6 Nov 2025

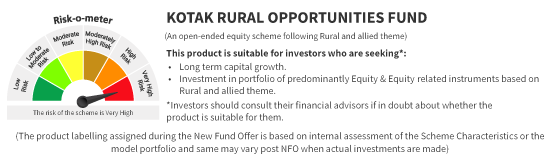

Kotak Rural Opportunities Fund offers investors a chance to participate in India’s evolving rural transformation. The scheme aims to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in the rural and allied economy. It seeks to capture opportunities arising from rising rural incomes improving infrastructure and greater digital inclusion through a diversified research driven investment approach.

Key Takeaways

- The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in Rural & allied theme.

- However, there can be no assurance that the investment objective of the scheme would be achieved.

- It follows a bottom up, research driven approach and adopts the Growth at Reasonable Price (GARP) philosophy to identify quality businesses

- The fund offers market cap flexibility, investing across large cap, mid cap and small cap segments for balanced exposure

- Its investment universe spans sectors such as agriculture, construction, manufacturing and services

- The NFO period is open from 6th November to 20th November 2025

- Suitable for long term investors with a very high risk appetite who wish to participate in India’s evolving rural transformation story

Disclaimer - The above-mentioned investment universe is not exhaustive in nature. For detailed information, please refer the scheme information document (SID) or visit https://www.kotakmf.com/Information/forms-and-downloads | The portfolio and its composition is subject to change, and the same position may or may not be sustained in future. The fund manager may make the changes, as per different market conditions and in the best interest of the investors within the investment universe.

What is the Rural India Theme?

The Rural India theme refers to an investment that focuses on companies that are either participating in or expected to benefit from the growth and development of India’s rural economy. This theme recognizes that rural India is an integral part of the country’s overall economic framework contributing significantly to national income, employment and consumption.

- The theme encompasses a broad range of sectors that are linked to rural progress such as agriculture, construction, manufacturing, and services.

- Companies within these areas may derive a portion of their revenues from rural markets or contribute to improving rural livelihoods and connectivity

- By investing in businesses with meaningful exposure to rural and allied activities, the Rural India theme seeks to capture potential rural investment opportunities arising from long term structural changes including rising rural incomes, enhanced infrastructure, greater digital access and diversification of employment beyond agriculture

- As per SEBI’s categorization framework thematic or sectoral funds invest predominantly in a specific theme or sector and carry higher concentration risks compared to diversified equity schemes. Therefore investors should evaluate their risk appetite and investment horizon before considering exposure to such funds

Why Invest in the Rural India Theme?

Rural India is evolving rapidly moving beyond its traditional dependence on agriculture to become a more diversified and dynamic segment of the economy. Better infrastructure, improved digital access and rising household incomes have reshaped consumption and created new business opportunities across sectors. The Rural India theme reflects both a long term structural transformation and favourable short term drivers supported by policy measures and growing domestic demand.

1. Long Term Structural Opportunity

Rural India remains a key contributor to India’s overall GDP and employment base. In recent years it has witnessed notable diversification into manufacturing, construction and services aided by sustained infrastructure investment and government programs:

- Enhanced connectivity - More than 7.83 lakh km of rural roads have been developed under the Pradhan Mantri Gram Sadak Yojana (PMGSY) improving connectivity and access to markets

- Digital inclusion - Rural Economy India now has a larger base of internet users than urban regions supporting the growth of e-commerce, financial inclusion and digital services

- Manufacturing expansion - India’s position among the Top 5 global manufacturing economies (with a USD 781 billion output in 2024) has led to non farm job creation and higher income opportunities in smaller towns and rural districts

- Rising incomes - Rural per capita income has crossed the USD 2,000 mark often viewed as an inflection point for increasing discretionary consumption

- Evolving employment trends - A gradual employment shift from agriculture to non farm sectors reflects deep rooted rural transformation

These developments collectively reflect the structural depth and diversification of India’s rural economy which continues to play an essential role in supporting long term domestic growth.

Source: PMGSY Report, PIB, NielsenIQ, IAMAI-Kantar ICUBE 2024 report, Ambit Capital | As per latest available data | World Bank report 2024, As per latest data available | Data is as per Calendar Year 2024| Pradhan Mantri Gram Sadak Yojana (PMGSY)

2. Short Term Growth Drivers

While the structural story remains strong near term economic indicators also support rural activity and consumption:

- Favorable monsoon - Approximately 81% of India received normal or excess rainfall in 2025 aiding stable agricultural output and farm incomes

- Policy momentum - Continued focus on rural infrastructure, electrification, housing and welfare programs is contributing to improved livelihoods and local employment

- Improving consumption environment - A combination of stable prices, supportive government measures and enhanced agricultural productivity has sustained rural demand

Together these factors highlight how the Rural India theme represents an evolving opportunity that aligns with India’s broader vision of inclusive and sustainable growth

Source: IMD; CMIE; ICRA Research| CMIE, Kotak Institutional Equities | https://upag.gov.in| As per latest data available

What is Kotak Rural Opportunities Fund?

The Kotak Rural Opportunities Fund is an open ended equity scheme following a thematic investment approach. The scheme seeks to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies that are participating in or expected to benefit from the rural growth and development of India’s rural and allied economy:

1) Scheme Characteristics

The Kotak Rural Opportunities Fund provides investors with a chance to participate in India’s rural transformation and growth story:

- Opportunity to Benefit from Rural Theme - Invests in companies driving rural and allied sector growth

- Broad based Theme - Includes firms with rural linkages branches, supply chains, factories and distribution networks

- Market Cap Agnostic - Diversified across large, mid and small cap companies for balanced exposure

- Potential for Long term Growth - Focuses on the structural rural economy story powered by expanding Bharat investment opportunities

2) Investment Philosophy

The Kotak Rural Opportunities Fund follows a bottom up research driven approach to capture India’s rural investment opportunities:

- Bottom Up Approach - Focuses on identifying quality companies using the BMV framework Business, Management and Valuation within sectors linked to rural growth

- Stock Selection - Invests in businesses showing sustainable growth at reasonable valuations aligned with the expanding rural economy in India

- No Market Cap Restriction - Offers flexibility to invest across large cap, mid cap and small cap companies enabling exposure to diverse Bharat investment opportunities

- Participation in Growth Potential - Targets companies benefiting from India’s rural transformation and infrastructure development story

- Investment Universe Relies on in house research to identify top ideas and long term rural opportunities for investors

Why Kotak Rural Opportunities Fund?

The Kotak Rural Opportunities Fund is designed to help investors participate in India’s evolving rural and semi urban growth story through a diversified research backed investment approach:

- Broad based rural exposure - The scheme invests in companies that are directly or indirectly connected to rural and allied segments including construction, agriculture, manufacturing and services

- Market cap flexibility - The fund has the flexibility to invest across large cap, mid cap and small cap companies, allowing for a balanced mix of stability and growth potential

- Research driven selection - Identifying fundamentally strong businesses aligned with Bharat investment opportunities.

- Diversified theme - The portfolio aims to capture opportunities across multiple sectors that contribute to or benefit from rural India’s development thereby maintaining diversification within the thematic framework

- Long term orientation - The scheme is structured for investors seeking to participate in the long term structural transformation of rural India through equity investments

Who Should Consider Investing?

The Kotak Rural Opportunities Fund may be suitable for investors who:

- Seek long term capital appreciation by investing in equity and equity related securities of companies linked to India’s rural and allied economy

- Have a very high risk appetite and are comfortable with the market fluctuations typically associated with thematic equity funds

- Want diversification beyond urban centric industries by leveraging rural investment opportunities

- Have a long term investment horizon and believe in the broader themes of consumption, infrastructure and rural development within India’s growth story

How to Invest in the NFO?

You can invest in the Kotak Rural Opportunities Fund NFO through:

- The Kotak Mutual Fund website

- Registered distributors and investment platforms

- Kotak Mahindra Bank branches

NFO Period 6th November – 20th November 2025

Key Features of Kotak Rural Opportunities Fund

The Kotak Rural Opportunities Fund offers investors an opportunity to participate in India’s rural and allied growth story through a diversified, research-oriented investment approach:

| Feature | Details |

|---|---|

|

Scheme Type |

An open-ended equity scheme following Rural and allied theme |

|

Investment Universe |

Companies engaged in Rural and allied theme such as agriculture, construction etc. |

|

Market Cap Exposure |

Flexibility to invest across large cap, mid cap and small cap companies |

|

Investment Approach |

Bottom up stock selection with a focus on identifying fundamentally strong and sustainable business models |

|

Investment Objective |

The investment objective of the scheme is to generate long term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in Rural & allied theme. However, there can be no assurance that the investment objective of the scheme would be achieved |

|

Fund Manager |

Mr. Arjun Khanna, CFA, FRM with over 18 years of experience across banking, financial services and equity research |

Conclusion

Rural India has evolved into a vibrant part of the national economy fuelled by reforms, digitalization and rural infrastructure development. The Kotak Rural Opportunities Fund provides investors a way to gain exposure to this broad based growth theme through a diversified portfolio of companies linked to rural and allied development.

By maintaining flexibility across market capitalizations and following a disciplined research driven approach the fund aims to identify businesses aligned with India’s long term rural transformation. Investors with a long term horizon and suitable risk appetite may consider this thematic scheme as part of a diversified portfolio that aligns with the broader vision of inclusive growth

FAQs

1. What is the Kotak Rural Opportunities Fund?

The Kotak Rural Opportunities Fund is a thematic equity scheme that aims to generate long term capital appreciation by investing in companies that are contributing to or benefiting from India’s rural and allied economic development.

2. What is the investment objective of Kotak Rural Opportunities Fund?

The investment objective of the scheme is to generate long term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in Rural & allied theme.

However, there can be no assurance that the investment objective of the scheme would be achieved.

3. How does this fund differ from other equity schemes?

Unlike diversified equity funds this thematic fund focuses specifically on sectors and businesses linked to the rural economy and consumption growth.

4. Is the fund limited to agricultural companies?

No, the investable universe includes sectors like agriculture, construction, manufacturing and services that have rural linkages. Please refer Scheme Information document for complete information in regards to investable universe.

5. What type of investors can consider this scheme?

The fund may be suitable for investors seeking long term capital appreciation who wish to diversify their portfolio through exposure to India’s rural and allied growth story.

Disclaimers

The information contained in this (document) is extracted from different public sources/KMAMC internal research. All reasonable care has been taken to ensure that the information contained herein is not misleading or untrue at the time of publication. This is for the information of the person to whom it is provided without any liability whatsoever on the part of Kotak Mahindra Asset Management Co Ltd or any associated companies or any employee thereof. Investors should consult their financial advisors if in doubt about whether the product is suitable for them before investing.

The document includes statements/opinions which contain words or phrases such as "will", "believe", "expect" and similar expressions or variations of such expressions, that are forward looking statements. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with the statements mentioned with respect to but not limited to exposure to market risks, general and exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on the services and/or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc.

This is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of it, in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this material are required to inform themselves about, and to observe, any such restrictions. The sector(s)/ stock(s) referred, if any should not be construed as any kind of recommendation and are for information/used to explain the concept.

Past performance may or may not be sustained in future. For more details visit www.kotakmf.com. For detailed portfolio and related disclosures for the scheme(s) please refer our website https://www.kotakmf.com/Information/forms-and-downloads. The portfolio and its composition is subject to change and the same position may or may not be sustained in future. The fund manager may make the changes, as per different market conditions and in the best interest of the investors. To view the latest complete performance details of the Scheme(s) kindly refer to the factsheet on our website https://www.kotakmf.com/Information/forms-and-downloads.

Investors may consult their financial expert before making any investment decision.