17 Nov 2025

In the pursuit of long term wealth creation investors often seek equity schemes that may offer a balance between stability and growth. Large and Mid-Cap Funds may help to achieve this objective by investing in both well established large cap companies and growth oriented mid cap companies. In line with SEBI’s mutual fund classification these schemes are required to invest a minimum of 35% of their total assets each in large cap and mid cap stocks. This structure provides investors with a diversified portfolio that combines the relative stability of large companies with the possible growth potential of mid sized businesses making it suitable for those with a medium to long term investment horizon

Key Takeaways

- Balanced Approach - Combines large caps’ stability with mid caps’ possible growth potential for long-term wealth creation.

- SEBI Regulated Allocation - Minimum investment in equity & equity related instruments of large cap companies 35% of total assets. Minimum investment in equity & equity related instruments of mid cap stocks 35% of total assets

- Professional Management - Experienced fund managers actively manage sector and stock exposure based on market conditions

- Long Term Focus - Suited for those with an investment horizon of three years or more to ride out short term volatility

- Taxation - Treated as equity oriented schemes. investors should check the latest mutual fund taxation norms for applicable rates and benefits.

SEBI’s Market Capitalization Framework

The Securities and Exchange Board of India (SEBI) has defined a uniform classification of companies based on their market capitalization. This standardization helps bring consistency and transparency across all mutual fund schemes making it easier for investors to compare and understand fund categories. As per SEBI:

- Large Cap Companies - Represent the top 100 companies in India ranked by full market capitalization.

- Mid Cap Companies - Include companies ranked from 101st to 250th by market capitalization

- Small Cap Companies - Cover companies ranked 251st and below based on market capitalization

What is a Large and Mid Cap Fund?

A Large and Mid Cap Fund is an equity mutual fund that invests in a mix of large sized and mid sized companies listed in India. These funds combine the relative stability of established large cap companies with the possible growth potential of mid cap businesses offering investors a balanced opportunity for long term capital appreciation.

As per the Securities and Exchange Board of India (SEBI) guidelines every Large and Mid Cap Fund must allocate:

- At least 35% of its total assets in large cap stocks (top 100 companies by market capitalization)

- At least 35% in mid cap stocks (companies ranked 101st to 250th by market capitalization)

This SEBI defined structure ensures transparency, consistency and comparability across mutual fund categories allowing investors to evaluate schemes like the Kotak Large and Mid Cap Fund on standardized parameters.

Investment Objective and Core Strategy

The primary objective of a Large and Mid Cap Fund is to generate long term capital appreciation through a diversified portfolio that includes both large cap and mid cap companies.

These funds follow a balanced approach by combining stability with possible growth potential:

- Large Cap Stocks - Provide business stability, strong fundamentals and consistent performance across market cycles

- Mid Cap Stocks - Offer higher growth opportunities as these companies expand their scale, product range and market presence, but subject to market risks

By blending both segments a Large and Mid-Cap Fund seeks to capture the growth potential of emerging businesses while maintaining resilience through well know leaders making it an suitable choice for investors aiming for sustained wealth creation over the long term.

Investors who wish to understand how Kotak Mutual Fund’s investment team approaches stock selection and portfolio rebalancing can explore the Large and Midcap Fund Investment Strategy for deeper insights into how the Scheme maintains a balance between potential growth and stability.

Key Features of Large and Mid Cap Funds

- Balanced Equity Exposure - These funds combine the stability of large cap companies with the possib;e growth potential of mid cap companies offering investors a well rounded equity exposure across market segments

- SEBI Mandated Allocation - In line with SEBI regulations Large and Mid Cap Funds must invest a minimum of 35% of total assets each in large cap and mid cap stocks ensuring diversification and adherence to category norms

- Focus on Long Term Wealth Creation - Designed for investors with a long term investment horizon (typically 3 years or more) these funds aim to deliver capital appreciation through exposure to established leaders and emerging growth businesses

- Active Fund Management - Professional fund managers actively rebalance the portfolio across market segments and sectors based on evolving economic conditions, company performance and valuation opportunities

Benefits of Investing in Large and Mid Cap Funds

- Balanced Growth and Stability - Large and Mid Cap Funds combine the stability of established large cap companies with the possible growth potential of mid cap businesses. This blend helps investors achieve a balance between consistent returns and higher growth opportunities.

- Diversification Across Market Segments - By investing across India’s top 250 companies by market capitalization these funds provide exposure to multiple sectors and industries, helping reduce concentration risk and improving portfolio resilience.

- Consistency Across Market Cycles - The large cap component lends stability during market downturns while mid caps have the possible potential to outperform in bullish phases. This dynamic mix helps the fund maintain balance through different market conditions

- Active and Professional Management - Managed by experienced fund managers these schemes follow a research driven investment process identifying quality companies with sound financials, competitive advantages and credible management teams

- Wealth Creation Through Compounding - Investors can use Systematic Investment Plans (SIPs) to invest regularly and benefit from rupee cost averaging. Over time this disciplined approach enhances long term wealth creation through the power of compounding

To know whether this category aligns with your financial goals and risk profile read our detailed guide on Why Consider a Large and Mid Cap Fund, it highlights the suitability factors, investor profile and long term benefits of investing in this category.

Understanding the Risks in Large and Mid Cap Funds

- Equity Market Risk - NAVs fluctuate with stock market movements

- Mid Cap Volatility - Mid cap companies can experience sharper price swings

- Fund Manager Risk - Active decision making may affect short term returns

- Economic Risk - Inflation, interest rate changes and macroeconomic trends can influence performance

Taxation of Large Cap and Mid Cap Funds

The tax treatment depends on the holding period. Equity funds are taxed differently with short term gains taxed higher than long term gains. Investors should also account for exit load while planning redemptions.

As mutual fund taxation is subject to periodic changes through government and regulatory updates, investors are advised to refer to the latest Kotak Mutual Fund Tax Reckoner for detailed and up to date information

Conclusion

Large and Mid Cap Funds offer investors a well balanced opportunity to participate in India’s growth story by combining the relative stability of established large cap companies with the possible growth potential of mid cap businesses. These funds aim to achieve long term wealth creation, subject to market risks through diversification, professional management and disciplined investing

While they carry moderate risk due to market linked exposure their dual allocation may provide relative stability during market downturns and provides scope for possible higher returns over time. Investors with a medium to long-term horizon and a moderate risk appetite can consider these funds as a core component of their equity portfolio.

As always investors should evaluate their financial goals, investment horizon and risk tolerance before investing.

FAQs

1. What is a Large and Mid-Cap Fund as per SEBI?

SEBI defines it as an equity oriented mutual fund that invests a minimum of 35% each in large cap and mid cap companies.

2. How are Large and Mid Cap Funds different from Large Cap Funds?

Large Cap Funds invest only in the top 100 companies whereas Large and Mid-Cap Funds include companies up to the 250th rank offering higher growth potential.

3. Are Large and Mid Cap Funds good for beginners?

Yes, they are suitable for investors seeking exposure to equities with a balance between stability and growth.

4. What is the recommended investment horizon?

At least 3+ years to benefit from compounding and ride out market volatility.

5. Can I invest in a Large and Mid Cap Fund through SIP?

Yes, you can start a Systematic Investment Plan (SIP) in a Large and Mid Cap Fund. SIPs help you invest regularly benefit from rupee cost averaging and build wealth gradually through long term compounding.

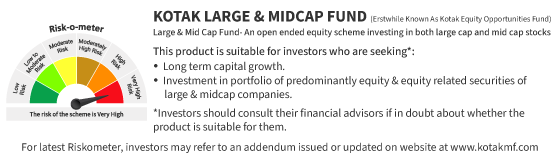

Kotak Large and Midcap Fund

An open ended equity scheme investing in both large and mid cap stocks

Disclaimers

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.