and persistent current account deficits (CAD)

Source: Bloomberg, Data as of 3rd Dec 2025

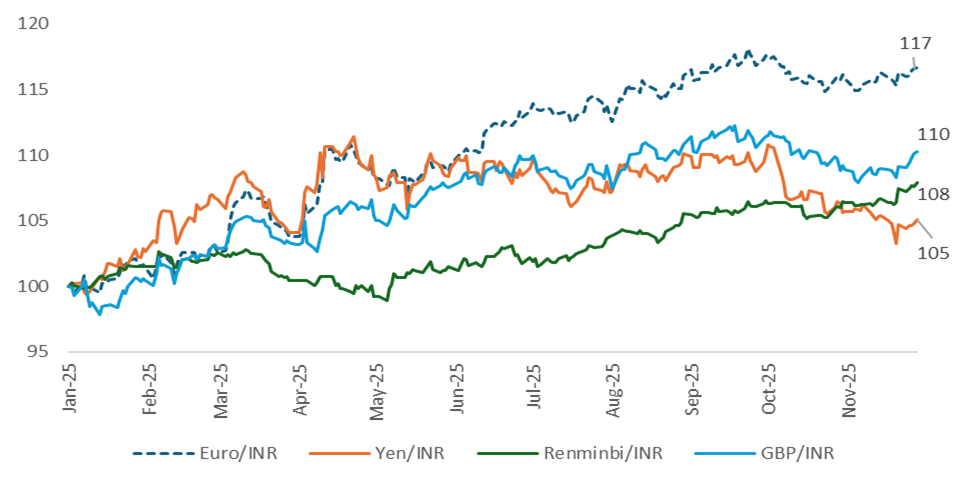

The rupee’s weakness is not limited to the U.S. dollar; it has slipped against other major currencies as well. The Nominal Effective Exchange Rate (NEER), which represents the weighted average of the rupee’s exchange rate against 40 key trading partners, shows a decline of about 8% in 2025 (up to October).

INR Has Depreciated 5% To 17% In Last 11 Months Vs. Other Currencies

Source: Bloomberg, Data as on 28th November 2025

More importantly, the Real Effective Exchange Rate (REER), which adjusts NEER for inflation differences, has fallen by nearly 9.9%. This sharper drop in REER indicates that the rupee’s depreciation is not just a nominal adjustment but an erosion of purchasing power.

But, the Indian currency depreciation is a long trend and not a sudden surprise. The Indian Rupee has been on a deliberate, consistent depreciation journey since the 1991 liberalisation. From ₹17 in 1991 to ₹90 in 2025 that’s 34 years of losing roughly 4.5 % per year on average.

| Decade | Avg. Yearly Depreciation against the USD |

|---|---|

| 1990 – 2000 | ~ 9% |

| 2000 – 2010 | ~ 0% |

| 2010 – 2020 | ~ 5% |

| 2020 – 2025 | ~ 4% |

Source: Bloomberg, FBIL Reference rate, RBI Handbook of Statistics, *31/03/1990 till 31/12/2000, Calculated using Compound Annual Growth Rate (CAGR)

While the rupee’s long-term slide reflects structural trends since liberalization, there are multiple forces shaping the recent decline.

The current account deficit (CAD) reflects the gap between India’s imports and exports of goods and services. When imports rise faster than exports, the deficit widens, putting pressure on the rupee. In recent years, gold imports have played a significant role in influencing the CAD, with FY25 witnessing notably large inflows.

However, currency policy can serve as a powerful tool for trade competitiveness. The rupee’s gradual depreciation is a gradual move to make Indian exports more attractive in global markets. A similar approach is evident in China, where foreign reserves have surged to ~USD 3.3 Trillion from ~USD 1.9 Trillion in 2009 letting the yuan weaken by ~44% vs INR, helping Chinese exports remain competitive on the world stage.

Source: Bloomberg, As of 12 Dec 2025

Additionally, U.S. tariffs on India stand at 50%, the highest globally, compared with an effective tariff of around 16% on ASEAN economies, some of India’s biggest competitors in the U.S. market. India’s exports to the U.S. are up 10.1% YoY in FYTD26 till October, driven largely by substantial front-loading of shipments when tariffs were lower. However, sectors such as gems and jewellery, textiles, apparel, agriculture, etc impacted by tariffs have recorded a 34% YoY decline in exports. If a trade agreement is not reached, these pressures may further weigh on the CAD.

While the current account captures India’s trade and income flows, the other side of the balance of payments, the capital account plays an equally critical role in determining rupee stability. The sharp slowdown in capital inflows as seen in FPI which is tracking at US$0.4bn in FYTD26 (till November) v/s US$7.5bn in FYTD25. The slowdown is evident in both equity and debt. Though FDI flows are showing signs of picking up, the impact is modest.

Source: Centrum wealth, IDFC first bank, Bloomberg, as per latest data available

A widening CAD may mean a higher demand for dollars (for imports), with fewer offsetting inflows from exports or services. That, coupled with capital outflows may push the INR lower.

However, one cannot compare the 2013 rupee fall to the current fall. The 2013-rupee fall was one of the toughest phases for India. When the US Federal Reserve announced it would slow down its money-printing program, investors rushed out of emerging markets, and India was hit the hardest because our economy was already weak. Inflation was very high, the current account deficit stood at 4.8% of GDP (FY2013), and India was heavily dependent on foreign flows to finance this large deficit. Global investors even placed India in the “Fragile Five,” which further dented confidence. The rupee lost almost 20% of its value, import costs surged, bond yields spiked, and markets turned nervous.

Source: KMAMC Internal, Bloomberg, Business Today article dated 27 Jun 2013, BBC article dated 28 August 2013, As per latest data available

In 2013, real rates were low, and consumption-driven growth had led to a very high trade deficit. When the dollar liquidity tap was suddenly shut during the taper tantrum, the impact was severe. This time, the situation is very different, real rates are competitive, growth is healthy, and the currency has become cheaper. Inflation is under control, reserves are strong, and services exports provide a cushion to the economy. Therefore, the current dip is more of an opportunity than a threat, as it can attract capital flows into India.

RBI Isn’t Losing Control, It’s Managing the Pace

Many people believe the Reserve Bank of India is failing to protect the rupee. But the truth is quite different. The RBI is not trying to stop the rupee from weakening completely. The RBI lets the rupee move with the slope of global markets but steps in when the speed becomes too high. The goal is not to push the rupee upward, but to prevent sudden drops.

Global agencies describe India’s currency system as “crawl-like.” This means the rupee is allowed to move in small, gradual steps, without sharp shocks. The RBI is not resisting the direction. It is guiding the journey.

In fact, the RBI Governor said while replying to a question on rupee depreciation at a post-monetary policy press meet, "We don't target any price levels or any bands. We allow the markets to determine the prices. We believe that markets, especially in the long run, are very efficient. It's a very deep market."

Source: The Hindu, RBI, As on 10 Dec 2025

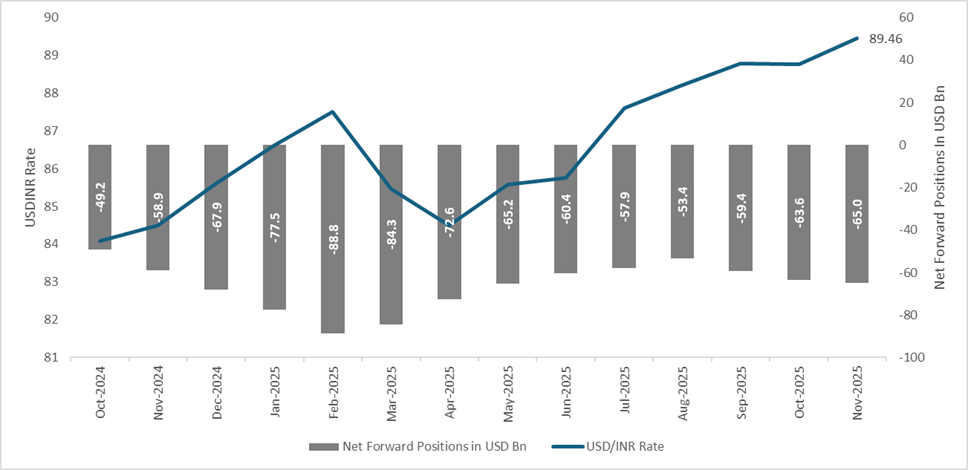

RBI is also using forward contracts to support the rupee. These agreements to buy dollars in the future act like an insurance cover. With a USD 65.0 billion short forward book and a policy of limited intervention, the RBI helped calm markets during uncertainty over the India–US trade deal and continued FPI selling driven by a higher trade deficit.

This mix of reserves and forward positions gives India a strong currency shield. Many countries face trouble when they run out of dollars during global shocks. India has dollars today and more lined up for the future. With such a war chest, the rupee may be better positioned to face potential challenges. Even at 90, it is adjusting rather than collapsing.

RBI's short dollar forward book

Source: Bloomberg, Nov 2025 Forward positions are industry estimates

Yet, a falling rupee isn’t always a sign of weakness. In fact, under the right conditions, it can strengthen India’s position in global trade. It may sound unusual, but a weaker rupee can make India stronger in the global market. When the rupee drops, our exports become cheaper for other countries. Companies that earn in dollars get more rupees when they convert their earnings.

Think of an IT company in Bengaluru. If it earns one million dollars from a US client, it receives more rupees today compared to two years ago. That extra income helps the company grow, hire more people and invest in new projects. In simple terms, a weaker rupee quietly boosts India’s export earnings. This matters even more now, as global trade is becoming tougher because of higher tariffs and political tensions.

The United States has raised tariffs on many Indian products, but the weaker rupee has softened the impact. It absorbs part of the loss and protects exporters from a bigger hit. It works more like a shock absorber. Additionally, rupee depreciation has a different impact on various sectors.

| Positive Impact | Negative Impact |

|---|---|

| IT Services | Oil & Gas (Importing) |

| Pharmaceuticals | Aviation |

| Textiles | Electronics |

| Gems & Jewellery | Automobile |

| Agriculture | Foreign Education |

| Travel |

Source: KMAMC Internal

In many countries, when the currency drops, food prices rise very fast. This is known as imported inflation. But India is different because we do not depend much on imported food. We grow most of what we eat: wheat, rice, pulses, milk, vegetables, sugar and spices. So, our inflation mostly comes from things within the country, such as poor rainfall or storage problems, not from changes in the rupee. A 5% depreciation adds only 15–25 bps to inflation. This is why the rupee can fall without creating a big jump in everyday prices. Thus, for most Indians, the cost of daily essentials stays almost the same.

Source: Bank of Baroda report as of 5 Dec 2025

While the rupee has seen some volatility, India’s economic fundamentals remain solid. Growth continues, supported by a strong domestic market and policies focused on reforms. The country has ample foreign exchange reserves to handle external shocks, and rising services exports strengthen the economy further. Inflation is controlled, which keeps the macroeconomy stable and investors confident. Overall, these factors make it clear that India’s economy is resilient and well-prepared to navigate currency fluctuations.

Shibani Kurian, Senior Executive Vice President, Fund Manager & Head – Equity Research, Kotak Mahindra Asset Management Co. Ltd says, “The recent weakness in the INR has been a function of many factors including demand from importers, weak foreign inflows, uncertainty over US – India trade deal and an elevated domestic trade deficit. On a normalised basis, given that India runs a current account deficit, the expectation is of depreciation by 2-3% annually. In the near term with the uncertainties over trade and tariff persisting, it is likely that the currency bias would remain towards depreciation. Given the adequate forex reserves, the Indian central bank however would likely take appropriate steps to prevent any sharp volatility in the currency.”

The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s). These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.